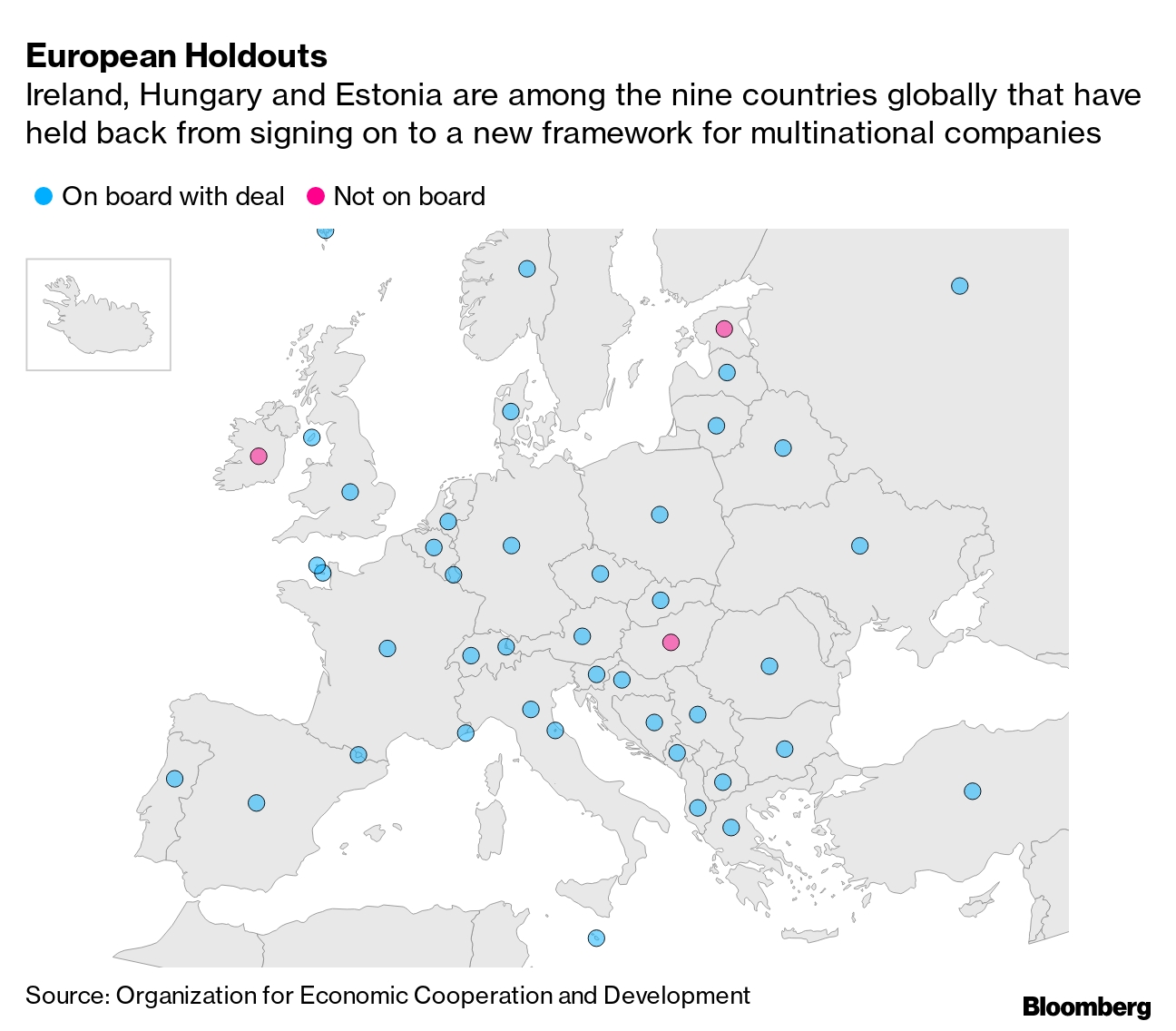

| Welcome to the Brussels Edition, Bloomberg's daily briefing on what matters most in the heart of the European Union. Europe's tourism industry is hoping for a boost from the long-awaited digital Covid-19 passports launched yesterday by the EU, but the system has limitations and travel will remain hampered by a patchwork of national restrictions. Even as member states prepared to begin issuing the "Digital Covid Vaccination Certificates" that are supposed to facilitate travel inside the bloc and boost the tourism sector, Germany last week slapped new restrictions on anyone arriving from Portugal due to the spread of the delta variant there. And the system so far does little to help anyone outside the EU, including the U.K. and the U.S. In short, travelers may still have to do a ton of research before setting off for that much-needed vacation this summer. — John Ainger What's HappeningSunlit Uplands | U.K. Chancellor of the Exchequer Rishi Sunak suggested that he's given up on securing financial services equivalence with the EU and will instead make the most of the country's freedom to set its own rules — including abandoning the bloc's MiFID II regulations. Will that be enough for the City of London to reclaim top spot in Europe for share dealing? And what about the ever-growing area of green finance? Royal Welcome | Angela Merkel is set to receive a very warm reception on what is almost certainly her final U.K. visit as German Chancellor today. She'll meet the Queen at Windsor Castle and Prime Minister Boris Johnson at Chequers, his country retreat outside London, while also enjoying the rare privilege for a foreign leader of addressing the cabinet. Johnson will cap things off by announcing an academic medal in her honor in a bid to put five years of Brexit tension to one side. Talking Strategy | European Central Bank policymakers will hold a special meeting in Frankfurt next week in a bid to wrap up the institution's strategy review, according to Omfif, a think tank for economic policy. It is expected to put the finishing touches on a new definition of price stability. Here's the backstory of what the ECB aims to achieve. No Fad | And while policymakers are debating that, the argument over whether the pick up in inflation is set to last is also raging. Tune into this week's Brussels Edition podcast to hear why the chairman of the European Parliament's Budget Committee, Johan van Overtveldt, believes it may not just be a passing fad. Hungarian Relief | Hungary, which has suffered the second-highest Covid-related deaths per capita since the pandemic's outbreak, has reported no daily virus-related fatalities for the first time since early September. That contrasts with other countries, which are battling rising cases of the delta variant. Here's why we should be concerned about new strains and here's the latest in the battle against the virus. In Case You Missed ItBritain's Bonus | A few more court defeats for Google in the EU and the U.K. may be set for a billion-dollar payday. Britain stands to recoup as much as 1.8 billion euros from its share of fines that the EU has levied against companies such as Alphabet Inc.'s Google over the years, according to the EU's budget report published yesterday. Banking Boost | European banks could see a cap on dividends and share buybacks lifted at the end of September, according to ECB President Christine Lagarde, offering the clearest signal yet that the industry will be able to boost returns for long-suffering shareholders. There had been a de facto ban on shareholder returns as a trade-off for unprecedented relief and taxpayer-funded stimulus in the pandemic. Plagiarism Scandal | A key contender to replace Angela Merkel, Green party leader Annalena Baerbock, defended herself against plagiarism charges that are rocking her campaign amid sinking poll numbers. Responding to charges that she plagiarized part of a book she wrote, she called it a personal attack and diversion from critical issues such as climate change. Transforming Spain | European recovery funds flowing into Spain will help to transform its economy as firms invest to make businesses more digital, cleaner and energy-efficient, leaders of companies including Repsol and Endesa told is on a Bloomberg panel. The nation is expected to receive as much as 140 billion euros in grants and cheap loans during the next six years. Factories Hiring | European factories are recruiting at the fastest pace in at least 24 years as they try to meet surging demand. Manufacturers reported the hiring boom in surveys by IHS Markit, which showed output in the euro region and in the U.K. rising at or near the fastest pace since the data has been collected. Austria and the Netherlands led the employment growth. Europe's Wealthiest | Ever wondered which country's citizens are Europe's wealthiest? Is it Luxembourg, or maybe Belgium? Click here to find out. Chart of the Day A handful of countries are still withholding support for the proposal to overhaul global taxation that was backed yesterday by more than 130 countries and jurisdictions. The European holdouts include Hungary and Estonia, as well as Ireland, which has attracted some of the world's biggest companies thanks to its low tax rate. Under the broader deal, which still needs significant negotiations over the details, rules could be implemented as soon as 2023 that would curtail tax avoidance by making companies pay an effective rate of "at least 15%" and give smaller countries more revenue from foreign firms. Today's AgendaAll times CET. - 1:30 p.m. Germany's Merkel, U.K.'s Johnson news conference after talks at Chequers

- 2.30 p.m. ECB President Lagarde speaks at the Rencontres Economiques d'Aix-en-Provence

- 6.30 p.m. Bloomberg Television interview with German Finance Minister Scholz

- Commission President von der Leyen visits Lithuania in relation to the recovery and resilience facility

Like the Brussels Edition?Don't keep it to yourself. Colleagues and friends can sign up here. For even more: Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and gain expert analysis from exclusive subscriber-only newsletters. How are we doing? We want to hear what you think about this newsletter. Let our Brussels bureau chief know. |

Post a Comment