| Hello. Today we look at how central bankers are addressing the delta variant, a boost in resources for the International Monetary Fund and the labor markets in the U.K. and U.S. A year and a half into the coronavirus era, it seems global central bankers are coming to the realization that they'll be living with it for a while yet so there's no need to change course with each ebb and flow of infections. That's one of the key takeaways from the Reserve Bank of Australia's surprise decision Tuesday to stick with its planned tapering of bond purchases, even with a lockdown in the nation's biggest city set to send the economy into contraction this quarter. "The experience to date has been that once virus outbreaks are contained, the economy bounces back quickly," Governor Philip Lowe said in a statement reinforcing plans to reduce weekly bond purchases to A$4 billion ($3 billion) a week in early September from A$5 billion now.  Philip Lowe Photographer: Mark Graham/Bloomberg Lowe's decision not to flinch in the face of the delta variant leaves Australia still in line with others like Canada and New Zealand who are tip toeing away from emergency settings. And in South Korea, there's growing signs of support for normalization to start as soon as this year, minutes of the latest policy meeting showed on Tuesday. Federal Reserve officials dropped a mention of progress on the virus from their policy statement last week and some have started to talk about the risks of the delta variant. But they also inched closer to withdrawing stimulus. Attention now turns to Brazil, where its central bank is tipped to hike rates on Wednesday by a full percentage point, the biggest jolt since 2003. Then the Bank of England convenes its rate-setting panel on Thursday. It must also weigh what to do in the face of rising coronavirus infections. British officials who favor patience on scaling back stimulus will likely dominate the policy discussion, with risks to the labor market recovery outweighing a surge in inflation. That leaves Governor Andrew Bailey and colleagues showing little hurry to cut their 875 billion-pound ($1.2 trillion) bond-buying plan.

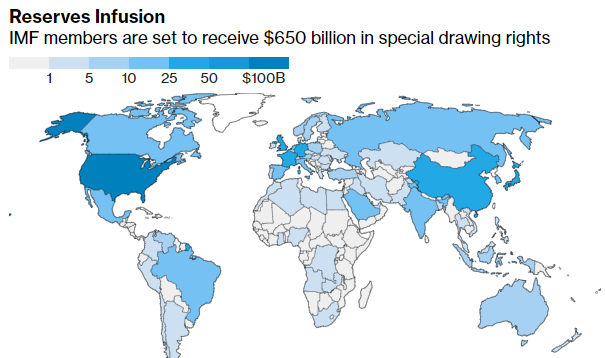

— Malcolm Scott  Member nations approved the biggest resource injection in the International Monetary Fund's history, with $650 billion meant to help countries deal with mounting debt and the fallout from the Covid-19 pandemic.

The creation of the reserve assets — known as special drawing rights — is the first since the $250 billion issued just after the global financial crisis in 2009, with Managing Director Kristalina Georgieva billing it as "a shot in the arm for the world" that will help boost global economic stability. - Staff wanted | One of Britain's biggest challenges post-Brexit is companies across key parts of the economy just can't find enough people.

- Safety net | America's gig workers are about to lose the access to some of the Covid-era social protections that regular employees enjoy, posing a challenge to the Biden administration.

- Fed choice | President Joe Biden has a tough decision in choosing the next Fed chair: Play it safe by giving Jerome Powell a second term or take a chance on somebody more liberal like Lael Brainard, who would please progressives in Congress yet potentially agitate Wall Street.

- Inflation pulse | Tokyo consumer prices unexpectedly rose for the first time in a year, another sign of a recovering inflation pulse. South Korea's inflation unexpectedly picked up speed again in July.

- Price pain | Turkey's inflation climbed more than expected in July to nearly the level of the central bank's benchmark rate, further diminishing the chances of an early cut in borrowing costs sought by the president.

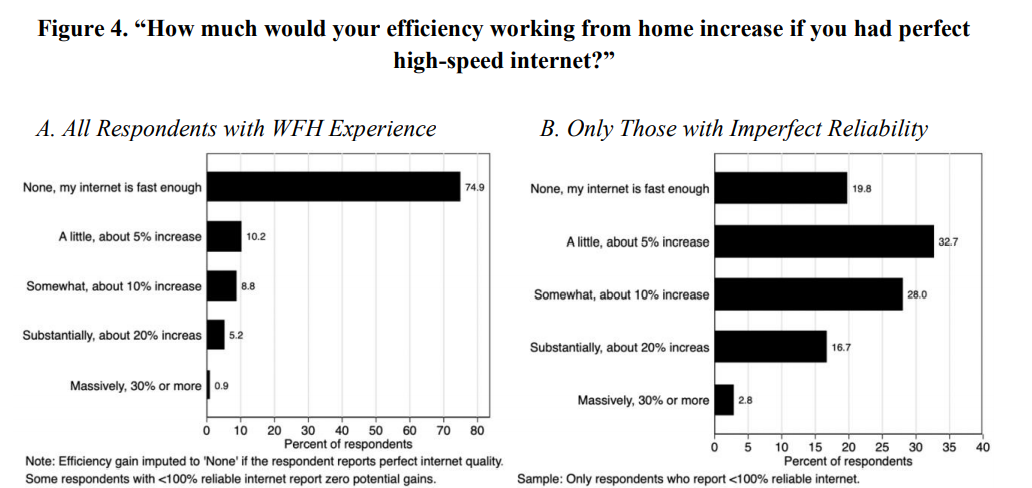

In the age of working from home, moving to high-quality, fully-reliable internet access for all Americans would raise labor productivity by an estimated 1.1% in the coming years, according to academics Jose Maria Barrero, Nicholas Bloom, and Steven J. Davis.

That infers output gains of $160 billion per year, they said in a study published by the National Bureau of Economic Research. "Our survey data also say that subjective well-being was higher during the pandemic for people with better home internet service conditional on age, employment status, earnings, working arrangements, and other controls," wrote the study's authors. "In short, universal access would raise productivity, and it would promote greater economic and social resilience during future disasters that inhibit travel and in-person interactions." A Nobel laureate speaks...  Read more reactions on Twitter - Click here for more economic stories

- Tune into the Stephanomics podcast

- Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter

- Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment