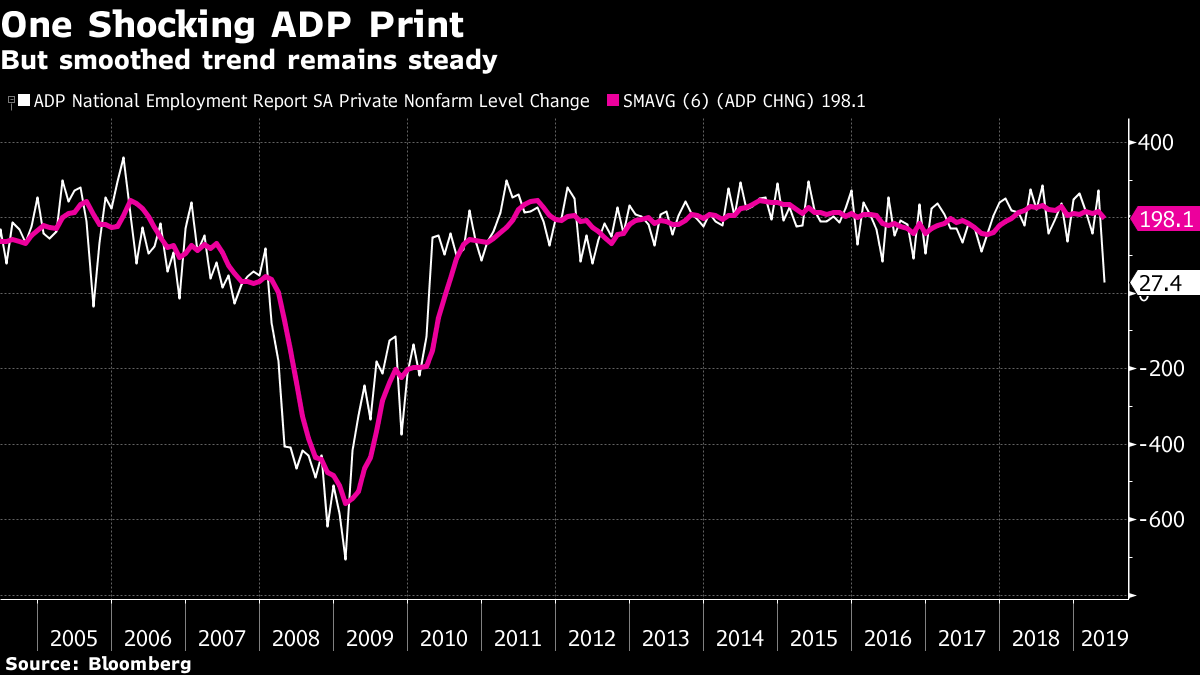

| Welcome to your morning markets update, delivered every weekday before the European open. Good morning. The European Central Bank will announce its interest rate decision, markets will continue pondering the direction of Federal Reserve policy and Fiat Chrysler and Renault's merger plans are in tatters. Here's what's moving markets. ECB Day In a week when the central bank policy outlook has taken a decidedly dovish turn, the ECB's tone and where it indicates rates are going will be the event of the day. Traders are now betting on a cut in the next year, only months after a raise had been the consensus. The bank's newly retired chief economist says central banks are going to have a tough time dealing with a world of growing protectionism and declining trust in institutions. For Thursday, the ECB will face a Europe where labor market slack is being underestimated and where there are mixed feelings about Japanification. Fed Ammo Having adjusted to expecting that the Fed will eventually cut interest rates in the face of the threats posed by trade tensions, markets are now considering whether the central bank will have enough ammo to keep the "Powell Put" functioning as it should. As least the yield curve seems to be recovering some of its predictive powers. The Fed is going to need plenty of ammo with predictions the trade war will cost the global economy $800 billion, though its Beige Book indicates the U.S. economy is improving. Still, for investors, they've now got a trade war ETF to play the story. Fiat Walks Away Fiat Chrysler Automobiles NV abruptly withdrew its offer to combine with Renault SA after the board of the French carmaker postponed making a decision on the proposals for the second time. The decision will put yet more focus on the European autos sector on Thursday, which may also see some impact from President Donald Trump saying that "not nearly enough" progress has been made in talks with Mexico, a new front in the trade war that has further rattled the car industry. On to France Trump's European sojourn continues with a visit to France for the 75th anniversary of the D-Day landings. Yesterday he was in Ireland, where he attempted to reassure on Brexit but ultimately left with more questions hanging. Angela Merkel also issued a warning about threats to world peace as she attended an event with the president. Back in Brexit-land, Conservative leadership hopeful Michael Gove broke with most of the other candidates and said he could live with another short delay to the Oct. 31 deadline, helping to set up no-deal as the battleground for those vying for Number 10. By the way, this is how the next prime minister will be selected. Coming Up... Asian stocks were mixed as the Mexico talks sapped sentiment, with the safe-haven yen edging higher. Oil entered a bear market on Wednesday and those losses have broadly held into Thursday on fears of a supply glut following a jump in U.S. inventories. OPEC and Russian energy ministers will be meeting. Chinese President Xi Jinping will speak in Russia, while German factory orders and euro-area GDP data will keep traders busy ahead of the ECB. And after the U.S. close, watch for the first results from the world's hottest vegan stock, Beyond Meat Inc. What We've Been Reading This is what's caught our eye over the past 24 hours. And finally, here's what Mark Cudmore's interested in this morning The month of May saw the U.S. add the least number of jobs in nine years, according to Wednesday's ADP employment report. However, this is a very volatile report and the smoothed trend has been remarkably steady for the past eight years. Many people like referencing the 3-month moving average but I prefer using the 6-month moving average (pink line in chart below), which suggests there's no trend of weakness yet. Even as someone who has turned structurally bearish on U.S. stocks, I acknowledge that the labor market has been remarkably resilient. Unfortunately, that hasn't translated into significant real wage gains for all sectors of society. Widening inequality in the U.S. means that asset prices are no longer as correlated with the U.S. jobs market as they once were. Fifteen years ago, the monthly non-farm payrolls report (due this Friday) was the pinnacle of U.S. economic data releases for most traders. Its dominance has since been slowly eroded and it no longer raises the same level of tension and nerves in financial markets as it once did. It's now just another piece of a large puzzle.  Mark Cudmore is a Bloomberg macro strategist and the Managing Editor of the Markets Live blog. Bloomberg Terminal users can follow him there at MLIV <GO> Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Before it's here, it's on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can't find anywhere else. Learn more. |

Post a Comment