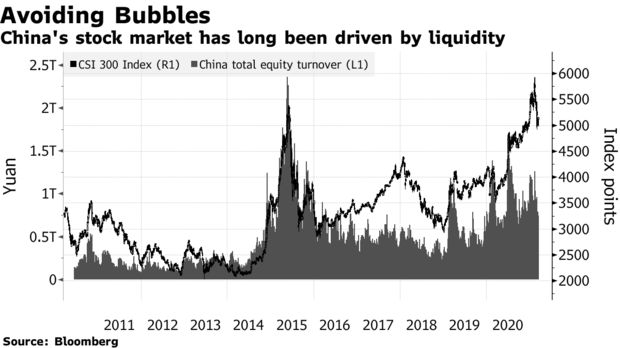

| The U.S. and EU sanction China over alleged human rights abuses. Hong Kong's vaccine roll-out is being hampered by reliance on Chinese shots. Japan turns its back on climate change targets. Here's what people in markets are talking about today. The U.S., U.K., the EU and Canada imposed sanctions against China over alleged human rights abuses on the Uyghurs in Xinjiang, drawing an immediate reaction from Beijing. The EU kicked things off with sanctions that target four Chinese nationals and one entity. The U.S., Canada and the U.K. — chairing the Group of Seven meetings this year — largely mirrored these actions that are largely symbolic and unlikely to impact China's economy or behavior. China reacted by saying the move was based on lies and disinformation and said it would sanction 10 individuals and four entities on the EU side, saying the measures "harm China's sovereignty and interest" and weren't based on facts. Asian stocks looked set for a higher open, tracking rallies in the U.S. as Treasury yields dipped ahead of a series of closely watched auctions this week. Futures climbed in Japan and in Hong Kong, while Australian contracts edged lower. Technology shares led gains in the U.S. that saw the Nasdaq 100 rise 1.7% and the S&P 500 Index up 0.7%. Turkey's markets tumbled after the central bank governor was ousted. The dollar weakened slightly and oil edged higher after its worst week since October. Bitcoin is raising energy concerns while trading around $50,000. Hong Kong's vaccine roll-out is being hampered by reliance on Chinese shots. When Carrie Lam rolled up her shirt sleeve to get the Asian financial hub's first Covid-19 vaccination last month, she gave a ringing endorsement of Sinovac's shots. But since Lam's public inoculation, confidence in both Sinovac and her government's vaccine drive has plummeted. Seven deaths and dozens of adverse reactions were reported following the first 160,000 doses of the shot. Residents began signing up in droves for the vaccine made by BioNTech and Pfizer, the only alternative shot available. Investigations revealed no connection between the deaths and China's shot, but the hysteria came on top of mounting public mistrust of Hong Kong authorities over the past two years as Beijing moved to restrict free speech and lock up democracy advocates. Japan is one of the last countries in the world to support coal-fired generation overseas — and it's considering financing new capacity in Bangladesh. If an expansion to the Matarbari power plant moves forward it may prove awkward for Prime Minister Yoshihide Suga, who has pledged to make Japan carbon neutral by 2050. The Japan International Cooperation Agency said in an email it's conducting an environmental and social impact assessment for an expansion to the Matarbari power plant. While the country has tightened conditions for participation in overseas coal projects, it has left the door open to new plants if recipient countries commit to long-term decarbonization and support only the highest-efficiency plants. A Japanese billionaire's once drab clothing firm has become the latest sportswear sensation, rivalling household names like Uniqlo. Yoshio Tsuchiya's Workman, which started life as a maker of drab uniforms for laborers, has expanded into low-cost but functional sportswear and outdoor gear. Workman's shares have more than quadrupled since the start of 2018 and its evolution has won praise from investors, analysts and even Tadashi Yanai, the entrepreneur behind Uniqlo and Japan's richest man. Some observers question whether the positive momentum has reached its limit but for analyst Ruhell Amin, global head of retail equity research at William O'Neil, the retailer has the potential to really take off when the country gets clear of the Covid-19 pandemic. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayYears ago I wrote that "China's markets resemble nothing if not a great rolling ball of money that moves from asset class to asset class, constantly searching for the next source of sizable returns." In a country marked by capital controls, excess liquidity is effectively trapped and forced to ricochet like a pinball in a machine. Skilled investors in China's markets are able to identify where this money will flow to next, scouring policy statements for hints of government initiatives or for signs that authorities might clamp down on a particular company or market, and watching message boards and the like for retail trends.  There are signs the U.S. is now going down a Chinese-style ball-of-money path too. Sloshing liquidity courtesy of a dovish central bank will probably end up ping-ponging between U.S. assets. While some of it might leak out of the States, viable alternatives to U.S. assets are limited with yields now low around the world (Chinese bonds and stocks are definitely an alternative, but there's also limited supply for overseas investors). At the same time, investors will probably do well to eye increased government spending and fiscal stimulus for signs of where money might go to next. Money released by the state doesn't flow evenly to all things and everyone. Pinpointing exactly where it's going is getting even more important. In this kind of environment, market bubbles don't necessarily burst so much as roll from one thing to the next. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment