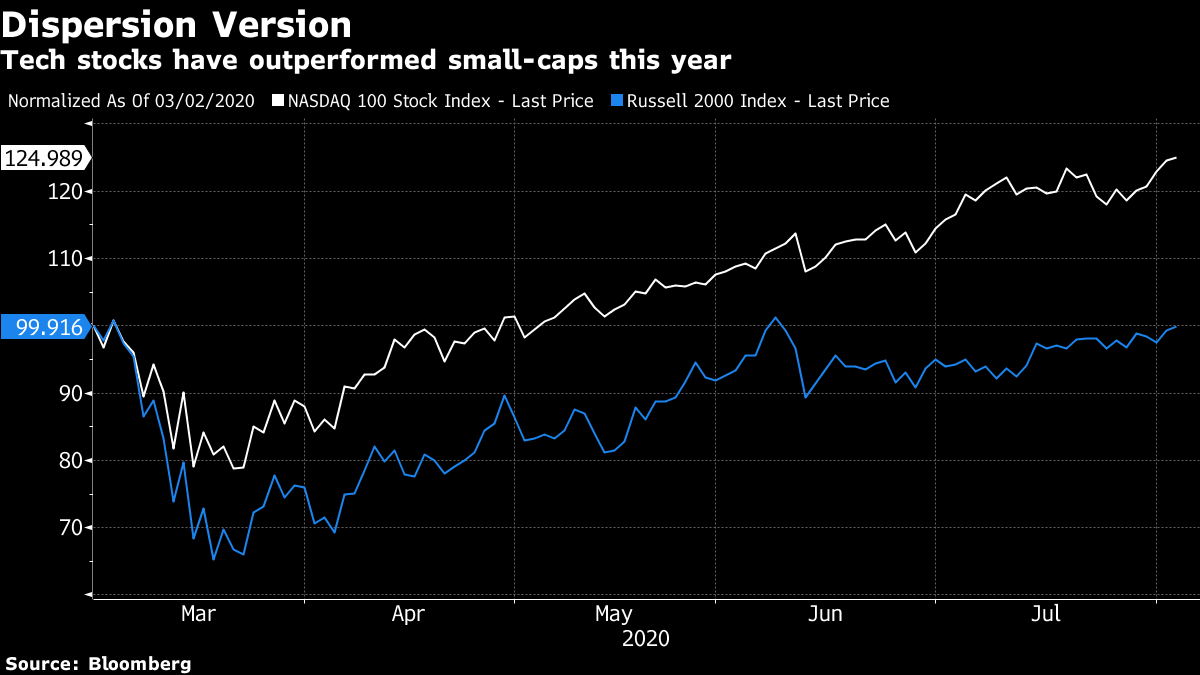

| The U.S. and China prepare for talks to assess the phase-one trade deal. Huge explosion kills dozens in Beirut. And vaccine results send Novavax investors on wild ride. Here are some of the things people in markets are talking about today. Senior U.S. and Chinese officials are planning to assess the nations' phase-one trade agreement this month against a backdrop of rising tensions between the countries, according to people briefed on the matter. The discussion, led by U.S. Trade Representative Robert Lighthizer and Chinese Vice Premier Liu He, would take place on or around Aug. 15, six months after the agreement took effect, as directed in the text of the accord, the people said. The White House declined to comment, and the U.S. Trade Representative's office didn't immediately respond to a request for comment. A massive explosion at Lebanon's main port rocked Beirut, overwhelming hospitals dealing with the injured and dying. The blast was so large it blew out windows across the capital and was even heard from Cyprus. Authorities say it was caused by highly explosive materials at the port, but didn't say whether it was an accident or an attack.The casualty toll continued to climb through the night on Tuesday, with the health minister saying around 11 p.m. that 67 people were killed and some 3,600 injured.Video footage showed what appeared to be a fire, followed by crackling lights and then a much larger explosion as an enormous cloud of smoke rapidly engulfed the area around the Port of Beirut. Buildings in the area and miles away were severely damaged, including the electricity company and other government entities. Novavax shares saw huge swings in extended trading as investors took a critical eye to early data on its experimental vaccine for Covid-19 following a 3,800% rally in the stock this year. The shares briefly fell as much as 34% postmarket on Tuesday, before paring the decline. The two-injection regimen when administered concurrently with Novavax's immune-boosting technology generated antibody responses that were four times higher than those seen in people who had recovered from the disease. Some of the healthy adults in the study experienced side effects including fever, headache and fatigue. As urgency in the race for immunization grows, Singapore is funding research by U.S. vaccine developer Arcturus Therapeutics in order to secure the first doses of any successful final product. Meanwhile, the Governor of Japan's Osaka prefecture touted the powers of gargling medicine to control the coronavirus, sending related shares jumping and clearing shelves of the medicine, even as some questioned the findings. With signs of easing in some of the hardest-hit U.S. states and an increase in new cases in Germany, Poland and the Netherlands, here's how Bloomberg is tracking the virus. Asian stocks looked set for modest declines Wednesday as investors mulled the progress of stimulus talks in Washington and reports of a plan to review the U.S.-China trade deal. Treasuries pushed higher. Futures pointed lower in Japan, Australia and Hong Kong. S&P 500 Index futures opened flat. Earlier, the benchmark closed modestly higher after wavering between small losses and gains throughout the day. The dollar weakened against major peers. Gold rallied to above $2,000 an ounce. Ten-year Treasury yields fell to their lowest since March. Oil dipped after climbing to its highest in nearly two weeks as an explosion in Beirut stoked fears over instability in the region. Argentina's overseas notes rallied after the government reached a $65 billion restructuring deal with creditors. If ever there was a bad time to own the biggest developer in the world's most expensive real estate market, this would be it. Just ask the Kwoks. The family behind Hong Kong's largest property empire has seen its fortune shrink by almost $8 billion in the past 12 months, the steepest drop among Asian clans on Bloomberg's ranking of the world's wealthiest dynasties. Battered by Hong Kong's worst political and economic crises since at least 1997, shares of the Kwoks' Sun Hung Kai Properties are now trading at less than half the value of the company's net assets — within a hair's breadth of the most depressed level on record. The selloff is more than just bad news for Hong Kong's richest family, which will endure with a diminished net worth of $30 billion. It also reflects a sobering outlook for the city as a whole. What We've Been Reading This is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in this morning We've talked before in this space how the coronavirus crisis seems to have accelerated trends that were in play before the pandemic started. Department stores that have been struggling for years are now filing for bankruptcy. Airlines that have always had difficulty covering their cost of capital are grappling to survive. Meanwhile, big tech companies that were outperforming before 2020 continue to do so this year, and because they dominate the S&P 500, the index as a whole is rising. Looking at the stock market rally on a sector basis is a good riposte to the notion that there's a huge disconnect between equity prices and the overall economy. Stocks are rallying, sure, but they're not necessarily doing so indiscriminately.  On the other hand, sectoral performance doesn't do much to dissuade the notion that flows and liquidity are what matters right now. The stocks attracting money continue to attract money because they are attracting money. It's a circular argument but it's one that also explains why technology shares continue to blow past perceived peaks. In this version of events, there is no limit to how much the shares can go up — because markets are no longer self-limiting. The connection between individual corporate earnings and yields has broken because investors aren't chasing value but inflows. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment