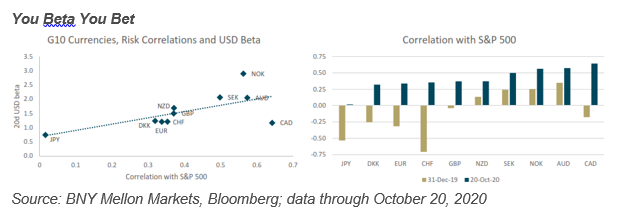

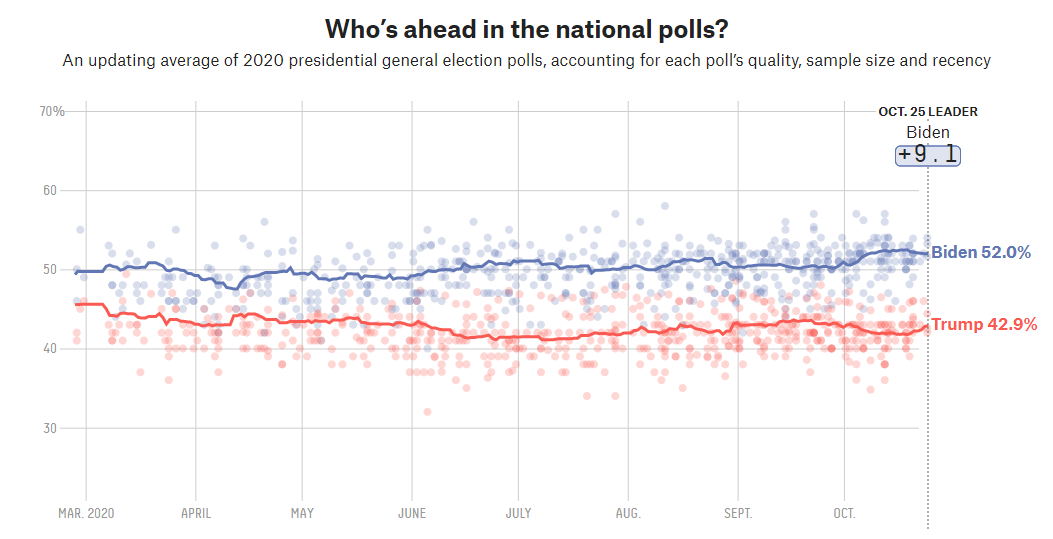

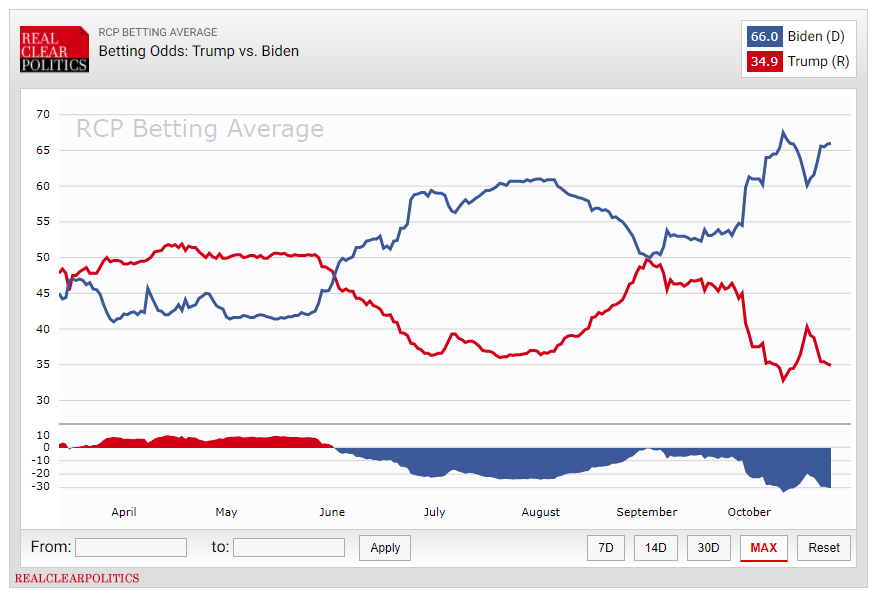

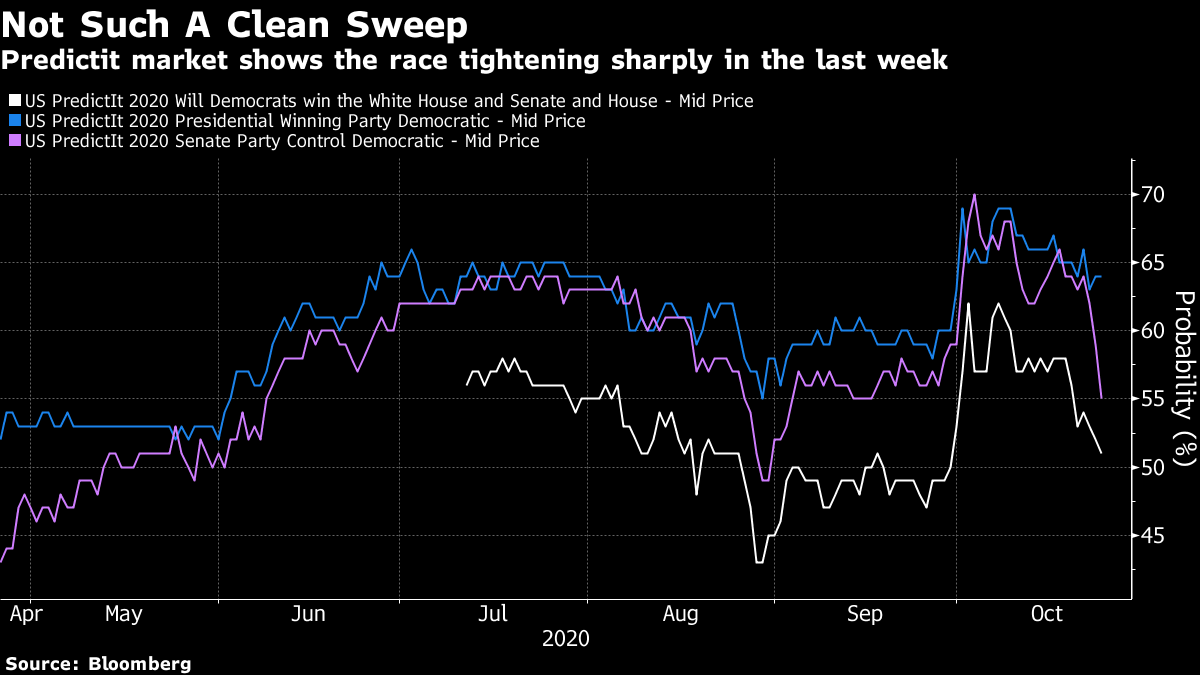

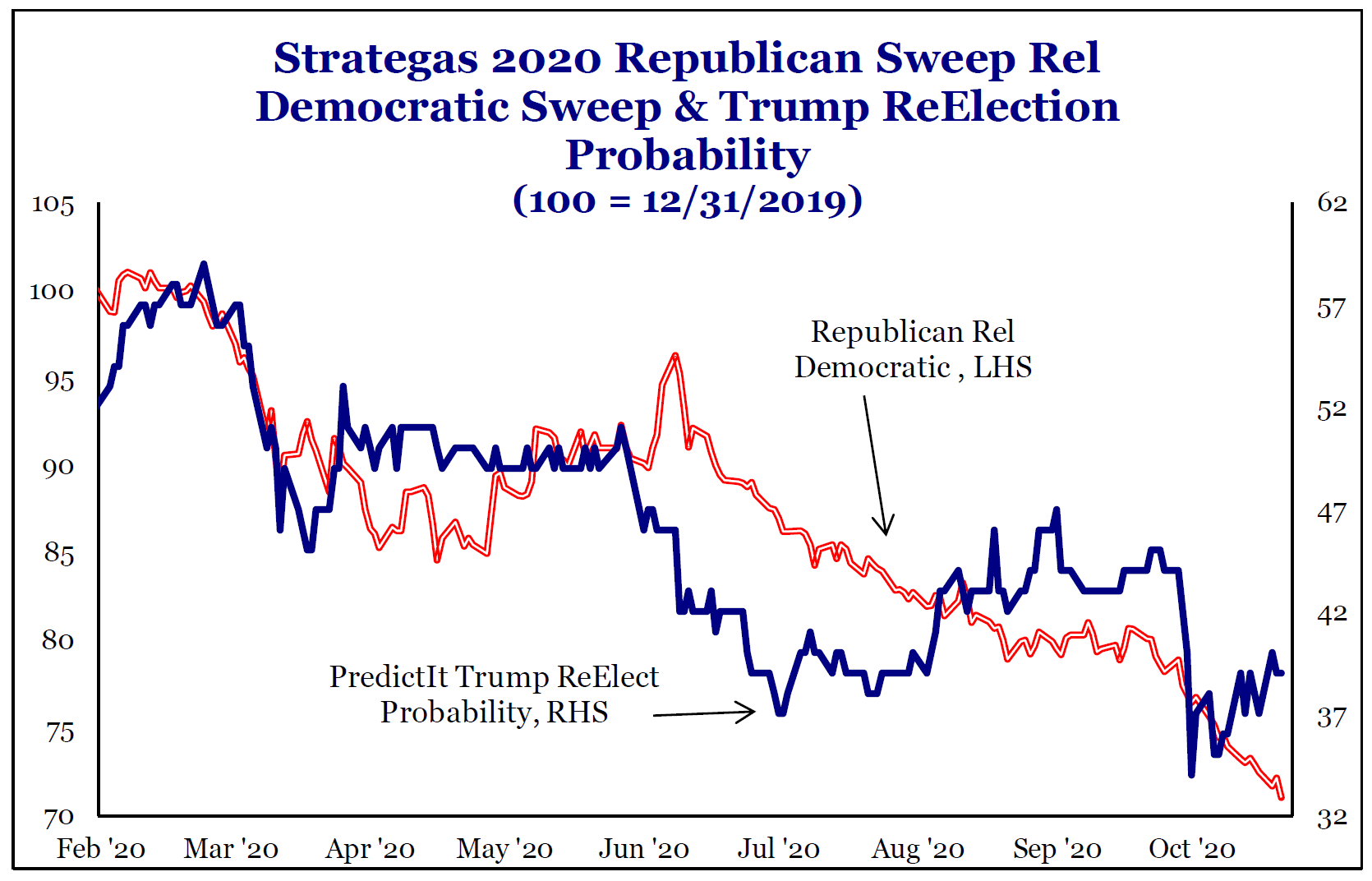

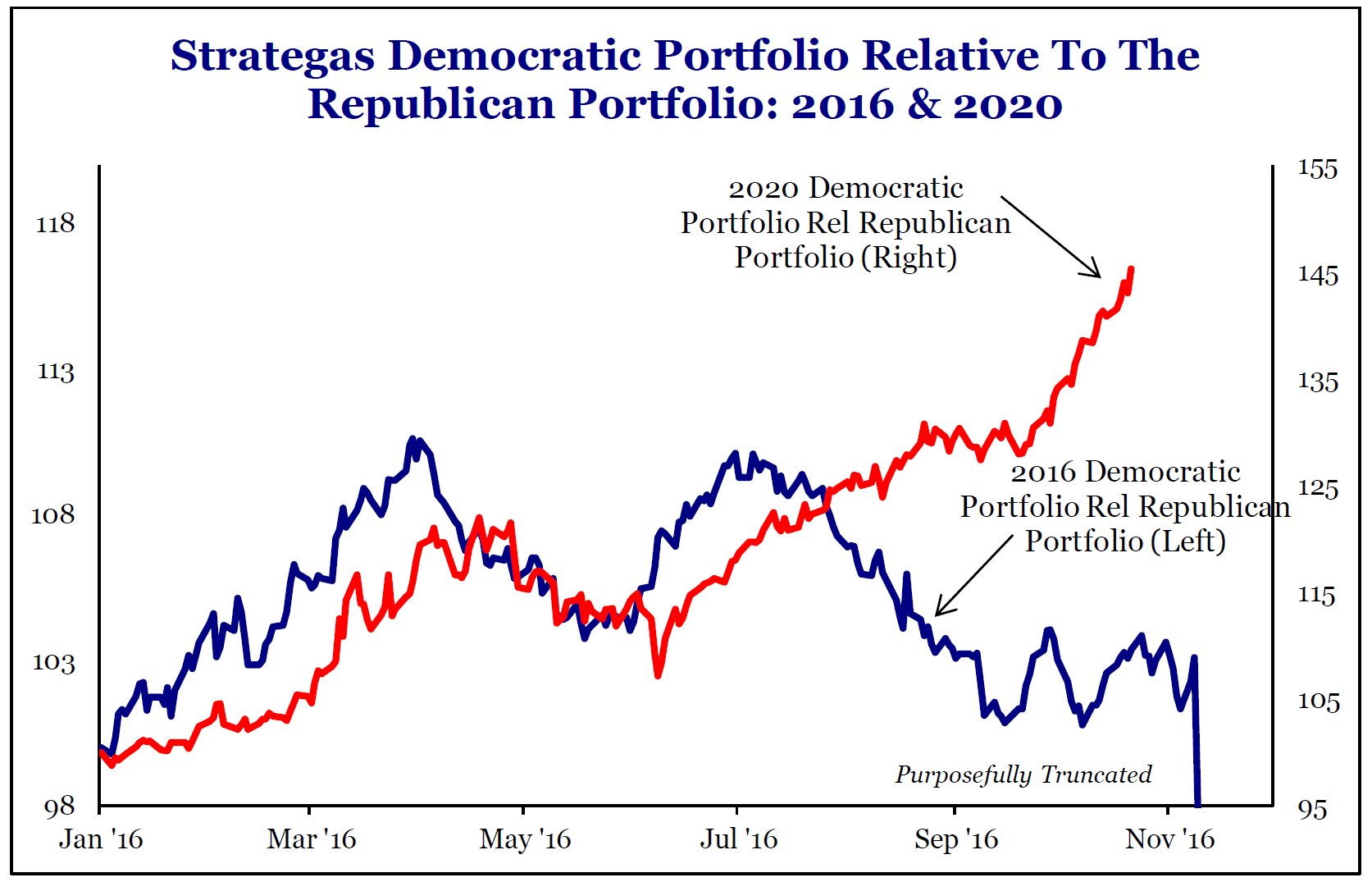

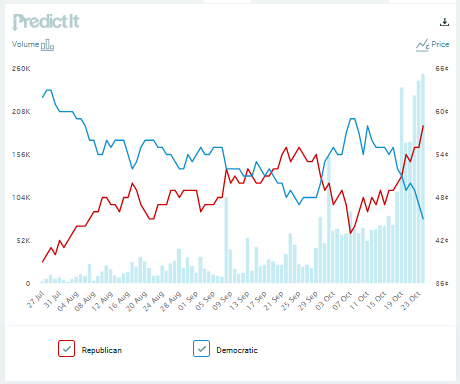

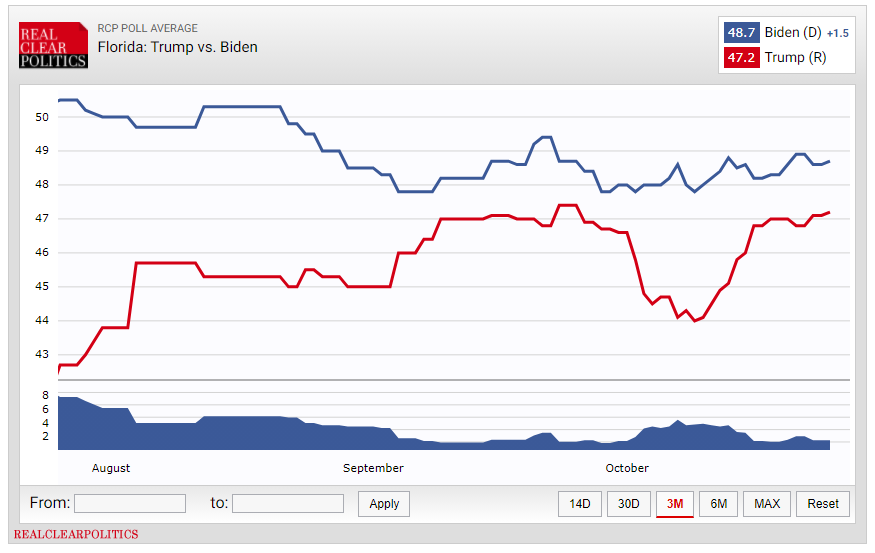

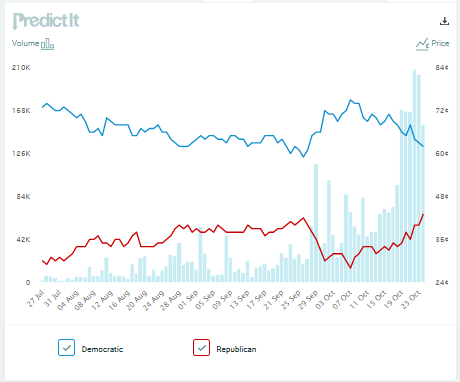

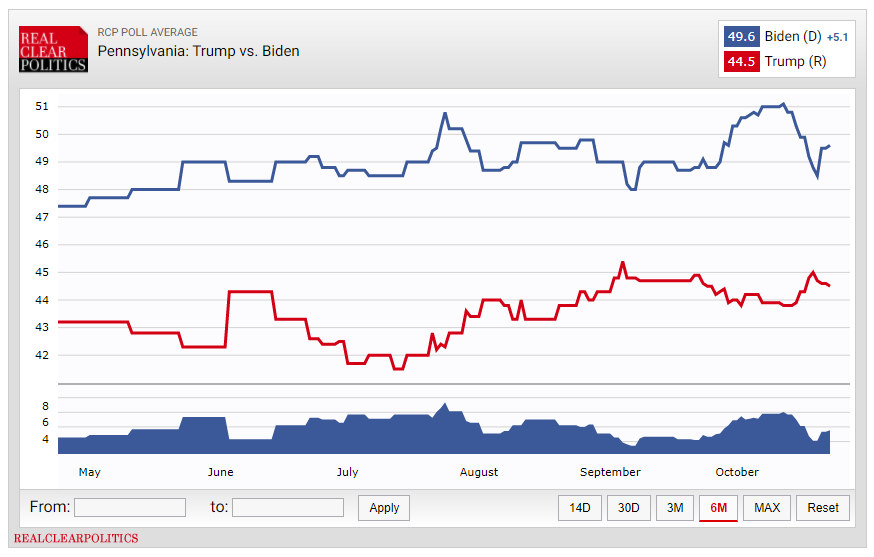

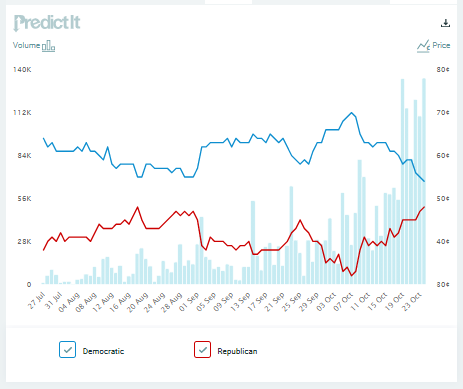

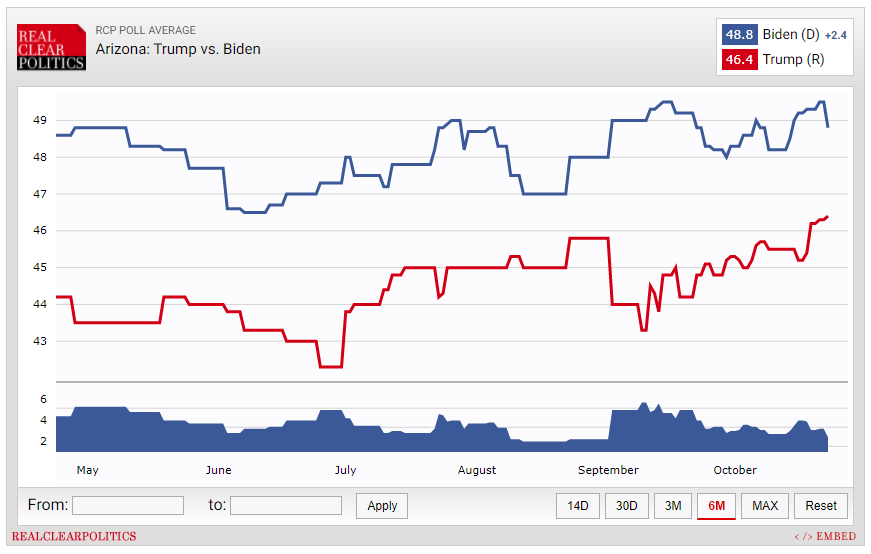

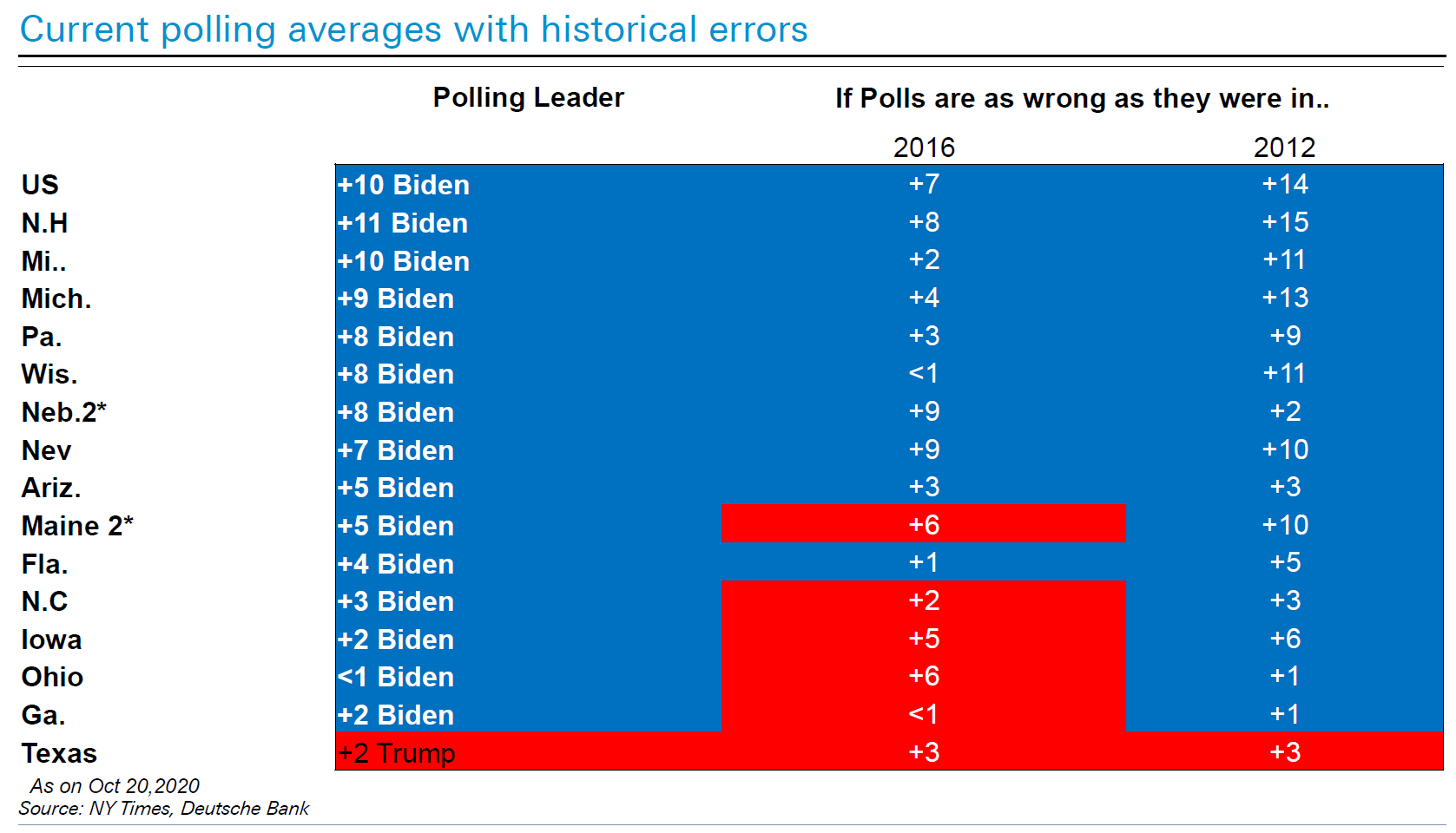

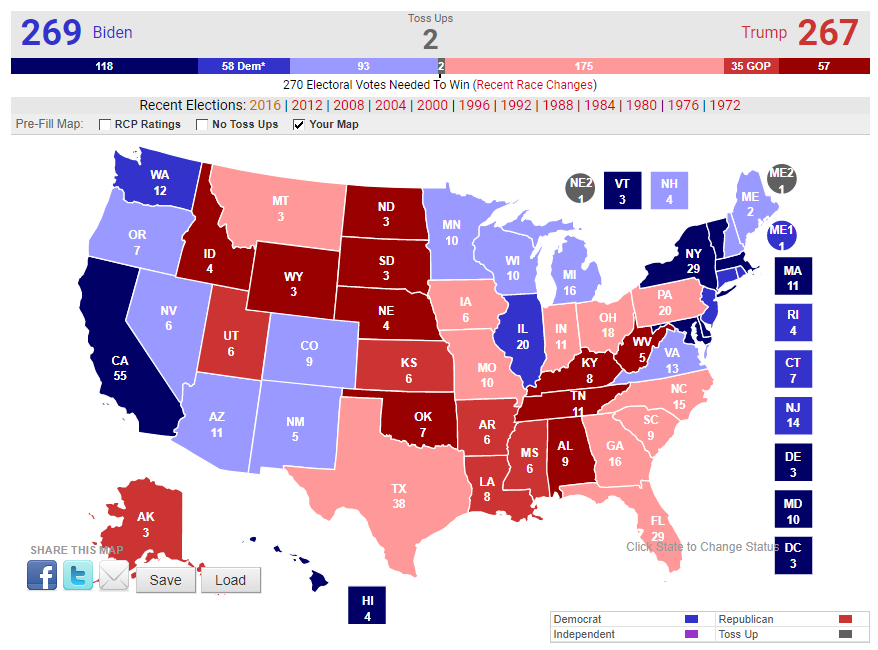

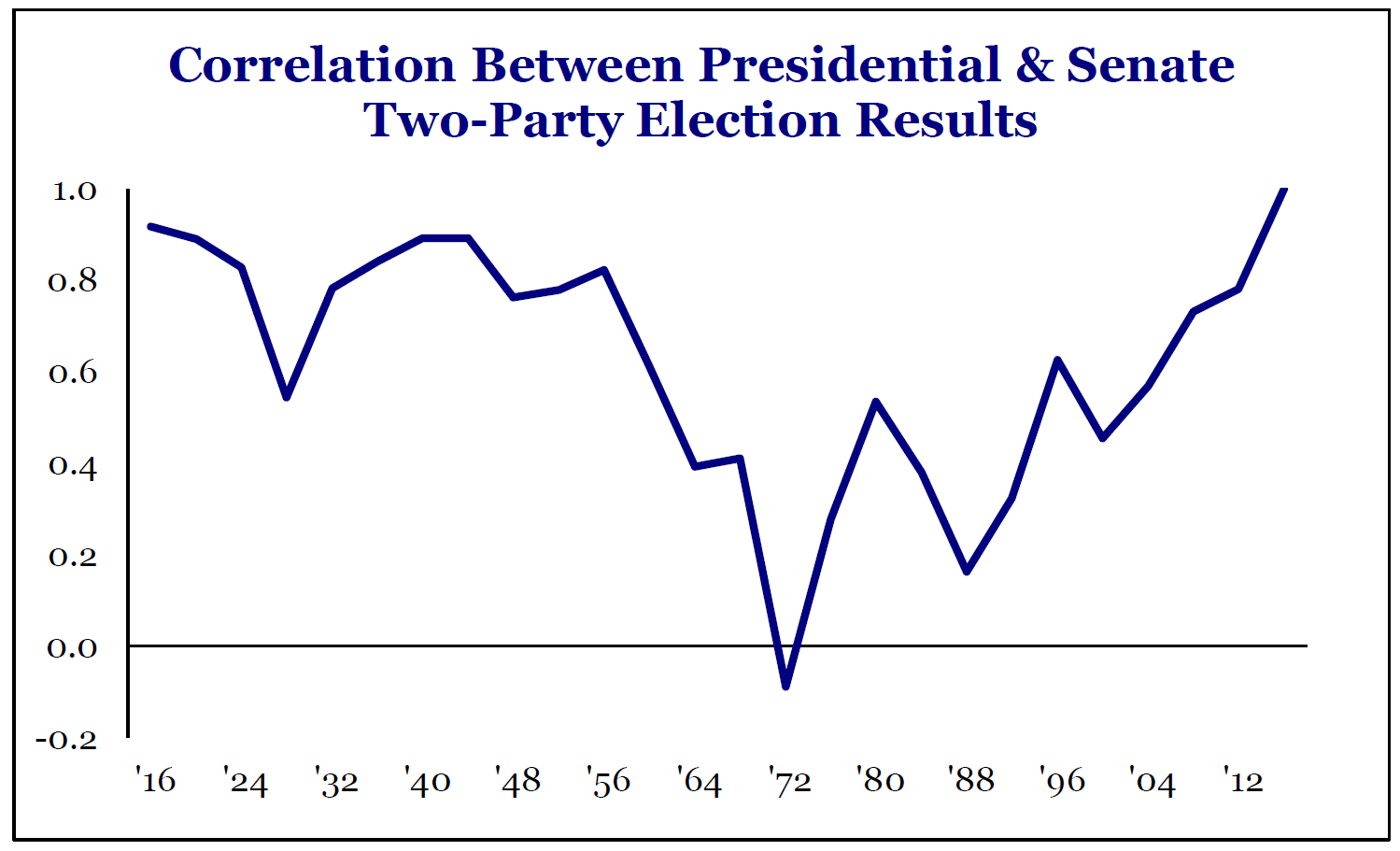

Unfortunately, the U.S. Election Matters Warning: This will be yet another newsletter largely devoted to the U.S. election. I appreciate that this isn't good for the mental, cardiovascular or intestinal health of many subscribers. It's also pretty bad for mine. But the topic is unavoidable because it is truly driving markets all over the world. For at least another nine days, and quite possibly for much longer. U.S. markets are transfixed by the political drama. The extraordinary and polarizing persona of President Donald Trump more or less guarantees this. For the last few weeks, conversation has been framed by the possibility of a "Blue Wave" in which Democrats take both the Senate and the presidency, and then embark on full-on fiscal expansion. This has fed into a belief in a coming "reflation" trade, in which growth and inflation at last return after more than a decade. In the wake of this, the dollar weakens, and stock markets around the world take off. Belief in the U.S. growth/reflation trade is now driving everything. One dramatic illustration comes from John Velis, U.S. investment strategist at Bank of New York Mellon Corp. He shows that day-to-day movements in risk (as crudely represented by the S&P 500) are the leading drivers of all the main developed market currencies. at present. This is a new and unusual development — across the board all currencies are far more tightly linked to U.S. equities than they were at the end of 2019:  What's going on? Velis explains: We interpret this unusual state of affairs as policy and political risk on steroids. The US election, where a Biden victory is still the predominant scenario according to the polls, is top of mind. If Biden does perform in line with the current polls, we'd view that as short term positive for the equity markets, a negative for the dollar, and a positive for the major crosses as a result. If the U.S. equity market is hogging attention, something similar can be said about the dollar. Global equities are inversely related to the level of the dollar, in large part thanks to its function as a haven when investors are risk-averse. As this chart shows, the MSCI ACWI index, which includes developed and emerging markets, is moving almost perfectly in alignment with the Bloomberg dollar index:  The reasons for this were nicely summarized by Oliver Jones of Capital Economics in London: the basic reasons why the dollar has tended to head in the opposite direction to global equity prices remain as valid as ever. The most obvious is the dollar's role as a safe haven, as illustrated vividly in March. Among other things, the dollar's haven role is a function of the fact that the US has deeper and more liquid financial markets than any other country, and the fact that dollar borrowing is such a large share of global credit – things which have not changed, and are not likely to soon. To this we must add the specifics of the growth trade and the excitement over a Blue Wave. U.S. demand is critical to any hope for a major return to global economic growth; it relies on aggressive spending, and continued lenient monetary policy. The U.S. trade deficit has deepened in recent months, and this has been critical in helping the rest of the world out of the Covid-led slump. As Jones says: "Crucially for the dollar, the Fed has accommodated this rebound." Thanks to the Fed, the good news on U.S. demand has buoyed stocks without being choked off by rising Treasury yields. As U.S. inflation expectations have been climbing since March, U.S. real yields have fallen — and that has helped ensure both that the dollar weakens and that global stocks strengthen. This raises one question about the Blue Wave hypothesis. A big splurge of spending by a Democratic government would require lots of new bond issuance, which would tend to raise yields, while growth should in any case drive higher long-term rates. U.S. real yields have underpinned global stock valuations for the last two years, as this chart shows:  So the Blue Wave trade relies not only on a lot of money from a bunch of enthusiastically Keynesian politicians. It also requires the Fed to keep real yields negative, in a way never seen before this year. It's a big ask, but for the time being the world is enthralled by the American political process. What Does the Market Say? That leads to another question. Are global macro investors right to be putting their chips on a Blue Wave? Different markets express a view on the election in different ways, but those most directly affected by the result tend to suggest that the odds are being overstated. For reference, the single most obvious way to predict an election result is by asking people how they will vote in a poll. At the national level, all the aggregated polls of polls show Joe Biden with a comfortable lead. This is from FiveThirtyEight:  The most direct way for the market to take a view is through spread betting. RealClearPolitics' aggregation of betting odds shows Biden with a two in three chance of winning, having rebounded from a sharp dip last week:  This is tighter than the probabilities implied by the polls, which are closer to 80%. Meanwhile prediction markets, where bettors buy futures which pay out after a given result, show Biden's chances falling steadily to just below 65%, while the chances of taking the Senate have just dived to 55%. The chance of a Democratic clean sweep is put at almost exactly 50-50:  Bettors on Predictit think they see something that others don't. As for the stock market, Dan Clifton of Strategas Research Partners maintains separate baskets of individual stocks that would benefit from a Democratic or Republican sweep. The "Democratic" basket includes infrastructure, renewable energy, managed healthcare and cannabis stocks, as well as companies that would benefit from a change in trade policy. It also includes gun stocks, as sales would likely rise with a Democratic sweep. The "Republican" basket includes energy, defense, and financial stocks, as well as for-profit prison and education groups, and stocks that would benefit from Republican healthcare policies, and from deregulation and lower taxes. On this, the stock market seems to be betting more confidently on a Democratic sweep than the prediction markets:  Interestingly, four years ago, the same exercise revealed a tell that stock market investors weren't convinced of a Hillary Clinton victory. At this point in the campaign, the Democratic portfolio was underperforming:  What is spurring Predictit bettors to see a tightening race? It is of course possible that they are just wrong, and that the market prices reflect some internal biases. But another important point is the polling evidence in the critical marginal states. This is how Predictit views the chances in Florida:  And this is the RealClearPolitics average of Florida polls:  They show a tightening, just as happened four years ago. But they do not show Trump ahead. Back then, the momentum took Trump to victory, and bettors are extrapolating forward to reach the same result. Now, here is how Predictit views another crucial state, Pennsylvania:  Again, the race is perceived to have tightened substantially. If we look at the polls, there was indeed a sharp drop for Biden, although the polls also suggest that Trump has much work to do:  Finally, in Arizona, Predictit is inclined to view the race as almost a toss-up. Again, the tightening is dramatic:  Here is the polling average for Arizona, which shows slow and steady progress for Trump:  In all cases, bettors are extrapolating continued improvement for Trump in the next few days, which may be harder than in 2016 because there are fewer undecideds, and many have voted already. They may also be betting that the polls are wrong. However, the polls at present would suggest a comfortable Biden win, even if they are out by as many percentage points as they were four years ago. The following chart is from Deutsche Bank AG:  It does look at this point as though the prediction markets are overstating Trump's chances. How does all of this reflect on the global predictions of a reflationary Blue Wave? There are significant variations between markets, but the bottom line is that it would be well to be careful about this. The following map is one I made myself on the RealClearPolitics site. It gives you the opportunity to "create your own map." In this one, I awarded Biden all the states that Hillary Clinton won, along with Arizona, Wisconsin and Michigan. This brings him to 269 votes, when 270 are required for victory. In this scenario, everything could depend on the two states that allocate an elector to each congressional district rather than on a "winner-take-all" basis. If Trump could win the more conservative of Maine's two districts, and the most liberal of Nebraska's three districts, the election would be tied at 269. More to the point, literally any state could change the result, so the chance for a contested election would be very high. This scenario, to be clear, isn't that far-fetched:  The chance of major uncertainty is being underestimated in the broader markets, then. The same is probably also true of the chances of an ultimate Trump victory. Meanwhile, another scenario that has emerged in recent days involves the difference between a "Blue Tide" in which the Democrats get 50 or 51 seats in the Senate, and a "Blue Wave", in which they gain 55 or 56 and are much less beholden to moderates. As Clifton of Strategas points out, 2016 was the first time in a century where every state with a Senate election voted for the same party for both the Senate and the presidency:  The states with Senate elections this year tend to be conservative. At present the Democrats have their nose ahead in enough to gain 51 seats, including one — Iowa — where Trump is ahead in the presidential polls (and where the Senate polls are almost tied). A Blue Wave thus defined would require the Democrats to take seats in a series of other states that were won by Trump in 2016, and don't at this point look likely to vote for Biden, including Georgia, Montana, South Carolina, and Kansas. This is possible, but only just. Survival Tips I have two survival tips today. The first is not to click on the link I provided to draw your own map of the electoral college. It won't be good for your sanity. The second is to listen to this historic clip on YouTube. Alphabet Inc., the owner of YouTube, is currently under antitrust scrutiny, and deservedly so. But clips like this remind us that there was something wonderful about YouTube in the first place. In terms of star power, this is something like a classical music equivalent of the Live Aid concerts, involving Leonard Bernstein, Glenn Gould and Igor Stravinsky. Bernstein gives us all a lesson on the problems of classical interpretation, particularly on scores as old of those of Bach; then he conducts Gould playing Bach (in his television debut); and eventually hands the baton over to Stravinsky to conduct his own ballet, The Firebird. I had no idea that anything like this existed. Thanks to the reader who sent me the link. I'm very happy to continue crowd-sourcing like this — plenty of other tastes in music welcomed. Have a good week. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment