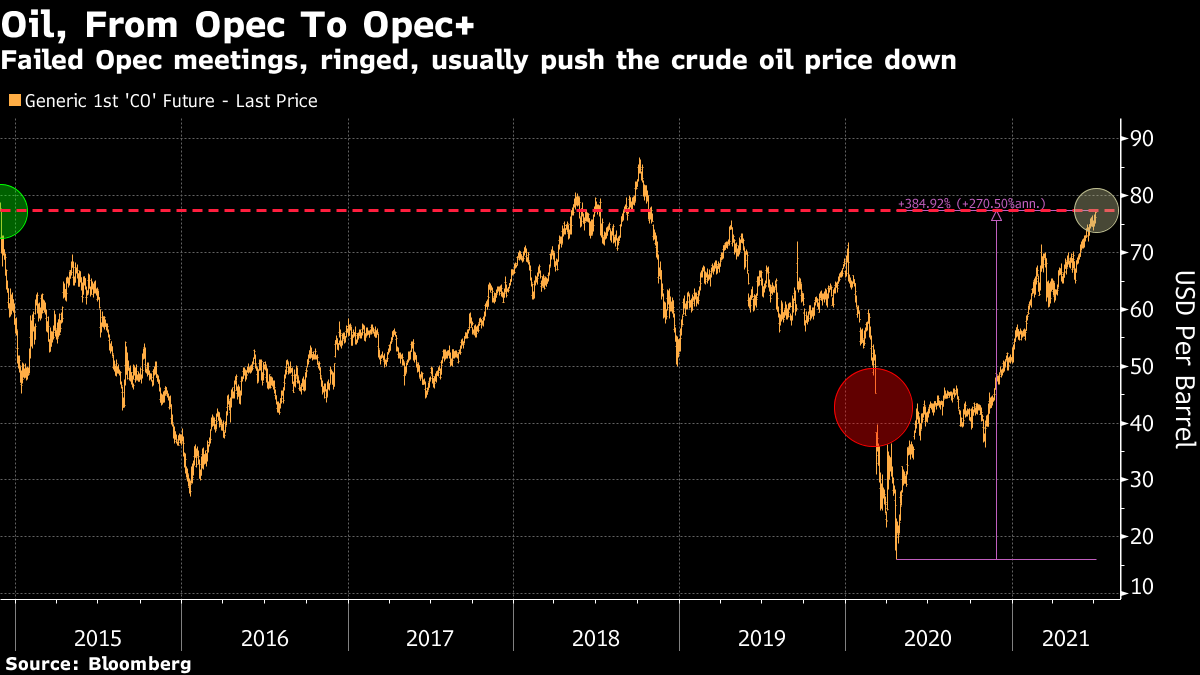

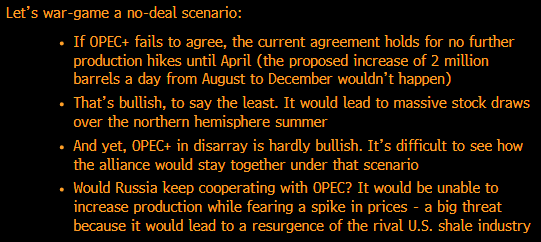

| It feels as though we've been here before. It also feels, as in so many other respects in these last bizarre 18 months, as though we have managed to turn through 180 degrees while still having little idea how we did it. Back in the second week of March last year, the Organization of Petroleum Exporting Countries, universally known as OPEC but now expanded to "OPEC+" after Russia joined its deliberations, held a disastrous meeting in which it failed miserably to reach an agreement. As a result, the oil price tanked. Now, OPEC+ has held another disastrous meeting in which it failed miserably to reach an agreement. The result, this time, is to push the oil price upward. While not as dramatic as last spring's debacle, Brent crude has now risen almost 400% since its low last year. (The gain in the West Texas Intermediate benchmark has been infinite after its price briefly went negative amid freakish conditions last year.) Brent is approaching its peak from 2018, and has also regained all the ground it lost following what is now known as the "Thanksgiving Day Massacre" from November 2014, when OPEC failed to reach agreement on cutting production and the oil price dived:  The last OPEC+ collapse fed into horrifying talk of a deflationary spiral as the world prepared to shut itself down to combat the pandemic. Now, with the vaccines' job largely done in several of the largest economies, its latest bout of indiscipline could feed into the new narrative that inflation is about to return in a way not seen since the 1970s, when OPEC regularly dominated the front pages. Why would a failed OPEC meeting have this kind of effect? OPEC is famous for making of the rest of the world pay more for oil. Its very purpose is to get as much money as it can for its oil (without overplaying its hand). More or less by definition, it would seem to follow that a mess at OPEC would mean cheaper oil. The difference this time is that the petroleum producers were trying to agree on an increase in supply, which would all else equal reduce prices. The United Arab Emirates scuppered the deal because it wanted to raise its production by even more. That implies that there is pressure within OPEC to let prices fall, and by more than some had been expecting. But this raises the question of what the baseline is, or what happens if nobody can get what they most want (in business school negotiations classes, known as a BATNA for "Best Alternative to a Negotiated Agreement"). The price has risen on the assumption that without an agreement, the BATNA will be to continue with supply at its current restricted levels. But that is a questionable assumption. This is how my colleague Javier Blas, who has been covering OPEC and the way the oil market deals with it for a long time, summed up the probabilities on the live blog held on the terminal:  As Javier suggests, this bullish scenario looks a little too good to be true. The UAE, and other producers, have to be wary of the potential competition from U.S. shale, and they need to avoid provoking the West with unnecessary inflationary pressure that exacerbates supply chain bottlenecks. Any eventual deal, it would appear, would involve more production rather than less, while any "no deal" could be disastrous for OPEC, with all discipline finally lost, while also quite possibly seeing some producers breaking ranks and increasing output. It might thus be dangerous to pile too heavily into oil just now. The cartel's difficulties dealing with an environment where it has to accommodate Russia and also treat the U.S. as a competitor show that it is less able to control the price than it used to be. It makes sense to brace for a world in which oil is more volatile. But it would be risky to bet too much that this meeting will mean continuing tight controls on production. Another view comes from Samuel Burman, commodities economist at Capital Economics Ltd: The UAE wants a higher baseline for its quotas to allow for higher domestic production to reflect the fact that its production capacity has increased since the October 2018 baseline. The country is also probably somewhat irritated that Russia hasn't been compliant with the agreement so far. (Russia is currently overproducing by around 100,000 bpd and hasn't introduced any compensatory cuts at all.) Somewhat unintuitively, the price of oil rose by 1% on the reports that the meeting had been delayed. Investors are presumably pricing in the possibility that July's quotas will remain in place during August. While this may turn out to be the case, we think that this spat involving the UAE increases the chances that the entire agreement falls apart which would clearly pose a downside risk to our near-term price forecasts.

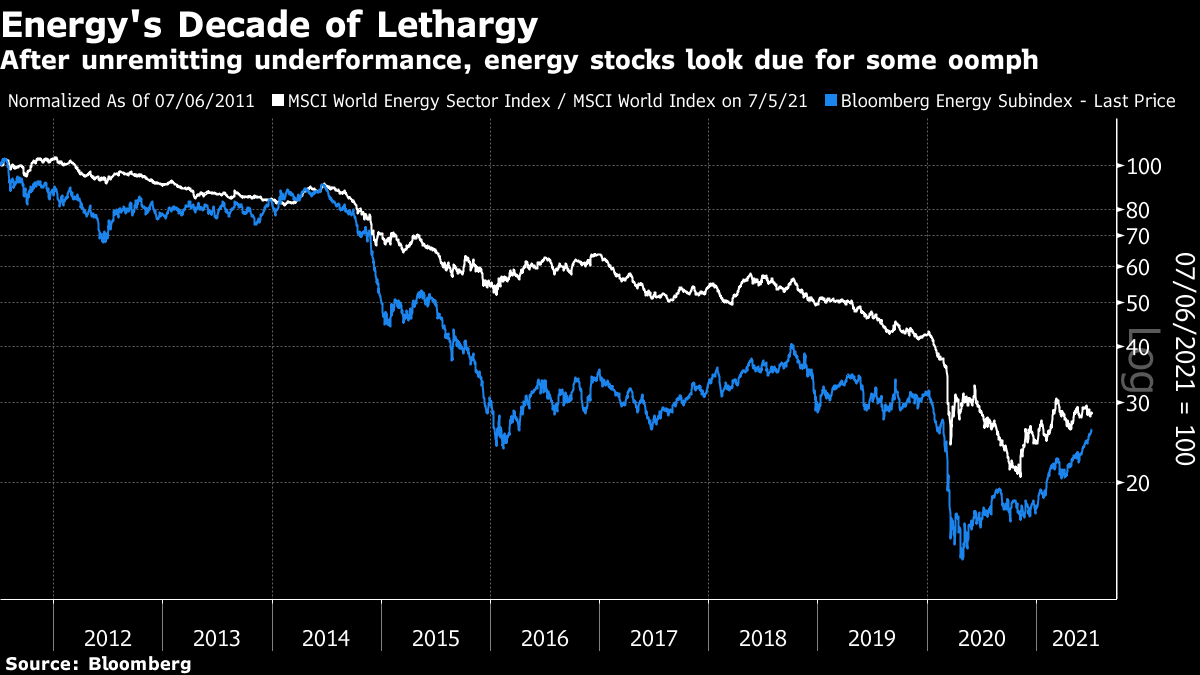

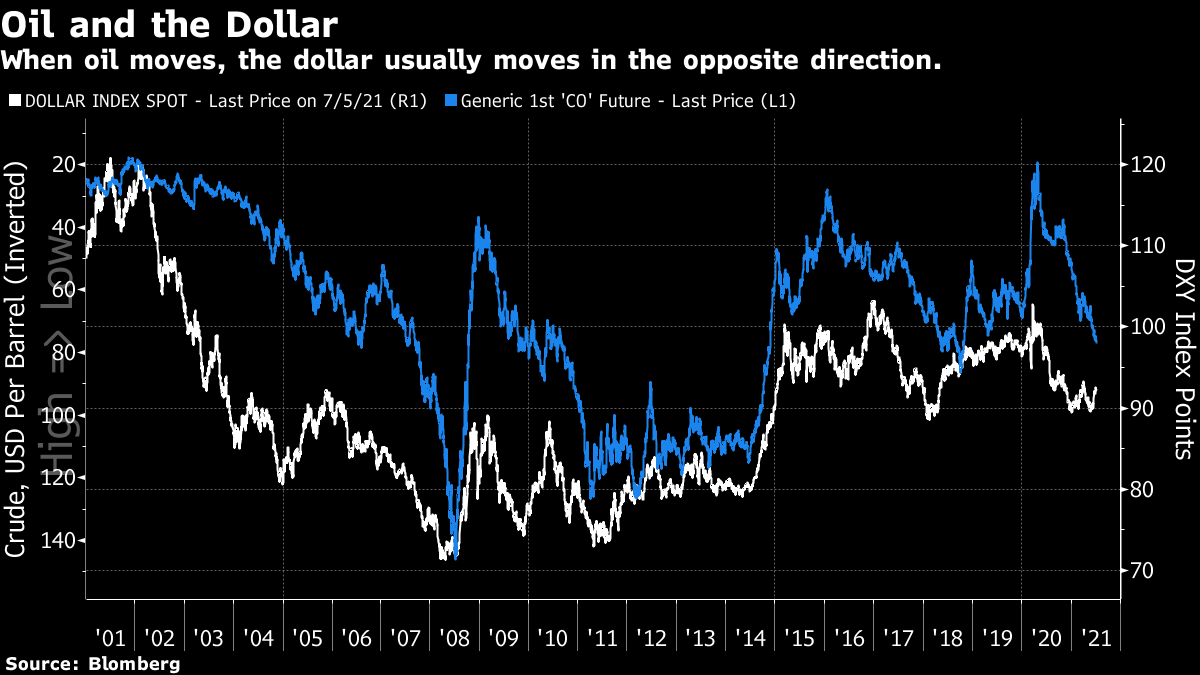

A weaker OPEC means a more volatile oil price, and possibly piles on the upward pressure that is coming from the reopening. A non-existent OPEC, which is easier to conceive of now than in decades, would mean cheaper oil. The Effects of Higher OilAssuming the oil price really does rise from here, what are the implications? One fairly straightforward one should be stronger energy stocks. For obvious reasons, their performance relative to the stock market as a whole tends to follow energy prices, but their recovery from last year's seizure has been far weaker than the rebound in the underlying oil price. This is because of the recent bout of nerves over the so-called reopening trade. If the economy manages to keep reopening on anything like the schedule that now seems reasonable, energy stocks look well positioned to take advantage:  Then there is the intriguing issue of the dollar. Traditionally, and logically, there is an inverse relationship between the currency and the crude price. As international oil transactions are denominated in dollars, this is close to inevitable. The dollar's big rally in late 2014 overlapped precisely with oil's collapse. The currency's weakening as crude enjoyed its post-Covid recovery made sense; its recent strengthening as oil makes fresh cyclical highs makes less sense. Technical chart factors, which matter a lot in the foreign exchange market, suggest that the dollar is on an upward trend. Continuing oil strength would be a problem for that:  Another nice and simple approach would be to look at what happened after the last OPEC+ implosion in March last year, and do the opposite. This is how I concluded my Points of Return write-up that day, almost 16 months ago. It's proved largely right — and the way markets have moved since then should at least be an encouraging reminder that market mechanisms do include a strong ability to right themselves: In the long term, there is an opportunity for everyone to benefit from cheaper fuel prices. Historically low bond yields are also effectively an invitation from the market for governments to borrow as much as they like, so if ever there was a time for fiscal expansion, this is it.

In the short term, we should expect a run on bank stocks, and energy stocks. Faced with such evidence of deflation, cyclical stocks will come under pressure. So will everything in what might be called the emerging market complex — industrial metals, as well as emerging market stocks, debt (which if denominated in dollars will be much harder to pay off), and currencies.

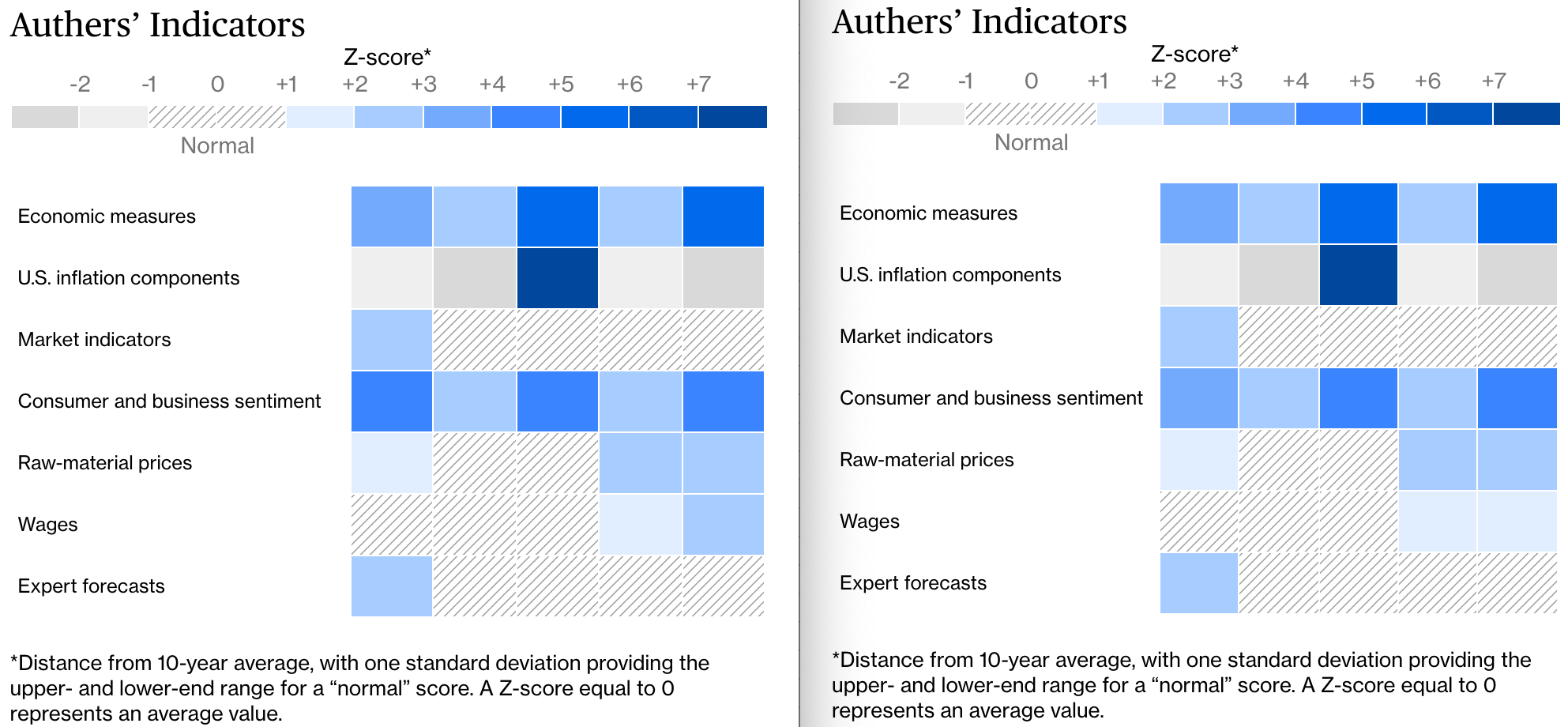

If you really think OPEC will keep supply lower as a result of this, or at least prove unable to cut back on the rising trend in oil prices, then do the opposite of this. Everything in the reopening trade looks much healthier than it did 16 months ago. And we might just have market mechanisms, rather rather than cartels, to keep prices at a sensible level. Authers' IndicatorsThe goings-on in the oil market will help to roil inflation expectations still further. Meanwhile, the latest update of our heat map, in which we offer 35 inflation indicators, shows that the bifurcation in expectations is deepening. The bond market is growing more relaxed, while surveys of businesses and consumers continue to show executives complaining of higher prices, while consumers say they are bracing for higher inflation. Higher oil prices by definition help to raise headline inflation, because fuel is included in the index. They can also have a deflationary effect as they leave people and companies with less money to spend on other stuff. The febrile atmosphere in the oil market needs to be watched; it is in conditions like this that inflationary psychology can take hold. The Federal Open Market Committee minutes from last month are also due this week, which could conceivably shift perceptions of the Federal Reserve — although it is hard to see much of a shift after the central bank's concerted attempts to calm people down following the FOMC's initial radical impact. Overall, looking at the latest heat map, it is hard at first to spot the difference from last week, even after a big download of data to start the month. That suggests calm, but also some complacency. The business surveys and the wage inflation numbers are darkening — it's intriguing that the bond market is as calm as it is.  Risks & RewardsFor yet more discussion about the inflation debate, we hope you'll find the latest Risks & Rewards discussion with Lisa Abramowicz useful. She came to it directly from anchoring Bloomberg Surveillance's coverage of the unemployment numbers which, very much like the heat map above, turned out to be quite a Rorschach test. Like an ink blot, what you saw in them said as much about you as it did about the labor market.  Survival TipsIf you want a friend, get a dog, they say. I was brought up in a cat household, I married another cat person, and I've never owned a dog. But I did spend the long weekend in America dog-sitting a lovely golden retriever called Hugo. If you need a friend, I can confirm, you definitely want a dog, not a cat. If you want to make friends of a bunch of strangers, I can also confirm that dogs are much, much better than cats. Apart from a few vitriolic disputes with neighbors when trying to retrieve a cat from their property, the various felines in my life have never introduced me to anyone. On any given walk with Hugo, he would introduce me to several dozen strangers, representing a full range of New Yorkers by gender, ethnicity and age. People really, really want to lavish love on a golden retriever. If you already have cats, I candidly cannot recommend adding a dog to the mix. And if you have a busy life style and a small Manhattan apartment, it's questionable whether it's fair to a large and energetic (and incredibly lovable and infallibly enthusiastic) new friend to keep them there. But yes, if you want a friend, get a dog. And thanks Hugo for a special Fourth of July. Have a good week everyone. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment