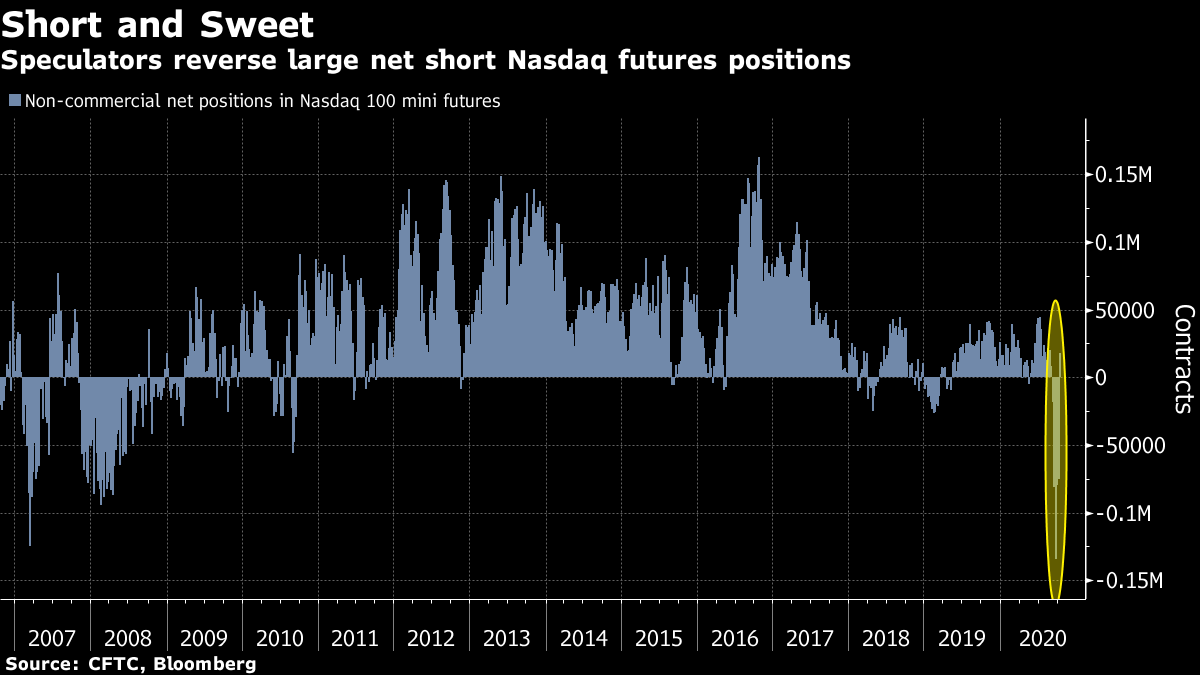

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning. There's optimism on getting a U.S. stimulus deal before the election, the U.K. may rewrite its lawbreaking Brexit bill and earnings season gets underway. Here's what's moving markets. RestrictionsWith Covid-19 cases in much of Europe at records, millions across the region are facing greater restrictions on their movement. Switzerland will require masks in public indoor spaces effective Monday and gatherings of more than 15 people will be forbidden. Belgium, which has the most cases per capita in Europe except for the Czech Republic, announced plans for new restrictions starting today, with Ireland set to approve its tightest measures since April. In Britain, Prime Minister Boris Johnson warned he will have no choice but to impose the toughest level of pandemic restrictions on Manchester, unless the city's mayor backs down and agrees to new curbs. New DeadlineA pre-election agreement on U.S. stimulus remains possible, according to House Speaker Nancy Pelosi, who set a Tuesday deadline for an agreement with the White House. Meanwhile, President Donald Trump indicated that he is closer to Democrats' demands for a larger overall package than Congressional Republicans, calling in to a Wisconsin TV station to say he could exceed the amounts floated so far and voicing confidence that he "could quickly convince" Republicans wary of another large spending package. The weekend developments, raising optimism about progress on an aid package, boosted U.S. stock index futures. Defusing the BillBritish officials are prepared to water down Boris Johnson's controversial lawbreaking Brexit legislation in a move that could revive failing talks with the European Union, according to people familiar with the matter. With the EU taking legal action over the proposed bill, Johnson's officials believe Britain's House of Lords will cut the contentious clauses despite the Prime Minister's refusal. Negotiations over the two sides' future relationship have stalled, with the prime minister announcing on Friday that he will focus on preparations to leave the EU's single market and customs union at the year-end without a trade deal -- though he is still open to talks if the bloc changes its stance. In Full SwingEurope's third-quarter earnings season is in full swing this week, with highlights including Philips NV today, UBS Group AG on Tuesday, Unilever NV on Thursday and Barclays Plc and Daimler AG on Friday. With earnings across the region emerging from a pandemic-induced trough, market participants are looking for signs of what a Jefferies strategist has called ``the mother of all profit turnarounds.'' Analyst estimates imply a dramatic jump in earnings from the previous quarter, with companies in four of the Stoxx 600's 20 sector groups set to shift, in aggregate, from losing money in the second quarter to turning a profit in the third. Only one group -- travel and leisure -- is still expected to incur a loss. Coming Up…Philips NV posted third-quarter profit that beat estimates while Swiss bank Julius Baer Group Ltd. recorded ``considerably'' higher quarterly inflows. Up next, miner BHP Group Plc will release production figures, while French care home operator Korian SA is due to post a sales update after markets close. In the afternoon, European Central Bank President Christine Lagarde is due to speak at the central bank's conference on monetary policy. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningIn the ``battle'' between bullish retail traders and their bearish institutional counterparts I wrote about on Thursday, it seems the professionals are blinking first. Hedge funds have pulled back from one of the biggest short positions in U.S. tech stocks in over a decade, in a near-record buying spree of Nasdaq futures last week. Net speculative positions in Nasdaq 100 mini contracts surged by the most in more than 13 years in the week through Oct. 13, according to the latest Commodity Futures Trading Commission data. The increase was the second biggest on record in data going back to 1999 and left speculators net long the futures for the first time since the beginning of last month. The buying frenzy comes after fast-money accounts had driven net short bets to the highest since before the financial crisis during September. The U.S. tech gauge has risen over 9% from its Sept. 23 low amid signs of a return of bullish options activity that helped push it to an all-time high earlier that month. That might have spooked the bears. But the Blue Wave thesis, that a big Democrat win in next month's elections doesn't have to be bad for stocks, could also have triggered a reassessment of short bets that were looking pretty aggressive.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment