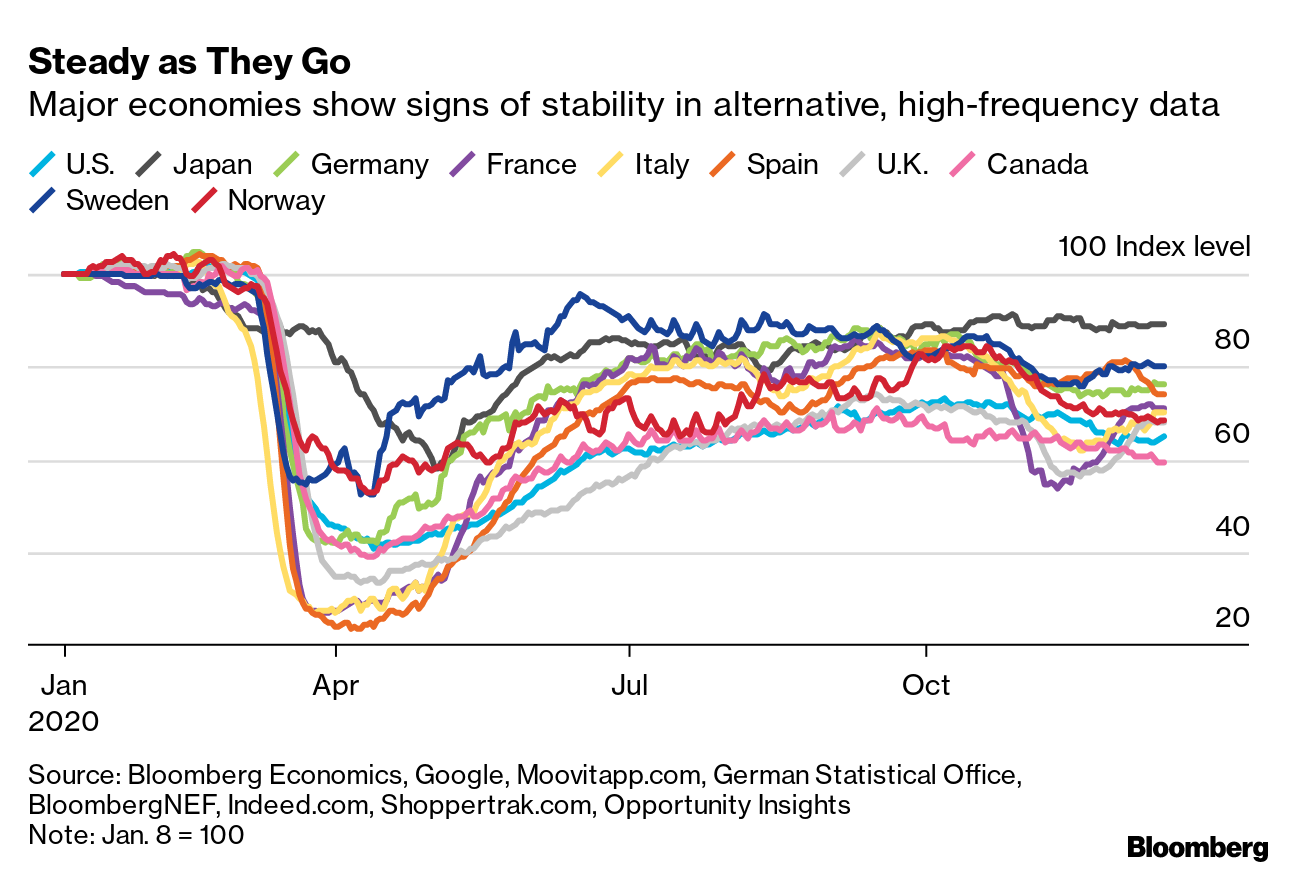

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. European medicines regulators are working hard to brighten up a somber end of the year. They'll meet on Monday before Christmas, more than a week earlier than initially planned, to consider the Covid-19 vaccine developed by Pfizer and BioNTech and potentially pave the way for a speedier approval of the shot. Commission President Ursula von der Leyen said the first citizens in the bloc could be immunized before the year is over. The shot is already being rolled out in the U.K. and the U.S., which has become a source of frustration in the EU — especially considering that German researchers played a leading role in the vaccine's development. The news will be particularly welcome in the bloc's biggest economy, which is entering a hard lockdown today as infection rates remain stubbornly high. — Alexander Weber What's HappeningBudget Vote | EU lawmakers are expected to give their final signoff today to the bloc's 1.8 trillion-euro stimulus package and mechanism linking funds to rule-of-law adherence. The vote by the European Parliament comes after leaders reached an eleventh-hour deal last week, clearing the way for the landmark spending plans to be rolled out in the new year. Waiting Game | Europe will make a fresh attempt to keep alive the international agreement on curbing Iran's nuclear program when the EU chairs a meeting today of the deal's dispute-settlement body. The hope is that U.S. President-elect Joe Biden, who takes office on Jan. 20, will help revive the landmark accord after Donald Trump turned his back on it. Hacking Defense | The EU will today unveil its cybersecurity strategy, which is set to include policies aimed at building operational capacity in the bloc to prevent, deter and respond to attacks. The plans come as government agencies and corporations in the U.S. and abroad are reviewing their computer systems for signs of breaches, after a hacking campaign tied to Russia. Bank Dividends | European regulators lifted their de facto ban on bank dividends while imposing strict limits on payout levels. To maintain financial strength, the European Central Bank said lenders should keep dividends and share repurchases to less than 15% of profit for 2019 and 2020, or 0.2% of their key capital ratio, whichever is lower. Soured Loans | The Commission is also due to present a plan on how to deal with an expected increase in distressed debt following the deepest recession in the EU's history. It should largely build on existing guidance to governments on how to set up national bad banks and the use of public cash injections into struggling banks. In Case You Missed ItAid Limits | Germany wants the EU to more than double the amount of aid nations are allowed to dole out to individual companies. In a letter last week, German cabinet officials pleaded for an increase in the current limit of 3 million euros, we've learned. Austria supports the push. Tech Threat | The Commission unveiled sweeping new regulations for major tech platforms, threatening to break them up if they treat their own services more favorably at the expense of rivals. Companies like Amazon, Apple or Google also face fines of as much as 10% of their revenue if they don't comply. Data Transfers | Facebook fought a preliminary decision by Ireland, its lead EU privacy watchdog, that risks curbing its transfers of vast amounts of commercial data across the Atlantic. It said the ruling was "rushed" and unfairly singled it out among other big tech rivals. Airline Help | European airlines were guaranteed longer relief from the impact of the coronavirus, after the Commission won the final go-ahead to suspend airport slot-use obligations until late March. EU member states and the bloc's parliament backed waiving a requirement that carriers use at least 80% of their takeoff and landing positions or risk losing them. Missing Action | While global central banks are voicing support for the fight against climate change, few have yet taken concrete action to support the transition of the financial system to a more sustainable basis, a survey showed. Chart of the Day Alternative, high-frequency data show activity in several of the world's largest advanced economies stabilized after weakening earlier in December. Activity was little changed in the U.S., Germany and Spain, according to Bloomberg Economics gauges that integrate data such as mobility, energy consumption and public transport usage. The U.K., France and Italy saw gains. Today's AgendaAll times CET. - 9:30 a.m. The EU's top court rules in challenges involving a group of Cypriot savers who claimed compensation over the restructuring of the Cypriot banking sector

- 11 a.m. The EU's General Court rules on a challenge by the International Skating Union against a 2017 Commission order to drop penalties

- 11 a.m. The EU's lower court rules in a challenge by American Airlines against the Commission

- 11 a.m. Commission press conference on cyber security

- 12:30 p.m. Commission press conference on non-performing loans

- 1 p.m. German Chancellor Angela Merkel takes questions from lawmakers

- 2 p.m. Video conference of the Eurogroup

- European Parliament will assess the outcome of last Friday's EU Summit with Commission President von der Leyen and Council President Charles Michel

- EU agriculture and fisheries ministers continue meeting in Brussels

Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. For even more: Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment