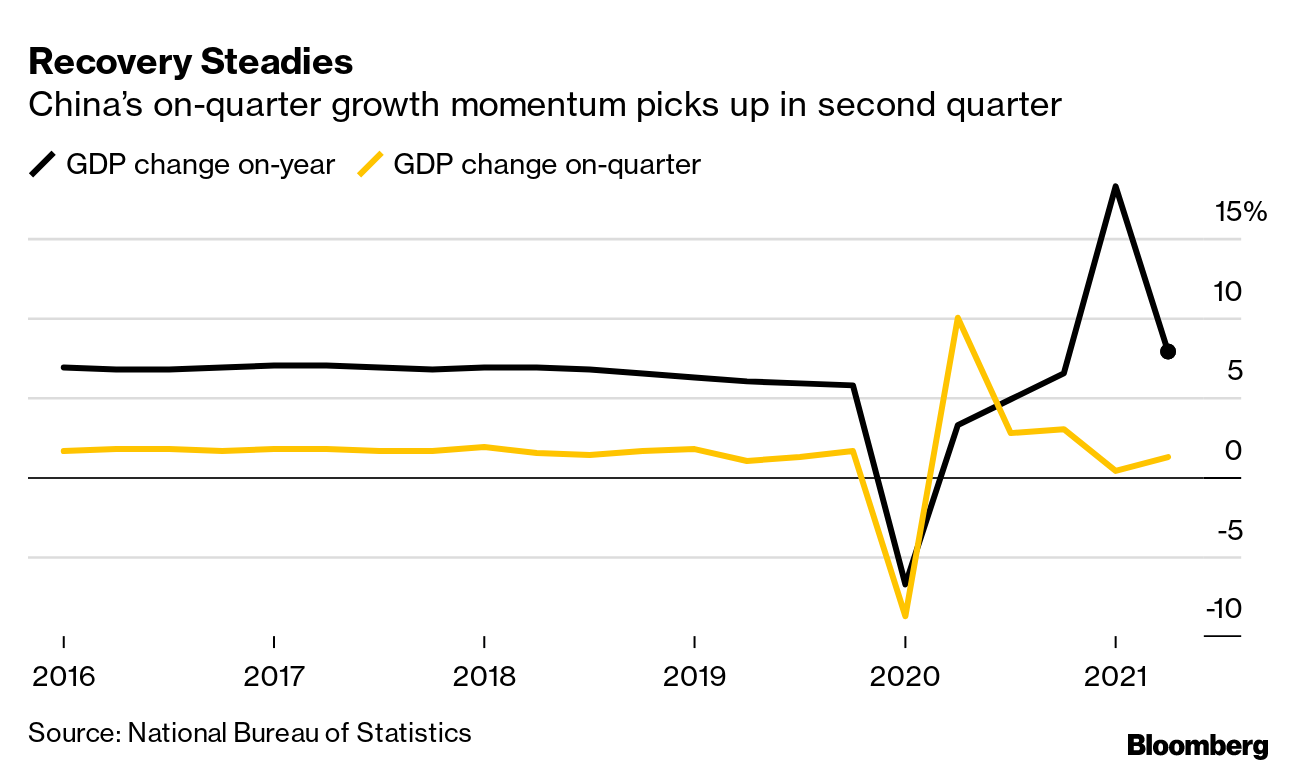

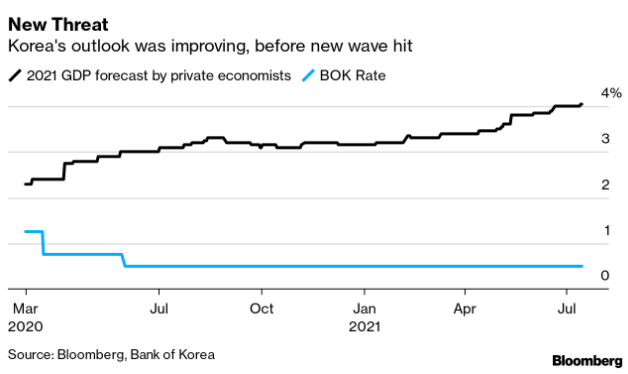

| Hello. Today we look at the lessons for the world from China's economic trajectory, South Korea's policy shift and how Covid-19 exposed weaknesses in America's supply chains. China LessonChina was first-in and first-out of the Covid-19 economic crisis, so its experience offers some valuable lessons for the rest of the world. Closely watched data Thursday showed GDP rose 7.9% from a year earlier in the second quarter, from 18.3% in the previous three months.  Lesson 1: What happens after the VIn a pattern we're likely to see across the globe, the economy's expansion returned to more-normal levels after the initial bounce from the lows of a year ago washed through the data. In the U.S., for instance, economists forecast growth of 12.8% in the second quarter from a year earlier, moderating to an expansion of 6.7% in the third. Lesson 2: Consumers are late to the partyConsumers have been lagging the recovery in China. Until now perhaps. Retail sales expanded 12.1% in June from a year earlier, beating estimates, led by an almost 30% increase in spending at restaurants and catering services. Helen Qiao, chief Greater China economist at Bank of America Securities, said the spending strength was a "great surprise." Lesson 3: Young people are missing outChina's jobless level remained steady at 5% in June, but it's a different story for the nation's young. The unemployment rate for people aged 16-24 was 15.4%. With millions of graduates about to hit the jobs market, that suggests policy makers will need to do more to create work. Lesson 4: Incomes are laggingIncomes aren't growing as fast as the economy, which will limit how much consumption can rebound. China's Ministry of Commerce has said it expects retail sales to grow only 5% a year in the period 2021-2025, well below the pre-pandemic level. Other governments such as America's splashed a lot more stimulus cash than China did, but once that fades, incomes elsewhere may struggle to keep pace too. Lesson 5: Policy direction won't be one-wayAs the Fed begins to discuss how and when it'll reduce bond purchases and some smaller developed-world central banks dial back their stimulus, China's experience suggests this'll be a stop-start process. Having reined in credit growth, the PBOC reversed course on Friday in a surprise move to cut the proportion of deposits banks have to lock away. Others may find they too need to be flexible once their recoveries begin to moderate. — Malcolm Scott The Economic Scene Another day, and another central bank heading toward tightening. Bank of Korea Governor Lee Ju-yeol on Thursday said officials will discuss raising its key interest rate from its next meeting in August after playing down the likelihood that the latest virus surge will dent the economy's recovery. While they left rates unchanged at 0.5% at the end of their policy meeting, a call for a quarter percentage point hike from one member helped send Korea bond futures plunging and strengthened the won as investors boosted their hawkish bets on the BOK to move early. New Zealand yesterday announced an end to quantitative easing, the Bank of Canada took another step down the tapering road and Chile hiked rates for the first time in two years. Today's Must Reads - Patient policy makers | Not all central bankers are in a hurry: Jerome Powell said it's still too soon to scale back the Federal Reserve's aggressive support for the U.S. economy, while acknowledging that inflation has risen faster than expected. Similarly, Bank of England Governor Andrew Bailey said he won't rush to make judgments about spiking inflation. Angola's central bank governor told us that he expects to keep the benchmark rate unchanged for the rest of the year. And European Central Bank Governing Council member Ignazio Visco said in a Bloomberg TV interview that he doesn't see policy being tightened for a long time.

- Digital dollar | The idea of a government-backed virtual currency has support in policy circles, but Wall Street sees a threat to its consumer-finance dominion.

- Financial balm | Senate Democrats' plan to expand Medicare coverage would help a growing senior population often struggling with hefty out-of-pocket medical expenses, potentially providing ballast for the economy in coming years.

- Hiring frenzy | U.K. companies added payrolls at a record pace in June as the reopening of the economy triggered an unprecedented scramble for staff.

- Chip cover | Booming semiconductor exports are masking the misery in Taiwan's services sectors, with restaurants, hotels and retail taking the biggest hit from the Covid outbreak.

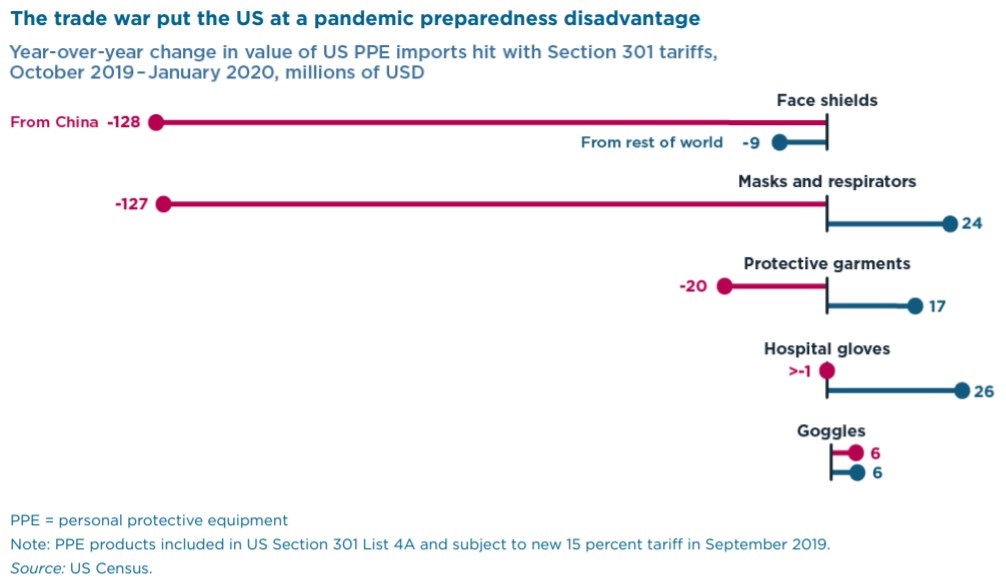

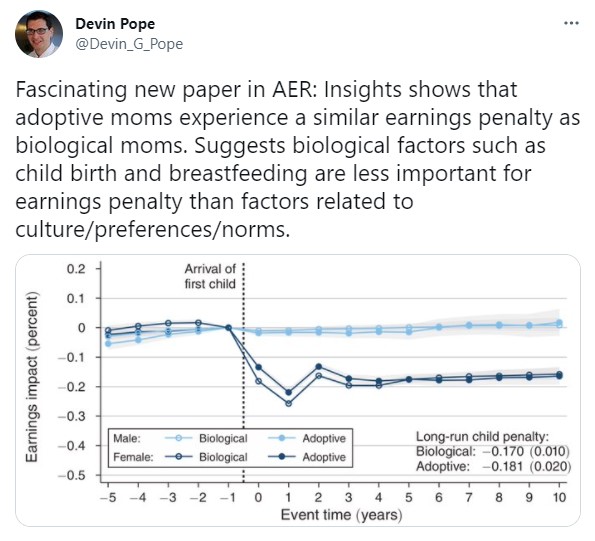

Need-to-Know Research The shortages of personal protective equipment and use of extraordinary trade and industrial policy during the pandemic revealed significant failures in preparedness, according to a new working paper by Chad Bown, a senior fellow and trade expert at the Peterson Institute for International Economics in Washington. Noting U.S. President Joe Biden's attempts at initiating a rethinking of international cooperation for trade in such medical supplies, Bown argues that "achieving those objectives will require different incentives and forms of international trade policy cooperation than were in place before the pandemic." Bown also calls for a new framework to "define the proactive international policy coordination required at the first signs of the next emergency." On #EconTwitterThe collateral cost of kids.  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment