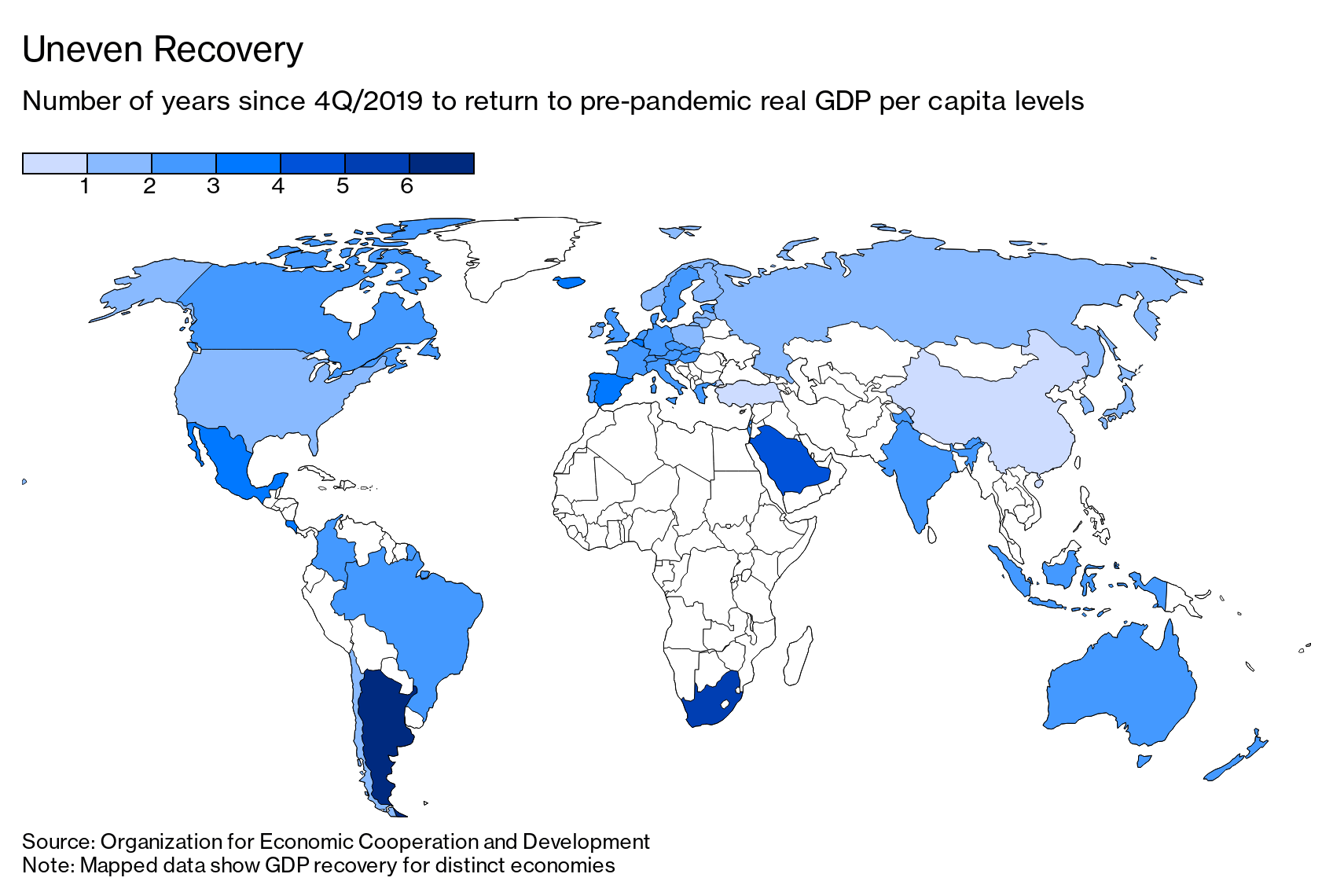

| Hello. Today we look at the OECD's new economic forecasts, examine what Friday's U.S. jobs report has in store and explore the interaction between trade and gender equality. Left BehindThe global economic recovery is looking K-shaped. That's the warning made today by the Organization for Economic Cooperation and Development. Yes, it boosted its forecast for global growth to 5.8% from 5.6%, but it did so while also worrying the rebound may fuel inequalities worldwide as some people struggle to rediscover their pre-pandemic standards of living. Argentina and Spain, for example, risk facing more than three years between the onset of the coronavirus and the return of per-capita economic output. That compares to just 18 months in the U.S. and under a year in China.  "It is with some relief that we can see the economic outlook brightening, but with some discomfort that it is doing so in a very uneven way," OECD Chief Economist Laurence Boone said. "The risk that sufficient post-pandemic growth is not achieved or widely shared is elevated." The divergence could worsen because of a failure to get enough vaccines and support to emerging and low-income economies, which already have less capacity to absorb shocks and could face sovereign funding issues, the Paris-based institution said. Without inoculations in all countries, the OECD said new variants and renewed lockdowns could hit confidence, plunge activity back into a disruptive stop-go pattern, and bankrupt firms. Entering the great the inflation debate, the OECD acknowledged the risk of rising prices amid higher operating costs, with virus containment and supply disruptions leading to shortages of components, and muted competition as a result of bankruptcies. But it echoed central bankers by saying tensions should fade by the end of the year as production capacity normalizes and consumption shifts toward services. —Simon Kennedy The Week AheadThe U.S. jobs report for May due on Friday augurs a pivotal moment for investors to assess whether the surprisingly tepid job gains seen last month were a momentary blip or the start of something more persistent. The median forecast of economists surveyed by Bloomberg News is for a 650,000 gain after April's disappointing 266,000 What Bloomberg Economics Says:"The April jobs miss was a one-off and ongoing reopening across the country will pull a significantly higher number of Americans into employment in May. June and July data will test whether the recent slowdown in hiring stemmed from Americans opting to receive unemployment benefits instead of seeking to get back to work, as augmented benefits will expire in half of the states across the nation."

A number of Federal Reserve officials are scheduled to speak this week, including Chair Jerome Powell, who will address a climate change conference on Friday alongside International Monetary Fund chief Kristalina Georgieva, European Central Bank President Christine Lagarde and People's Bank of China Governor Yi Gang. Concurrently, Group of Seven finance ministers will start a two-day meeting in London, at a time of diverging fortunes across the bloc and when a plan to reshapeglobal taxes is in debate. Still, a full global deal to overhaul taxation rules may not be achieved until October, the OECD said Monday. Central banks in India, Australia, Israel and Ghana are among those interest setting rates. All are expected to stay on hold. Today's Must Reads - China births. Beijing will allow all couples to have a third child in a bid to arrest an aging population and shrinking birthrate that threatens the country's long-term economic prospects.

- Cooling the yuan rally. China's central bank raised the amount of foreign-currency deposits lenders need to set aside as reserves, a move that may help stem the yuan's rally by reducing the supply of other currencies in the country.

- Fed pivot? Inflation readings are coming in hotter than Fed officials expected and could accelerate when they debate scaling back their massive bond-buying. Vice Chairs Randal Quarles and Richard Clarida both declared last week that policy makers could begin this discussion at "upcoming meetings."

- 'Spirit of Green.' It's been almost three years since William Nordhaus became the first economist to win a Nobel Prize for research on climate change. Now he has a new book out with a note of optimism. Read our interview here.

- Grace period. Argentina will hold off on a $2.4 billion debt payment with the Paris Club that's due Monday and will instead use a 60-day grace period to try to reach an agreement with the group.

- Stepping aside. The governor of the Central Bank of Iran said his deputy will takeover management of the institution while he focuses on his presidential election bid.

- Turkey's downside. The economy continues to outpace the majority of its Group of 20 peers, but that doesn't necessarily mean its citizens are getting richer given price and currency instability.

- Work from paradise. An Indonesian ministry will introduce a "Work From Bali" program for civil servants aimed at helping to revive the island's battered economy.

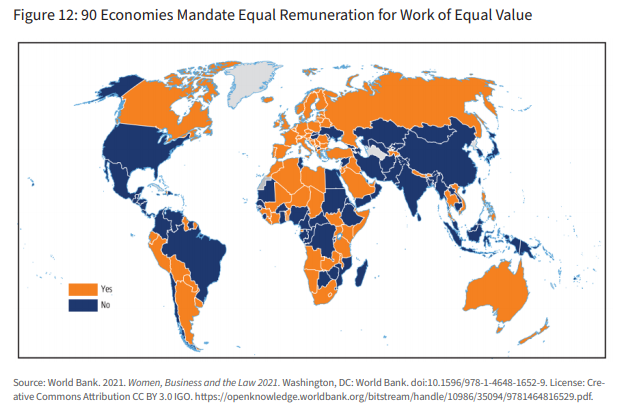

Join the Debate on the Bloomberg TerminalWe'll be further exploring the world of new economics with reporter Matt Boesler and John Jay College associate professor J.W. Mason on June 1 at 10 a.m. ET. Terminal users can join us here and send any questions you have for J.W. or Matt to TOPLive@bloomberg.net. Need-to-Know Research The Center for Strategic and International Studies has a new report out that explores the interaction between trade and gender equality. It found that while trade liberalization has increased global market access for women as well as men, more can be done. Governments can insert gender-specific language in trade agreements and work to elevate women's voices, with demonstrated commitments such as these seen as crucial to leveling the gender playing field for women in trade, it said. Read the full research on the web. On #EconTwitterEconomists' power is a joking matter.  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment