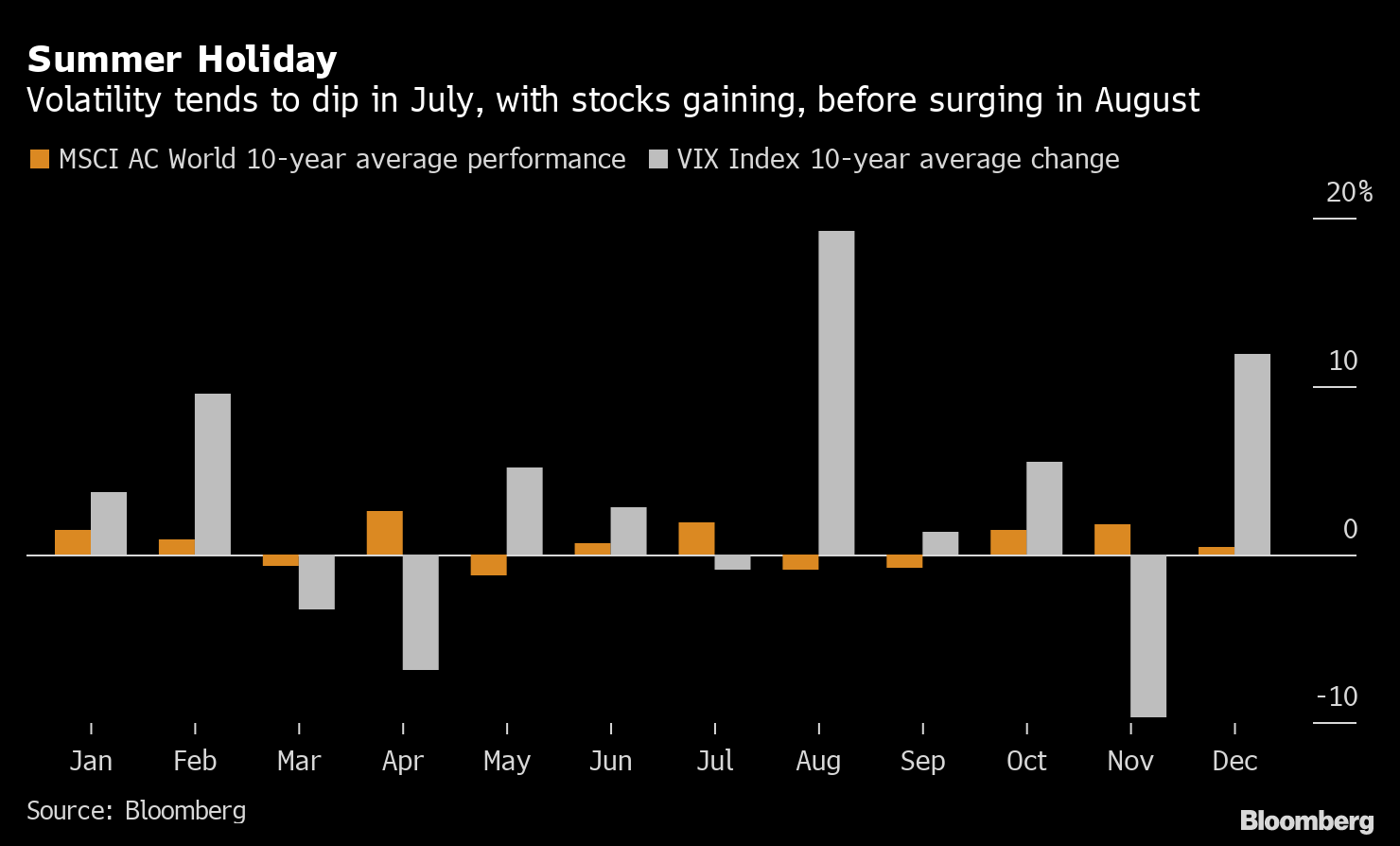

| Good morning. Oil deal in balance, global tax rebels, positive J&J vaccine developments and nonfarm payrolls ahead. Here's what's moving markets. OPEC+ InfightingCrude oil futures in New York climbed above $75 per barrel, trading around the highest since 2018, after the United Arab Emirates blocked an OPEC+ deal at the last minute. The standoff could lead oil-producing countries to refrain from increasing output at all, falling back on terms that call for production to remain steady until April next year. For some commentators, oil prices may rise to $80 per barrel. Tax RebelsA deal on a more balanced international corporate tax system championed by the Biden administration came a step closer as 130 countries and jurisdictions backed a plan that includes a minimum corporate rate and tax-sharing on multinational firms' profits. However, three European Union nations resisted the plan, which could prevent the bloc from signing an agreement. Ireland, which has a corporate tax rate of 12.5%, said it's "not in a position" to join the consensus on a global minimum rate of at least 15%. J&J JabJohnson & Johnson said its single-dose vaccine can neutralize the delta variant of the virus, boosting hopes that the highly transmissible mutation won't derail the economic reopening. The variant is expected to become the dominant strain in the U.S. and has raised concerns about the summer holiday season in Europe. Earlier this week, Moderna said its vaccine produced antibodies against the strain. Going AloneThe U.K. will forge ahead with its own rules for financial services post-Brexit, seeking to bolster London's competitive advantage. The British government has tried securing firms' access to the EU financial market through equivalence rulings that recognize each side's regulatory requirements but those hopes are fading. It comes as EU countries vie to lure business from London, with Paris becoming JPMorgan's trading hub in Europe. Coming Up…European stocks are set to follow the S&P 500 higher ahead of the closely watched monthly U.S. payrolls report. Asian stocks had a weaker session, dragged down by China. It's a quiet day for earnings with Sweden's Nobina one of the few to report. ECB President Christine Lagarde speaks at the Rencontres Economiques d'Aix-en-Provence economic forum. In the U.K., the opposition Labour Party unexpectedly won a key by-election, a result that's likely to provide some respite for leader Keir Starmer. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningWith gains in June sticking to the seasonal script for global stocks, July should be more of the same if historical patterns hold. The MSCI AC World Index has risen 1.9% this month on average over the last 10 years and volatility -- as measured by the VIX Index -- has retreated, according to data compiled by Bloomberg. But the data also show bulls don't have much time to get comfy -- price swings come roaring back in August and stocks retreat. The VIX's average jump that month is about 19% over the last decade. Of course the move is exaggerated somewhat by the volatility gauge's more than doubling during the August 2015 China selloff/flash crash -- but only in terms of magnitude not in direction. And while seasonality is rightly criticized regarding stock moves, there is a bit more logic to it in terms of volatility. Trading activity does dry up in the summer months so prices tend to swing more in the thin liquidity.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment