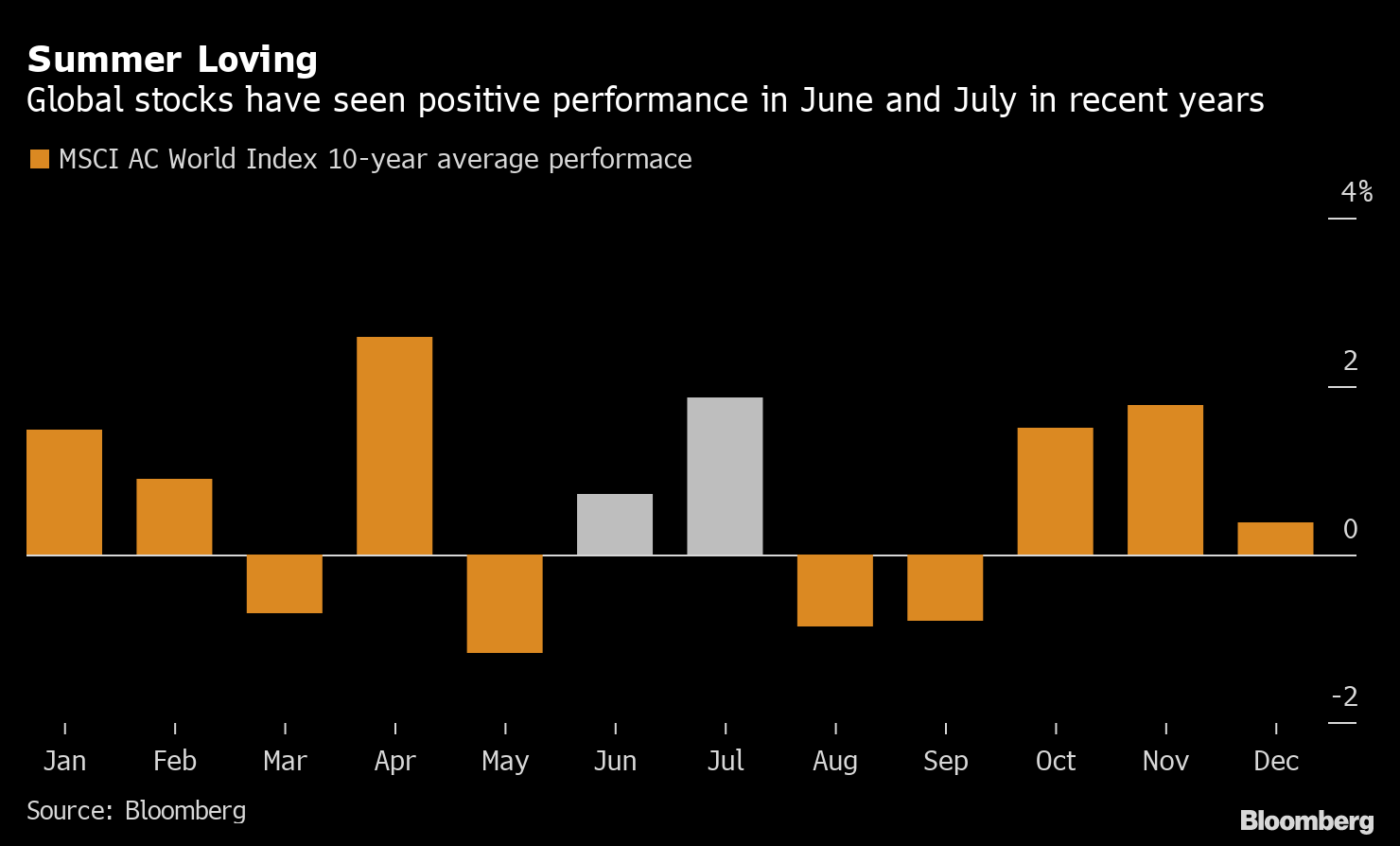

| Good morning. Germany's Greens slide in polls, a bloc emerges to oust Israel's Netanyahu, and U.K. intelligence find the virus lab leak theory "feasible." Here's what's moving markets. The Origin QuestionAs the U.S. reported its lowest coronavirus infection levels in a year, two disease experts warned that the world needs the cooperation of the Chinese government to trace the origins of Covid-19 and prevent future pandemic threats. The precise origins of the virus remain obscure, though the theory of an accidental leak from a laboratory gained traction last week, when U.S. President Joe Biden said that two "elements" of the intelligence community leaned toward a natural origin, while another leaned toward a global hub for coronavirus research in Wuhan. Britain's Sunday Times reported that British intelligence agencies now believe it is "feasible" that the global pandemic began with a leak. Anti-Netanyahu BlocIsraeli leader Benjamin Netanyahu's opponents edged closer to ousting him on Sunday after an erstwhile ally agreed to join an emerging alternative government. Pro-settlement security hawk Naftali Bennett said he'd work towards a national unity government with centrist Yair Lapid. The coalition Lapid is trying to cobble together would ally nationalists, centrists and leftists, secular and religious, Arab and Jew in the most unlikely alliance in the annals of Israeli politics, all of them driven by a desire to replace the 71-year-old Netanyahu, who is on trial in a Jerusalem court on multiple graft charges. Belarus SqueezedThe Biden administration announced it would re-impose U.S. sanctions against nine Belarusian state-owned enterprises and is developing additional penalties to target officials in the administration of President Alexander Lukashenko over the forced landing of a Ryanair jetliner and the arrest of a dissident journalist. In a bid to offset Western pressure, Belarus's main ally Russia will release $500 million from a previously agreed loan after talks between the country's leaders in Sochi. Ebbing TideAn earlier surge of support for Germany's Green Party seems to be receding with four months to go before the country heads to the polls. It declined for a second consecutive week while Chancellor Angela Merkel's conservative bloc clawed back support in the weekly Insa poll for Bild am Sonntag. Support for the Greens fell to 22% while the Christian Democratic bloc rose 1 percentage point to 25%. Merkel isn't seeking a fifth term after 16 years in office, meaning Germany's parliamentary election on Sept. 26 will set the stage for her successor. Coming Up…Expect a quieter start to the week with markets in the U.K. closed for the Spring Bank Holiday, while U.S. markets will be shut for Memorial Day. Spain, Portugal, Italy and Germany all report May inflation data, while the Riksbank's Governor Stefan Ingves speaks at the Swedish Economics Association's annual meeting. Real-estate investors Immofinanz and CPI Property Group as well as videogame developer CD Projekt are among the earnings to watch, as a lighter week for results kicks off. And with just two weeks before Copa America was due to start, the football tournament finds itself without a host as an increase in Covid cases rules Argentina out. What We've Been ReadingThis is what's caught our eye over the weekend. And finally, here's what Cormac Mullen is interested in this morningIt looks like the "Sell in May"' worrywarts got it wrong. The MSCI AC World Index is poised to confound bears with a month-to-date gain of 1.3% through May 28, and just one trading day to go in what is traditionally the global equity gauge's weakest month of the year. A surge in European shares has been the standout contributor, with monthly gains in the Stoxx 600 closing in on 3% -- well above returns seen in the U.S., Asia and emerging markets. Equity bulls can also look forward to a solid couple of months ahead, at least if recent seasonal patterns return. The MSCI AC World has gained 0.7% in June on average over the last 10 years -- and another 1.9% in July, according to data compiled by Bloomberg. Of course having seen that bearish calls for May didn't quite work out this year, investors could be forgiven for doubting that bullish ones for June and July will fare any better.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment