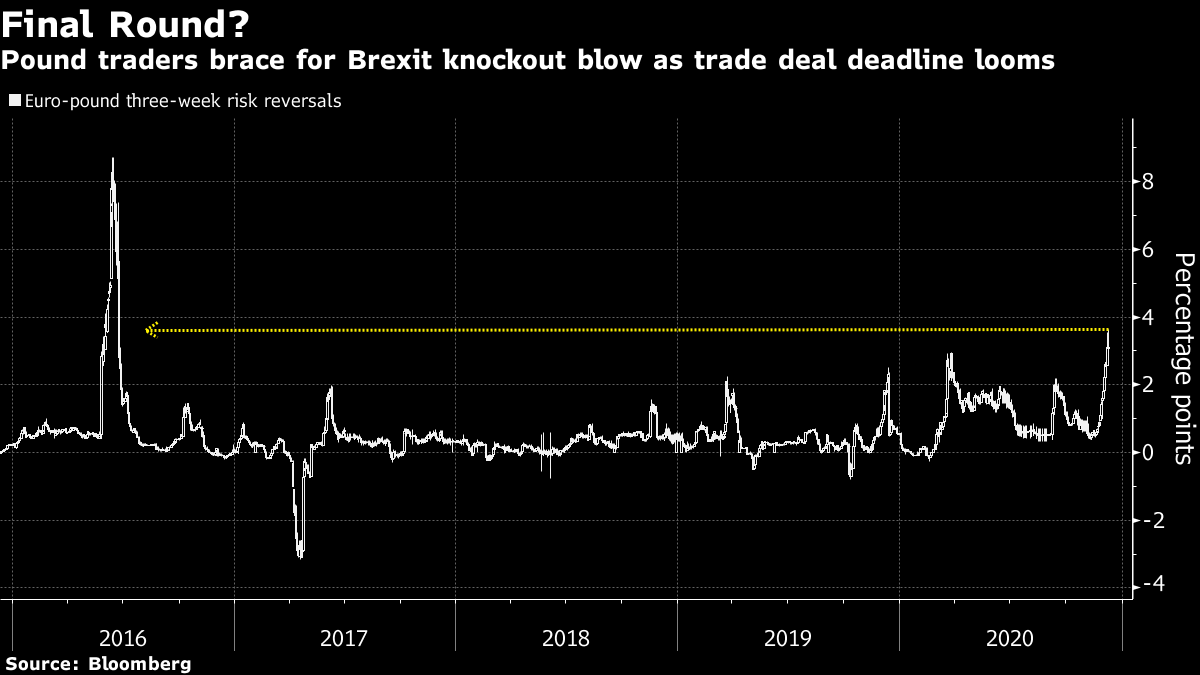

| Good morning. A European summit and central bank meeting come on the same day, Facebook faces a competition lawsuit and stocks are edging lower. Here's what's moving markets. Double HeaderIt's a big day for European politics and economics. Leaders are set to meet in Brussels to discuss further pandemic coordination, along with issues like climate change and security. The summit comes after Poland and Hungary agreed on a budget compromise with Germany, and as Brexit talks are set to continue until Sunday. Focus turns to the European Central Bank in Frankfurt this afternoon, with policy-makers having indicated that they'll extend their unprecedented stimulus programs. Here's an ECB decision day guide. Zuckerberg's Empire ThreatenedMark Zuckerberg's empire is under threat after the U.S. Federal Trade Commission filed an antitrust lawsuit against the technology giant, accusing it of abusing its monopoly powers in social networking to stifle competition. The suit focuses on Facebook's acquisition of photo-sharing app Instagram in 2012 and the messaging service WhatsApp two years later. The deals were meant to "squelch" competitive threats, the commission wrote in its complaint. Stocks LowerAsian stocks slipped and European futures are edging lower after U.S. benchmarks fell Wednesday amid dimming prospects for fresh fiscal stimulus. The pound, meanwhile, fell as large gaps remain in the Brexit discussions. JPMorgan reckons stocks are set for a $1.1 trillion boost next year amid increased demand from retail investors and a reduction in supply due to leveraged buyouts, share buybacks and a slowing need for equity raisings. Away from stock markets, the bank says the rise of cryptocurrencies may be coming at the expense of gold. Vaccine Document HackPfizer said some documents submitted to Europe's top drug regulator regarding its Covid-19 vaccine had been accessed in a cyber-attack on the agency. The company and partner BioNTech said the European Medicines Agency informed them that the attack would have no effect on the timing of the vaccine review. Coming Up…We'll get industrial production data from the U.K. and France, and inflation statistics from the U.S. Elsewhere, online grocer Ocado reports earnings, and in the U.S., Airbnb has its trading debut after an initial public offering gave it a fully diluted value of about $47 billion. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningThe not-so subtle fish dinner between British Prime Minister Boris Johnson and European Commission President Ursula von der Leyen failed to provide a Brexit breakthrough but has at least given traders another deadline to place their bets on -- this Sunday. Options markets -- specifically three-month euro-sterling risk reversals -- show they are now paying more to guard against further pound declines than at any time since the aftermath of the 2016 vote. That's evidence of an overwhelmingly bearish bias against sterling that should get contrarian traders salivating. Having been bludgeoned over the head by Brexit for four years now, any degree of "closure" could well lead to catharsis, not panic. Not only because both the good and bad scenarios are negative and will have been extensively analyzed but also because the British economy will hopefully get a natural boost next year -- earlier than most -- from a vaccination-driven post-pandemic recovery. The pound is down 7% against the euro this year, already a sizeable move. Nobody likes a bad break-up, but sometimes it makes it easier to move on.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment