| There's a grand old journalism school cliche that the real news is happening wherever everyone was looking a year ago. In the markets, with a much shorter attention span even than journalists, we can maybe cut that down to two weeks. The U.S. stock market had an unpleasant Thursday session to end the month, but still brought the S&P 500 no lower than its trough on Monday last week, the day when the difficulties of the stricken property developer China Evergrande Group first prompted a wave of fear in U.S. markets. As the intervening days have brought ample fresh excuses to sell, for those who wanted to sell, that implies that people are far more confident about the Evergrande situation now. It is hard to see why. Some of this can be down to the psychological concept of "anchoring." Two weeks ago, the question was whether Evergrande would turn into a Chinese Lehman crisis. The odds look good that it won't. Once this had been duly internalized, it became much easier to ignore disquieting evidence that Evergrande will do significant damage to a Chinese economy that already appeared to be slowing. In terms of new "news," we now know that Evergrande is starting to pay money it owes to people who hold its debt through wealth management plans, or WMPs, which are China's most popular retail investment vehicles. However, it has still only paid the first 10% of what was due last month. In itself, this implies a 90% haircut is still a possibility, which would be a horrific outcome. We also now know that the government has been prepared to buy a stake in Shengjing Bank Co., a regional lender, from Evergrande. This was a classic move to limit the risk of financial contagion a la Lehman, and helps to confirm that China isn't going to let Evergrande turn into a generational crisis if it can help it. As Beijing does have the tools to stop that happening, this is good news for the rest of the world. However, the priorities that the Chinese government is showing should alarm more or less everyone. WMP-holders need to be paid something because there are a lot of them, and an Evergrande default would hurt them grievously. There have already been angry demonstrations over the issue. So domestic political stability and the survival of the Communist leadership remain paramount, as they have been for decades. Meanwhile, buying the Shengjing stake not only helped Evergrande and all its creditors. It also helped out a long list of ultra-wealthy stakeholders in Shengjing, many of them politically connected and good friends with Hui Ka Yan, Evergrande's billionaire founder. It looks like crony capitalism. Finally, there is the issue of foreign creditors. At the time of writing, there has still been no payment to holders of a dollar-denominated bond who were due to be paid Wednesday. At this point, it looks like the priorities are: - Avoid a systemic Lehman-style crisis;

- Avert popular unrest over WMPs;

- Make sure all the well-connected cronies are OK;

- Maintain good relations with overseas investors and creditors.

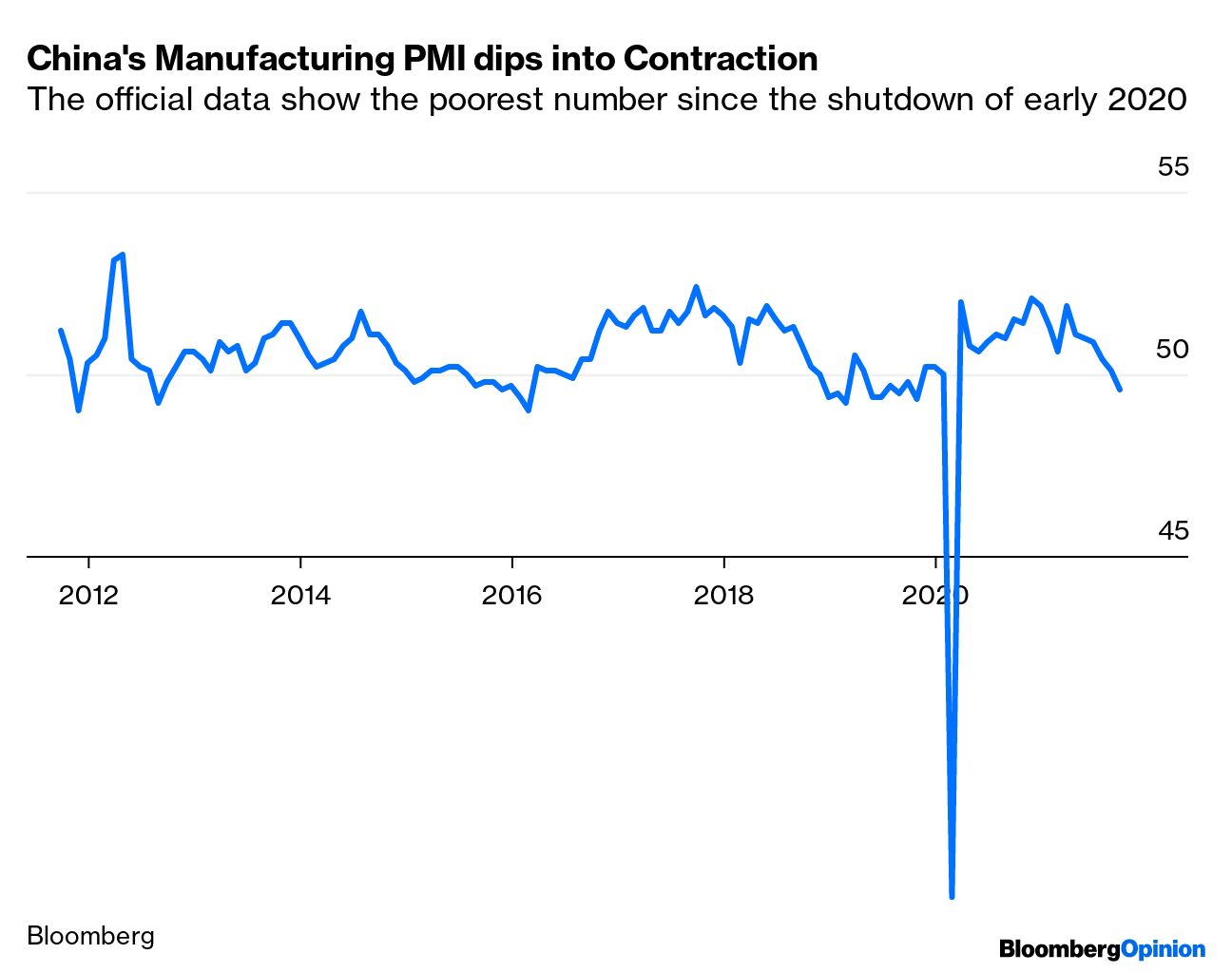

Number 4. at this point seems to come a long way behind the first three. This may well be a defensible set of priorities for the officials trying to manage the crisis in China, but it's not great news for international investors. It would imply a much slower flow of investment money into China in future, and likely would portend more damage for dollar-denominated Chinese assets. To be clear, this is a developing situation. Chinese priorities may yet prove to be different from the list above, and foreign creditors may be much happier. But the key point is that it's hard to frame all this as particularly good news since Evergrande first struck fear into Western investors at the beginning of last week. Further, Evergrande feeds into mounting evidence of a slowing Chinese economy, which has contributed to the risk-off moves and shift into the dollar of the last few days. Unlike much of the rest of the world, China doesn't have a lot of data to come in the next week. Its ISM surveys for September are already out, and they show an ongoing slowdown. The Caixin and the official numbers moved in different directions, as Chinese data continue to be problematic (to be euphemistic). Bloomberg Intelligence's advice is to prefer the official number as a guide to the strength of industry. That is a shame, because the official number shows manufacturing dipping into contraction:  The effect of China's power shortages is already visible. The administration has made a priority of fixing that problem, but it remains to be seen whether it can. It's hard to imagine that Evergrande, or the general attempt to clamp down on leverage in real estate which has been going on for a while now, will yet have had much effect on the numbers. We're about to get the standard beginning-of-the-month deluge of data, which will reveal whether other countries' manufacturing sectors are also slowing. In the U.S., Friday will also bring consumer sentiment and inflation expectations from the University of Michigan, and the latest readout of the PCE deflator, the Fed's favorite inflation gauge. It's likely that we will continue not to talk that much about China and Evergrande. But the news will continue to be in the place that everyone was talking about two weeks ago. Next week we will hold our online conversation on Winning the Losers' Game, the classic polemic in favor of indexed investing by Charles D. "Charley" Ellis, which was published in its eighth edition earlier this year. If you have time to take a quick look through it over the weekend, it's worth the time. It's very well written, in handy bite-sized chapters, and there should be a lot in there to spark ideas for anyone who is involved in investment.  If you have questions for Charley, who has been at the center of the investing business for decades, please send them to the book club email address: authersnotes@bloomberg.net. The more we have in advance, the better we can arrange the conversation. Now for the details. This is only a "club" in the sense that Oprah Winfrey's book club is. There are no meetings or membership fees or anything like that. Every month or so I nominate a book to read, and a month later we hold a conversation about it. Like Oprah's club, but with not quite so many participants, the idea is to make this a fun way to give ourselves some reading to do. The discussion itself is a live blog on the Bloomberg terminal. If you don't have access to the terminal, you can't follow it live. You can, however, submit questions, and you can read the entire transcript when we post it on the website later in the day. The conversation will involve Charley, with me and Janet Lorin, who is Bloomberg's expert on university endowments. We will start at 11 a.m. New York time Tuesday, Oct. 5, and the chat will last for 90 minutes. Please send in any and all questions for Charley that you think relevant. Mentioning Janet Lorin leads me to this piece which she published Thursday. Endowments have a financial year that ends June 30 (better fitting the rhythm of the academic year), and tend to take many months before they publish their results, but the numbers that Janet has dug up in conversations around the sector suggest that something truly remarkable is afoot. She has found many universities that are ready to report returns of more than 60% for their last financial year. For them, the pandemic came to the rescue. Negligible interest rates helped many of their investments, while years of patient holdings in venture capital funds paid off spectacularly amid the pandemic upheaval. This passage is little short of extraordinary: "There will probably be nothing like this in our lifetime," said James Clarke, senior vice president of investments and treasurer of the Kansas University Endowment Association. "It almost felt like 2021 was the realization of the promises we were made about the internet 20 years ago -- we spent our lives doing virtual meetings on Zoom with products delivered to our door and unlimited Netflix." About 30 venture funds that Kansas has invested in posted triple-digit gains, he said.!!!!

The emphasis is mine, as those numbers are mind-blowing. In a sense, this is an example of the market acting as a balance for the pain inflicted elsewhere in the economy. Few sectors were hurt more grievously by the pandemic than higher education. They've lost income, and decades of merrily increasing fees by more than inflation have ground to a halt. With many colleges struggling to survive, and convince students that four years of residential education is really worth it, investment gains like this will be manna from heaven. It's also a dramatic contrast with the previous market crisis, in 2008, which forced several big endowments, including even Yale, to borrow to meet commitments to provide income to their colleges. This year also saw the passing of the most famous endowment investor, Yale's David Swensen. He found a way to win the losers' game, by concentrating on private markets where he could hope to have an edge over others and could take advantage of his ability to live with illiquidity. Ellis chaired Swensen's investment committee at one time, and told me about the secrets of Yale's success under Swensen here. It's worth noting that winning the losers' game often boils down to indexing, minimizing fees, and concentrating on maintaining a sensible long-term asset allocation — but Ellis's ideas are also consistent with the model that Swensen pioneered, and which appears to have received extraordinary posthumous validation in 2020-21. And Swensen's own advice for individual investors was to stick to index funds and rebalancing, which is largely the formula in Winning the Losers' Game. Feel free to ask Charley Ellis about Swensen's legacy and the extraordinary goings-on in the endowment world, as well as the eighth edition of his book. It should be fun. One of the sorest lacks caused by the pandemic has been the ability to get together with a large crowd of other people and have some good innocent fun. I'm not enjoying baseball all that much at present (have a look at how the Red Sox have done recently), but soccer back in the homeland is beginning to grab my attention. Thanks to an easy opening schedule and some luck, my home town team from Brighton are somehow sixth in the Premier League. One extra goal on Monday this week and they would have gone top for the first time ever. I have no grasp of how long this is going to last, so I'm enjoying it while I can. What is great about soccer as played in Europe and South America is the involvement and inventiveness of the crowd. Football fans are getting ever better at adapting pop songs, be they ever so obscure. Liverpool won the Champions League a few years ago with the aid of a tune adapted from a cheesy Italian disco song of the 1980s and renamed Allez Allez Allez. Down in Brighton, the lynchpin of the team is a wonderful Malian international called Yves Bissouma. The fans took Tequila by the Champs and changed it to a hymn to Bissouma, who loves it and has even started dancing when the fans serenade him. But the best I've come across is an adaptation of I Wanna Be Adored by the Stone Roses, one of the greatest opening tracks of all time, for one of the greatest albums of all time. Fans of Celtic in Glasgow adapted it to serenade their own beloved French international, Edouard Odsonne. Now it has become I Wanna Be Edouard. Odsonne himself has now moved south of the border to Crystal Palace (unfortunately), and the Roses are generally adopted by Manchester United (while Manchester City play Oasis, another great Manchester band). But still, what good fun, and it hurts nobody. Let's look forward to cramming together with thousands of other people and shouting ourselves hoarse. It's worth it. Have a good weekend everyone. Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment