| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. The European Commission will raise some 80 billion euros in bonds and billions more in bills to finance the EU's jointly-backed stimulus, but it's not certain that everyone will get the money they expect. We spoke with Commission Vice President Vera Jourova, who said the plan is to aggressively implement the new rule-of-law conditionality for funding. If corruption, weak courts or poor law enforcement are found to put EU money at risk of embezzlement, then payments may be frozen. Jourova told us the Commission has "no obligation" to wait for an EU court ruling on whether the strings attached to disbursements are legal. And if the ruling comes too late, the Commission will "have to" trigger the process before it lands.

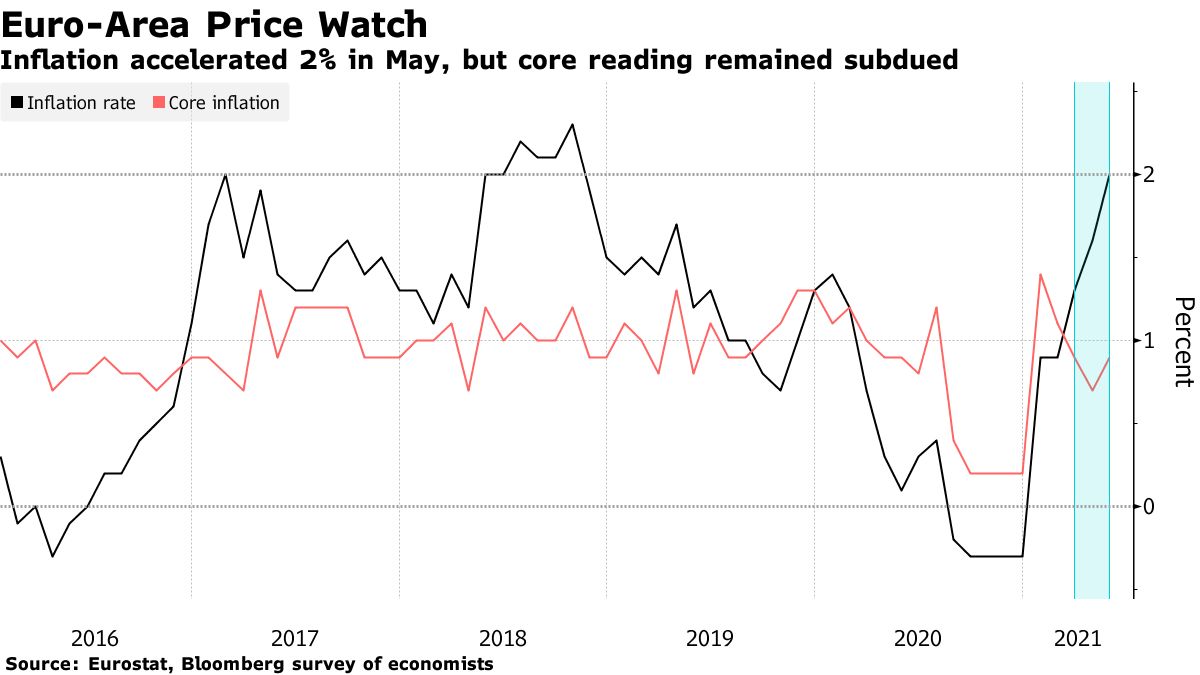

—Stephanie Bodoni and Nikos Chrysoloras What's HappeningFiscal Pass | EU countries won't have to worry about getting their finances in order for another year after a suspension of the bloc's fiscal rules through 2022 is confirmed today. With the focus having shifted to national recovery plans and a debate on a broader overhaul of the bloc's spending rules not due until later in the year, this normally key moment in the EU's fiscal oversight will have few fireworks. Pipeline Politics | Germany is sending a high-level delegation to Washington as part of an effort to patch lingering rifts, including tension over the Nord Stream 2 gas pipeline and allegations of U.S. spying. Here's what to expect ahead of the big EU-U.S. summit this month. Expensive Holidays | Europeans are in for a costly summer as the region's delayed economic recovery unleashes surging demand. The question is whether accelerating inflation will alter the longer-term expectations of companies and households. If it does, that could create a self-reinforcing cycle. Gender Equality | The good news is that under a new gender equality plan drawn up by Mario Draghi's government, men and women in Italy will finally have the same earnings and employment potential. The bad news is that it's going to take another decade. Read our interview with Italy's minister for equal opportunities. Corporate Taxes | With global talks on setting a floor on corporate taxes, Ireland is pushing to protect its long-standing 12.5% rate. Even if it succeeds, a series of tax transparency initiatives may eventually undermine its coveted status as a haven for multinationals. The latest breakthrough is a deal struck last night between EU negotiators forcing multinationals to report how much they pay in taxes in each country. In Case You Missed ItNuclear Deal | A bleak assessment of Iran's nuclear transparency cast a pall over months of arduous diplomacy aimed at restoring its atomic accord that has major implications for Mideast security, global business and oil markets. Despite recent statements of optimism from Iranian and European officials, significant differences at the talks in Vienna remain. Franco-German Motor | At the height of the pandemic, Germany and France hatched a plan to bring medical production back to Europe. Less than 12 months later, the initiative has hit a wall. Read how election-year politics in Germany and the fading urgency of the coronavirus crisis have brought the effort to a standstill. Green Banks | European banks spent almost a decade claiming they're part of the fight against climate change. Now, investors and regulators want them to prove it. Bloomberg News analyzed annual reports and similar filings from a selection of Europe's major banks, and we found that the disclosures provide a limited view into only a portion of their business. Hi-Tech Policy | The French government will use algorithms and artificial intelligence to identify small firms at risk of collapse in the wake of the Covid pandemic, and provide as much as 3 billion euros to protect them. The new tools come amid warnings that a jump in insolvencies as governments pare back crisis aid could hamstring the economic recovery. Chart of the Day Inflation in the euro area climbed in May to the highest level in more than two years after economies across the region started to lift virus restrictions and rebounding demand aggravated supply bottlenecks. The European Central Bank has stressed that price increases will likely be transitory, and that it's still premature to talk about an unwinding of monetary support. Today's AgendaAll times CET. - European Commission presents economic policy recommendations for the euro area and member states, as well as proposals for strengthening the Schengen area

- European Commission adopts plan for a secure European e-ID to be unveiled tomorrow

- 7 p.m. EU Commission President Ursula von der Leyen meets Dutch Prime Minister Mark Rutte in Brussels

- Bank of France Governor Francois Villeroy de Galhau, Bundesbank President Jens Weidmann and IMF Managing Director Kristalina Georgieva speak at climate conference

Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. For even more: Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment