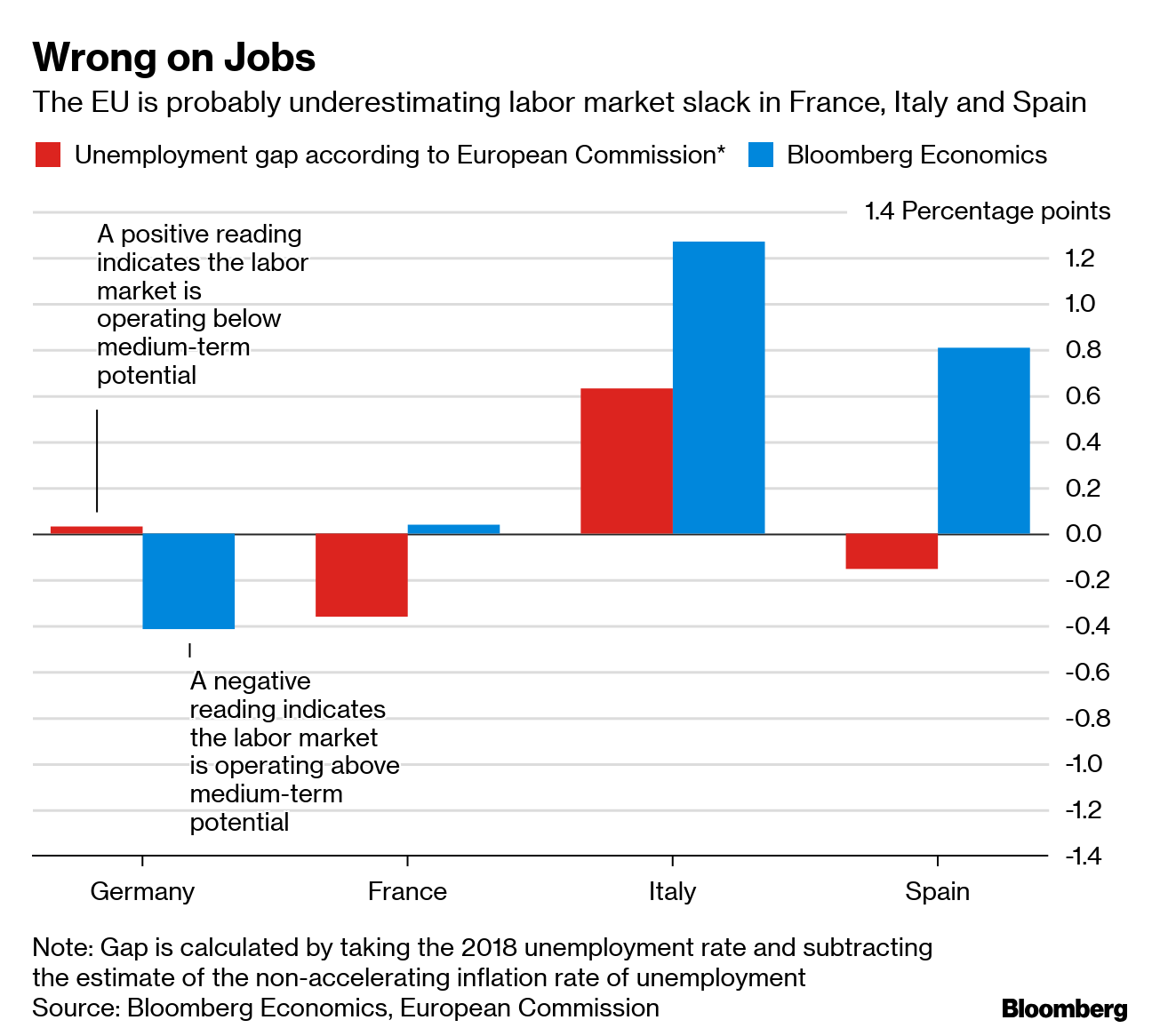

Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. Sign up here to get it in your inbox every weekday morning. European Central Bank policy makers are in Vilnius today for their annual out-of-town meeting, where they will decide on whether the euro area needs more stimulus as the global economy flirts with recession. They'll discuss updated economic forecasts, plunging inflation expectations and escalating international trade tensions. Investors and economists are increasingly calling for action from Mario Draghi, who is in the final months of his term. If he acts, he won't be alone. Central banks from Australia to the U.S. have taken steps or signaled openness to easing, if necessary. — Viktoria Dendrinou and Paul Gordon What's HappeningTrump's Travels | As President Donald Trump comes to France today for the commemoration of the 75th anniversary of the D-Day Normandy landings, polls show his popularity in the country has risen. He attended a similar ceremony yesterday in the U.K., where he met briefly with German Chancellor Angela Merkel. On a visit later to Dublin, he reassured Ireland that it has nothing to fear from Brexit, leaving observers with more questions than answers. End of May | Theresa May is technically stepping down as Conservative leader tomorrow, and the race to succeed her is well underway, amid warnings from early favorite Boris Johnson that the party faces an extinction threat if Brexit is delayed beyond October. Tory leadership contests are curious beasts in which front-runners often don't win. Here's a guide to how it works. Italian Bluster | After Brussels warned Italy over its failure to rein in its debt, the key question is whether the country's populist government will seek a confrontation or a compromise. Signs so far haven't been too promising: Deputy Premier Matteo Salvini said his administrationwon't back down from its plan to cut taxes, regardless of EU threats. French Car Crash | So much for Macron changing everything. Fiat Chrysler abruptly withdrew its offer to combine with Renault, blaming the biggest shareholder of the French carmaker, which is none other than the government itself. The merger would have created the world's third-largest automaker. In Case You Missed ItDanish Rejection | Exit polls in Denmark's general elections indicated that a center-right government that has relied on an anti-immigrant, euroskeptic party to stay in power for the past four years is being thrown out. Mette Frederiksen, the 41-year-old head of the opposition Social Democrats, is set to become the country's youngest prime minister and its second female head of government. Bank Bailout | Slovenia isn't backing away from its collision course with the ECB over compensating investors who lost money in a 2013 bank bailout, Premier Marjan Sarec said. The ECB has warned that this would violate a ban on euro-area central banks paying liabilities for a state, and is threatening to take the matter to the European Court of Justice. Montenegro's Woes | Montenegro is taking steps to retool its public finances after clawing its way back from the economic havoc caused by a Belt-and-Road loan from China worth almost a fifth of its economy. The loan triggered a 2014 credit-rating downgrade by S&P Global markets, making it the only country in Europe to be "at particular risk of debt distress," and serving as a warning for other countries temped to turn to China for financing. Polish Resignation | When it comes to commemorating the past, nothing is straightforward in Poland these days, even for something that until recently was widely regarded as the country's biggest political triumph. In the Polish opposition stronghold of Gdansk — the city where Lech Walesa famously made a stand against the communist regime — there's a sense of resignation that the ruling nationalists will win again in another key election for Europe, Marek Strzelecki and Wojciech Moskwa report. Quiz | This week's quiz is for the financial-regulation aficionados among you. Back in 2011, the European Commission proposed the introduction of a financial transaction tax to make the private sector pay its "fair share" in the crisis. A group of 10 countries still hasn't given up on the idea. By how much has the estimated revenue from the tax fallen during the almost eight years of talks? Find the answer in tomorrow's newsletter. Chart of the Day The European Commission is probably underestimating labor market slack in France, Italy and Spain, according to Bloomberg Economics. That may sound like a technical point, but it has real life consequences — limiting how much these countries can spend before falling foul of budget deficit rules imposed by Brussels. BE thinks the job markets in the three countries still have some way to go before reaching their potential, while Germany might already have been operating above potential last year. Today's AgendaAll times CET. Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. We also publish the Brexit Bulletin, a daily briefing on the latest on the U.K.'s departure from the EU. For even more: Subscribe to Bloomberg All Access for full global news coverage and two in-depth daily newsletters, The Bloomberg Open and The Bloomberg Close. WhatsApp: Join us on WhatsApp to get news, insight and analysis of the day's top stories. Sign up here. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment