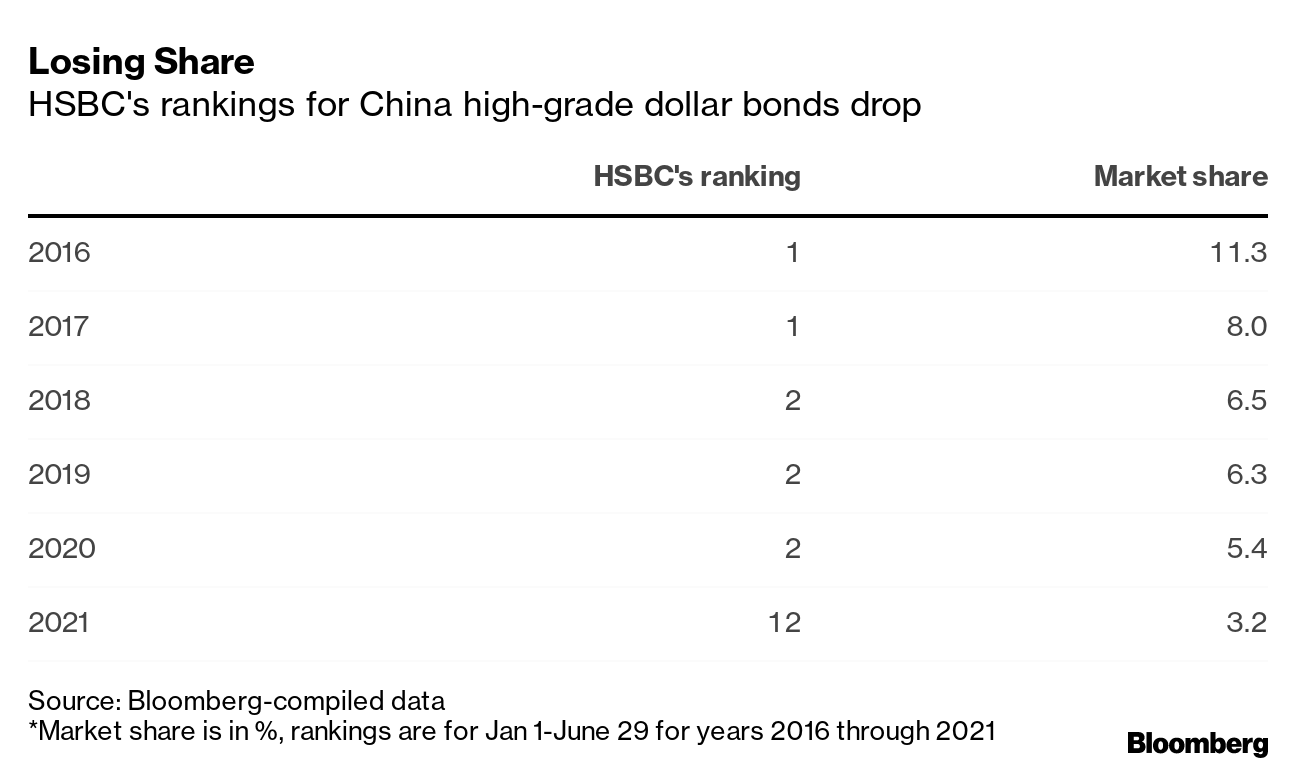

| China's Communist Party turns 100 this month, and President Xi Jinping celebrated Thursday by telling the world that any would-be foreign oppressors would have their heads cracked open against a "steel Great Wall." Xi said much more than this, of course, during his nationwide address from above Mao Zedong's portrait in Tiananmen Square, but that line will probably go down as one of the most memorable from his 65-minute speech. More importantly, it set the tone for a bolder, more defiant and nationalist China that's likely to push back hard against any "sanctimonious preaching" from the U.S. and Europe over human rights or other issues.  Photographer: Lintao Zhang/Getty Images AsiaPac The event itself was a spectacular show of China's wealth and might, including a meticulously choreographed military parade under an artificially clear sky that wowed the crowd of about 70,000. It was such an exclusive ceremony that just the mere presence of Evergrande's founder in the audience was enough to bolster the embattled property developer's bonds. Yet despite its absolute control, challenges abound for the party that Mao helped found a century ago, including tackling China's bloated state enterprises, reversing a declining birth rate and bringing down debt. Taming of Hong KongIn Hong Kong, which on Thursday marked its own anniversary — 24 years since the U.K.'s handover of the city to China — things were more subdued. And that was by design. The police deployed about 10,000 officers to stamp out any unauthorized gatherings, even taking the step of locking down Victoria Park, which has traditionally been a rallying point for local pro-democracy activists. Authorities ended up arresting 19 people on the day, a far cry from two years ago, when they were overwhelmed with some of the most brutal protests the city had seen in decades. Still, violence did occur. A 50-year-old man stabbed a police officer and then used the weapon to kill himself. The officer sustained a serious back injury and was sent to the hospital for treatment.  Photographer: Chan Long Hei/Bloomberg That things were relatively quiet in Hong Kong on what is typically a vociferous day should not be a surprise. International concern has steadily been growing that the former British colony long known for being the freest place on Earth has been anything but in the past year. That's largely because of the national security law Beijing rammed through just over a year ago. Since the measure was enacted — without public debate — Hong Kong authorities have swiftly clamped down on dissent. The anti-Beijing protests that roiled the city up until 2019 have been silenced, more than 100 activists have been arrested, the pro-democracy Apple Daily newspaper has been shuttered and the opposition party has effectively been disbanded. Alibaba Back in the SaddleIn business news, Alibaba appears close to making its first major investment since enduring a bruising crackdown on Jack Ma's internet empire. The e-commerce giant and a provincial Chinese government are leading a group that's nearing a deal to buy a stake in the retail arm of Chinese billionaire Zhang Jindong's struggling Suning conglomerate, news that boosted its bonds.  Should the deal go through, it would signal a comeback for Alibaba since authorities levied a record $2.8 billion antitrust fine on the company in April. But all's not well with Ma as his fintech arm Ant Group is still undergoing a painful state-ordered transition that will result in the company being regulated more like a bank. As for Zhang, the Suning founder will likely no longer have control of the company after the deal, marking the end of a run as a high-profile entrepreneur who drove his firm into an array of businesses, including ownership of the Inter Milan soccer team. HSBC's China WoesHSBC's fall from grace in China keeps reverberating three years after it became embroiled in geopolitical spats between Beijing and the west. The bank lost about a third of its debt capital markets team covering Chinese state-owned enterprises. HSBC began missing out on bond deals from Chinese state enterprises after the London-based bank became entangled in a U.S. probe of Huawei's finance chief in late 2018, exacerbated by tensions between China and the U.K. over issues including political freedoms in Hong Kong. The departures underscore the challenges still facing HSBC in China despite recent efforts to improve relations with Beijing. HSBC, which says that China is critical to its bond-market strategy in Asia, has fallen to 12th place this year from second in 2020 among managers of investment-grade dollar bond deals in China, a market segment where the biggest issuers are SOEs and technology titans.  What We're ReadingFinally, here's a few other stories that caught our eye: It's time to Power On. A new weekly newsletter by Bloomberg's Mark Gurman will deliver Apple scoops, consumer tech news, product reviews and the occasional basketball take. Sign up to get Power On in your inbox on Sundays. |

Post a Comment