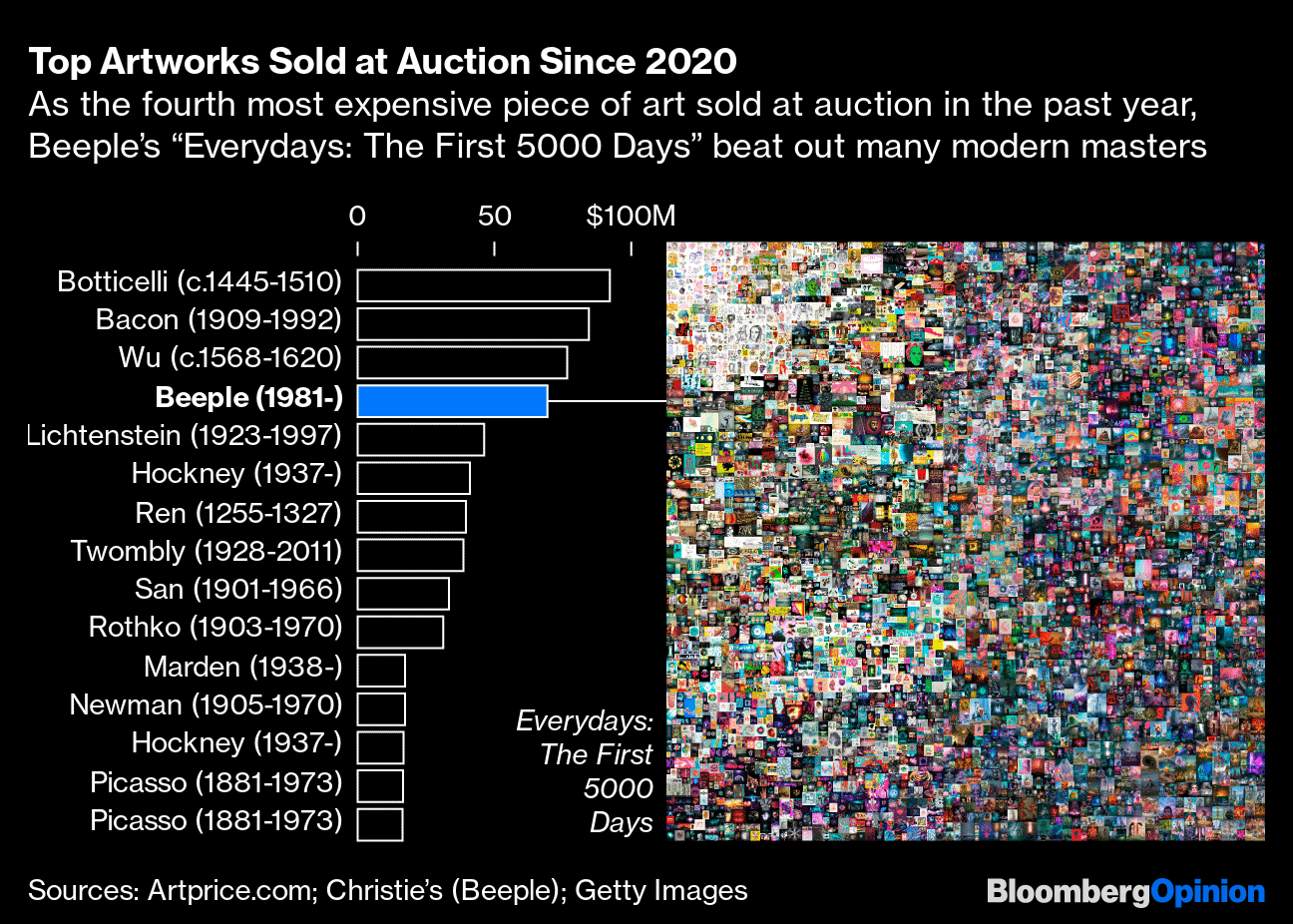

| This is Bloomberg Opinion Today, a manifesto of Bloomberg Opinion's opinions. Sign up here. Today's AgendaToo Soon, Ray DalioRay Dalio is a hedge-fund legend, and not just because of his, uh, colorful management style. By some measures his "radical transparency" has made him the best hedge-fund manager in history. But Dalio had a rough 2020, badly mistiming bets around the pandemic. Unfortunately, a long anti-bond manifesto he published yesterday on LinkedIn suggests his timing may still be off a smidgen. Dalio agrees with many Bloomberg Opinion writers that bonds are wildly expensive and offer dismal returns, a situation not helped by the U.S. government relentlessly backing up the Bond Truck to dump even more on the market. But as Marcus Ashworth notes, timing is everything: The Fed and other central banks will be mopping up much of that debt for the foreseeable future. Dalio is anti-anything-priced-in-dollars, but the greenback should benefit from a U.S. massive economic rebound for, again, the foreseeable future. Being too early is basically the same thing as being wrong, and the Oracle of Westport looks early on this one. Dalio suggests investors look to Asia, specifically China — which, as luck would have it, happens to be a place Bridgewater Associates has already pitched an expanding tent. China does offer higher bond yields, but that may only compensate you for the country's dicey rule of law, Marcus notes. And Beijing's micromanagement means Chinese stocks are unlikely to crash, John Authers writes, but that same micromanagement means they also offer little in the way of thrills. Chinese regulators have already clipped Alibaba's wings and may next take away its most influential platforms, writes Tim Culpan. Now they're turning to the Tencent conglomerate, which Tim and Shuli Ren write could suffer if Beijing destroys its ability to behave like a venture capitalist. "The United States could become perceived as a place that is inhospitable to capitalism and capitalists," Dalio warns near the end of his letter, referring to the threat of dire new taxes on the wealthy. One could argue that China, which has "communism" printed right on the tin, is already there. Further Investment Advice Reading: Huge concentrated market bets can sometimes pay off massively but more often result in poverty. Diversify. — Victor Haghani and Richard Dewey Let's Not Go Droning OnPresident Barack Obama became infamous on the left for his liberal deployment of drones in the Middle East. President Donald Trump took care of that problem by simply no longer keeping track of all the drone attacks. Now President Joe Biden has a chance to lift Trump's veil of secrecy and return transparency and accountability to this practice, writes Bloomberg's editorial board. He could also restore some Obama-era standards that Trump dropped, including making sure civilians aren't in the way. A trickier foreign-policy puzzle for Biden is how to handle the war in Yemen, where many of these drone attacks have happened. For a while there it seemed so simple: Just tell Saudi Arabia to get out, something Trump never wanted to do. But it's not that easy, writes Hussein Ibish, especially with the Iran-backed Houthi rebels still running amok in the country. They will have to be convinced to accept a peace deal and end the war. Crypto Regulation Don'ts and Don'ts We wrote yesterday about how central banks could deal with the threat of Bitcoin by replacing it, which drew some thoughtful commentary from Bitcoin cultists, er, enthusiasts. For example, did you know you could spell "moron" with a "g"? Anyway, India is considering solving the cryptocurrency problem by banning cryptocurrency altogether. This is not quite what we had in mind! Andy Mukherjee warns such a ban would make it harder for the country to create its own official digital currency. Before he left office, Trump's Treasury Department proposed a rule that would make it trickier to transfer cryptocurrencies from regulated wallets to unregulated ones, in an effort to attack money laundering. Aaron Brown writes such a rule would barely make a dent in laundering but would make legitimate crypto uses more annoying. Telltale ChartsThe youngs are saving the art world by buying art online and on the blockchain, writes Andrea Felsted.  Further ReadingEurope may soon slap tariffs on goods that don't meet its climate standards, unless the U.S. decides to play along. — Peter Orszag Europe is being far too cautious about potential risks of the AstraZeneca vaccine, hurting its pandemic fight. — Lionel Laurent It's a win for Dublin that Stripe has committed to it, but financial regulators need to be on their toes. — Elisa Martinuzzi U.K. police must do a better job of making women feel safe in the wake of the Sarah Everard murder. — Therese Raphael Biden has to get more urgent about getting nominations confirmed. — Jonathan Bernstein Telling Justice Stephen Breyer to retire only makes it harder for him to do so. — Noah Feldman ICYMIWhere you can take home the most pay after taxes. The world's three biggest coal users plan to burn even more. The Bobby Bonilla contract was good for the Mets. KickersCone snails are liars and murderers. (h/t Alistair Lowe) Florida found voter fraud … in high school homecoming votes. (h/t Scott Kominers) FINALLY: An NIT bracket. (h/t Jamie Ellis) Comets are more dangerous than we thought. Notes: Please send homecoming votes and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment