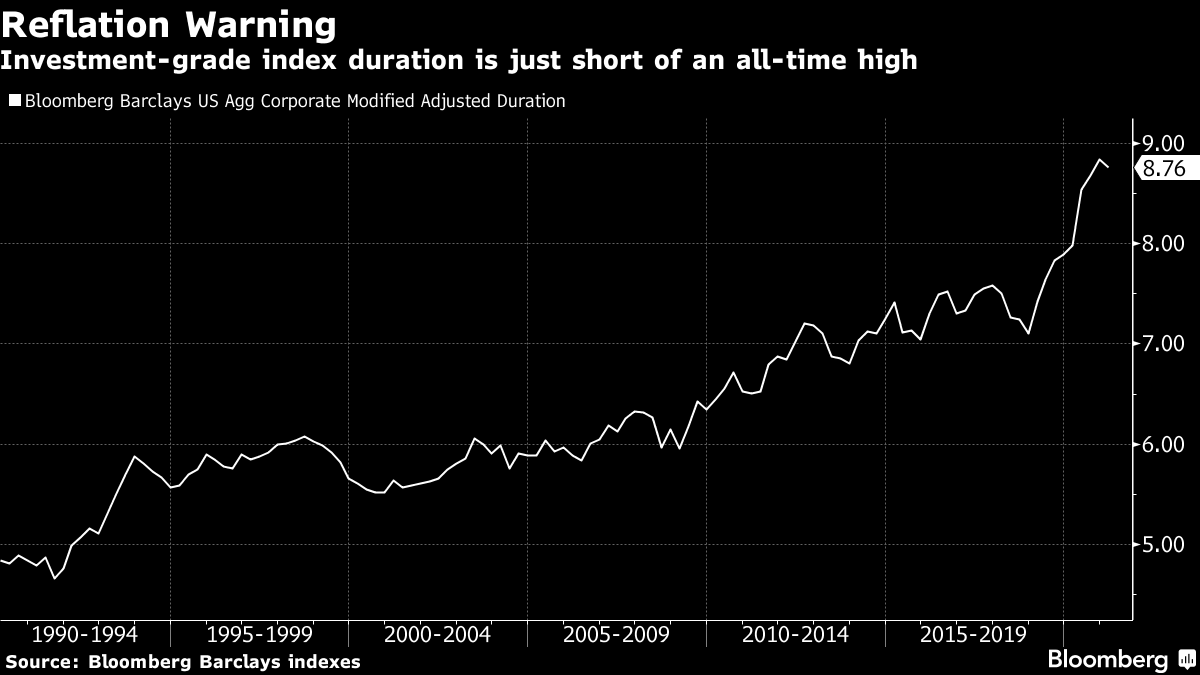

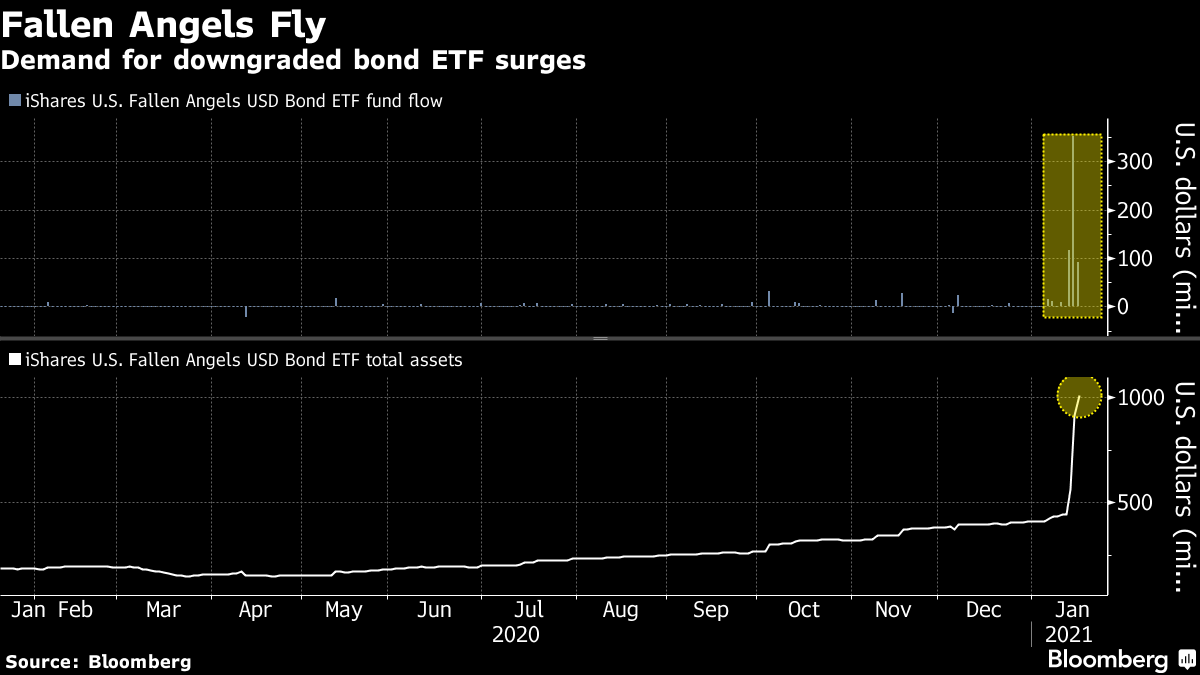

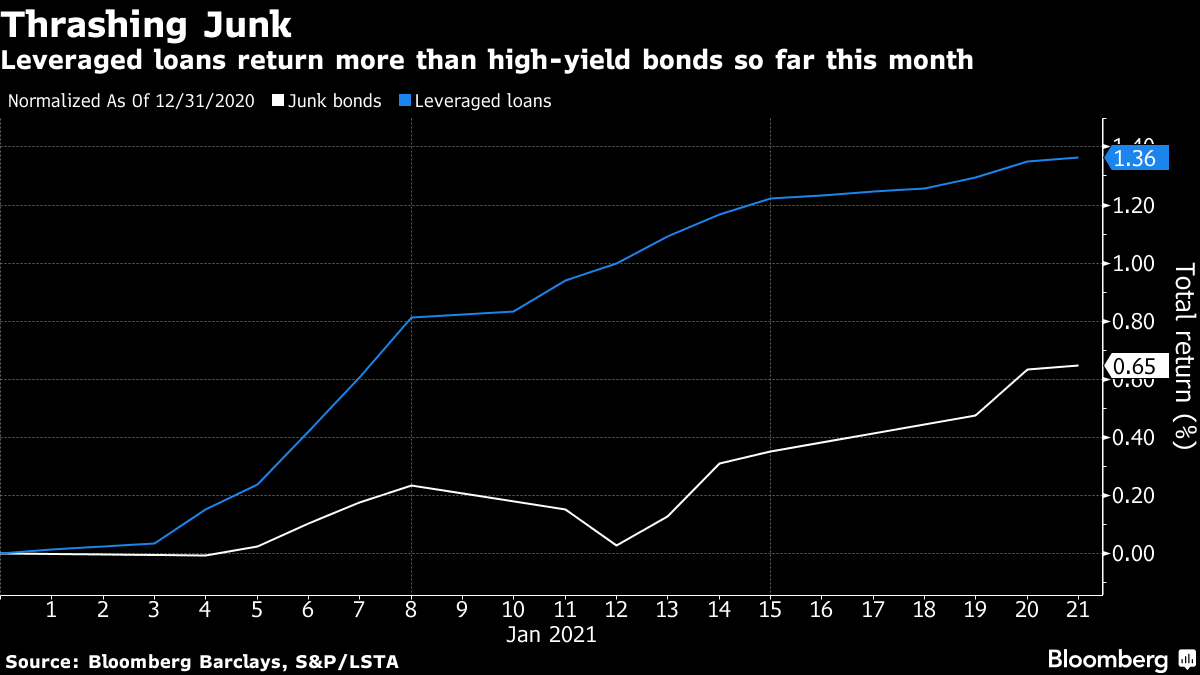

| Welcome to The Weekly Fix, the newsletter cosier than #berniesmittens. Running on MMT"The world has changed," Treasury Secretary nominee Janet Yellen told senators this week. For anyone who didn't spend last year under a rock, she could have been talking about any number of things. But she was referring to the interest-rate environment, and specifically the government's ability to issue massive amounts of debt without driving up the cost of it. That's Exhibit A in the case for using deficit financing to resurrect the U.S. economy. The cost of debt interest payments relative to the size of gross domestic product is now lower than it was in 2008 during the financial crisis, she said. That's thanks in large part to the Federal Reserve's commitment to keep interest rates near zero throughout the economic recovery, and its purchases of government bonds at the rate of roughly $80 billion a month. Which brings us to regime change in the investing world -- it's here in 2021, it's not reflation and it's not lucrative, according to Janus Henderson's Jim Cielinski. That experiment of expansive fiscal and monetary policy is a shorthand expression of Modern Monetary Theory -- which says governments generally have more scope to spend in times of low inflation. "As a politician it's easy to embrace MMT," Cielinski said. "You're going to see in the next few years many economies test the limits of this." Growth will recover, but markets have already priced in most of what we'll see on the inflation front. Inflation-linked bonds are tapped out and the curve steepener trade is "long in the tooth," says Cielinski, who'd be a buyer of the U.S. 10-year bond at a 1.25%-1.5% yield. As Japan's experience has shown, this path of fiscal and monetary expansion leads not to surging yields, the money manager said, but to "volatility collapsing." Yet Another MirageThat's unwelcome news to the late-comers to the inflation-linked bonds fest. ETF-land is still seeing money coming into TIPS funds -- and January could well mark the eighth consecutive month of inflows, says State Street Global's Matthew Bartolini. "The more recent buyers may be paying for past performance," he said this week. Given the rise in breakevens, the chance of inflation-linked bonds returning more than regular Treasuries is slimmer, he said. "Overall, TIPS relative performance may not be as strong in 2021 as it was in 2020, as higher inflation expectations are, to a degree, priced in." That said, several Wall Street inflationistas have warned that inflation will stage a deceptive surge in the next couple of months. That is, price indexes will jump as the year-on-year comparisons capture the deflationary shock of the pandemic. Goldman Sachs's William Marshall pointed out this week that base effects like this can bump up the yield curve and breakeven inflation rates. It's best to lean against any market moves based on a cold sweat about the Fed rushing to tighten policy, in his view, as that inflationary mirage is likely to dispel by the third quarter. In the meantime, of course, the good news is that the combination of strengthening growth and tame price pressures is a boon for risk assets. And a "goldilocks" outlook for above-trend growth and below-trend inflation over the next year remains the most popular among fund managers in Bank of America's latest survey. Incidentally, also from that survey, conducted this month: Bitcoin vaulted to the top of the "crowded trades" list -- replacing Long Tech for the first time since October 2019 -- with 36% of the vote. As is so often the case with such stats, the most intriguing question is what the other 64% of fundies are thinking. Better AngelsNot so long ago investment-grade debt was the darling of the fixed income world. It was a haven from the issuers most at risk as the pandemic raged, with dedicated Fed support facilities, and it still offered some yield. Now, the central bank backstop is gone, and with spreads at three-year lows, high-grade may be a tougher sell. Investors are fretting about such things as leverage and an inflation surprise with historic levels of duration risk in the benchmark indexes.  There is a case for tighter credit spreads in the trend of deleveraging and corporate savings that could follow this crisis, according our reporter Sebastian Boyd. And investment grade mutual funds are still drawing sizable inflows, despite a negative return so far this year, according to Bloomberg data.  But shifts are afoot -- one notable rotation seems to be occurring into sectors that took the brunt of the pandemic's assault. The recovery trade that's arisen from optimism about vaccines and their distribution has driven record weekly inflows into the iShares U.S. Fallen Angels USD Bond ETF (ticker FALN), writes Katherine Greifeld, cross-asset reporter and sometime Weekly Fix scribe. The fund tracks corporate bonds that lost their investment-grade status, and its assets have now doubled to more than $1 billion. (Here's more from Katie on how credit ETFs have reshaped the the way investors manage liquidity.)  The bigger move, dictated by concerns about rising yields and possibly slightly less support from the central bank, appears to be into leveraged loans. Risky loans took in their largest weekly hoard of cash since March 2017 earlier this month, according to Refinitiv Lipper mutual fund data. That comes after a year when investors pulled money from the funds in all but 12 weeks, reports Jack Pitcher. The appeal of a floating interest rate in a scenario of improving economic growth is clear. The current yield on senior loans is comparable with the high yield market, says State Street's Bartolini, but investors can probably capture more price appreciation on loans. Rallies in high yield have pushed the average price of the bonds above par, while senior loans are still trading below. Moreover, they're typically higher in the capital structure, and so can offer higher recovery rates if all goes pear-shaped. Moreover, it's clear which asset class is on top so far this year, with our Veronica Graff reporting that BlackRock and DoubleLine are among the U.S. heavyweights taking the plunge.  Bonus PointsJanet Yellen may be the first Treasury Secretary... to have a rap song. The richest in the U.S. are reaping in money in the pandemic like never before. Jack's back. The trees are getting tired of saving us. |

Post a Comment