| Hello. Today we look at President Joe Biden's plans to invest in housing, what South Korea's shrinking population signals for the world and the Federal Reserve's bloated balance sheet. Biden's Housing Challenge Covid-19 threw what was an already-complex American housing system for a loop. On one end, Black and Hispanic households lost jobs at faster rates than White families and are more likely to be behind on rent or mortgage payments.

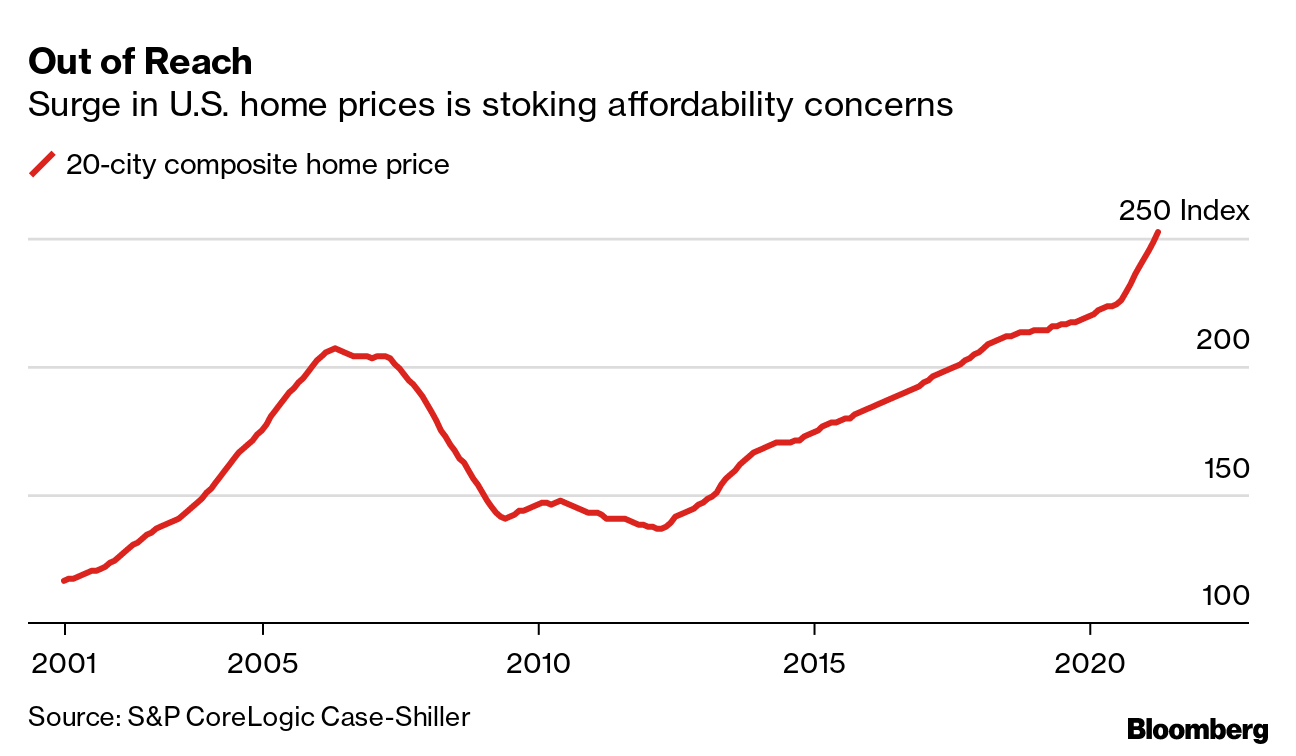

At the other, the Federal Reserve's easy monetary policy sent mortgage rates to historic lows, allowing the well-heeled to refinance and buy second properties. Many first-time buyers are finding themselves shut out of the booming market. Data on Tuesday showed home prices surging the most since 2005. "If you don't have excellent credit, if you don't have a really high and competitive down payment, and if you don't have the ability to go over ask, good luck," says Ali Wolf, chief economist at Zonda, a housing data and consulting firm.

The challenges of the pandemic come on top of extremely complicated U.S. housing policy. Since the 1930s, the federal government has rolled out layer upon layer of programs and incentives to help the poor, middle class, veterans and others afford homes. In other words, no national housing policy from the ground up.  Biden wants to do better. His administration is pushing for $213 billion to "produce, preserve and retrofit" more than 2 million homes as part of its sprawling infrastructure package, as well as a raft of social spending that will increase the amount Americans have to keep roofs over their heads. All this would come on top of the more than $50 billion Congress has allocated to help households that missed rent and mortgage payments during the pandemic. While the pandemic has forced the federal government to be more nimble as it set up programs and deployed relief money, there's no guarantee the measures — even if enacted — will prove a silver bullet.

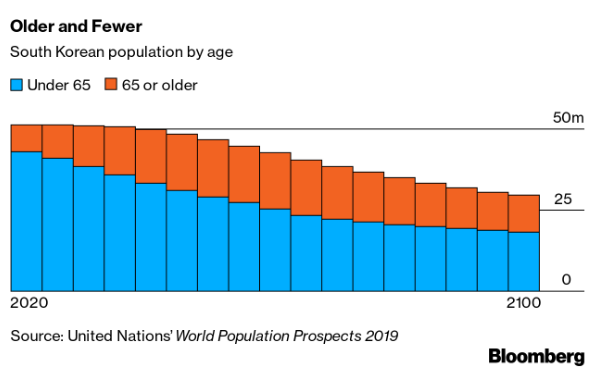

"The biggest risk is implementation," says Carol Galante, faculty director at the Terner Center for Housing Innovation at the University of California at Berkeley. — Olivia Rockeman The Economic Scene South Korea last year registered more deaths than births for the first time in recent history, prompting then-Vice Finance Minister Kim Yong-beom pronounced the milestone a "death cross." While Korea's predicament is extreme, it's not unique: Globally, 1 in 6 people will be over age 65 by 2050, compared with 1 in 11 last year, according to projections by the UN's Department of Economic and Social Affairs.

"The problem of declining population is no longer a future challenge; it is a current reality in many economies," says Sonal Varma, chief economist for India and Asia (except Japan) at Nomura in Singapore. - Read Sam Kim's full story for Bloomberg Markets magazine here.

Today's Must Reads - Global tax. European governments are increasingly confident a deal will soon be struck with the U.S. on a minimum global corporate tax and related measures to make multinationals pay more to the countries they operate in, Bloomberg reported.

- Kiwi shift. New Zealand's central bank projected that its official cash rate may start to rise in the second half of next year, joining Canada in flagging a potential withdrawal of stimulus.

- Fed makeup. With only months left on their current terms, Federal Reserve vice chairs Randal Quarles and Richard Clarida were reminded on Tuesday that their time in office may be drawing short.

- China Softens. China's strong economic momentum eased slightly in May, according to an aggregate index combining eight early indicators tracked by Bloomberg.

- Andean havens. Latin America's traditional safe spots Chile, Peru and Colombia are no longer safe from the ire of investors amid political upheaval.

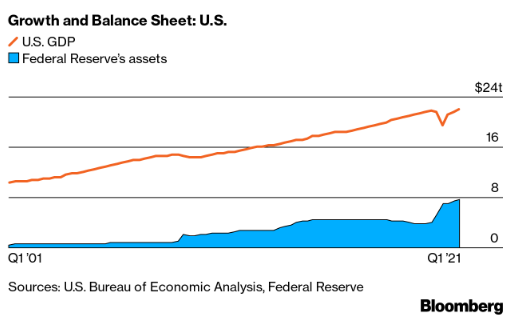

Need-to-Know Research The size of the Federal Reserve's balance sheet could rise to $9 trillion by 2023 and remain at that level or drop as low as $6.6 trillion by 2030 under a range of scenarios, the New York Fed said in a study. It's currently $7.9 trillion. "The Fed balance sheet is going to be gigantic for a long time," says Alan Blinder, a former Fed vice chairman who's now a Princeton professor. - For more insights on what bloated balance sheets mean, check out Jeff Black's analysis from Bloomberg Markets magazine.

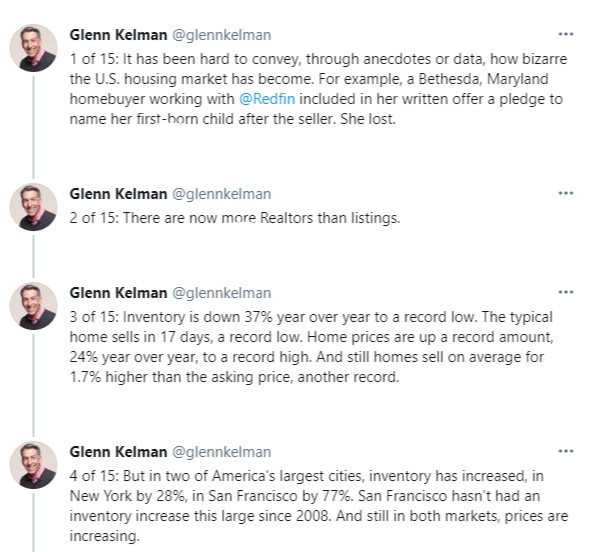

On #EconTwitterHousing is on everyone's mind:  Read more reactions on Twitter Enjoy reading the New Economy Daily? -

Click here for more economic stories -

Tune into the Stephanomics podcast -

Subscribe here for our daily Supply Lines newsletter, here for our weekly Beyond Brexit newsletter - Follow us @economics

|

Post a Comment