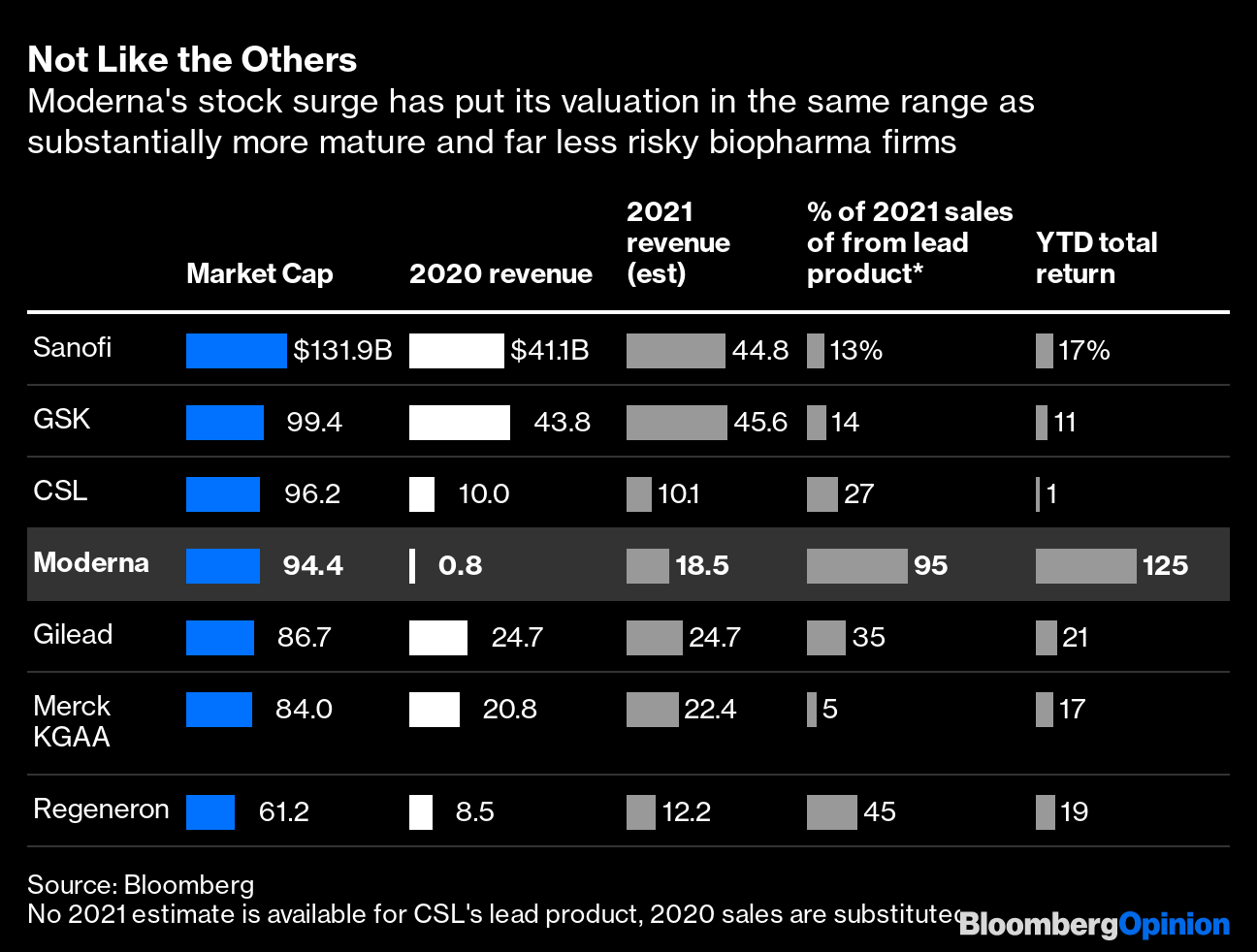

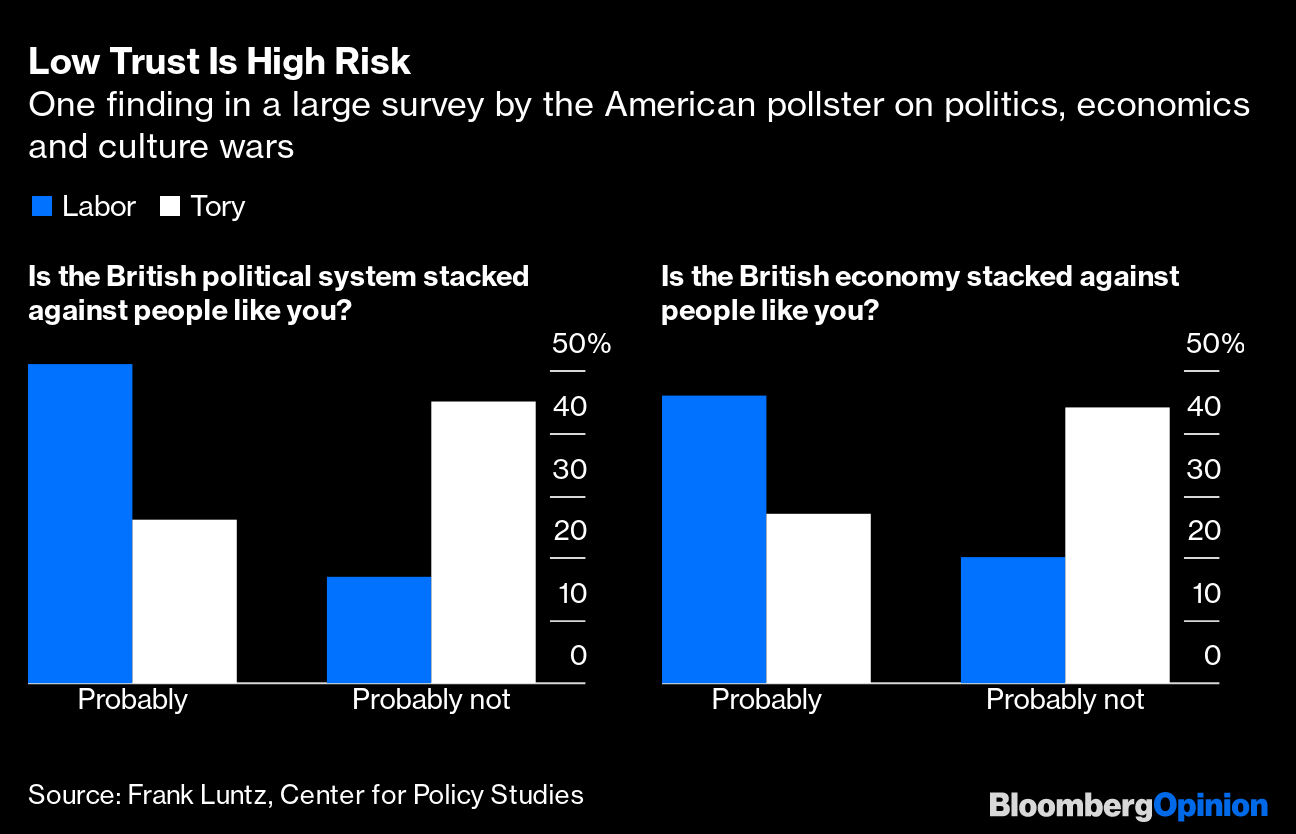

| This is Bloomberg Opinion Today, a crumbling oil cartel of Bloomberg Opinion's opinions. Sign up here. Today's AgendaOPEC Is Fighting AgainAfter a decades-long toxic relationship with OPEC, it's understandable if the world still cringes whenever the oil cartel looks grumpy. But the good news is it's quickly losing its ability to hurt us. OPEC+ — which combines Original Formula OPEC with Russia and some other petrostates, in a less-appealing supergroup than Lou Reed and Metallica — failed over the weekend to agree to raise oil production to cool off prices. This briefly caused oil to spike to six-year highs and got inflation panickers panicking all over again. But then everybody thought about it for half a minute and realized it was probably going to be fine. The last time these countries truly failed to agree on anything, oil hilariously fell to negative dollars. They won't let that happen again, and they also won't let prices get so high they crush the economy, writes Liam Denning. And anyway, U.S. frackers are always around as a counterweight. In fact, the real story here is that OPEC+ is losing its raison d'etre, Liam writes, with big producers such as the UAE increasingly eyeing independence. As the world transitions to greener energy, OPEC's power over us will drain away. But that ride might not be smooth. OPEC's market mojo may be waning, but it still helps us avoid wild price swings, writes John Authers. The goal is to make that matter as little as possible as quickly as possible. Didi Do's and Don'tsTwenty-two billion American dollars in market value went bye-bye today after Chinese regulators threw the regulatory book at the country's top ride-hailing company, Didi Global. This happened less than a week after Didi's U.S. IPO, believe it or not. Matt Levine notes regulators had strongly suggested Didi delay the listing, calling its outlook mostly cloudy with a 90% chance of book-throwing. But it rushed to market anyway. The courts may yet decide how much this rhymes with "impurities scrod." To be sort of fair to Didi, Shuli Ren writes it saw a frothy U.S. market where investors can't get enough of joke investments and went for broke. Its regulatory troubles weren't a state secret, and it is morally wrong to let a sucker keep his money, after all. And the IPO underwriters probably could have done a better job of flagging the risks for American investors, writes Anjani Trivedi. For the rest of us throwing money at every SPAC, meme and crypto that moves, we might want to take a minute to read Barry Ritholtz's 10 rules for not accidentally setting all your money on fire. Under the category of the "Behavior Is Everything" rule might fall an admonition to always read the fine print on Chinese IPOs. Further Didi Reading: Once more, with feeling: China doesn't care if Americans invest in its companies or not. — Shuli Ren Meet the New Way of Working, Same as the Old WayWe wrote last week about how flex work is the hot new corporate perk and that even banks will have to play along to attract talent. Marcus Ashworth is not convinced about the bank part. He has read the "new way of working" news releases from Credit Suisse, Standard Chartered and others and deems them squishy and unworkable. Citigroup's Jane Fraser might have the right balance of RTO and WFH, but Marcus doubts other banks have figured it out or will even try for very long. Keep those pants pressed and train passes handy. Telltale ChartsSure, Moderna makes a mean Covid vaccine, but that does not make it a $100 billion company, writes Max Nisen.  Though they have a queen and say "boot" instead of "trunk," the British are a lot like Americans when it comes to profound cultural divisions that threaten democracy, writes Therese Raphael.  Further ReadingPresident Joe Biden shouldn't just cede the ability to fast-track trade agreements, leaving it to Congress to weaken them. — Bloomberg's editorial board Israel's new government can't ignore Palestinian peace, or conflicts will continue. — Bloomberg's editorial board Biden's remarkably steady approval rating suggests partisan polarization rules everything around us. — Jonathan Bernstein Climate change threatens the future of Napa Valley wine country. — Frank Wilkinson Let's imagine a fantasy university that would be both more affordable and more useful. — Tyler Cowen Not enough American workers make a living wage. Businesses and government must end this. — Nir Kaissar This year's Sun Valley media mogul camporee could be an M&A banker's paradise. — Tara Lachapelle Here's how to talk to your broke friends about their money troubles. — Erin Lowry ICYMIBiden will seek new "right-to-repair" rules. Iceland cuts working hours, productivity shrugs. China may never rule the world. KickersWe were promised jetpacks. And we're … getting them? (h/t Scott Kominers) Brain implant detects, kills pain automatically. We'll need jetpacks and brain implants to fight the radioactive hybrid terror pigs. There's trouble in doomsday prepper paradise.  Notes: Please send radioactive hybrid terror pigs and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment