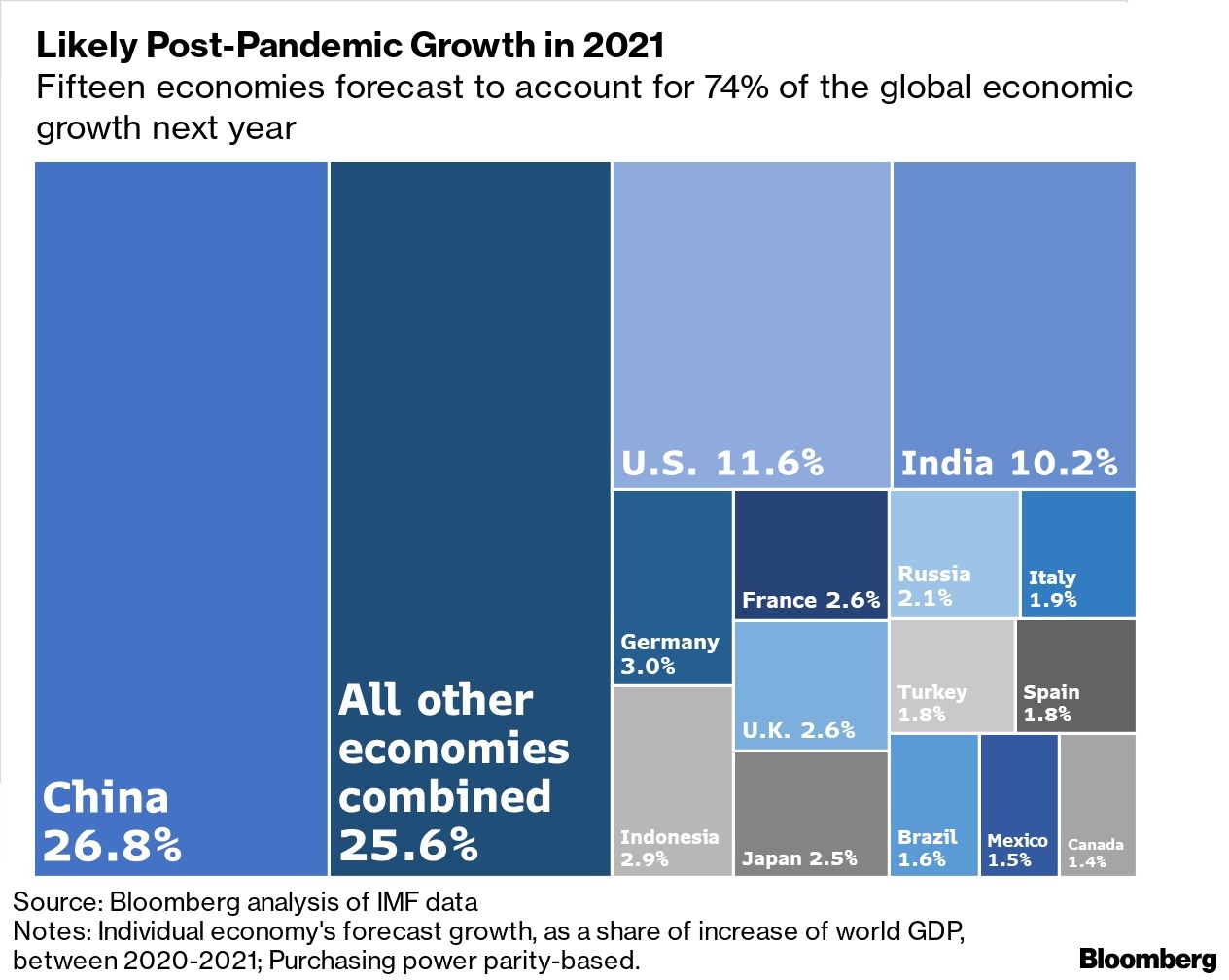

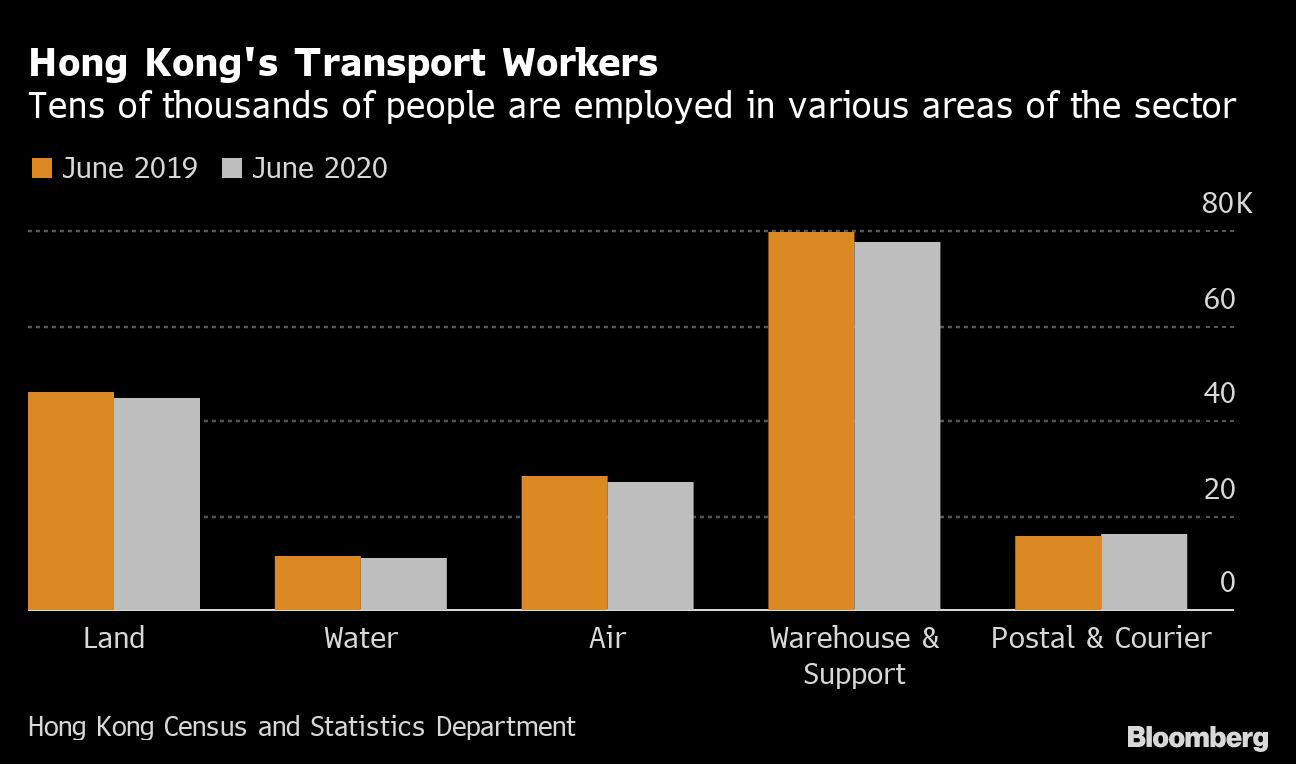

| A strong Chinese economy can make up for many shortcomings. That was the verdict delivered this week by the Lowy Institute's annual Asia Power Index, which ranks the influence of 26 nations and territories. While the U.S. continues to be the region's top power in 2020, the 10-point lead America enjoyed over China just two years earlier has since shrunk by half. And Herve Lemahieu, director of Lowy's Asian Power and Diplomacy Program, thinks China may surpass the U.S. in the think tank's rankings by the end of this decade. It wasn't all good news for China though. Beijing saw a "notable fall" in its diplomatic clout due to accusations it withheld information in the early days of the outbreak and because China's so-called "wolf warrior" brand of aggressive diplomacy has repelled many countries. And that's where a strong economy has helped. Because of Beijing's success at containing the coronavirus, China is expected to be the world's only major economy that sees growth this year. The U.S. economy, meanwhile, could take until 2024 to recover to pre-pandemic levels, the Sydney-based Lowy Institute estimates.  Bloomberg Bloomberg Indeed, this week also saw a slew of Chinese economic data that seemed to suggest a growing advantage for Beijing. While third-quarter GDP expanded at a slower-than-expected 4.9% pace, both retail sales and industrial production gained momentum in September. By contrast, the U.S. is expected to announce that its economy contracted in the third quarter by 3.5% from a year earlier, according to the median estimate in a Bloomberg survey of economists. The Eurozone is seen shrinking by 7.2%, while Japan is expected to contract by 6.6%. Those circumstances will leave the global economy depending on China as its only major growth engine. Vaccine Race Even with the level of success that China has had at getting infections under control, the country continues to take extreme steps to fight the pandemic. The city of Qingdao, for instance, tested more than 10 million people in four days after discovering 13 infections earlier this month. Another example has been how widely Beijing is allowing the use of vaccines that have yet to finish clinical trials. In July, authorities approved the use of three vaccines for frontline medical workers and for officials manning the country's borders. That was later widened to include workers at state-owned companies traveling abroad, with the government also considering whether to let students heading to study overseas receive the shots. Critics have warned that such wide administration of an unproven vaccine could be dangerous. China has defended its practices by highlighting the close tracking it conducts of anyone who gets a shot and noting that there have yet to be any serious side effects. Airline Layoffs It's been a year - or two - to forget for Cathay Pacific, the storied airline of Hong Kong that this week announced it was cutting thousands of jobs. Hit first by widespread street protests that led many travelers to eschew Hong Kong, Cathay was already in a weakened state when the pandemic ground travel to a halt. Even a much needed $5 billion lifeline it got in June in hindsight looks insufficient. Now, in addition to the layoffs, Cathay is also renegotiating compensation with crew and planning to shutter its Cathay Dragon brand. Unfortunately, those moves haven't made the outlook any less ominous. With international travel not expected to return to pre-Covid levels until 2024, and having no home market to fall back on, the jury is still out on whether even more cuts will be needed in the future.  Fire Sale Renrenche was one of China's hottest tech unicorns just two years ago. The company, which pairs up individual buyers and sellers of used cars, was valued at $1.4 billion in 2018 and counted among its investors names such as Goldman Sachs and Tencent. Since then, however, its fortunes have waned as a result of fierce competition from rivals such as Uxin and Softbank-backed Guazi.com. The disruptions to business caused by the pandemic ultimately left Renrenche with few options for its future. This week, the company agreed to be bought by 58.com for less than $1,300, or about the price of a new top-of-the-line iPhone 12. As part of the deal, which was yet to be finalized, 58.com would also provide a loan of at least $4 million. Once inked, the pact will cap off what has been a spectacular fall, echoing the fates of other highflying startups such as Mobike and Ofo, the fast growing yet ultimately unsustainable bike-sharing companies. Xi Thought The political season is upon us. There's obviously the U.S. presidential election on November 3, but about a week before then in Beijing, hundreds of senior Chinese Communist Party officials will be gathering for a seminal event of their own. From Oct. 26-29, members of the party's Central Committee will be holding a so-called Plenum behind closed doors to review and approve a wide-ranging package of policies designed to navigate the world's second-biggest economy through the five years ending in 2025. They'll also be considering the intricacies of Xi Thought, a panoply of President Xi Jinping's pronouncements on everything from ecology to military preparedness that when fused together becomes a philosophy. The infusion of Xi Thought into China's five-year plan would be the latest potent sign of his far-reaching influence and would also help pave the way for a third term after Xi's current stint in office ends in 2022.  Xi Jinping at a primary school in China's Hunan Province, in Sept. 2020. Photographer: Xinhua News Agency/Xinhua News Agency What We're Reading And finally, a few other things that caught our attention: |

Post a Comment