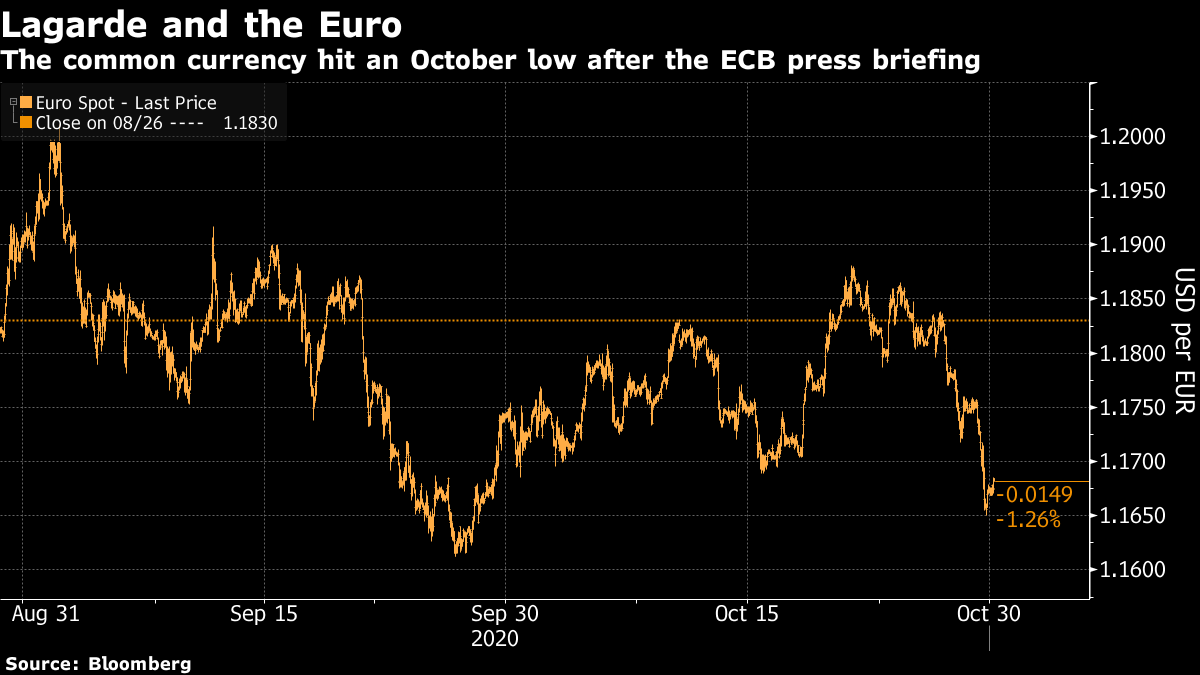

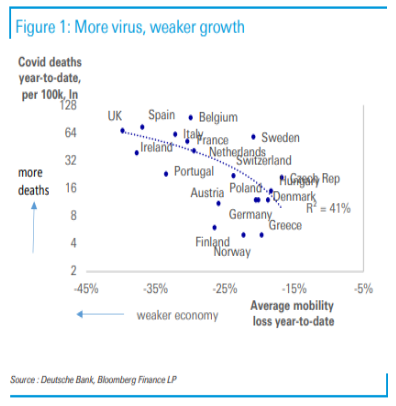

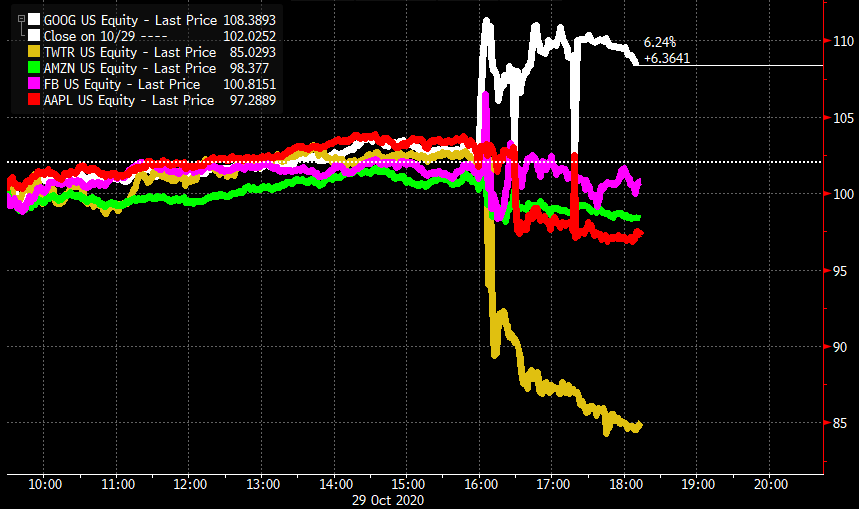

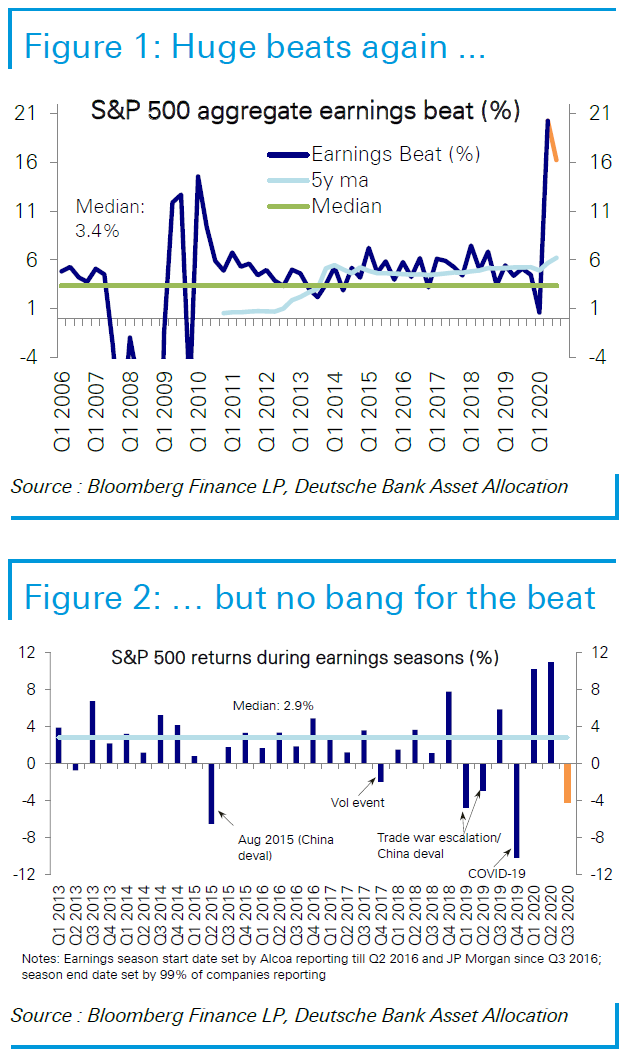

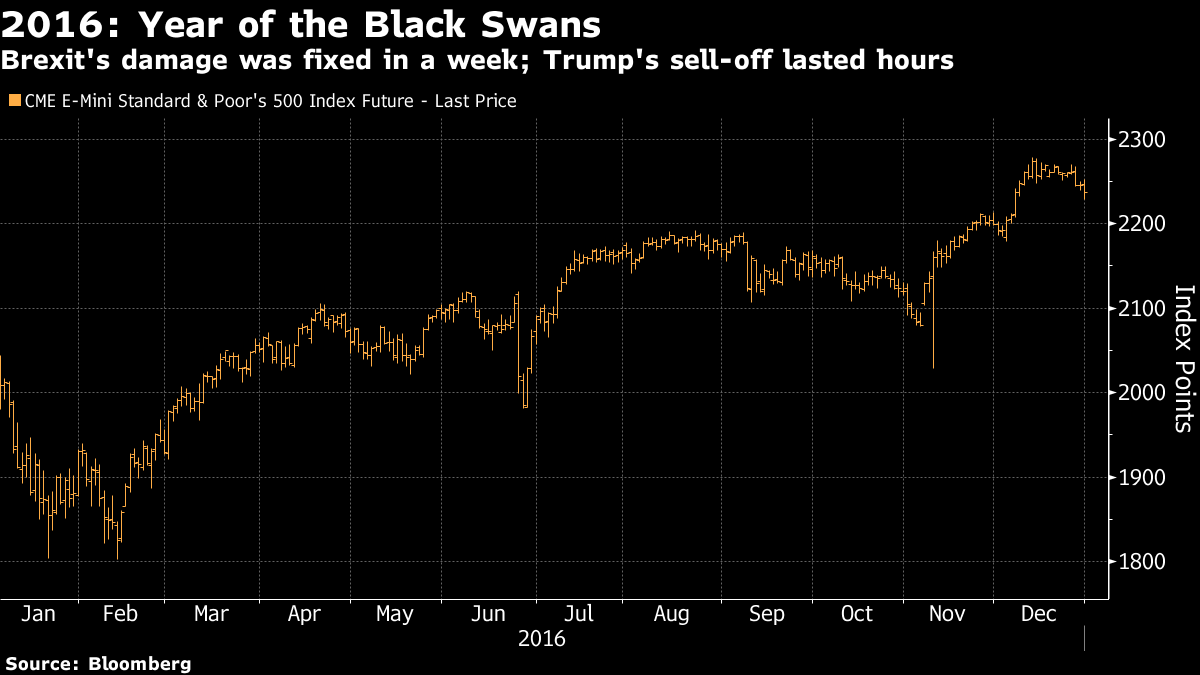

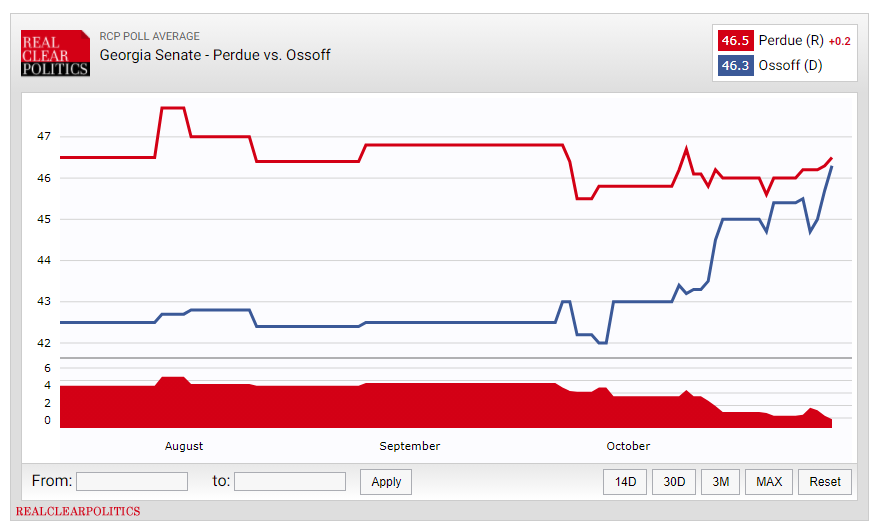

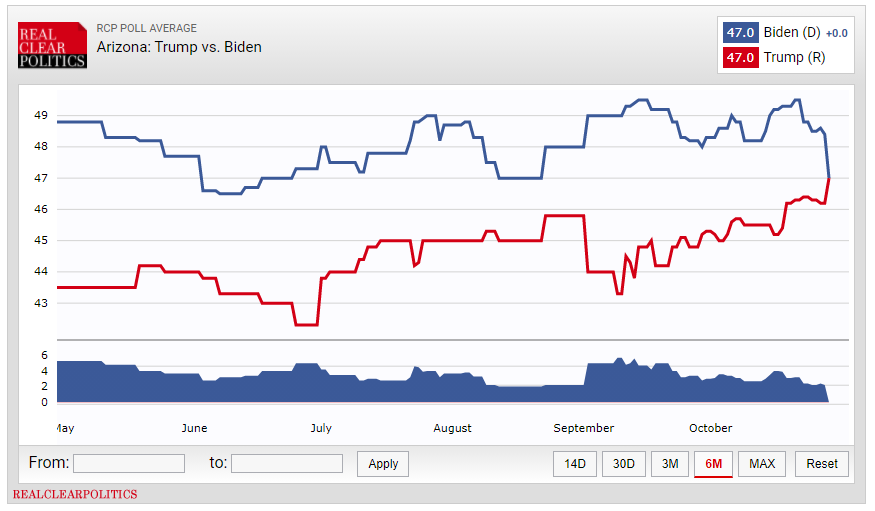

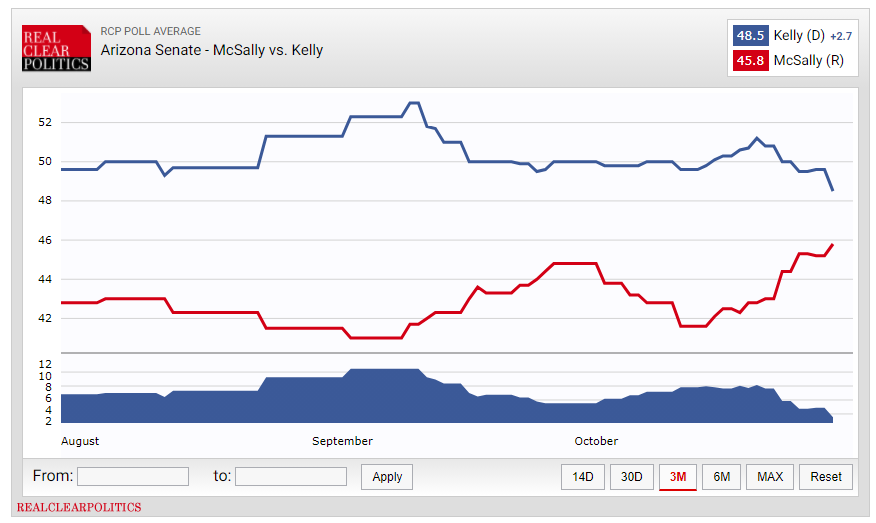

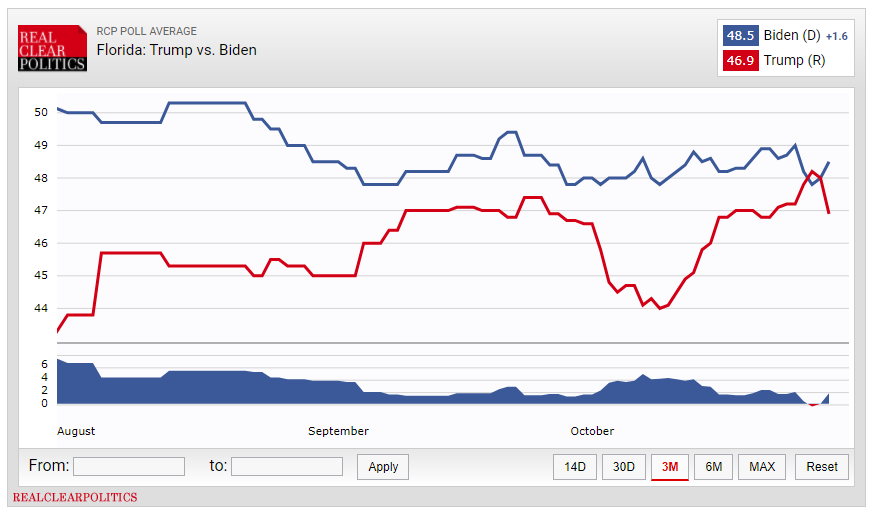

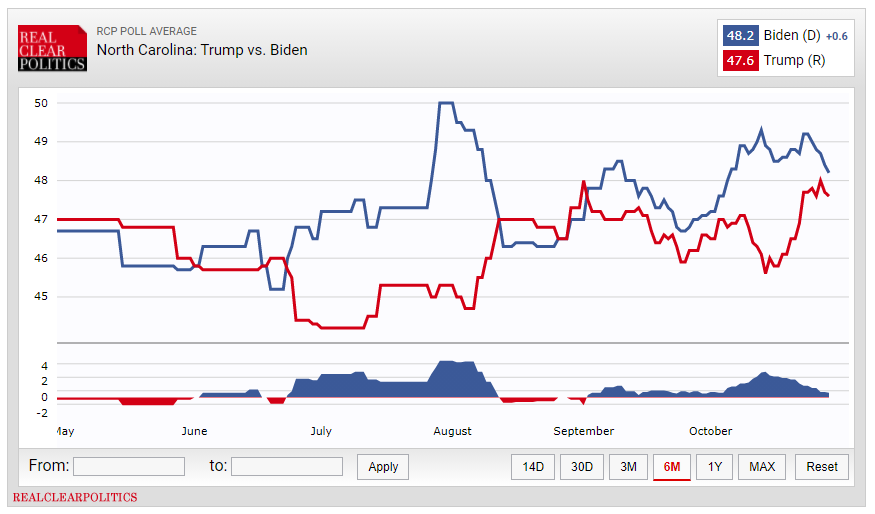

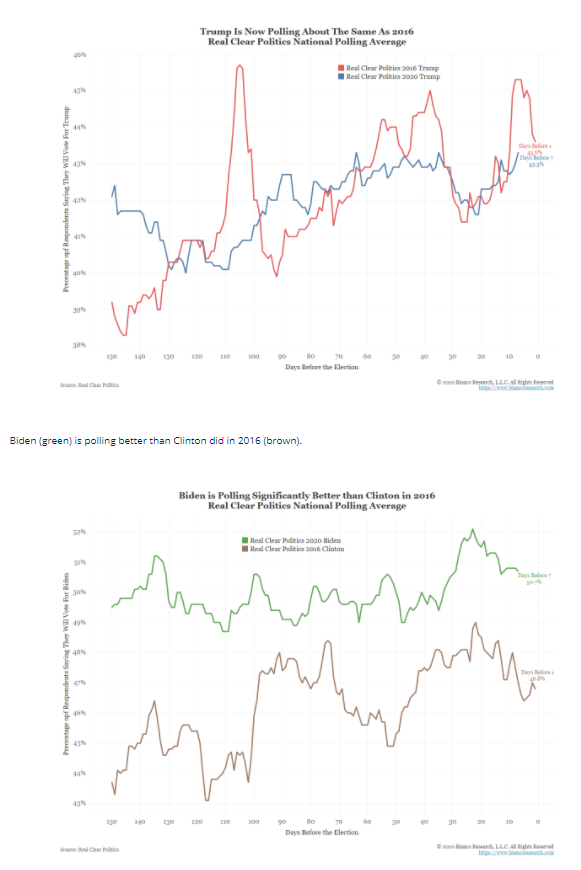

Be Careful Out ThereThis newsletter is normally about the long view. Tune out the noise, look to the long term, and things will be OK. The problem with this philosophy, usually a wise one, is that you have to survive the short term to get to the long term. That is problematic at present, because there are plenty of immediate concerns. On Thursday, we witnessed a surprisingly bellicose press conference from the European Central Bank early in the day, to be followed by the announcement of the single best quarterly U.S. GDP growth on record, and then at the end of the day earnings announcements from four of the five biggest companies on Earth (plus Twitter Inc.). Next week will start with the usual beginning-of-month deluge of economic data from around the world, with PMI reports particularly important. On Wednesday, the Federal Open Market Committee will meet, always a key moment. On Friday, the U.S. government will publish unemployment data, traditionally the single most market-sensitive announcement in the global economic calendar. With the coronavirus back, each day will bring new information on whether cases have started to grow exponentially once more. We are all more educated on epidemiology than at the start of the year, sadly, so there will also be desperate scouring of statistics on hospitalizations, the number we now know is the strongest indication of severity. And there will be an anxious eye on death statistics. So next week promises to be tempestuous. And you will probably have noticed that I didn't even mention the U.S. election, which this year promises to be a drama that starts Tuesday night, and continues all week. All I want to do with what follows is emphasize that nobody should take too many chances. Somebody somewhere is going to make an indecent amount of money next week, and doubtless someone else is going to lose a bundle. These things happen most weeks. But it's probably going to be wisest to emphasize capital preservation, and accept in advance that some money will be left on the table. So, what is going on? ECB Nothing happened at the ECB. What matters, greatly, is that the president, Christine Lagarde, was unusually emphatic in warning everyone to expect something more drastic at the next meeting in December (when the scale of the damage wrought by the virus should be clearer, and we should know the identity of the U.S. president who will take the oath of office next January). Her critical quotes were: "The euro-area economic recovery is losing momentum more rapidly than expected. We agreed that it was necessary to take action and therefore to recalibrate our instruments at our next Governing Council meeting." She added that there was "little doubt" the ECB would do something. With the assumption that Europe's coronavirus response would allow for rising rates and a strengthening euro now a thing of the past, the currency fell heavily:  As for exactly what the ECB will do at its next meeting, there is little point in speculating until some of the other uncertainties have been cleared up. What central bankers need to know is how bad the virus will be. That, rather than any decision over lockdown policy, is what matters — the greater the human toll, the greater the economic damage. That is the evidence of this chart put together by Deutsche Bank AG's foreign exchange strategist George Saravelos:  (Note, incidentally, that despite its reputation, Sweden is not an outlier.) FAANGs Four of the mighty five FAMAG stocks reported after the market (Microsoft Corp. had announced earlier in the week). All posted better than expected earnings. Only Alphabet Inc., the parent company of Google, was rewarded with a big pop in the share price after hours. For Apple Inc., Amazon.com Inc. and Facebook Inc., after-hours trading was uncomfortable despite results that broadly confirmed they were continuing to do well from lockdown conditions. Twitter, a much smaller company, published disappointing earnings and saw its share price drop almost 20% after hours.  A regular army of retail traders will have been on hand to trade these announcements, so we should take after-hours trading moderately seriously. It amplifies a point that had already become clear before Big Tech started to report; surprises weren't buoying companies the way they usually do. Deutsche Bank's U.S. equity strategist Bankim Chadha produced this graphic earlier this week. The effect will be even more pronounced if the after-hours action in the big tech stocks is confirmed in Friday's trading:  After the shock earlier this year, confusion driven by bizarre base effects was inevitable. And as the stock market had already recovered to new highs despite considerable economic damage, it shouldn't be surprising that earnings "beats" aren't prompting investors to buy more stocks. The Campaign Trail How risky will election night be? Very. Let me remind everyone of a cautionary tale from four years ago. Ahead of the election, the stock market had unambiguously traded on the basis that a Trump presidency would be bad for share prices. Then the election happened, the result became clear, and the markets (as represented by S&P futures trading in Asia) tanked. It was the second political "black swan" of the year, following the U.K.'s Brexit referendum, and the downward spikes caused by both are clearly visible in this candle chart of the S&P futures' performance for the year:  Even more apparent is that both were transitory. The U.S. market (although not Britain's) recovered from the Brexit shock in about a week. It recovered from the Trump shock before the night was even over. The dawning realization that the Republicans were also in a strong position in the Senate, and could now enact a very market-friendly agenda, helped change minds. So did an emollient acceptance speech from the new president-elect, which mentioned the word "infrastructure" several times. The president has never sounded so emollient since. And infrastructure week still hasn't arrived. But the S&P has never revisited the low that e-mini futures set that night. To whoever bought the bottom of that dip, and held: well done.  Plenty of scenarios remain possible, even if by Tuesday midnight Joe Biden does anticlimactically take enough states to make it clear he has won the presidency. That remains unlikely. What follows will be some polls cherry-picked from RealClearPolitics.com with the sole aim of dissuading anyone from making too big a bet on the outcome. Looking first at Georgia, which last elected a Democratic senator (who happened to be a triple-amputee war hero) in 1996, we see the polls suggesting that Democrat Jon Ossoff is surging toward a stunning upset victory:  But if we look to Arizona, a red state with a growing Latino population that the polls had shown as a virtual certainty to turn blue, with the aid of a popular retired astronaut candidate, we see a Republican surge as Democratic support suddenly gives way:   As for the two big swing states on the eastern seaboard that should be in a position to announce a winner Tuesday night, this is the poll of polls for Florida:  And this is the poll of polls for North Carolina:  They suggest both races are unusually volatile. Biden remains the favorite to win for the simple reason that if he holds all the states won by Hillary Clinton, and takes back the three upper Midwest states that she lost by a whisker — Pennsylvania, Michigan and Wisconsin — he will be president. The polls in all three suggest that he should win, even if they are as wrong as they were last time around. But none of those states is likely to make a final announcement on election night, because they cannot start counting early votes until Tuesday. And all are close enough that a superior mobilization by Republicans could yet clinch victory. That is the greatest reason not to take too many chances on this outcome. The underlying determinant of the winner will be the strength of the two parties' get-out-the-vote operations. Both sides are exceptionally motivated, and both have to contend with the pandemic. There is no way we can measure how well they have done until after the votes have been counted. To make this point another way, Jim Bianco of Bianco Research, a Bloomberg Opinion colleague, offered this chart earlier this week. If the polls are right, Trump is doing exactly as well as he did four years ago, and Biden is doing better than Clinton did:  Despite this, Trump is still seen in betting markets as having about a one-in-three chance of victory. As Bianco summarizes it: This suggests Trump will get the same votes he did in 2016 while Biden will pick up more new voters than Trump. In other words, this election is about turnout. Who will actually go through the effort of voting versus those who express an opinion without voting?

Nobody yet knows the answer to that question. It's fair to say that Biden is more likely to win than Trump. It's also fair to say that it would be unwise to bet very much on it. The main aim for the next week or so should be survival. Get through the short term, and then you can start deploying assets with many questions about the future at last answered. Anyone out there who places a big bet on the eventual winner should feel free to send me a gloating email. Survival TipsEveryone is fed up with the American political campaign at this point. So let's have a political jukebox to end the week. Campaign songs aim to raise the spirits. Some of my favorites, in no particular order: Don't Stop (Thinking About Tomorrow) by Fleetwood Mac (Bill Clinton's theme from 1992) Signed, Sealed, Delivered by Stevie Wonder (Barack Obama in 2008) I Won't Back Down by Tom Petty and the Heartbreakers (George W. Bush in 2000) Praise You by Fatboy Slim (Brighton's finest, and a fantastic video). The coolest thing about Al Gore's campaign in 2000. Indeed probably the only cool thing about it. This Land Is Your Land by Woody Guthrie (George H.W. Bush in 1988) Take A Chance on Me by ABBA (John McCain in 2008) YMCA by the Village People (Donald Trump this year), and Roar by Katy Perry (Hillary Clinton, 2016) Finally, I'm delighted to see two very different politicians have campaigned to songs by The Clash in recent years. Beto O'Rourke ran to the tune of Clampdown, while Rudy Giuliani's ill-fated 2008 campaign did at least have the song with the most appropriate lyrics of all time: Rudie Can't Fail. Lord knows what Joe Strummer would have made of this. I hope that you found at least something in there to raise the spirits. Have a good weekend. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment