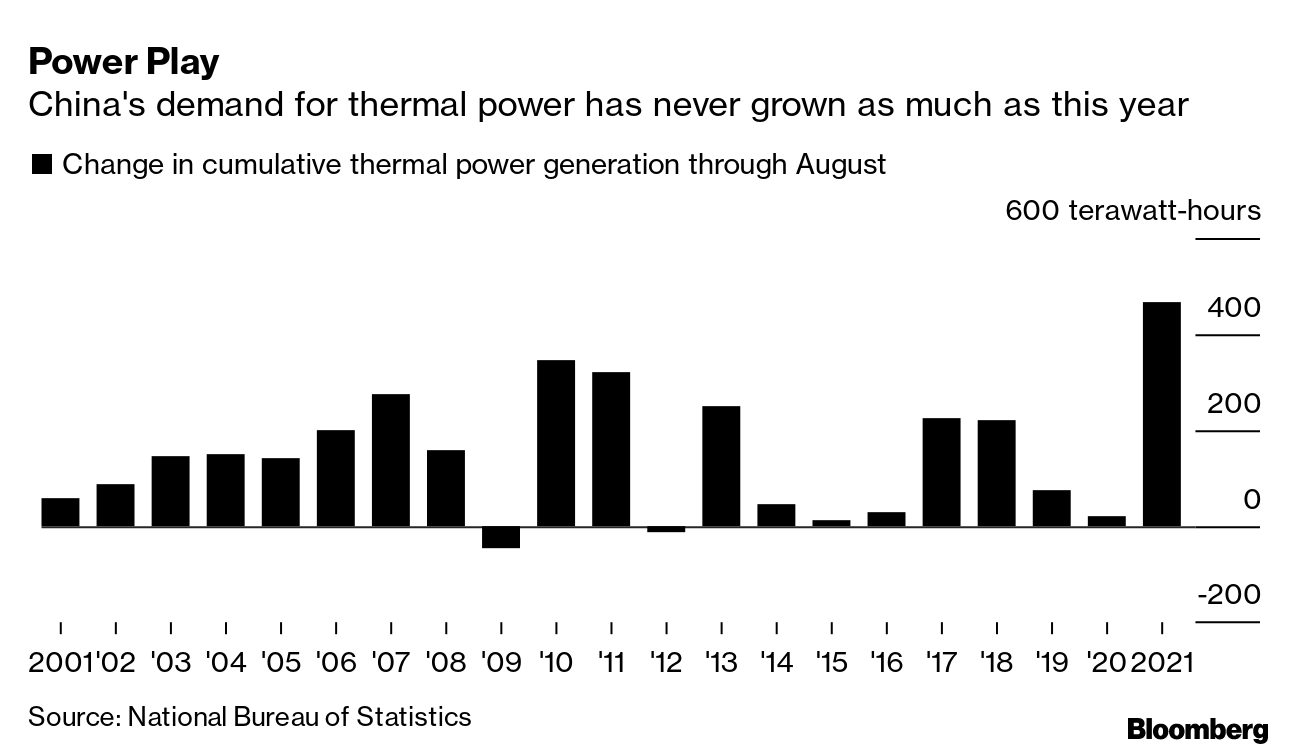

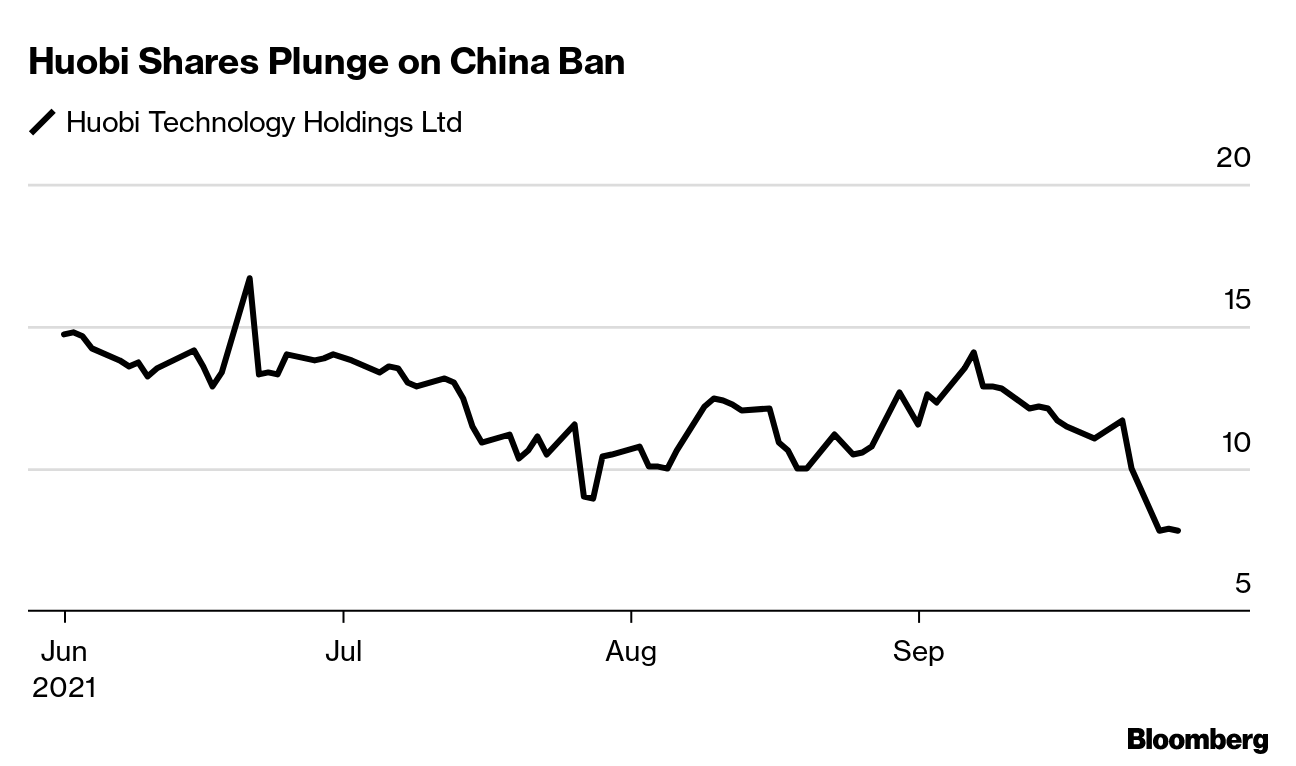

| Residents intermittently lost power across northeastern China. Offices stopped elevators calling at their first three floors in the southern province of Guangdong. A state-owned carmaker told staff to shut off the air conditioning and open a window instead. Those were some of the scenes as escalating electricity shortages threatened to hobble economic growth and snarl global supply chains. The power crunch that's affected over half of China's provinces was not, however, the result of some unforeseen calamity. It was an example of Beijing's long-term goals crashing very hard into the country's realities. As part of President Xi Jinping's pledge to reach carbon neutrality by 2060, China has reined in its coal production, which accounts for 70% of the country's electricity generation. That's led to supply shortages right as demand for Chinese exports caused industrial power usage to surge.  Coal prices have shot up as a result. The problem is that electricity prices, set by the government, haven't increased in tandem, and that's discouraging power producers from generating electricity. China has been ramping up its wind and solar capacity, but it's not enough to fill the gap. Beijing's ambitions meeting stumbling blocks is not uncommon. In 2017, a transition from burning coal to natural gas to provide winter heating was botched when there wasn't enough gas, leaving many to suffer freezing temperatures. More recently, the crackdown on after-school cram classes left many tutors out of work. Even the turmoil at Evergrande can be traced to Beijing's long-term objective of reducing risk in the financial system. As legitimate as many of these goals are, the problem is implementation. It's a challenge made all the more pronounced by China's top-down system, in which policy can change very quickly. A reverse in course is unlikely once China's top leaders have reached a consensus on an issue, be it education, debt or climate change. What can occur is a moderation in how policy is executed. Officials, for example, are already calling for more production and imports of coal. But with the end objective unchanged, the pain – even if dulled – is likely to persist. Manufacturing activity in China contracted in September for the first time since the beginning of the pandemic, according to an official gauge. The electricity shortage, it appears, is already weighing on the economy, with Zhao Qinghe, a senior statistician at the National Bureau of Statistics, pointing to the sluggish performance of energy-intensive industries. With winter on the horizon, a rebound in activity looks unlikely in the near term. The bills are piling up. With no sign Evergrande paid a bond coupon due last week, the deadline for another interest payment hit Wednesday. As of this newsletter's publication, there was no sign that had been paid, either. More deadlines are coming. Evergrande has three coupon payments due on Oct. 11 for dollar notes and another on Oct. 19 for a local bond. There are also four combined payments due in November and December. Another date to watch is around Oct. 23. Evergrande has a 30-day grace period for the Sept. 23 coupon it has yet to pay. If the payment hasn't been made within that period, the firm faces a default. Digital currencies largely shrugged off China's unequivocal ban on transactions involving cryptocurrencies. After initially plunging following the announcement late Friday, Bitcoin prices had rebound by Monday to where they were before the news. According to Bobby Lee, an early crypto mogul who founded and later sold China's first Bitcoin exchange, the bounce back showed the crackdown was expected and not as bad as some feared when it arrived. China has not banned its citizens from owning crypto, for example, even if they're not allowed to trade it. It wasn't good news for everyone, of course. Huobi Technology is one company that's taken a substantial hit. The firm, which runs an exchange with a big Chinese presence, announced after the ban that it'd no longer register new users with Chinese phone numbers and would "retire" existing mainland China accounts by the end of the year.  When Huawei Chief Financial Officer Meng Wanzhou returned to China almost three years after her arrest in Canada, her hero's welcome was broadcast live across the country. Beijing is indeed celebrating. The episode, Chinese Foreign Ministry spokeswoman Hua Chunying told reporters a few days later "once again proves" that Chinese citizens can rely on the Communist Party to "have their back." Less mentioned, meanwhile, are Canadians Michael Kovrig and Michael Spavor. The two were arrested in China days after Meng was taken into custody and then released shortly after she was. That concurrence is hard to ignore, even if both China and the U.S., which sparked everything with a request for Meng's extradition, insist no links exist between the cases. Whatever the circumstances of Meng's release, it looks like a win for Beijing. The question now is how her release will affect the direction of the broader U.S.-China relationship. With the G-20 scheduled for the end of October, and the possibility of a meeting there between Xi and President Joe Biden, we may not need to wait long for an answer.  Meng Wanzhou waves as she steps out of the plane upon arrival following her release, in Shenzhen on Sept. 25. Source: -/AFP A few other things that caught our attention: And finally, please note there won't be a newsletter next week because of the weeklong National Day holidays in China. We'll be back on Oct. 15. |

Post a Comment