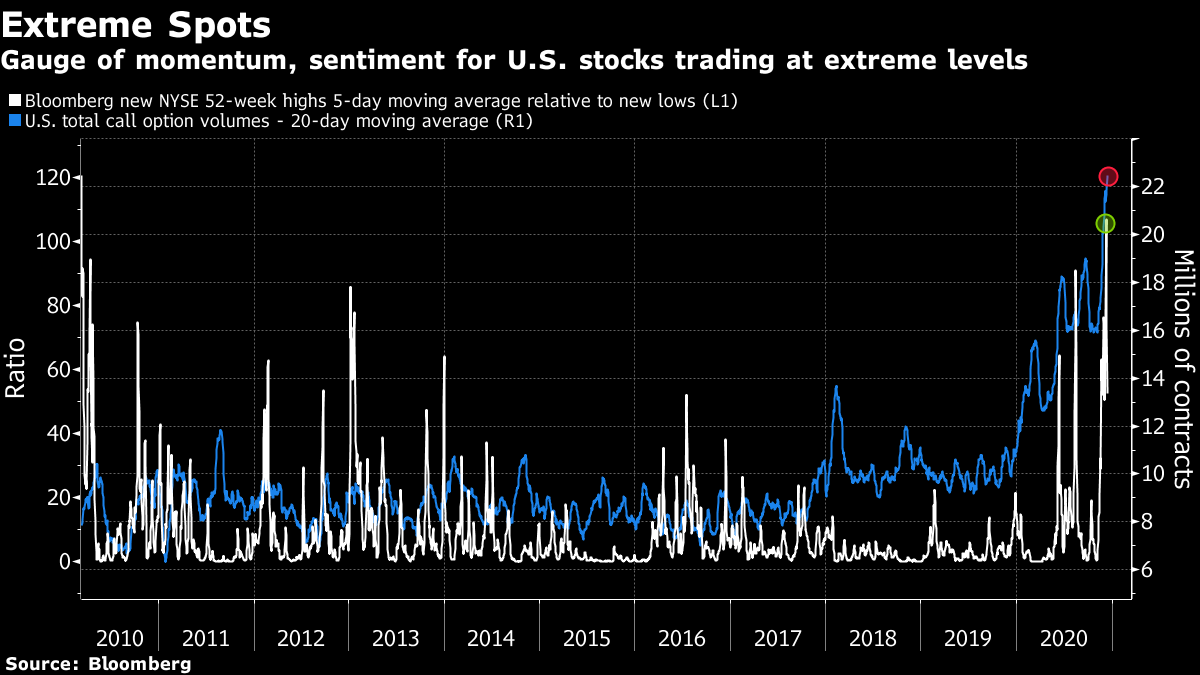

| Good morning. The Christmas restrictions debate, the lifting of a dividend ban and jittery traders watching Brexit. Here's what's moving markets. Christmas PlansThe U.K. government will keep plans to ease Covid restriction rules over the festive period, in spite of warnings from two medical journals about the potential impact on the health service early next year. Pressure is building in Europe for a quick approval of a vaccine as infections and deaths rise in the region, and Germany is pushing the European Union to double the aid limit for firms slammed by the pandemic. Canada is ramping up its vaccine push too in a bid to get doses to as many people as possible by the end of the year, while President Donald Trump is set to encourage citizens to take the vaccine, though without any detail on when he'll get it. DividendsThe European Central Bank has lifted a de facto ban on bank dividends, though it is keeping strict limits on payouts in order to ensure lenders maintain financial strength during the pandemic. The dividend limit still in place is at a more conservative level to that set out by the Bank of England last week. Elsewhere, a slew of Nordic banks slumped on Tuesday after a report that the FBI is investigating allegations of money laundering and fraud. That will keep investors in SEB, Swedbank and Danske Bank on their toes, though the three lenders said the report contained no new information. Jittery TradersVague rumors that a Brexit deal may be moving into view caused the pound to extend a rally and gilts to fall, with jittery traders grasping at any piece of news that may indicate which way the negotiations will go. A vote to ratify a deal on Christmas Day, should one materialize, has not been ruled out. The U.K. government is also attempting to drive forward other trade negotiations, with Prime Minister Boris Johnson to visit India for talks in January and a continuity deal signed with Mexico. This all comes amid warnings from truck companies about deliveries being turned away in the event of a no-deal, and as London touts its dominance as a financial services exporter. AcknowledgementPresident-elect Joe Biden's victory in the U.S. election was further cemented as Senate Majority Leader Mitch McConnell acknowledged the Democrat as the winner. He had declined to do so until now amid the attempt by President Trump to overturn the result based on unsubstantiated allegations of fraud. Biden also urged people to stay at home for what will be an "extremely limited" inauguration in January given the continued rise in cases and virus deaths. Republican leaders, meanwhile, touted progress toward a deal on Covid-19 relief and funding the government. Coming Up…Euro-area and U.K. activity indexes will be published and the big event of the day will be after European markets close, in the shape of the latest decision by the Federal Reserve plus a press conference from Chair Jerome Powell. Asian stocks gained ahead of the Fed decision and European stock-futures are pointing to a rise. The rally for oil, however, paused after a report indicated U.S. crude stockpiles have increased. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningThe stage is set for a volatile end to the year in the U.S. stock market after bullish and bearish signals both hit extreme levels in recent days. Bulls are being encouraged by the strengthening breadth of the current rally. A gauge of momentum — the five-day moving average of new 52-week highs on the New York Stock Exchange relative to lows — is just off its highest in 10 years. Bears are pointing to measures of extreme positive sentiment — such as record call option volumes — to bolster their case for a pullback. As Sundial Capital Research's Jason Goepfert put it, buying breakouts with leveraged positions in this kind of environment is highly risky, while shorting isn't much better, since momentum conditions can continue for weeks or months. The S&P 500 Index halted a four-day losing streak Tuesday, as Congress moved toward a spending package that would boost the economy. The U.S. benchmark is trading a fraction below its all-time high and has surged 65% from its March low. The latest Bank of America fund manager survey also comes with mixed messages for traders. Investors are the most bullish on stocks and commodities since February 2011, yet a plunge in their cash exposure has triggered a sell signal for equities, BofA strategists said.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment