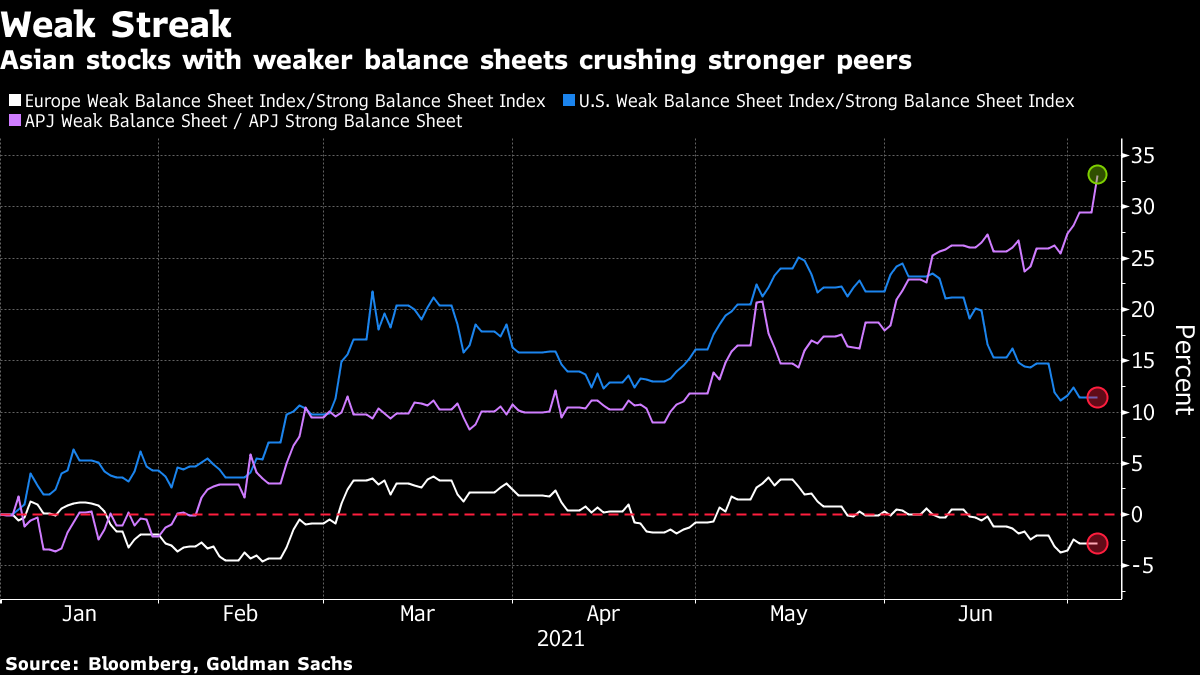

| Good morning. England pandemic rules, OPEC+ infighting, ECB review, Morrison latest. Here's what's moving markets. Live With ItBoris Johnson thinks people must learn to live with coronavirus. The U.K. prime minister announced plans to end social distancing and capacity limits at venues in England from July 19 and face masks will be made voluntary in all settings and the government will no longer instruct people to work from home. All remaining businesses will be allowed to open, including nightclubs, and none will be required to demand any proof of vaccination or testing before entry. The final decision will still need to be confirmed on July 12. OPEC+ InfightingOPEC+ abandoned its meeting without a deal, tipping the cartel into crisis and leaving the oil market facing tight supplies and rising prices. A disagreement over how to measure production cuts upended a tentative deal to boost output and swiftly devolved into an unusually personal and public spat between Saudi Arabia and the United Arab Emirates. What happens next will determine whether the breakdown of talks -- which sent Brent crude climbing toward $80 a barrel -- could escalate into a conflict as bitter and destructive at last year's price war. ECB IssuesThe European Central Bank is entering the final phase of its biggest strategy review in almost two decades, with officials looking to hammer out key differences over future monetary policy. The central bank's top policy makers are gathering this week for discussions delayed by the pandemic, and a key issue at stake is agreeing to a new formulation of the inflation target. The ECB's role in fighting climate change, as well as how to address an ever-evolving labor market will also be high on the agenda. These are the key issues to watch. Big ShopThe WM Morrison takeover saga took another turn Monday after buyout firm Apollo Global Management said it's considering making an offer for the company, shortly after the U.K. supermarket group had agreed to a 6.3 billion-pound ($8.7 billion) takeover from a consortium led by rival investment group, Fortress. That offer had trumped a bid from a third firm, Clayton Dubilier & Rice, which Morrison had rejected. Shareholders are wondering whether those firms have spotted some cheap real estate, while the episode has thrown the spotlight onto underperforming U.K. stocks. Coming Up…European stocks are looking flat, with trading light in Asia after the Independence Day holiday in the U.S. Supermarket earnings are in focus as Sainsbury's and online grocer Ocado report, just as bidders circle Morrison. Sweden's Industrivarden and Vulcan Materials in the U.S. are among the other major reports. ECB policy maker and Spanish central bank Governor Pablo Hernandez de Cos speaks at a banking conference. Finally, Bitcoin edges up after resuming a losing streak Monday. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningThere has been a notable divergence in the risk appetite of global equity investors over the last couple of months. Asia investors just can't get enough of the shares of companies with the weakest balance sheets, while their counterparts in the U.S. and Europe have shifted to favoring quality names. A Goldman Sachs Group Inc. basket of Asia ex-Japan stocks with less-than-robust balance sheets -- based on measures such as leverage and liquidity ratios -- rose to a fresh year-to-date high Monday against a cohort of stronger peers, and has outperformed by more than 30 percentage points. The surge stands in stark contrast to the performance of equivalent gauges in Europe and the U.S. which have lagged their more robust peers since May. The moves show an growing appetite for risk in Asia, where broader benchmarks have been underperforming those in other regions this year. In the U.S. and Europe -- which have experienced healthy returns -- they suggest investors are looking to protect those gains by switching to more robust names.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment