| Fresh China crackdown fears, crypto regulation and Covid hits Congress. Tencent Holdings Ltd. slumped as much as 11% and Chinese gaming stocks sold off as Beijing's crackdown on private enterprise threatened to spread to the online entertainment industry. A strongly worded article referring to online games as "spiritual opium" rattled investors still reeling from recent efforts by Xi Jinping's government to rein in tech firms. While it's unclear whether regulators now intend to shift their focus to gaming, Tencent has tangled with authorities over video games in the past. It comes as investors are already questioning whether China's stocks are "uninvestable." The country's automobile chip-makers also tumbled after the government launched a probe into possible price manipulation. Securities and Exchange Commission Chair Gary Gensler will give a speech about crypto on Tuesday — and judging by his first extensive interview on the subject, he's not pulling any punches. Ahead of his talk at the Aspen Security Forum, Gensler told Bloomberg News that the SEC is mulling a robust oversight regime, focused on rooting out fraud. "While I'm neutral on the technology, even intrigued — I spent three years teaching it, leaning into it — I'm not neutral about investor protection," said Gensler. While he wouldn't give a timeline for SEC action, Gensler has already asked Congress for authority to monitor crypto exchanges. The SEC chief also remained mum on the potential for approving a Bitcoin exchange-traded fund, even as filings pile up. Senator Lindsey Graham tested positive for the virus, underscoring the risk from the delta variant even for the vaccinated and vexing Majority Leader Chuck Schumer's plan to pass a $550 billion infrastructure bill this week. After falling dramatically since April, the pace of U.S. vaccinations has recently accelerated due to the rapid spread of the variant. Seventy percent of American adults have now received at least one shot in a key milestone hit one month later than President Joe Biden's target. The head of the U.S. Food and Drug Administration division reviewing Pfizer Inc.'s application for full approval of its vaccine said the agency is working quickly on the issue as the country experiences a "very real fourth wave." San Francisco and its surrounding counties reinstated mask mandates in indoor public spaces. Global stocks were mixed as investors weighed strong earnings against fresh concerns about China's clampdown on the tech sector. Overnight the MSCI Asia Pacific Index was little changed while Japan's Topix index closed 0.5% lower. In Europe the Stoxx 600 Index had gained 0.3% by 5:48 a.m. Eastern Time. S&P 500 futures pointed to green at the open, the 10-year Treasury yield was at 1.19%, oil gained and gold was lower. Durable goods and factory orders for June comes at 10 a.m. ET. Federal Reserve Governor Michelle Bowman gives welcoming remarks at a conference on low-income workers at 2 p.m. The annual Aspen Security Forum kicks off with a packed slate of current and former government officials. Here's what caught our eye over the last 24 hours. - Biden's Fed pick pits Powell against liberals.

- China's big crackdown is really on big capital.

- Square is paying $29 billion for this?

- Turkish inflation jump wipes out most of real interest rate.

- Kim Jong Un's head bandage adds to health mysteries.

- Why track cycling records are falling at the Tokyo Olympics.

- The secret life of sake.

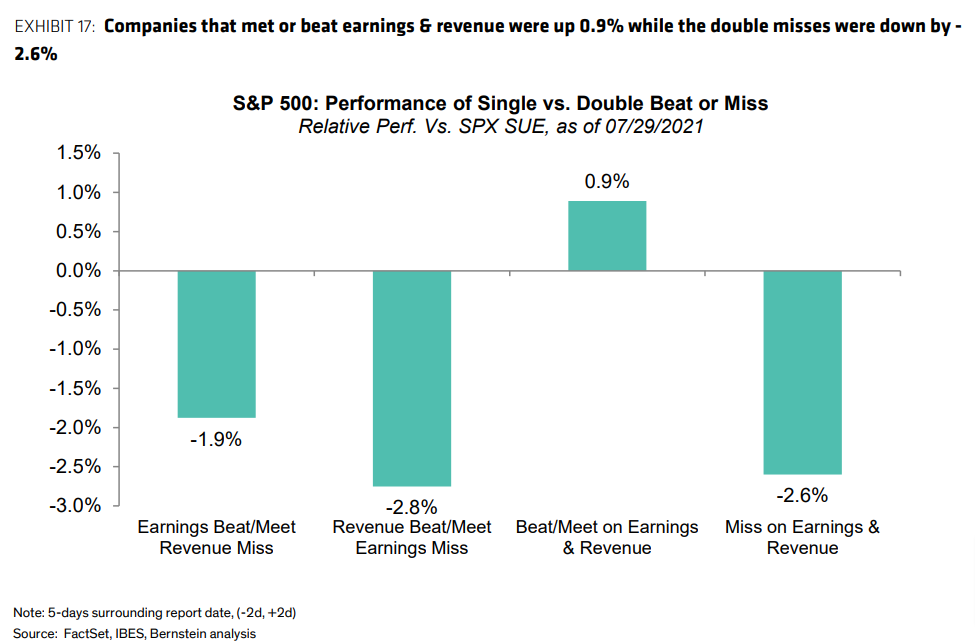

The second-quarter earning season has smashed expectations this year. According to Bernstein yesterday, with more than half of S&P 500 companies having reported, 92% managed to meet or beat earnings estimates while 86% have done so with their revenues -- the highest beat ratios since the first quarter of 2008. On top of that, JPMorgan strategists wrote last Friday that 78% of U.S. firms raised their profit guidance, the highest in data going back to 2012. In Europe, results have also been exceeding forecasts, especially among cyclical stocks.  This explains how solid equities have been even amid the China regulatory scare and a bond market that's flashing bearish economic signals. But Bernstein made another observation that I've heard from other corners as well: The market reaction to good earnings news has been quite muted. S&P 500 stocks that meet or beat expectations on both top and bottom lines were up just 0.9% while double misses were down 2.6%. It's always a bit hard to draw conclusions from these moves, but is this a sign markets have priced in a lot of good news over the past year? Or that estimates were simply a bit off on the low side after a relative lack of visibility last year? On a macro level, it sure feels like investors have moved on from the economic re-opening to worrying about the Delta variant. Anyhow, it's a good set of results to keep the famous bond-stock contradiction going. The hard part is what comes next after this first re-opening phase. Follow Bloomberg's Justina Lee on Twitter at @justinaknope Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment