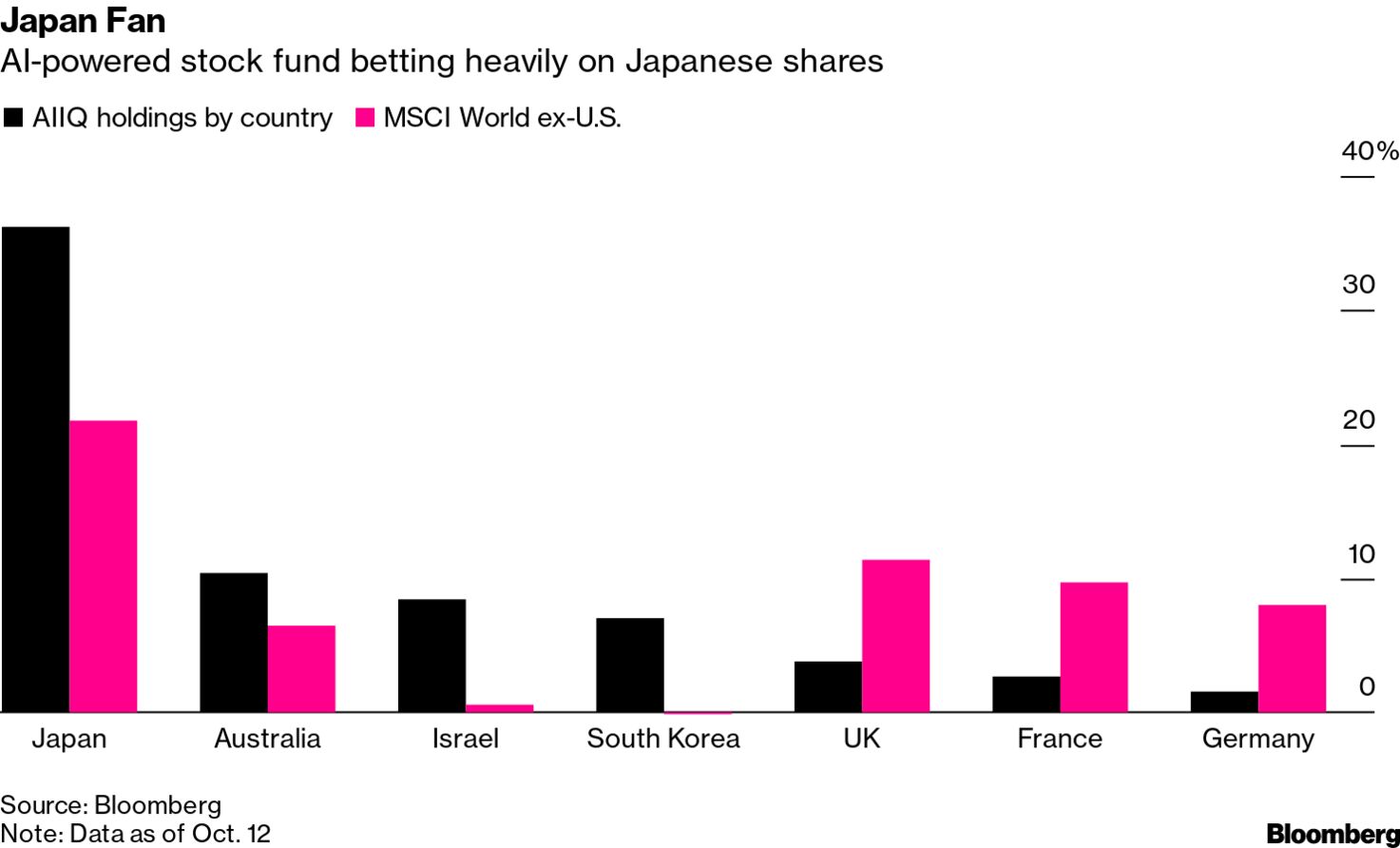

| Fed officials broadly agree they should start tapering soon. Mixing Covid vaccines produces promising results. Bollywood's leading men pitch cryptocurrencies ahead of Diwali. Here's what you need to know today. Federal Reserve officials broadly agreed last month that they should start reducing emergency pandemic support for the economy in mid-November or mid-December during increasing concern over inflation, according to minutes from their September meeting. The program could then end by mid-2022. The inflation outlook was raised in the near term after a robust discussion, though staff continue to expect the recent acceleration is "transitory." Federal Open Market Committee members noted that their contacts generally didn't expect bottlenecks to be fully resolved until sometime next year or even later. Asian stocks looked set to rise after longer term Treasury yields and the dollar fell as traders kept their eyes on elevated U.S. inflation. Futures edged up in Japan and Australia after U.S. shares snapped a three-day losing streak. Crude stabilized above $80 a barrel, giving oil-sensitive currencies a bigger boost. Meanwhile, upcoming China inflation figures will offer another read on price pressures stoked by supply chain disruptions and a jump in energy prices.  | The World Health Organization proposed a fresh team to lead an investigation into the origins of Covid-19 and other diseases after the last effort was wracked by controversy. In other virus news, mixing Covid vaccines produces as much or more antibodies as using the same shot as a booster, according to preliminary results of a widely awaited U.S. government-sponsored trial. Bill Gates says government and industry leaders around the world need to "get serious" about increasing vaccine-making capacity so that they can respond faster in the future. While the livestock deworming drug Ivermectin is unproven against Covid, it's proving lucrative for foreign generic drugmakers The IMF this week will discuss plans for a trust encouraging nations to move their economies toward a more climate-friendly, low-carbon future, according to its chief, Kristalina Georgieva. The trust will be funded by rich nations reallocating some of the reserves they received through the IMF's record $650 billion issuance in August. She expects the fund to meet its goal of getting countries to commit to $100 billion of onlending. Meanwhile, a major paper published in the journal Nature has concluded that the deep divide between rich and poor will widen as the planet heats up. Ahead of Diwali, a time when Indians go on a gold shopping spree, two of Bollywood's leading men are pitching another option: cryptocurrencies. India's top two crypto platforms have each tapped stars — one, Amitabh Bachchan, may be the most famous Indian actor of all time — to promote crypto as a superior and easy investment ahead of Dhanteras, the auspicious first day of the holiday, when buyers traditionally splurge on gold. Indians have expanded their Diwali investments to include stocks, real estate, diamonds and other assets. What's caught our eye over the past 24 hours: Global investors curious about where the robots are putting their retirement fund should look to Japan. An artificial intelligence-guided fund targeting stocks outside the U.S. is piling into Japanese shares which now make up over a third of its portfolio. The AI Powered International Equity exchange-traded fund has increased its weighting in the country to 36% this week from just 9% at the beginning of the year, according to data compiled by Bloomberg. That compares with a 22% weighting in Japanese stocks in the MSCI World ex-U.S. Index.  Japanese shares have been whipsawed in recent months by a change of government, the global surge in yields and a slump in the yen. Still, the country's shares are seen as cheap compared to international peers with export-heavy companies that offer good exposure to the global reflation trade. Australia is the next most popular bet for AIIQ, with a 10% weighting. The fund is heavily underweight on European shares, despite their solid year-to-date performance. AIIQ has risen about 6% so far this year, neck and neck with the MSCI gauge which is up almost 7%. The ETF beat the index by about 9 percentage points last year. The AI fund's "manager" — a quantitative model developed by EquBot — scrapes millions of regulatory filings, news stories, management profiles, sentiment gauges, financial models, valuations and bits of market data to choose developed-market stocks. Cormac Mullen is a markets reporter and editor for Bloomberg News in Tokyo. |

Post a Comment