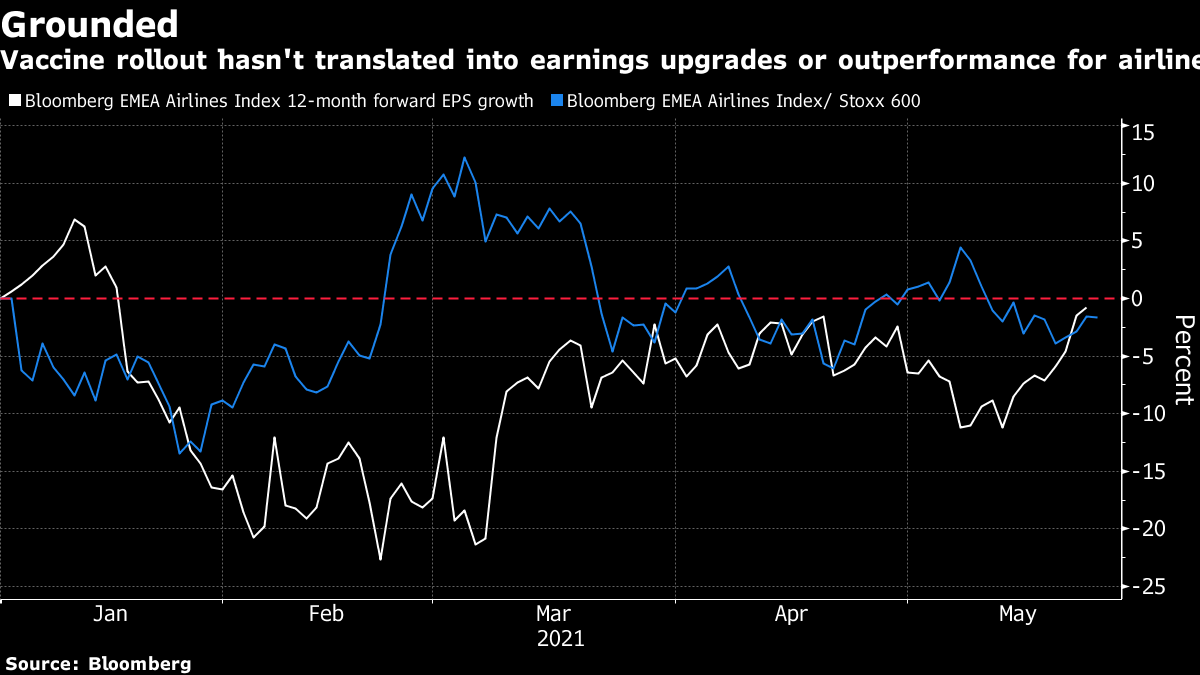

| Good morning. Cummings hearing, Fed taper talks timeline, Biden to meet Putin and Amazon sued. Here's what's moving markets. Dom's DayDominic Cummings, former chief advisor to U.K. Prime Minister Boris Johnson, will today face questions before a parliament committee on decisions taken during the Covid-19 outbreak. A year after putting Barnard Castle on the map, Cummings is expected to point the finger at Johnson for any alleged missteps, amid likely questions on the timing of the first lockdown and whether a "herd immunity" strategy was initially sought. The hearing comes as the government warns people to avoid traveling to parts of England where the so-called Indian variant is spreading. France, meanwhile, is considering further curbs on passengers arriving from the U.K. Taper Talks TimelineU.S. central bank officials may be able to begin discussing the appropriate timing of scaling back their bond-buying program at upcoming policy meetings, Federal Reserve Vice Chair Richard Clarida said in a Yahoo! Finance interview. The Fed is currently purchasing assets at a pace of $120 billion per month, but Morgan Stanley's chief executive predicts that it will begin tapering its bond buying toward the end of this year. Elsewhere, China's yuan advanced to a three-year high in onshore markets as the central bank there signaled it's comfortable with a recent rally. Biden to Meet PutinU.S. President Joe Biden will meet Russian President Vladimir Putin in Geneva on June 16 for their first in-person session since Biden took office. Russia's cyber attacks, military aggression, Belarus and human rights abuses are among the issues on Washington's agenda for the meeting, which will come at the end of Biden's first trip overseas since taking office. Biden is working to change the stance on Russia from that of Donald Trump, whose approach was clouded by a lengthy investigation into accusations of Russian interference in the 2016 election. Amazon SuedAmazon was sued by the attorney general for Washington, D.C., for allegedly engaging in anticompetitive practices that have raised prices for consumers. The antitrust lawsuit, the first to target Amazon in the U.S., says the firm's policies governing third-party sellers prohibit them from offering products at lower prices on rival platforms, which has led to artificially high prices for consumers and let the company build monopoly power. Coming Up…European equity futures are in the green after most stocks in Asia rose as the dollar weakened. British Land and Marks & Spencer are among earnings in Europe, while Chinese smartphone giant Xiaomi reports in Asia. In the U.S., GPU giant Nvidia is among the biggest firms reporting. Meanwhile, CEOs of JPMorgan and Goldman Sachs will be testifying before lawmakers in the Senate. And keep an eye on the skies for the "Super Blood Moon," a lunar eclipse in some parts of the world -- though the eclipse won't be visible from Europe. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningBackers of the arguably purest reopening trade in Europe -- its airline shares -- must be feeling pretty short-changed from the accelerating vaccine rollout. Though the Bloomberg EMEA Airlines Index has risen about 10% this year, that still lags the 12% rise in the benchmark Stoxx 600. As my colleague Michael Msika pointed out Tuesday, part of the underperformance likely stems from still muted earnings expectations for the group. One-year forward EPS estimates for the index are slightly below where they started the year, whereas forecasts for the broader market are up about 15%, according to data compiled by Bloomberg. Still, airline bulls are probably as well sticking with the trade for now. Europe is slowly peeling back border restrictions and the agreement to introduce vaccine certificates that will allow quarantine-free travel within the region has handed the beleaguered industry an important chance to salvage the summer tourist season. More progress is likely ahead of a G-7 summit in England in June, which could act as a catalyst for trans-Atlantic travel and finally nudge those earnings estimates higher.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment