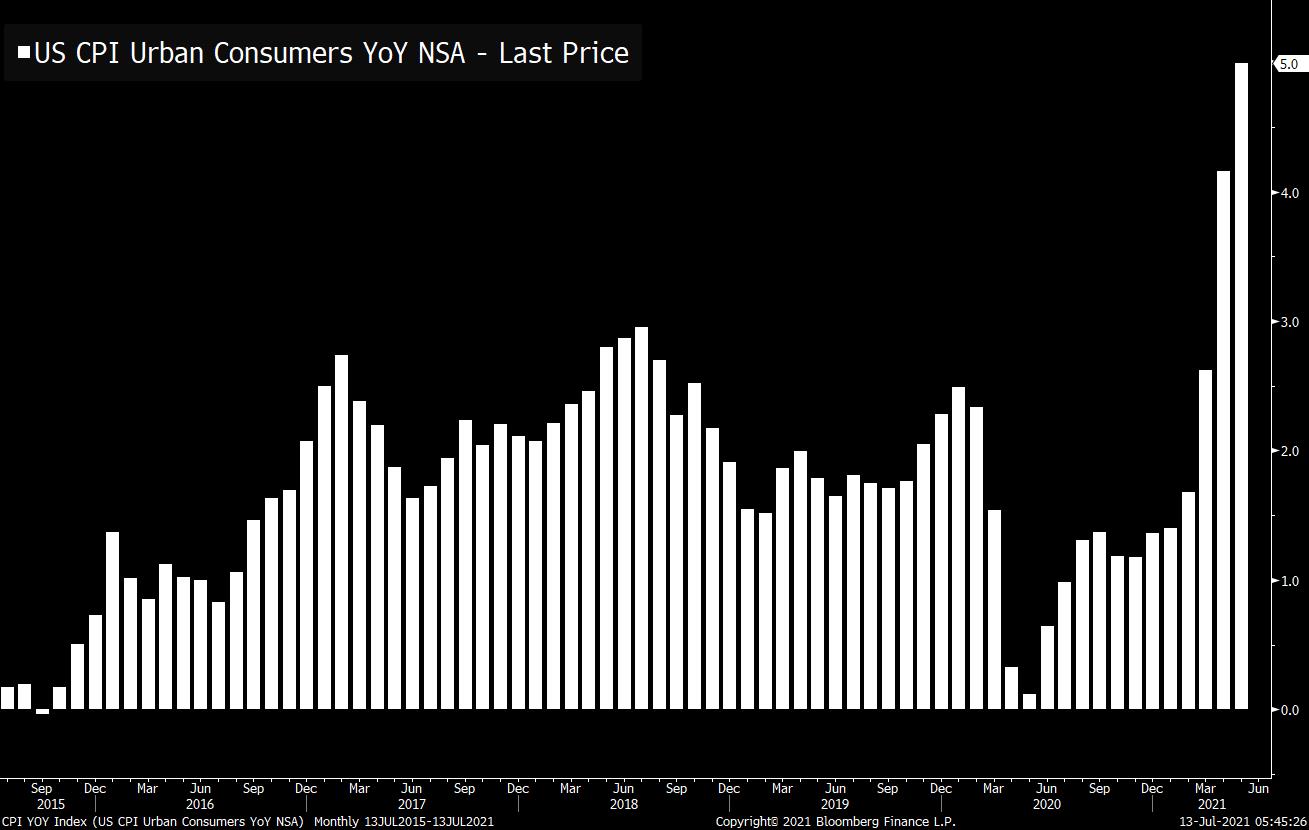

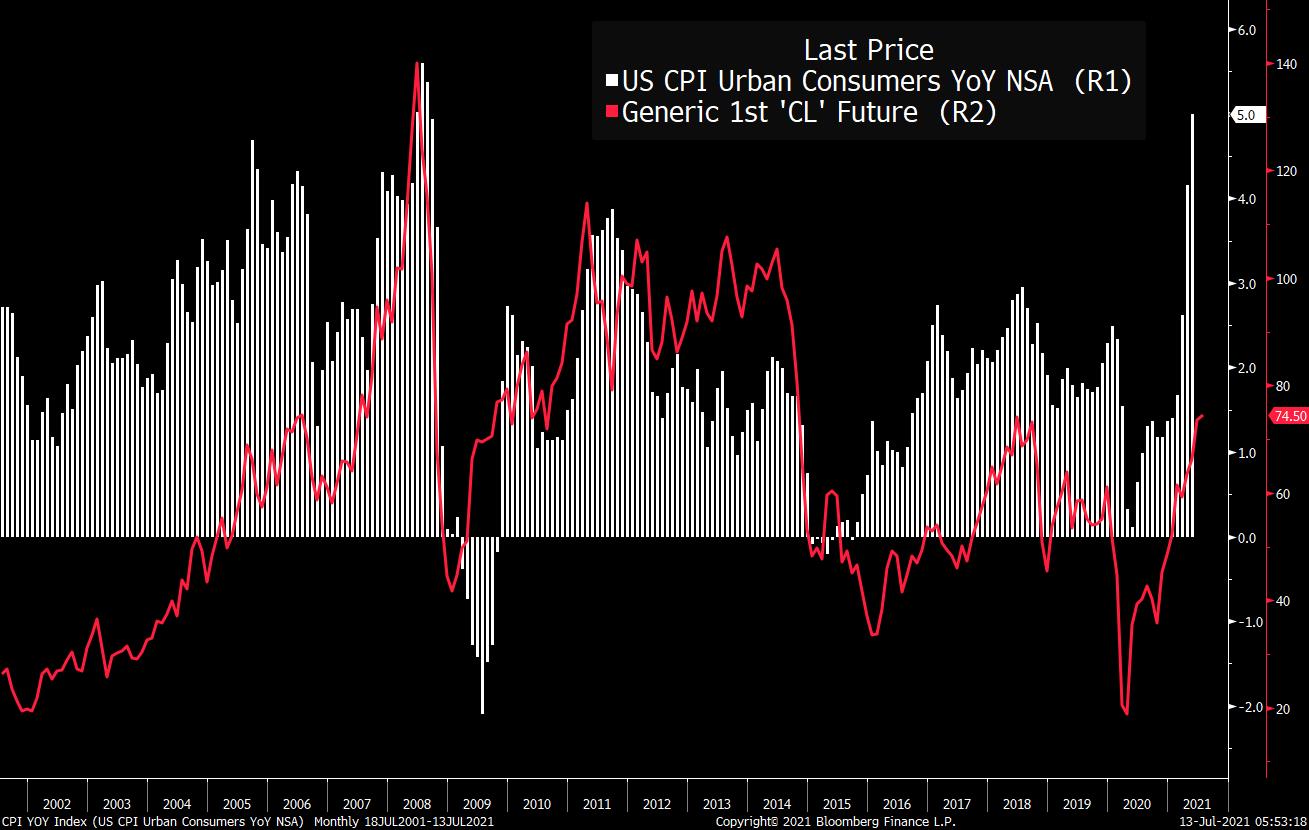

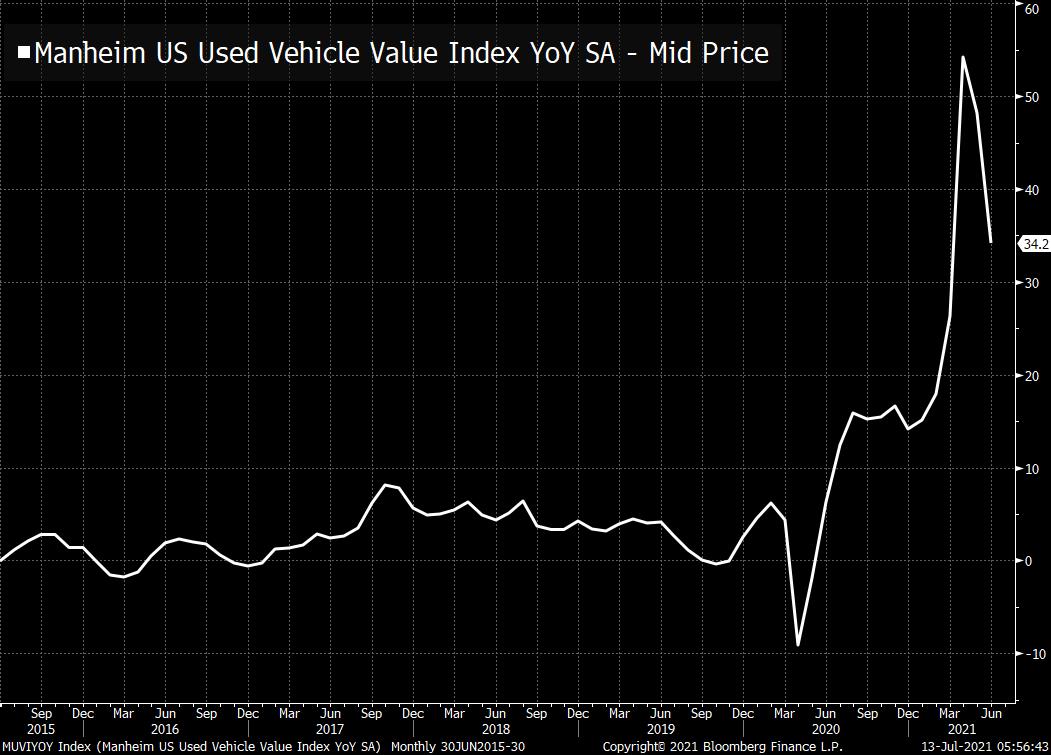

| Bank earnings, oil supply warning, and inflation data due. Earnings, payouts Goldman Sachs Group Inc. and JPMorgan Chase & Co. start Wall Street earnings season before the bell this morning. While revenue at the big banks is expected to fall, dragged lower by a drop in trading, a surge in dealmaking fees may reduce the size of the hit to their bottom line. There was mixed news for European bank shareholders, with the Bank of England saying it had fully removed limits on dividends while the ECB signaled it could take steps to ensure lenders avoid excessive payouts when the cap is most likely lifted later this year. Boost needed The International Energy Agency warned that global oil markets are set to "tighten significantly" unless there is an increase in production. With OPEC and its allies failing to reach agreement on output, and little sign of movement in time to allow a hike in August, crude inventories are set to fall even further below average levels. In the market this morning a barrel of West Texas Intermediate for August delivery traded as high as $74.74. Price rises There is likely to be something for both sides of the inflation debate in today's CPI number. The "transitory" camp will be pleased to see a small drop in the pace of price rises — should economist forecasts about today's data prove correct — while those worried about sticky inflation will point to the continued very high level of price growth. The median estimate for the headline number to have eased to 4.9% in June, with core inflation rising to 4%. The data is published at 8:30 a.m. Eastern Time. Markets mixed Global equity gauges are generally fairly quiet ahead of earnings and inflation data. Overnight the MSCI Asia Pacific Index added 0.8% while Japan's Topix index closed 0.7% higher as the regions stocks were boosted by a rally in Chinese tech companies. In Europe the Stoxx 600 Index was broadly unchanged at 5:50 a.m. with telecom shares lifted by strong Nokia Oyj results. S&P 500 futures pointed to little change at the open, the 10-year Treasury yield was at 1.366% and gold was slightly higher. Coming up... Minneapolis Fed President Neel Kashkari, Atlanta Fed President Raphael Bostic and Boston Fed President Eric Rosengren all speak at 12:00 p.m. The U.S. sells $24 billion of 30-years bonds at 1:00 p.m. The June Monthly Budget Statement is at 2:00 p.m. As well as the big banks, PepsiCo Inc. reports results today. What we've been readingHere's what caught our eye over the last 24 hours And finally, here's what Joe's interested in this morningToday at 8:30 we get the latest installment of the CPI report, and once again it's expected to be hot on a historical basis. Forecast for the headline number is 4.9% year-over-year, and 4.0 if you exclude food and energy.  Of course, as soon as the number comes out, the world will likely be divided into two camps, those who point to the headline number and sarcastically say "transitory!" and others who go into the guts of the report, and look at what were the key drivers pushing the number on one direction or the other. And while it can be dangerous go go spelunking into the various subcomponents in search of confirmation bias it's still wise to get a good grip on what categories are making the difference. I was listening to Skanda Amarnath of Employ America on David Beckworth's Podcast Macro Musings last night. And Skanda was making the point that if you look at what was driving inflation pre-Great Financial Crisis, it was in large part oil and other commodities, which were associated with the boom in China and other EMs. Here's a longer chart of monthly YOY CPI prints (white) alongside crude oil (red) and you can see how the soaring price of oil in 2006, 2007, 2008, coincided with rapidly increasing CPI.  Now the Fed, obviously, is not a fan of any sustained inflation. But it's main tool is simply to weaken the domestic economy (by raising rates), putting people out of work, lessening demand and hoping that that feels upward price pressure. Except that if all of the inflationary impulse is coming from Chinese oil demand, what exactly is that accomplishing? So again, you don't want to be the person who just shouts "transitory!" a second after the release hits, as if your sarcasm is some useful insight. And you don't want to hunt too deep just for a piece of information that supports your macro view. But to actually understand the current conditions, there's no substitute for looking at the drivers of inflation and sussing out how long they're likely to continue and whether the Fed has the levers at its disposal to do anything about them. For awhile it was used cars going to the moon that was the big story, but now they're rolling over.  Maybe this time we'll watch rent. Joe Weisenthal is an editor at Bloomberg Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment