| This week's Brexit Bulletin comes via Supply Lines, Bloomberg's daily global trade newsletter. You can sign up here. U.K. companies seeking to export their wares to the European Union will have to prove the origin of their goods to qualify for duty-free access under any potential post-Brexit free-trade agreement — a bureaucratic headache that's about to menace £150 billion ($195 billion) of goods. The end of Britain's customs union with the EU means U.K. firms will have to comply with so-called rules of origin to trade with nations in the region once the Brexit transition period ends on Dec. 31. Many have never had to identify the share of their exports produced domestically, and if they can't do it they'll have to pay tariffs on goods shipped to the EU. Read More: Brexit Red Tape Reality Dawns on Firms In addition to a new mountain of paperwork, a certificate of origin costs about £30 per shipment, according to the U.K. Trade Policy Observatory at the University of Sussex. The threat posed by post-Brexit rules-of-origin restrictions to U.K. operations of automakers such as Nissan and Toyota, which collectively employ about 10,000 people, could be existential. That's because trade agreements usually require about 55% of a product to be made locally in order to qualify for zero-tariff treatment. Yet only about 20% to 25% of the overall value of cars produced in the U.K. originates domestically, according to research group U.K. in a Changing Europe. Even the famous Mini Cooper would be in the firing line. Only about 40% of the value of the parts in the iconic vehicle, made by BMW at its factory near Oxford, are produced in the U.K. Given that it would be virtually impossible for Mini to replace European-made parts with U.K.-made ones by Jan. 1, models exported from Britain would be on track to face a 10% tariff without an agreement on rules of origin.  Mini Coopers at a plant in Cowley near Oxford, U.K. Photographer: Chris Ratcliffe/Bloomberg "Price increases would be inevitable, with potential for reduced demand and therefore reduced production," Graham Biggs, a spokesman for BMW, said in an email. Hopes hang on the U.K. and EU coming to an agreement on rules of origin in their ongoing trade talks. Britain has made an ambitious proposal that counts inputs as local provided they originate from the bloc or any country with which the U.K. or EU has a trade agreement. Until white smoke emerges from the talks — which could extend into October with no guarantees of a deal — companies are left not knowing whether they'll have to reorganize their supply chains to be able to export to the EU tariff-free post-Brexit.

— Joe Mayes and Siddharth Philip The Brexit Bulletin is taking a summer staycation. We'll return after U.K.-EU talks resume on Aug. 17th. Brexit in Brief - The financial industry is being warned (again) not to rely on "empty shell" offices to do business in the EU from next year.

- A post-Brexit trade deal with Japan is close to being agreed.

- The U.K. is turning a field near the White Cliffs of Dover into a lorry park for post-Brexit customs checks.

- Joe Mayes spent a hot morning checking out the site of another lorry park, near Ashford in Kent.

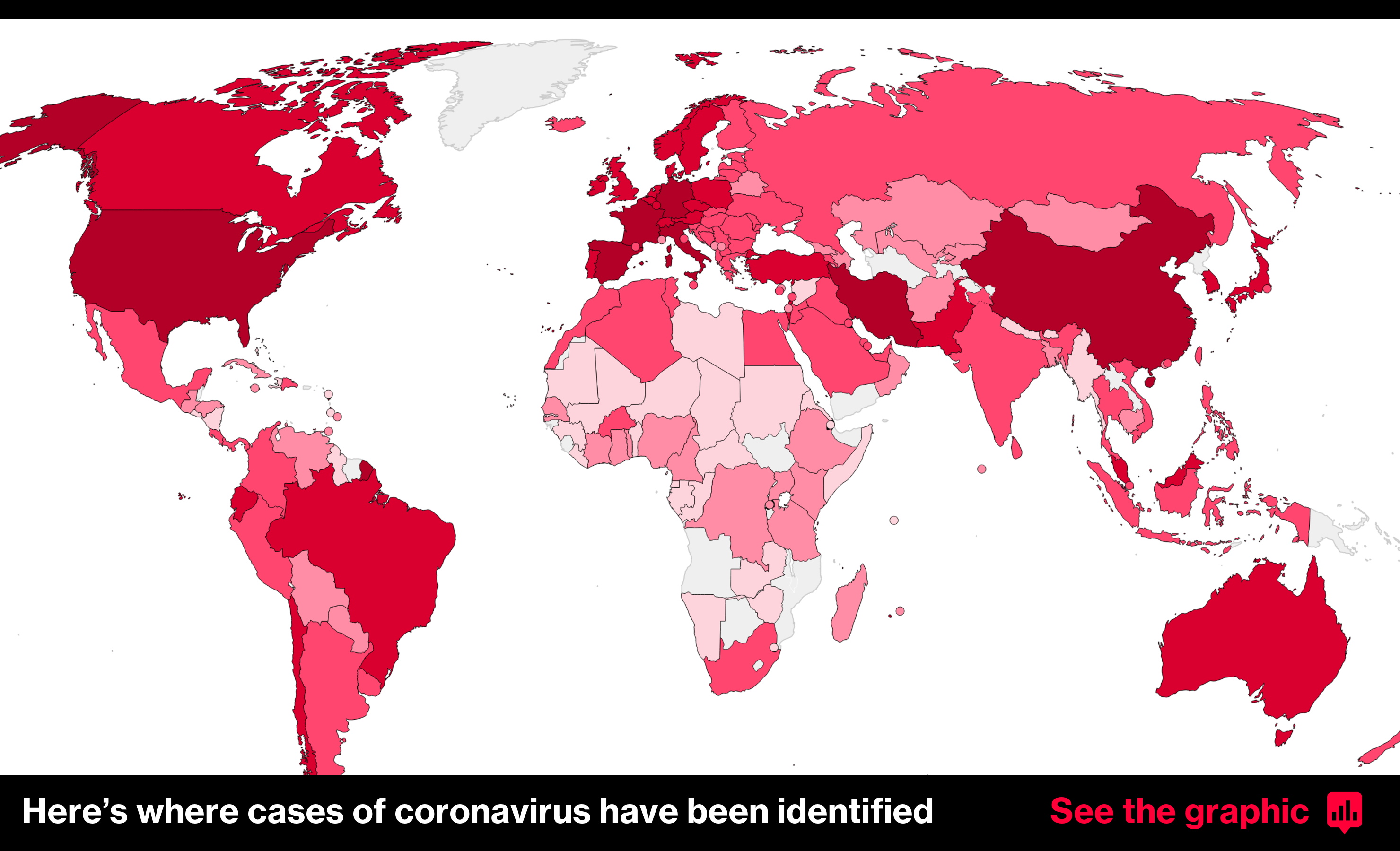

Beyond Brexit  Click here for the latest maps and data on the spread of coronavirus. Sign up here for our daily coronavirus newsletter, and subscribe to our Covid-19 podcast. Want to keep up with Brexit? You can follow us @Brexit on Twitter, and listen to Bloomberg Westminster every weekday. It's live at midday on Bloomberg Radio and is available as a podcast too. Share the Brexit Bulletin: Colleagues, friends and family can sign up here. For full EU coverage, try the Brussels Edition. For even more: Subscribe to Bloomberg All Access for our unmatched global news coverage and two in-depth daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment