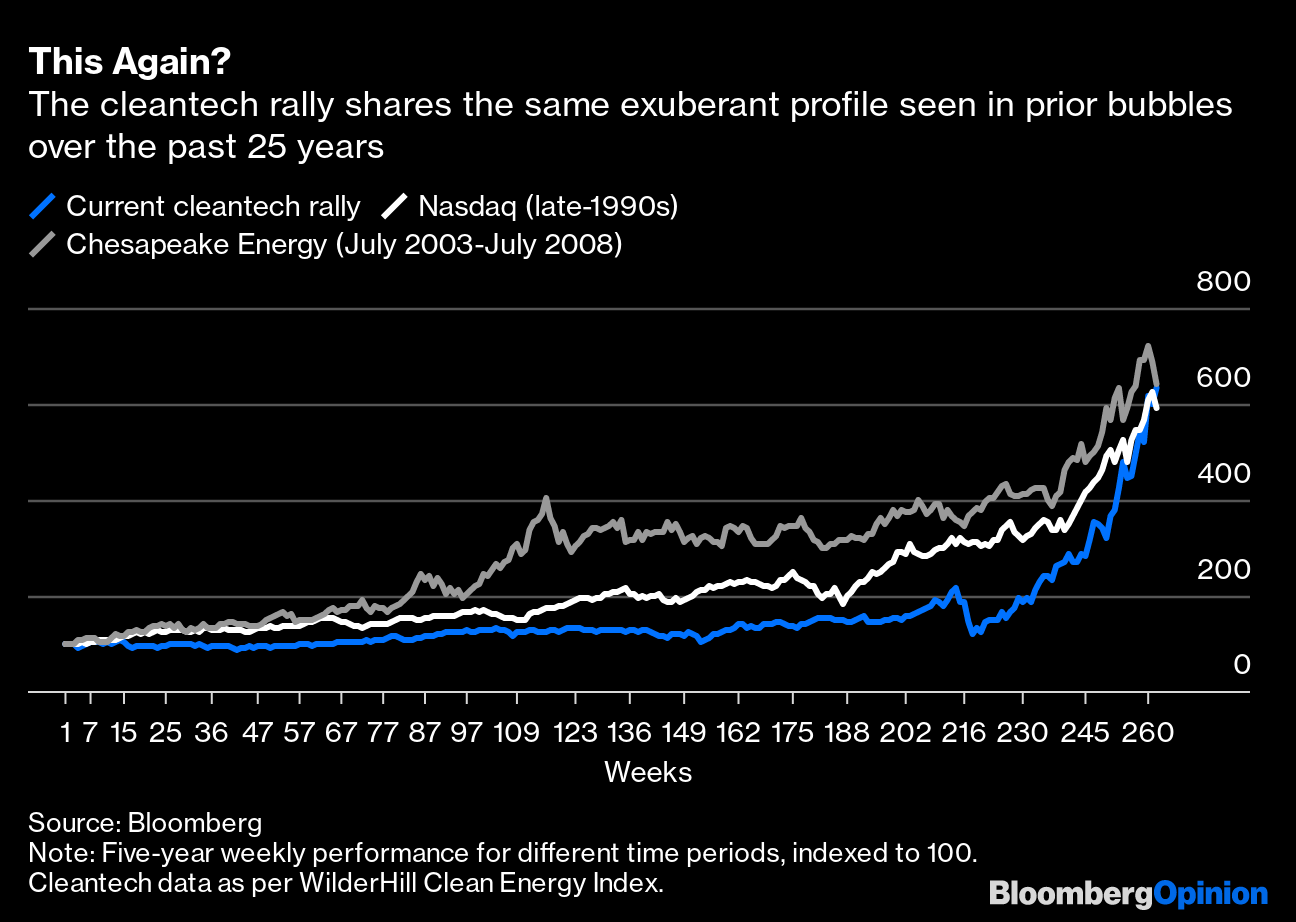

| This is Bloomberg Opinion Today, a filibuster of Bloomberg Opinion's opinions. Sign up here. Today's AgendaExploding Some Covid Economy MythsWe live in an era of fake news and conspiracy theories, but maybe the tide is turning. Social media is cleaning up its act, sort of. QAnon followers this week watched the edifice of malarkey on which their belief system was built crumble into dust. Here at Bloomberg Opinion, we do our part by shining the torch of enlightenment on all manner of misconceptions, today having to do specifically with the pandemic economy: Misconception No. 1: OMG Run Inflation Is Coming Inflation may really be coming, as we have warned in the past. But then again, maybe not. Yes, there's a glut of consumer savings in the U.S., but that doesn't necessarily mean it will all get spent anytime soon, writes Gary Shilling. Inflation may be the hot new worry, but stock and bond markets seem calm. Misconception No. 2: The Global South Keeps Falling Behind Maybe you've heard this one: The developed world has all the money and all the vaccines and will bounce back from the pandemic faster than developing countries, widening the gap between them. Except, as Ferdinando Giugliano notes, developed countries haven't exactly been exemplary at fighting the pandemic, while developing countries benefit from China getting its act together and first-world consumers buying a bunch of stuff. If anything, the gap between worlds keeps closing. Misconception No. 3: Movie Theaters Are Dead Many of us shed a tear last year when whole theater chains closed and studios sent new movies right to streaming. It seemed like the end of an era. But in parts of Asia where the coronavirus is more or less tamed, people are flocking to movie theaters again, writes Adam Minter, sharing air with germ-spewing strangers and everything. All it takes is a sense of safety and some decent content. Anything's possible. Further Pandemic Economics Reading: Industrial CEOs are pessimistic in words, optimistic in deeds. — Brooke Sutherland So Much for the Biden AdministrationSean Hannity deftly pivoted this week from pretending Joe Biden wasn't going to be president to pretending his administration had already failed:  To be fair, an existential threat to Biden's presidency did develop this week, as Senate Minority Leader Mitch McConnell threatened to filibuster all Senate business until Democrats agreed not to nuke the filibuster. Being unable to pass legislation with a simple Senate majority would pop the tires on Biden's first two years. But the Dems still have a majority in the Senate and seem united in response to McConnell's brinkmanship, notes Jonathan Bernstein. That leaves the former majority leader with small and shrinking leverage. Biden's critics on the right got some more ammunition in the form of news he might make Robert Malley special envoy to Iran. Eli Lake calls Malley a pushover for the regime and says his appointment would contradict what Biden's other foreign-policy nominees have said about striking a tougher nuclear deal. Further Biden Administration Reading: Putin's Problem Gets More ProblematicWe wrote earlier this week that Vladimir Putin had much to fear from returning rival Alexey Navalny, and already we're starting to look right. It gets exhausting sometimes, all this being right. Anyway, as Clara Ferreira Marques foretold, Navalny's predictable arrest, along with a Navalny-backed movie alleging a lavish lifestyle for Putin, have already started to fire up dissent in Russia. It's not a crisis yet, but Navalny has at least exposed the ugly reality of Russian politics, writes Bloomberg's editorial board, challenging Putin and the nation to do something about it. How to Covid BetterThe coronavirus news keeps swinging from good to bad and back, as sometimes happens at turning points. Today the news was mostly bad, as the U.K. warned its new variant is not only more communicable but also deadlier. This is preliminary and possibly even contradictory, but it's another reason to keep our guard up. Boris Johnson's government is even considering paying infected people to isolate, but as Therese Raphael writes, there are some big potential drawbacks. Someday hopefully soonish, enough people will have been vaccinated to end this nightmare. Even at that point, though, we'll still need Covid vaccines, and Aaron Kesselheim argues Biden should make sure they're sold on a cost-plus basis to keep them affordable once the government stops buying them en masse. Telltale ChartsHedge funds had a great year overall, but with vast differences between individual funds, writes Mark Gilbert.  A firehose of cheap capital to cleantech is a form of green stimulus, though it's causing risky bubbles, warns Liam Denning.  Further ReadingMexico keeps frustrating U.S. law enforcement efforts to fight cartels. Biden must fix this. — Bloomberg's editorial board London derivatives business is fleeing to New York, which isn't in Europe's interest, either. — Elisa Martinuzzi and Marcus Ashworth Here are five reasons the SEC should allow Bitcoin ETFs. — Eric Balchunas Amazon legally has the power of life and death over Parler, and that's OK. — Noah Feldman Google's threat to shut down news in Australia is the wrong way to turn down the regulatory heat. — Alex Webb ICYMIImpeachment II: Insurrection Boogaloo debuts in the Senate next week. Wall Street insists on helping New York with its terrible vaccine rollout. Reddit users won a battle against Citron in the GameStop wars. KickersThere's a moon rock in Biden's Oval Office. Area grocer takes delivery of bananas, heaps of cocaine. (h/t Scott Kominers for the first two kickers) Scientists find connection between the immune system and brain aging. The delayed movies of 2020, ranked by their trailers. RIP to Hank Aaron, who ignored racist death threats to break Babe Ruth's home run record. Note: Please send moon rocks and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment