| Hello. Today we look at the fallout from American children missing camp, how the pandemic exacerbated the global wealth gap and what a global minimum tax may achieve. Stampede on Summer CampAdd American summer camps to the list of overheating industries.

Like other sectors in the reopening economy, the old-fashioned institutions are witnessing out-sized demand and labor shortages. In a normal year, the $20 billion industry employs over a million people and serves almost 16 million overnight campers, according to the American Camp Association. Behind part of this year's search for spaces is an eagerness to find childcare as parents try to jump into jobs. Mothers between 25 and 54 remain out of the workforce at higher rates than everyone else, according to the Federal Reserve Bank of San Francisco.  Molly Martin and her daughter, Varya Smith-Martin, 6, at their home in Hinesburg, Vermont. Photographer: John Tully/Bloomberg Camps may also be struggling to find workers. Before the pandemic, they enlisted about 25,000 foreign employees annually, many of them college students, as counselors. With international travel constrained, only about 13% of overnight camps had any foreign staff in 2020, down from 73% in 2018, according to a American Camping Association survey. Visa programs were reinstated in March, but processing has been delayed by limited U.S. embassy and consulate services due to the pandemic.

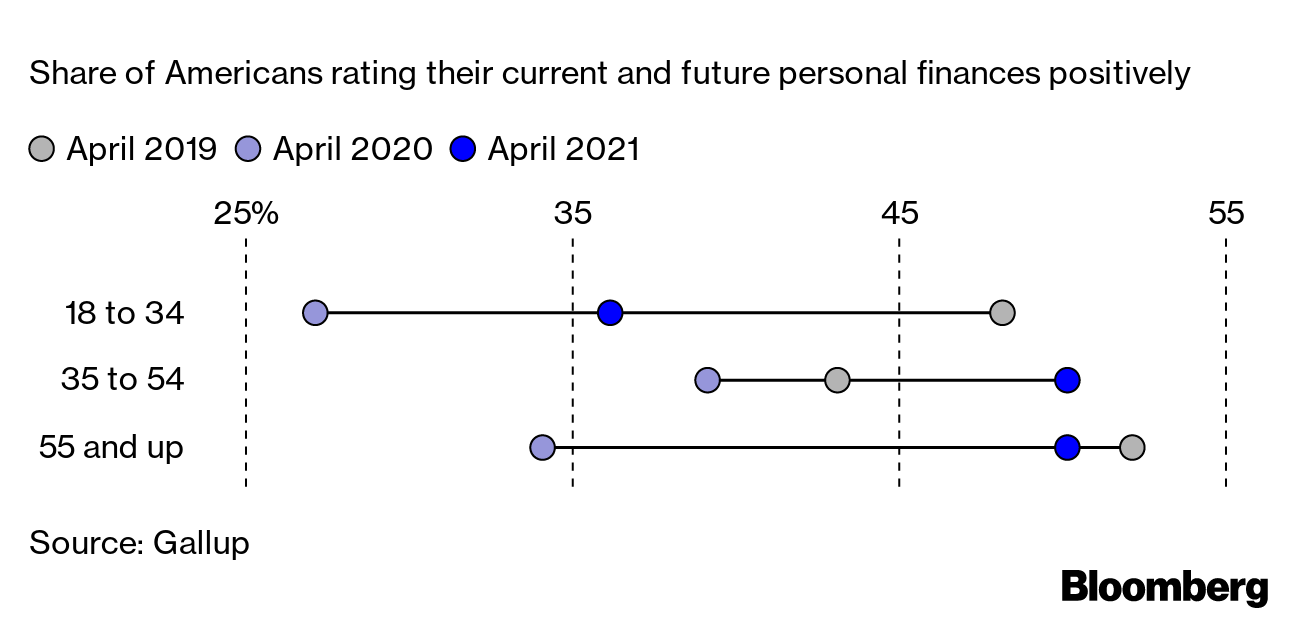

Such forces make for the most stressful camp season ever, especially given parents will pull their locked-down offspring away from screens. "This summer more than ever, kids really need camp," said Danny Kerr, director of Camp Pemigewassett in New Hampshire, the country's oldest sleepaway boys' camp still owned by the original family. —Payne Lubbers and Alexandre Tanzi The Economic Scene Covid-19 hasn't affected everyone equally. The virus has been deadliest for older people, but the pandemic-driven economic downturn wreaked havoc on the professional lives of many young people. In the U.S., stock market gains helped boost the wealth of senior workers and retirees while youth unemployment soared. The personal financial outlooks of the young have been the slowest to recover. Today's Must Reads - Costly summer. Europeans are in for a costly summer that will test central bankers' resolve on stimulus as the region's delayed economic recovery unleashes surging demand.

- Russia summit. President Vladimir Putin will host Russia's flagship investor showcase as he seeks to demonstrate its stuttering economy is back to business as usual despite Covid-19 and new waves of western sanctions.

- Weary seafarers. Ports around the U.S. are rolling out vaccines for seafarers, a lifeline to thousands of mostly foreign workers.

- Talking again. The U.S. and China took another step toward gradual re-engagement, with Treasury Secretary Janet Yellen and Vice Premier Liu He holding what they described as frank discussions.

- First-quarter boost. Australia's economy expanded faster than forecast, driven by increased investment and household spending. Canada's recovery in the quarter was fueled by surging home construction, while Italian government spending unexpectedly turned a first-reported contraction into an expansion.

- Turkey trouble. President Recep Tayyip Erdogan renewed calls for lower interest rates, pushing the lira to a fresh low against the dollar and piling pressure on his central bank governor to ease policy despite high inflation.

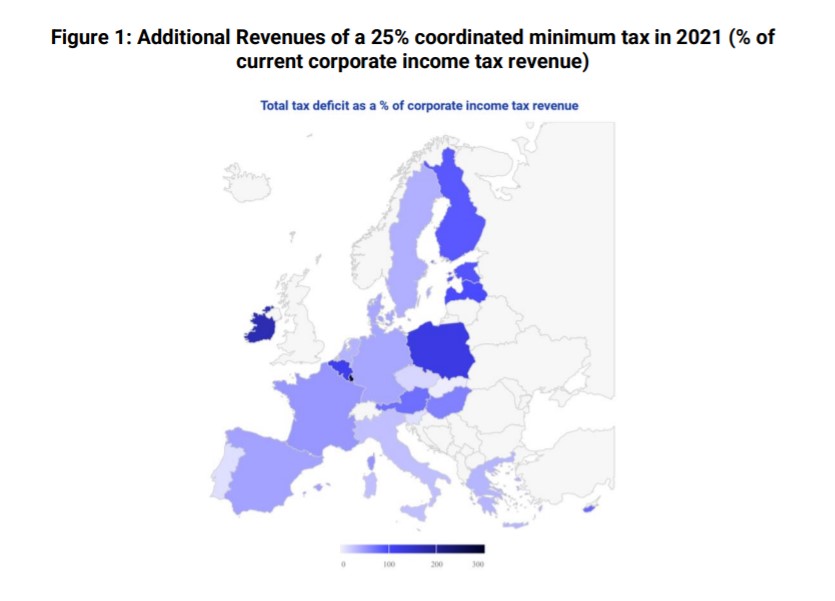

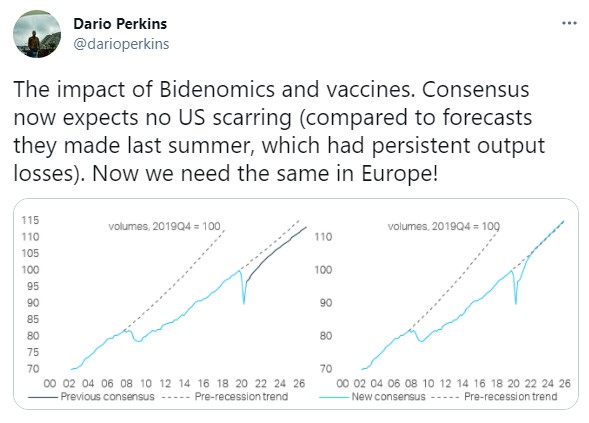

Need-to-Know Research A minimum global tax rate of 15% could generate the equivalent of 41 billion euros a year for the U.S. government and 48 billion euros annually for European Union countries, according to a new study. This research, published by the newly-formed EU Tax Observatory and co-written by economist Gabriel Zucman, looks at how much revenues could be collected by imposing a minimum tax on the profits of multinational companies. The topic is a hot one at the moment as Group of Seven finance ministers prepare for talks in London this week amid a debate on setting a global minimum. On #EconTwitterThe U.S. is set to escape the pandemic without economic scarring.  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

The fourth annual Bloomberg New Economy Forum will convene the world's most influential leaders in Singapore on Nov. 16-19 to mobilize behind the effort to build a sustainable and inclusive global economy. Learn more here. |

Post a Comment