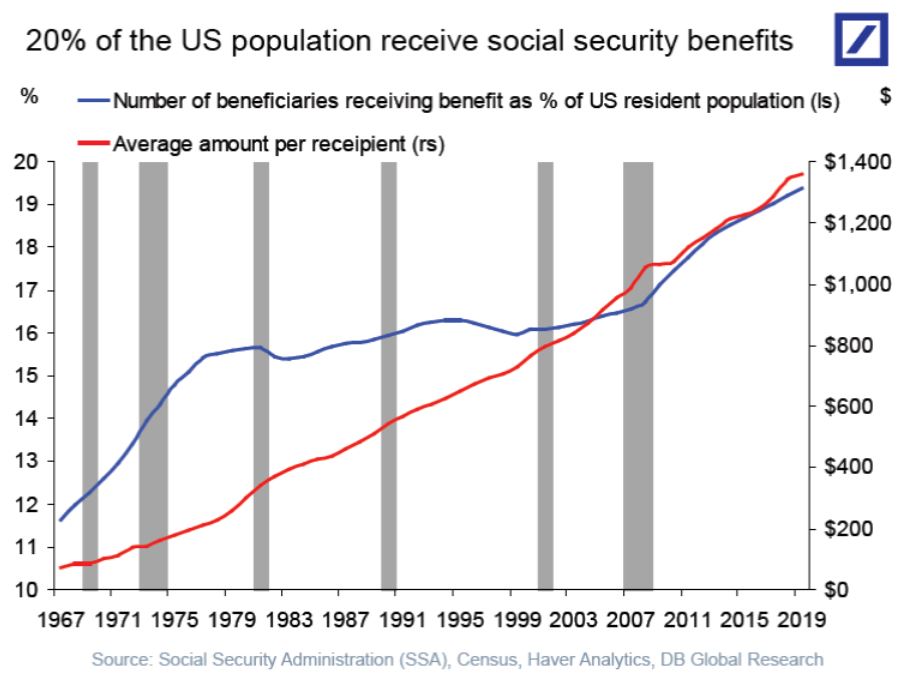

War risk recedes, China to sign trade deal, and global growth to remain sluggish. Peace rallyThe prospect of war between the U.S. and Iran faded after President Donald Trump backed away from threats to launch further attacks, instead calling for a deal with Tehran to make "the world a safer and more peaceful place." He said his administration would impose new sanctions on the Islamic Republic to push it back to the negotiating table. Markets cheered the deescalation, with oil this morning trading at levels last seen before the killing of a top Iranian general last week. Liu He comingChina confirmed that Vice Premier Liu He will travel to Washington next week to sign the phase one trade deal with the U.S. After that, there's round-two to look forward to. When President Trump announced the date on Twitter earlier this month he stated his intention to visit Beijing to start negotiations on the second phase. Meanwhile, China intends to open up oil and gas exploration to foreign companies, in an attempt to ease commercial frictions with the U.S. Growth outlookThe World Bank said that the global expansion will accelerate slightly to 2.5% in 2020, down from a previous 2.7% projection. In its latest Global Economic Prospects report the lender warned that conditions remain fragile as it lowered euro area and China estimates for this year. There was some good news from Germany this morning as industrial production rebounded, raising hopes the sector may be ending its protracted slump. Markets riseGlobal equity markets are extending yesterday's post-Trump speech rally. Overnight the MSCI Asia Pacific Index climbed 1.3% while Japan's Topix index closed 1.6% higher as the yen weakened. In Europe, the Stoxx 600 Index had added 0.4% by 5:40 a.m. Eastern Time with Germany's DAX Index coming close to its January 2018 peak. S&P 500 futures pointed to another positive session, the 10-year Treasury yield was at 1.870% and gold continued its slide. Coming up…Weekly initial jobless claims at 8:30 a.m. are expected to come in at 220,000. There are no fewer than six Fed speakers today: Vice Chairman Richard Clarida, Minneapolis Fed President Neel Kashkari, New York Fed President John Williams, Richmond Fed President Thomas Barkin, Chicago Fed President Charles Evans and St. Louis Fed President James Bullard. What we've been readingThis is what's caught our eye over the last 24 hours. Correction: Yesterday's email said that oil fell in the wake of the Iranian missile attack. Oil rose. And finally, here's what Joe's interested in this morningAt the moment, it seems, recession isn't high on the list of anyone's concerns about the U.S. The stock market is high, volatility is low, employment is growing, the Fed is disengaged and it seems unlikely that in an election year Trump would be inclined to cause any market shocks. But presumably another one will come eventually, and this incredibly long cycle will come to an end. In his latest blog post, University of Oregon economist and Bloomberg Opinion contributor Tim Duy highlights one reason why the art of recession forecasting is different from what it used to be, and that is the changing nature of manufacturing's impact on the U.S. economy. As he notes, we've seen multiple periods, post-crisis, where the manufacturing ISM has diverged significantly from the services ISM. Manufacturing just doesn't have the same macro oomph that it once had, even though an extraordinary amount of attention is paid to this number. Thus any old framework that's implicitly based on the idea of an economy overheating and producing too much stuff doesn't really work anymore. Another important factor is pointed out in a note from Deutsche Bank's Torsten Slok, which looks at the percentage of the U.S. population that's receiving Social Security and how much they're getting paid. Now on the one hand, people look at a chart of Social Security recipients that's going up and to the right, and that makes them anxious about all kinds of things. But the flipside is that a growing percentage of the population is receiving income that's not subject to the fluctuations of the economy. And that represents spending power that's more permanent and less volatile. And that's growing too. That's not necessarily bullish for growth, but it is bullish for diminishing macro-volatility. Between that and the decreasing pertinence of manufacturing, that's two good reasons to think predicting recessions will remain tricky.  Photographer: Weisenthal, Joe Photographer: Weisenthal, Joe Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment