| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. EU leaders will likely approve today a landmark stimulus package, after Germany brokered a compromise with Hungary and Poland to lift their veto over the deal. Disbursements will be tied for the first time to democratic standards, though potential sanctions won't kick in until the European Court of Justice has ruled on the legality of the new rules. An agreement will pave the way for the flow of $2.2 trillion to the continent's battered economies. Much of the new EU budget is earmarked to finance the transition to a low-carbon economy. Now that the money is there, Poland and other eastern holdouts may also lift their objections today to a stricter emissions-cut goal for 2030. A potential deal on the new climate target will have a transformational impact on the region's economy.

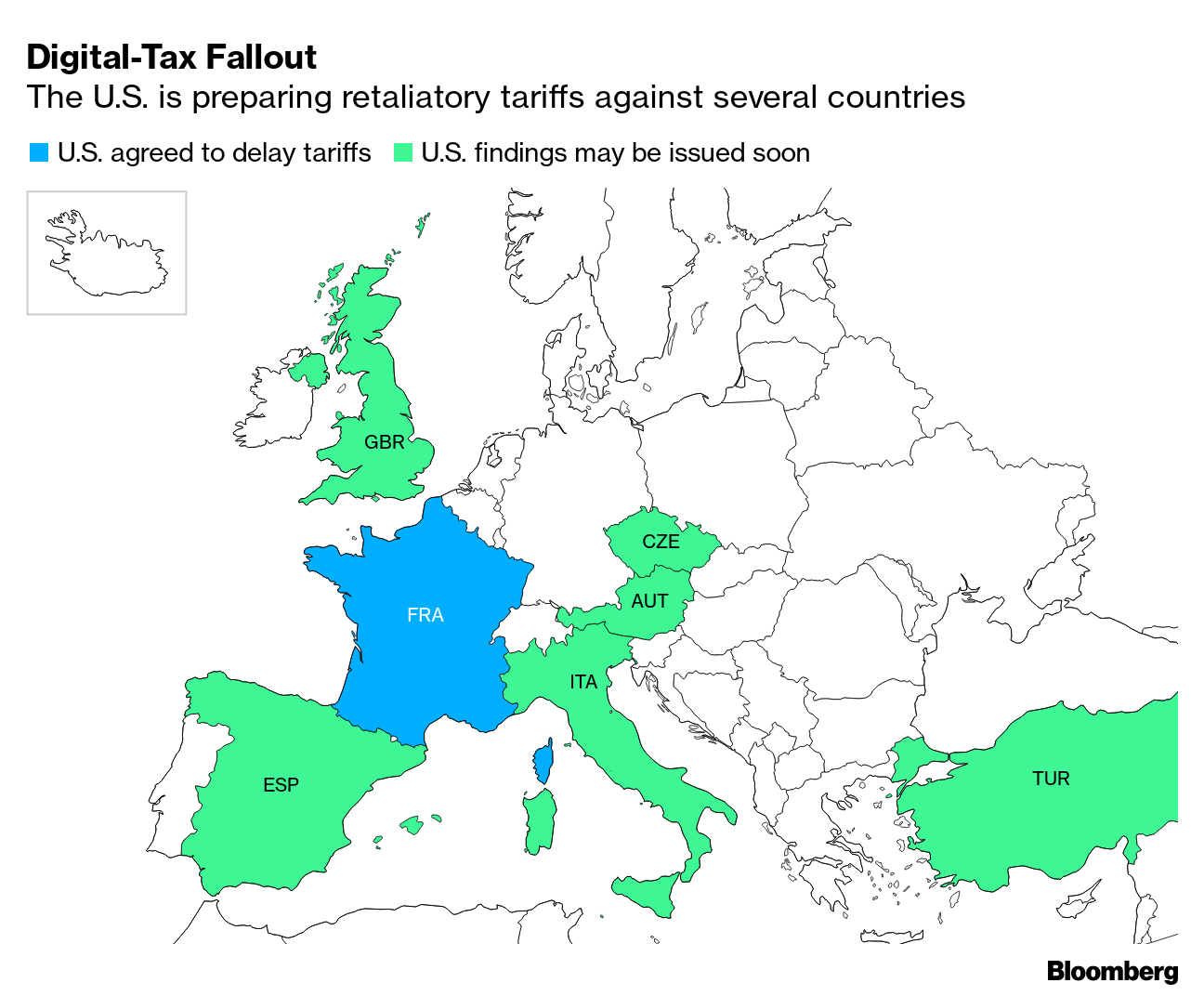

— Nikos Chrysoloras and John Ainger What's HappeningNo Breakthrough | The dinner meeting between Prime Minister Boris Johnson and European Commission President Ursula von der Leyen ended without a breakthrough on a post-Brexit deal. Large gaps remain between the two sides, and negotiators have until Sunday to come up with a pact on what the future trade relationship between the U.K. and the bloc should look like. Turkey Spat | At the summit today, EU leaders will also likely reiterate their threat to sanction Turkey over its maritime claims in Eastern Mediterranean, without — again — making good on such threats. The draft wording of the summit's communique not only falls short of Greek demands for an arms embargo, but has also left member states like France and Austria unhappy. Divisions over how to deal with Ankara will be laid bare once again. Stimulus Boost | The European Central Bank is poised to deliver another blast of monetary stimulus to carry the euro area out of the pandemic crisis. With new lockdowns hammering the economy, vaccines only just arriving and knife-edge Brexit talks, it's set to add 500 billion euros to its emergency bond purchases. Read our primer for today's meeting here. Bye-Bye Bonds | Another increase in bond buying may lead investors in Europe to start saying their goodbyes to the region's market, worried that soon there may not be any place left for them. By the end of 2021, the central bank will have bought so much there may not be a lot left for anyone else. We look to Japan to see how its bond market was gouged out. In Case You Missed ItCutting Tape | The EU has eased its signature regulations on capital markets and stock research in a bid to help the economy recover from the pandemic. Policy makers agreed to lighten administrative burdens on experienced investors and alter rules on commodity derivatives under the rules known as MiFID II. Covid's Arrival | The coronavirus was circulating in Italy as early as the end of November 2019, according to a new report published by the Centers for Disease Control and Prevention. It shifts the timeline for the beginning of the outbreak to late autumn 2019 from late February. Separately, the European agency that oversees medicines, including Covid-19 vaccines and treatments, said it was the victim of a cyber-attack. Debt Write-Off | Bank for International Settlements General Manager Agustin Carstens warned euro-area policy makers not to consider canceling government bonds bought during the pandemic — a proposal that had been floated by a top aide to Italy's Prime Minister. Carstens told Bloomberg Television that experience showed such policies wind up being "catastrophic." Slippery Slope | France's winter resorts have taken the government to court to keep ski lifts operating over the year-end holidays. President Emmanuel Macron has favored a reopening in January to reduce the risk of a new coronavirus resurgence. Meanwhile, a curtailed ski season is also wreaking havoc in Austria. Amsterdam's Lights | If your holiday decorations involve inflatable Minions or light shows that play Metallica songs, steer clear of Amsterdam: This year, the Dutch capital seems to have started a war on garish Christmas displays. Check out these rules that put the city at risk of being the grinch. Chart of the Day The U.S. is ready to impose tariffs on goods from France in early January in response to that country's resumption of levies on the revenues of multinational tech firms. Several other countries preparing similar taxes are also under investigation in Washington and may soon face tariffs. Hope of defusing the situation rides on talks for new global tax rules that won't conclude until mid-2021. Listen to this week's episode of the Stephanomics podcast for more. Today's AgendaAll times CET. - 10 a.m. EU Commission Vice-President Šefčovič, and Commissioners Breton and Sinkevičius present sustainable batteries strategy

- 1 p.m. EU leaders meet in Brussels; to discuss pandemic, climate targets for 2030, Turkey, EU budget, U.S-EU Relations

- 2 p.m. EU's Margrethe Vestager takes questions from European Parliament's economy committee

- 2:30 p.m. Press conference following Governing Council of the ECB monetary policy meeting

- 2:30 p.m. European Council Press conference by David Sassoli

- Executive Director of the European Medicines Agency, Emer Cooke, holds hearing at the European Parliament on the state of play on assessing and authorizing vaccines against Covid-19

Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. For even more: Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment