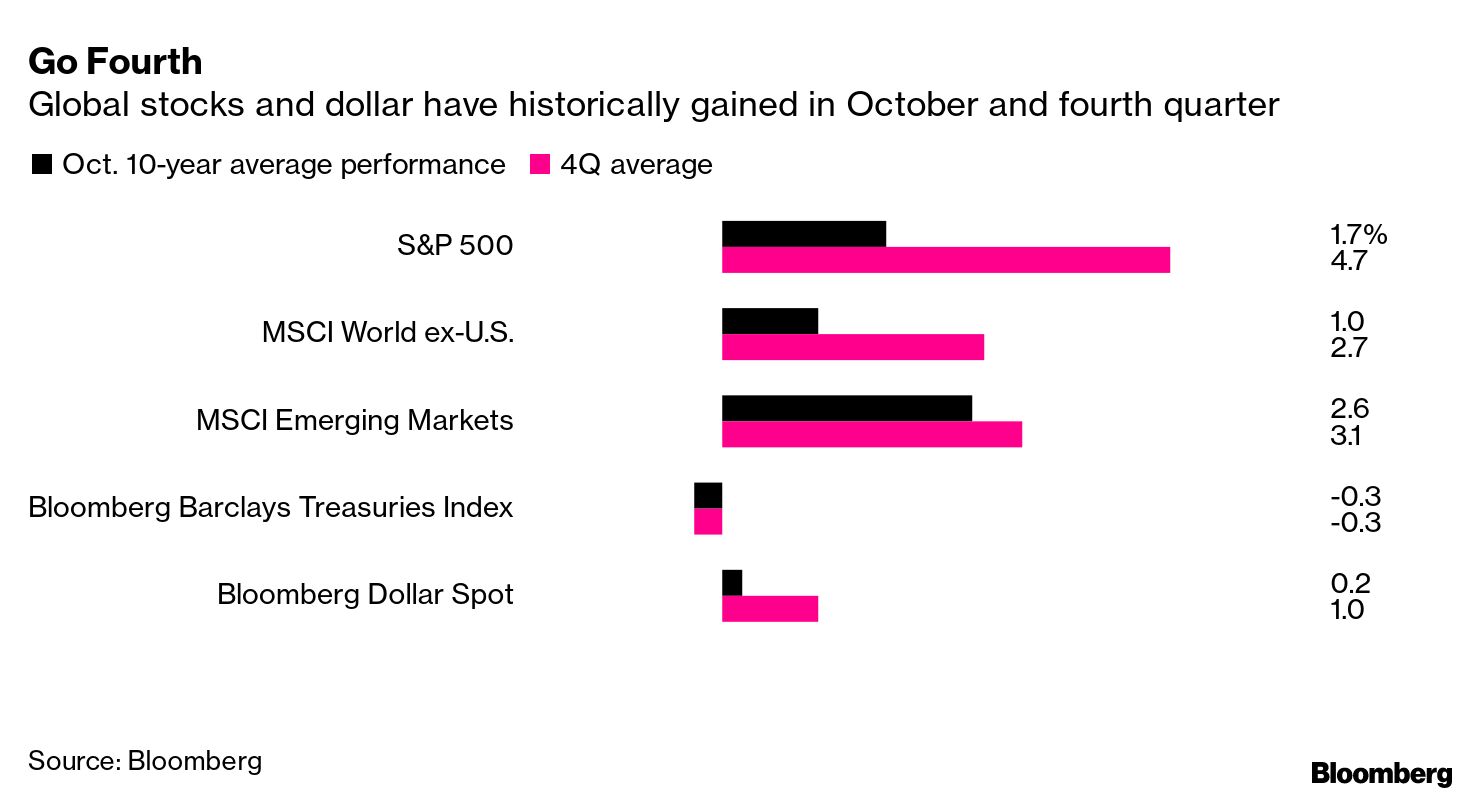

| Good morning. Inflation seen as temporary, more U.K. energy companies collapse, G-7 to discuss international travel and U.S. government shutdown avoided. Here's what's moving markets. Federal Reserve Chair Jerome Powell and his counterparts at the European Central Bank, Bank of Japan and Bank of England voiced cautious optimism that supply-chain disruptions lifting inflation rates around the world would ultimately prove temporary. When asked if U.S. policy makers overdid it in dealing with the economic crisis wrought by Covid-19, Powell argued instead that they had finally managed to avoid the perennial trap of a lackluster response. Three more U.K. energy companies were pushed out of business by sky-high natural gas prices, adding to pressure on the government to step in. Igloo Energy Supply, Enstroga and Symbio Energy announced their collapse on Wednesday, representing a total of about 233,000 households. The latest failures increase the chances that government intervention will be needed. Transport and health ministers of the G-7 countries are said to meet virtually on Thursday to discuss ways to restart international travel. The meeting is being organized by the U.K. While some countries have used so-called vaccine passports to successfully resume cross-border travel, others have held back on implementing app-based technology. Another sticking point has been whether to recognize vaccines in countries where they haven't been approved. U.S. lawmakers have reached an agreement to avoid a government shutdown on Friday, extending government spending until Dec. 3. Meanwhile, President Joe Biden and his aides scrambled to break a deadlock among Democrats that has stalled progress on his economic plans. Democratic progressives vowed to block a $550 billion infrastructure bill today without movement on a bigger spending plan. European stocks are set to gain, shrugging off weak Chinese data which left Asian stocks little changed. Today, fast fashion giant H&M reports earnings, alongside online fashion retailer Boohoo. The ECB's cap on dividends and buybacks ends today. Amid the ongoing inflation concerns, it's a stacked list of speakers today with Fed Chair Powell and Treasury Secretary Janet Yellen testifying at a House committee hearing, while Fed presidents from New York, St. Louis and Chicago all speak at separate events. This is what's caught our eye over the past 24 hours. After a stormy September, the seasonal winds look kinder for risk assets, if historical patterns are a guide. Over the last 10 years, emerging market stocks have led an October charge posting an average 2.6% return, with shares in the U.S. and other developed markets also climbing. All three cohorts go on to extend those gains for the fourth quarter as a whole, with U.S. shares showing an average return of almost 5%, according to data compiled by Bloomberg. Bond vigilantes will be pleased to see Treasuries don't fare too well in the last quarter, although the average decline in a Bloomberg gauge of the bonds is a modest enough 0.3%. Dollar bulls will cheer the greenback, which has tended to strengthen -- by about 1% on average over the last 10 years, based on the Bloomberg Dollar Spot Index. Of course there's a caveat -- and it's a big one -- the much-discussed wall of worry markets need to climb from central bank tapering to government shutdowns to stagflation to possible changes at the top of the Fed. But risk asset bulls can take comfort they have a solid seasonal foundation to start their ascent.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment