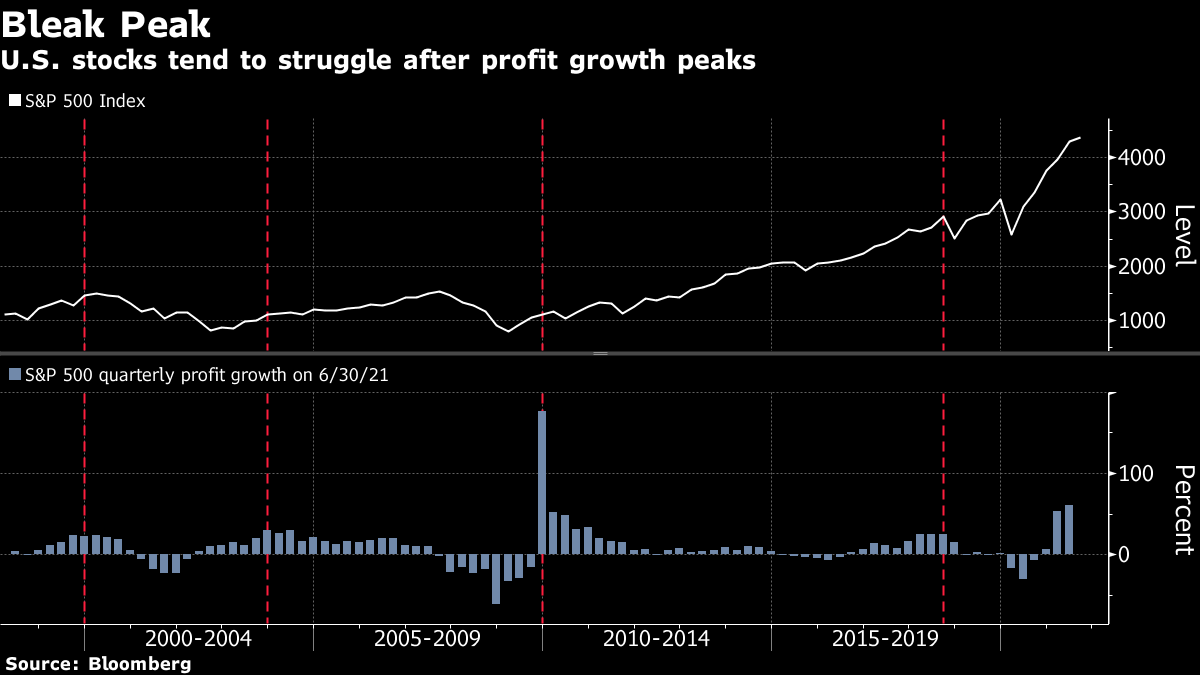

| Good morning. Decisions awaited on the digital euro, the EU's climate package and U.S. weed legalization. Here's what's moving markets. More CasesIncidence rates are on the rise across Europe as restrictions are eased and the coronavirus's delta variant becomes the dominant strain. The French government attributed more than 60% of new infections to the variant on Tuesday. The Netherlands logged a six-fold increase in cases during the week ended yesterday, a day after Prime Minister Mark Rutte apologized for an "error in judgement" in easing restrictions too early. Meanwhile, the U.K. government remains on course to ease remaining restrictions in England next Monday. Digital EuroEuropean Central Bank officials meet today to decide whether to move ahead with the creation of a digital euro. The next step would be an exploratory phase that ECB President Christine Lagarde says could take about two years, resulting in a virtual currency in euro-area citizens' figurative hands by the middle of the decade. Research and official remarks portray a payment system that is fast, easy to use, secure -- and, crucially for Lagarde, who has lambasted private crypto-assets -- not Bitcoin. Up a GearThe European Union is set to transform every corner of its economy -- from how people heat their homes to the cars they drive -- as the bloc uses a massive overhaul of rules to position itself as a global leader on climate change. Every industry would be forced to accelerate its shift away from fossil fuels in order to cut pollution by at least 55% from 1990 levels by 2030, according to proposals to be unveiled today, putting the EU on a path to eliminate greenhouse gas emissions by mid-century. High TimeA new U.S. Senate bill to legalize marijuana would let cannabis companies use banking services and trade on major stock exchanges, a potentially dramatic breakthrough for an industry long stymied by federal restrictions. The sweeping new legislation -- a draft of which Senate Democrats plan to release today -- would direct some tax revenue from marijuana sales to minority communities, which faced disproportionate arrests for marijuana possession. It would also keep some federal drug testing provisions and give the U.S. Food and Drug Administration oversight of cannabis regulation, a person involved in the negotiations said. Coming Up…European stocks are set to follow Asian equities lower after the surprise jump in U.S. inflation. It's the turn of the U.K. to report inflation data today. The Bank of Canada is expected to announce another round of bond tapering at its rate decision, following the move by New Zealand's central bank to end QE. There's lots going on in the corporate world too, with trading updates from Tullow Oil, developer Barratt and asset manager Ashmore, while in earnings Bank of America, Citigroup and Wells Fargo all report in a bumper day for U.S. banks. Meanwhile, Cathie Wood's Ark Investment Management has been selling Chinese tech stocks. Finally, France celebrates Bastille Day, but markets remain open. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningU.S. stocks greeted the start of second-quarter earnings season with a whimper, not only thanks to higher-than-expected inflation data but also because of mixed results from financial heavyweights JPMorgan and Goldman Sachs. Both firms beat analyst profit estimates only to watch their stocks slide Tuesday. It's a very early sign of what my colleague Lu Wang warned about recently -- that while profits may look robust when banks start reporting, the forecast earnings increase of 64% for all firms in the S&P 500 probably marks the peak of this expansion cycle. Peaks in earnings growth have tended to precede subpar performance in stocks, according to almost a century of data compiled by S&P Dow Jones Indices and Bloomberg. Since 1927, when profit momentum started waning, two-thirds of the time the S&P 500 fell or performed worse than usual in the following quarter. The most recent example was in 2018, after the boost from President Donald Trump's tax cuts faded. The U.S. benchmark fell 14% over the next three months after earnings growth peaked in the third quarter. With the S&P 500 now trading near its highest valuations since the dot-com bubble, there is little room for complacency.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment