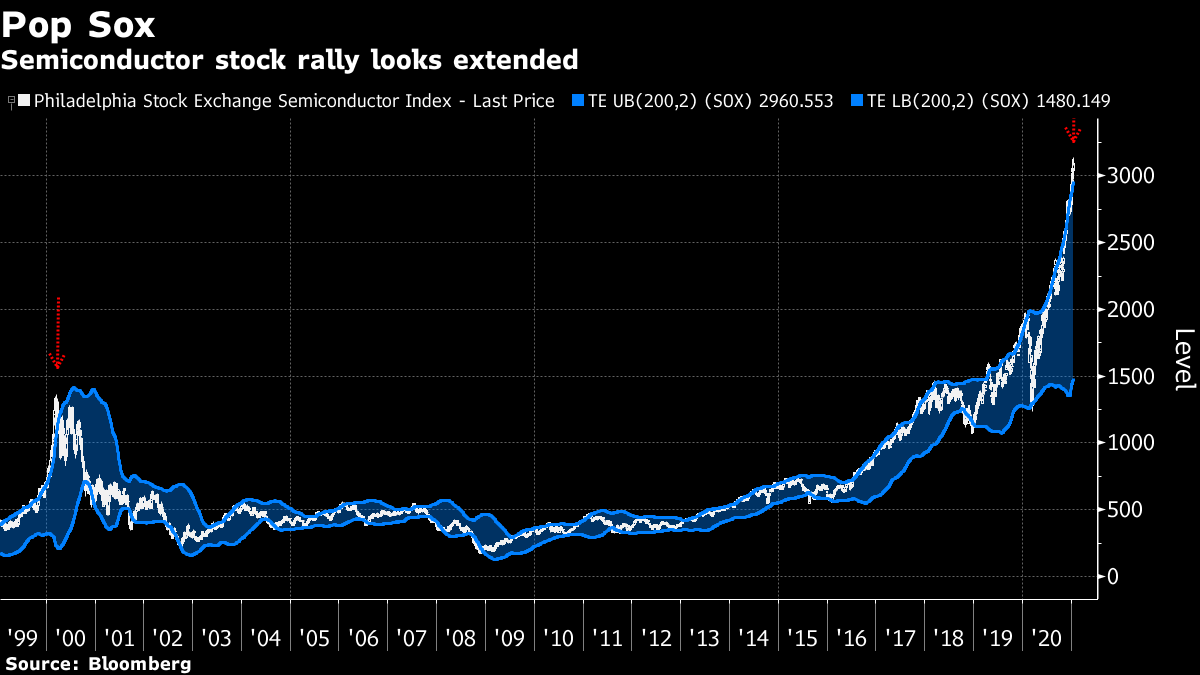

| Good morning. A virus anniversary, ECB decision day and Biden's first actions. Here's what's moving markets. Unwanted AnniversaryIt was a year ago today that the word "coronavirus" first appeared in this newsletter. Now, more than two million fatalities and a global economic recession later, it remains the dominant subject. In latest developments, the U.K. reported another record number of daily deaths, Germany mandated the use of medical-grade masks in shops and on transport, and a South Africa study raised questions about the protection Covid-19 antibodies provide against new virus strains. Still, Deutsche Bank is advising clients that late spring should be a real turning point for major economies, thanks to vaccines. Let's hope we're talking about something different this time next year. As You WereIt's a European Central Bank decision day, and while no interest rate change is expected, Bloomberg Intelligence analysts see potential downside risks to economic forecasts when President Christine Lagarde provides an update on the euro area at a press conference. Citigroup, meanwhile, says major changes to policy are unlikely, as the tools introduced last time -- akin to yield curve control -- are capable of adapting to moderate movements in expectations for the economy. The euro edges up against the dollar this morning. Here's a decision day guide. Weighing Up BidenStocks are gaining as traders weigh up what the new White House means for markets. Of near-term concern is the skeptical response from possibly influential Senate Republicans to President Joe Biden's proposed pandemic relief package. Biden, meanwhile, started his tenure vowing to end the "uncivil war" he says Donald Trump spurred, though he added his predecessor also left him a "very generous" letter. The new president signed executive actions to reverse withdrawals from the Paris Climate Agreement and the World Health Organization, and stop construction of Trump's infamous border wall. He's also expected to revoke a permit for the Keystone XL pipeline and end a travel ban against some predominantly Muslim and African countries. For stocks, reasons to be bullish continue to mount, investor Barry Ritholtz writes for Bloomberg Opinion. Twitter's Clampdown Twitter locked the official account for the Chinese Embassy to the U.S. after a post that defended the Beijing government's policies in Xinjiang, where critics say China is engaged in the forced sterilization of minority Uighur women. The move is the tech group's latest high-profile attempt to enforce its policies, coming shortly after it permanently banned Trump for repeated rules violations, and potentially complicates Beijing's efforts to reset relations with the U.S. under Biden. Beijing this week sanctioned former U.S. Secretary of State Michael Pompeo and other Trump officials just as Biden was being inaugurated, in a move that the White House called "unproductive." Twitter's decision also adds to an already complicated relationship between U.S. tech firms and the Asian nation. Coming Up…Companies reporting earnings include Entain, after the Ladbrokes bookmaker owner recently rejected a takeover approach, Swedish engineering giant Sandvik and Zur Rose, an online pharmacy whose share price has tripled over the past year. The Bank of Japan left its main policy rate unchanged after forecasting the economy will regain more lost growth than previously thought overnight. Elsewhere, Turkey, South Africa and Norway are all expected to leave rates as they are. In data we'll get euro area consumer confidence and U.S. housing starts. Finally, for fiscal stimulus in this region, Italian Prime Minister Giuseppe Conte won lawmakers' backing for 32 billion euros of extra spending, while the U.K. is drawing up plans to extend support for jobs in the months ahead. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningJust as one swallow does not a summer make, one day's performance does not make a trend. But a prominent absentee from Wednesday's 'everything rally' that greeted U.S. President Joe Biden was the Philadelphia Semiconductor Index, which pulled back from an all-time high and closed lower. Often seen as a leading indicator for the broader market, the gauge has been on a tear amid surging demand for chips, and is on track for its best January in nine years. Taiwan Semiconductor Manufacturing Co., the world's biggest contract chipmaker, supercharged the rise last week after it outlined plans for as much as $28 billion of capital spending this year -- an increase of 63% from 2020. So there is a clear fundamental reason for gains. But after a rally of 140% from its March low, the SOX is at its most extended since the dotcom bubble and is trading at a record gap from its 200-day moving average. Where the SOX goes next could lead the way for the broader market, and the time looks nigh for a breather.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment