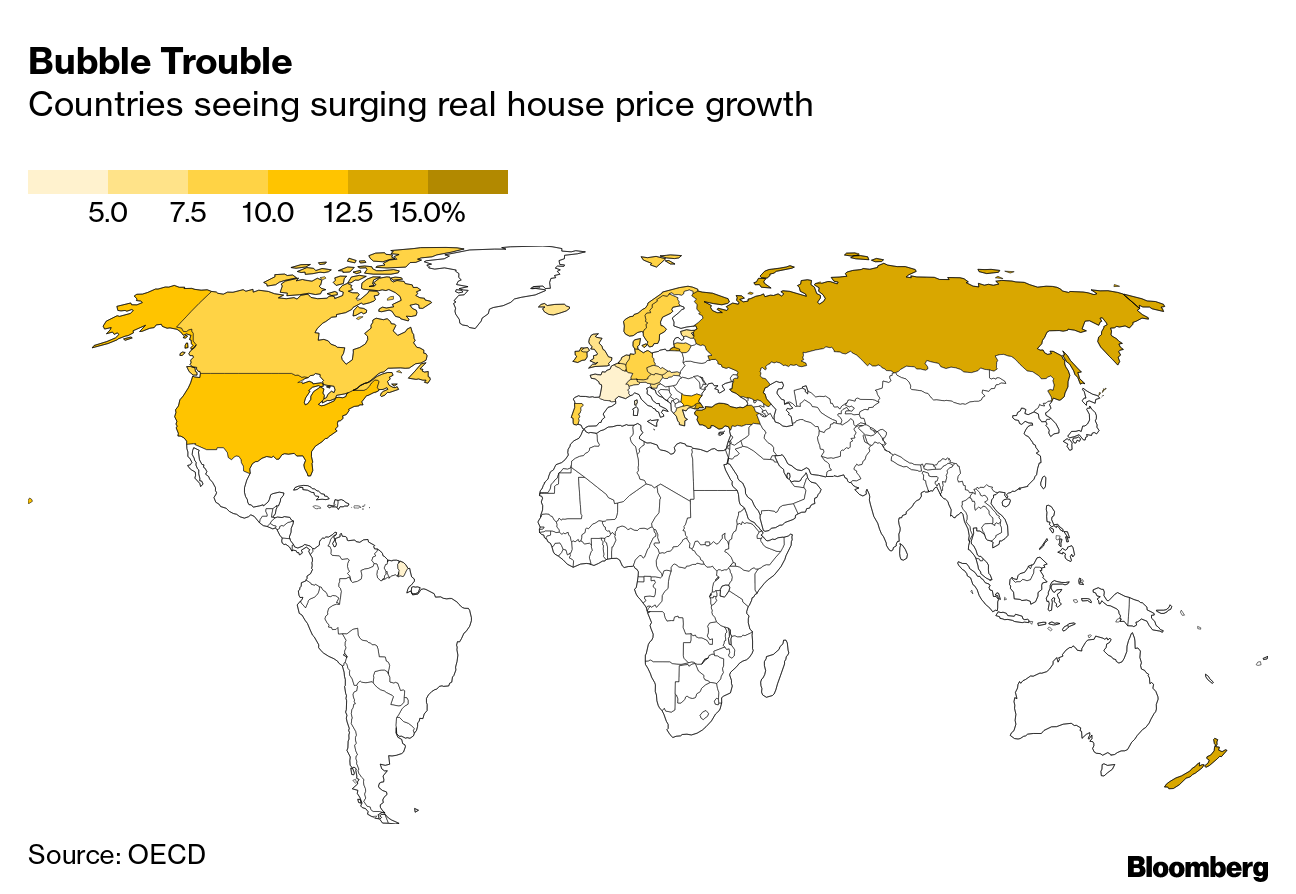

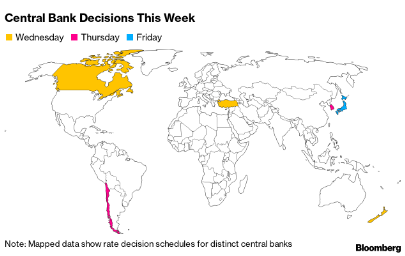

| Hello. Today we look at the challenge surging home prices pose for the world's central banks, the week ahead, and at deficit spending. Housing Dilemma When the coronavirus shuttered many parts of the global economy last year, major central banks had little choice but to jump in and cut interest rates to near zero and go on an unprecedented asset-buying spree to prevent the economic and health crisis from becoming a financial one. Now, as some monetary authorities including the Federal Reserve begin to tip toe away from those emergency settings, avoiding market turmoil remains a key mission, made all the harder by the housing booms their easing triggered.  As Enda Curran writes, withdrawing stimulus too slowly risks inflating real estate further and worsening stability concerns. Pulling back too hard means unsettling markets and sending property prices lower, threatening the economic recovery from the Covid-19 pandemic. With memories of the 2008 global financial crisis that was triggered by a housing bust still fresh, how to keep a grip on soaring home costs is a dilemma in the forefront of deliberations as recovering growth sees some central banks discuss slowing asset purchases and even raising interest rates. In the coming days, central bankers in New Zealand, South Korea and Canada meet to set policy, with real-estate concerns in each spurring pressure to do something to keep homes affordable for regular workers. New Zealand has the hottest property market in the world, according to the Bloomberg Economics global bubble ranking. The central bank's projections for the official cash rate show it starting to rise in the second half of 2022. Facing criticism for its role in stoking housing prices, Canada's central bank has been among the first from advanced economies to shift to a less expansionary policy, with another round of tapering expected at Wednesday's decision. The Bank of Korea last month warned that real estate is "significantly overpriced" and the burden of household debt repayment is growing. But a worsening virus outbreak may be a more pressing concern at Thursday's policy meeting in Seoul. Fed officials who favor tapering their bond-buying program have cited rising house prices as one reason to do so. In particular, they are looking hard at their purchases of mortgage backed securities, which some worry are stoking housing demand in an already hot market. "Real estate prices, as with other asset prices, will continue to balloon as long as global liquidity remains so ample," said Alicia Garcia Herrero, chief economist for Asia Pacific at Natixis who used to work for the European Central Bank and International Monetary Fund. "But the implications are much more severe than other asset prices as they affect households much more widely." — Malcolm Scott The Week Ahead Along with the trio in Wellington, Ottawa and Seoul, the Bank of Japan is in action this week. The focus on their Friday announcement will be on their green lending program and any revisions to economic forecasts. Elsewhere, China will publish gross domestic product data, U.K. inflation may turn out to have reached the fastest since 2018, the U.S. consumer-price report for June will also be released and Fed Chair Jerome Powell will testify in Congress. For a full rundown of the week ahead, click here. Today's Must Reads - Growing consensus | Finance ministers from the U.S. and Europe expressed confidence that a global tax deal endorsed by the Group of 20 on Saturday has enough momentum to overcome domestic political obstacles in time for it to be finalized in October.

- ECB countdown | President Christine Lagarde told markets to prepare for new guidance on monetary stimulus on July 22, and signaled that fresh measures might be brought in next year.

- Growth doubts | When long-term interest rates were surging earlier this year, Fed officials cheerfully interpreted the move as a vote of confidence in the U.S. economic outlook. By the same logic, this month's plunge in bond yields suggests investors may be having second thoughts.

- China cut | The economy's V-shaped rebound is slowing, sending a warning to the rest of world about how durable their own recoveries will prove to be. The outlook shift was underscored Friday when the central bank cut the amount of cash most lenders must hold in reserve.

- Office space | As the IMF plans for the return of staff to its facilities in Washington, the world's financial firefighter is mapping a strategy to allow employees to work part of the week from home beyond the pandemic — an idea that may reduce its physical-space needs.

- Staying alive | Britain's nightclubs are preparing to reopen for the first time in 16 months, but many will not survive.

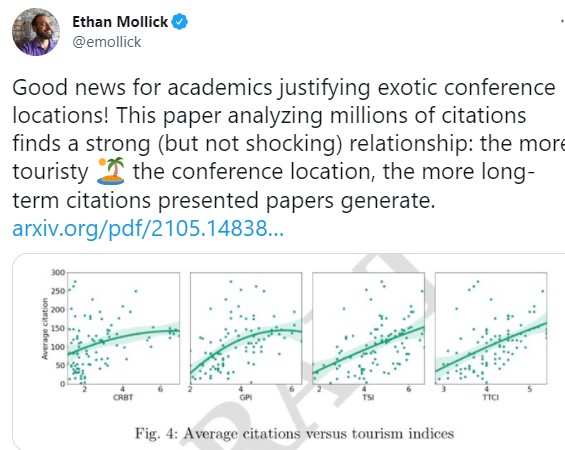

Need-to-Know ResearchThe current boom in deficit spending by governments around the world probably owes at least something to Olivier Blanchard, who in 2019 wrote, "Put bluntly, public debt may have no fiscal cost." Blanchard, a former chief economist of the IMF, argued that if the economy's growth rate is durably higher than the government's borrowing rate, a lump of debt becomes more affordable over time because interest payments shrink as a share of the economy. It seemed like an invitation to open the red ink spigots, even though Blanchard has since hedged and even expressed concern this year that the Biden administration's deficit spending will overheat the U.S. economy. Now, a pair of research papers by Boston University economist Laurence Kotlikoff and co-authors question Blanchard's original conclusions. They argue that accumulating debt to pay for current expenses is like a Ponzi scheme in that money from new players (the young) is used to pay off people who started playing the game earlier (the old). On #EconTwitterThat conference in Fiji is definitely worth it.  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment