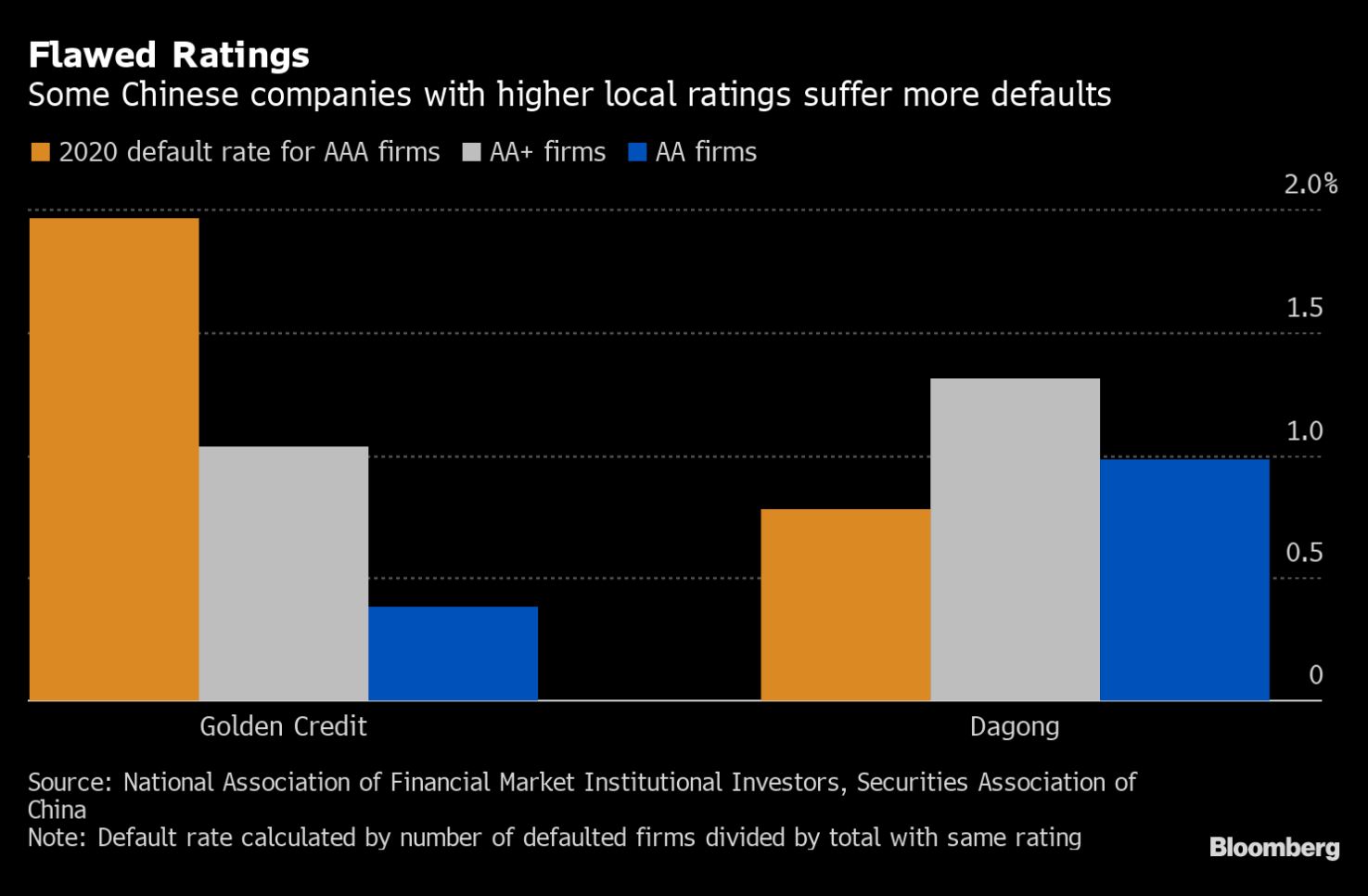

| AstraZeneca's Covid shot may get the green light, again, in Europe. Wall Street's biggest banks plow billions into China. Bill Gross is shorting U.S. Treasuries. Here's what people in markets are talking about today. Some of the EU's biggest governments are hinting that they may be ready to lift AstraZeneca suspensions. Italy and France will green-light the vaccine again if the European Medicines Agency advises it's safe in a statement expected on Thursday. A South African study showed AstraZeneca's shot didn't offer much protection against its virus variation. Vaccine nationalism in countries including the U.S. and India may hamper rollout in poorer and middle-income countries, according to Adar Poonwalla, CEO of the Serum Institute, world's biggest vaccine maker. In Hong Kong, social-distancing measures will be extended to Mar. 31 and HSBC's main office in the city will be closed until further notice. Cases are at record highs in the Pacific's most populous nation, Papua New Guinea, where the outbreak could have geopolitical implications. Asian stocks are set to open steady Wednesday as investors weigh the strength of the economic recovery ahead of the U.S. Federal Reserve's latest policy comments. Benchmark Treasury yields hovered near their highest levels in over a year. The S&P 500 closed lower after three sessions of record-breaking gains, Apple and Microsoft lifted the tech-heavy Nasdaq 100 and the Dow Jones Industrial Average fell from a record high. Futures were little changed in Japan, fell in Australia and rose in Hong Kong. Oil retreated and the dollar was steady. Bitcoin traded around $56,000, down from a weekend peak above $61,000. U.S. banks are plowing billions of fresh cash into China last year undeterred by political turmoil as the world's second-largest economy further opens its $50 trillion financial market. Goldman and CitiGroup are leading the way, and together with JPMorgan, Bank of America and Morgan Stanley they have $77.8 billion in exposure, up 10% from 2019. Europeans banks are also keen to boost investments. London-headquartered HSBC is increasingly pinning its future to Asia, with plans to invest at least $6 billion across the region, including China. Barclays is also looking to expand in Asia and build on its small presence in China. Hong Kong's bankers are working around the clock as the region's companies rush to go public. Initial public offerings in the city have already hit almost $11 billion, a close to 500% jump from a year earlier, with video streaming platform Bilibili and search giant Baidu among companies preparing multi-billion dollar deals. Digital roadshows and clients eager to move fast mean bankers are keeping dawn-to-midnight schedules, say some, even turning down deals where they're relegated to junior roles. Meanwhile SPACs are also reshaping Asian banking, with JPMorgan and Credit Suisse pulling people from other areas to focus on deals involving special purpose acquisition companies, according to people with knowledge of the moves. Huawei, owner of the world's largest portfolio of 5G patents, is demanding mobile giants like Apple cough up. The Chinese tech giant will begin charging a "reasonable" fee for access to its trove of wireless 5G patents, potentially creating a lucrative revenue source by showcasing its global lead in next-generation networking. It aims to get paid despite U.S. efforts to block its network gear and shut it out of the supply chain. The battles unfolding over who profits from 5G may dwarf the tech industry's earlier fights over smartphone technology. Read more about the ongoing patent war here. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayIt's a truism in markets that the things thought to be safest tend to become the most dangerous. Think back to triple-A rated securitizations during the financial crisis, which were used as collateral for billions of dollars of leverage and then became worthless. Or consider the drama in U.S. Treasuries last March — few would have expected such weird pricing discrepancies in the world's most liquid and reliable market. In China, the propensity for apparently "safe" securities to suddenly turn into something else entirely is highlighted in a recent regulatory report published last week and picked up by my Bloomberg colleague Ye Xie.  Bloomberg Bloomberg As he puts it, the report describes an "upside-down ratings" system where companies given higher credit ratings were ultimately more likely to default last year. For instance, 1.96% of companies rated AAA by Golden Credit Rating defaulted in 2020, compared to 0.38% of companies deemed less creditworthy and rated AA. At Dagong Global Credit Rating, AA+ companies defaulted more often than those rated a notch lower at AA. China has been ostensibly keen to encourage more differentiation in its credit market, but I don't think this is exactly what investors had in mind. No surprise then that the country's credit rating agencies are under increasing scrutiny. You can follow Tracy Alloway on Twitter at @tracyalloway. Something new we think you'd like: We're launching a newsletter about the future of cars, written by Bloomberg reporters around the world. Be one of the first to sign up to get it in your inbox soon. |

Post a Comment