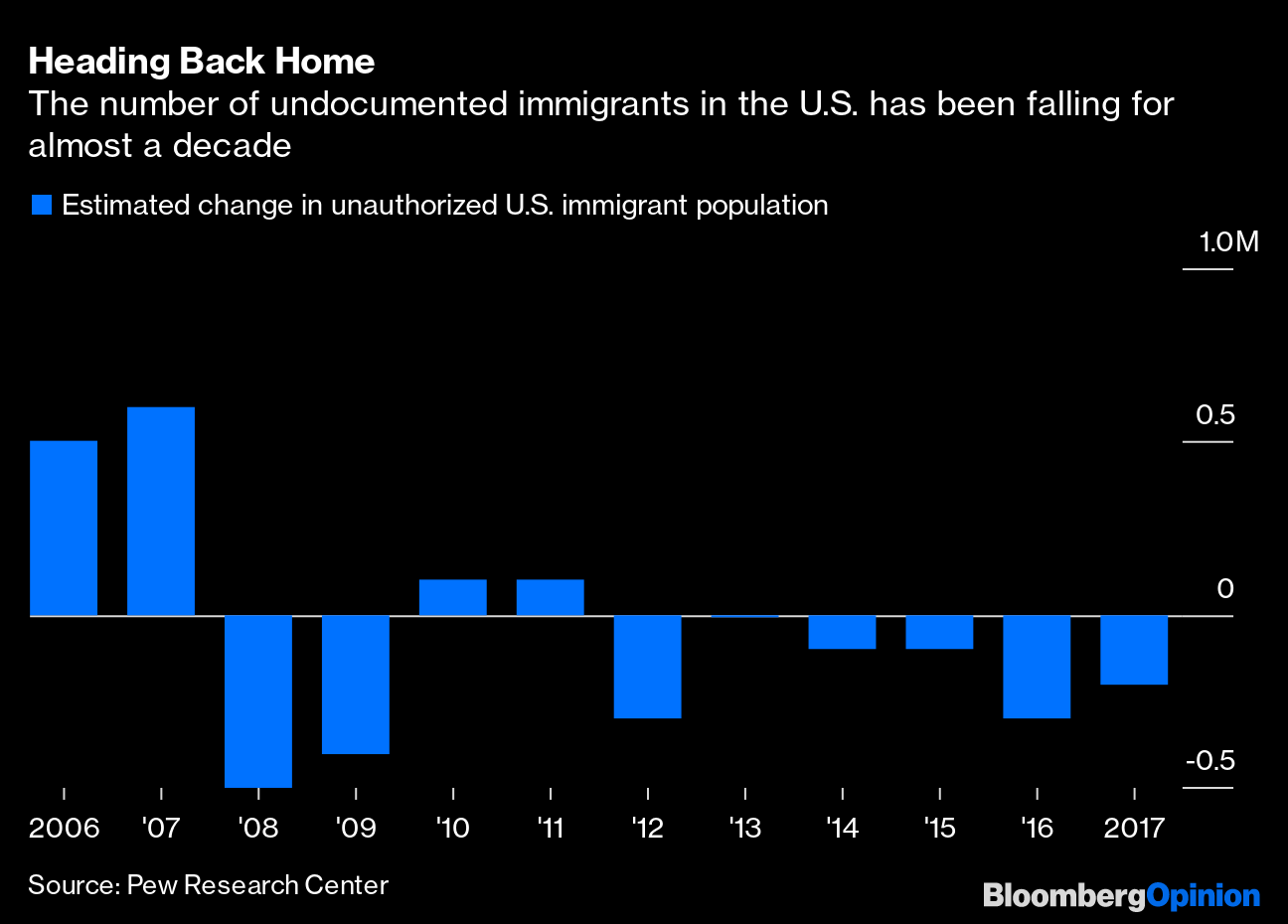

| This is Bloomberg Opinion Today, a triple-leveraged junk bond ETF of Bloomberg Opinion's opinions. Sign up here. Today's AgendaWacky Markets Can Always Get WackierThe film version of "Cloudy With a Chance of Meatballs" is about a guy who invents a machine that turns water into food. This is great, theoretically, until the machine goes haywire, rockets into the sky and starts spewing car-sized meatballs and other cuisine, turning this would-be solution into a big problem. That brings us to the Federal Reserve. It's meeting this week, which is a boring thing to type, especially with the Fed on autopilot, pumping cheap money into the economy as fast as it can for as long as it can. This is great, theoretically, like a machine that turns water into food, except that all the cheap money is feeding market imbalances that are not unlike clouds filled with giant, deadly meatballs. The Fed's job is a lot harder than it looks, Mohamed El-Erian writes, having to balance a short-term economic slowdown against decent long-term prospects and the accumulation of those meatball clouds. Take the corporate bond market, which has gone from merely bonkers to full-on truck-sized bananas in the past year, with U.S. non-financial corporate debt soaring to more than 90% of GDP from less than 75%, as Tara Lachapelle and Brian Chappatta write. Instead of trying to prune that debt this year, companies are selling more of it to finance huge mergers and acquisitions. Should be fine! Meanwhile, the stock market continues to skyrocket, slipping further from the surly bonds of reality, John Authers writes, with a whole dashboard of data to back him up. One piece of evidence is how Redditors these days can just up and decide to pump stocks such as GameStop to ludicrous heights on a whim. Matt Levine points out there is at least a shred of fundamental basis for the rally in a company running a bunch of empty video-game stores in ghost malls. But this gets us back to the meatball thing: Human-scaled meatballs are fine. Sears Tower-scaled meatballs may cause indigestion, or worse. Stimulus May Get Less StimulativeThe Fed cutting off easy money could puncture these bubbles. But the chances of that happening are falling as hopes for a new round of fiscal stimulus start to fade. Republicans and some moderate Democrats are balking at President Joe Biden's $1.9 trillion relief package. Michael R. Strain suggests Biden jump on one of the bipartisan compromise plans floating around, which he argues will still be enough to help the economy without burning up any of Biden's political capital. One idea Biden should drop is boosting the federal minimum wage to $15 an hour, Michael argues. He and other conservative economists think this will hurt job growth at the worst possible time. In fact, Karl Smith suggests abolishing the minimum wage altogether would create jobs. Whatever happens with all that, there's no doubt America's unemployment benefit system is outdated and full of holes, writes Claudia Sahm. She offers some ways to reform it and get more assistance to the people who really need it. Biden's plan to send $1,400 checks to everybody might at least have bipartisan appeal, because free money, duh. But that may send help to some people who don't really need it, writes Sophia Campbell. If you're one of those people, then you have a moral obligation to consider passing that money on, she writes. Further Stimulus Reading: Biden Needs an Innovation AgendaPoliticians love to talk about preparing America's economy for the future, and we'll hear it a lot this year, between Biden's first stimulus package and another planned bill to address infrastructure and other stuff. One simple way to future-proof the economy would be for the government to spend much more on research and development than it has lately, writes Bloomberg's editorial board. Without this and similar investments in innovation, the U.S. risks losing its status as the world's idea machine. Meanwhile, the world's hackers have no trouble innovating, as the massive SolarWinds attack shows. James Stavridis suggests Biden could steal a note from his predecessor and create a new branch of the military, the Cyber Force, dedicated to confronting the many and growing threats out there. One of Biden's plans for the future may be to regulate cryptocurrencies through the Treasury Department. But Tyler Cowen warns the technology is still too close to its infancy for us to understand how it operates best. Regulating it now could cause more problems than it solves. Telltale ChartsBiden's immigration reforms probably won't unleash a flood of illegal immigration, writes Noah Smith. For various reasons, Latin American immigration peaked a while ago.  With the Keystone XL pipeline dead, Alberta is low on options for exporting its oil, writes Julian Lee, who points out the province's stinginess boxed it off from its Canadian neighbors years ago.  Further Reading Dominion Voting Systems may struggle to win its libel suit against Rudy Giuliani. — Noah Feldman Merck's Covid vaccine setback isn't the end of the world. — Sam Fazeli Biden should harp on how surgical masks and N95s work better than cloth ones. — Justin Fox Marcus Rashford keeps making Boris Johnson look heartless and out of touch. — Martin Ivens Audio-chat app Clubhouse is the next big thing in social media. — Tae Kim Americans are buying a lot more fish to eat at home. — Sarah Halzack Roses are red, wafers are thin. Schools should teach poetry again. — Andrea Gabor ICYMICongress might get new stimulus passed by mid-March. New York and California will ease Covid restrictions, until tightening them again. The world's ice loss matches worst-case global warming scenarios. KickersSomebody scanned "Girl With a Pearl Earring" and created a 10 billion-pixel panorama. (h/t Ellen Kominers) We destroy bugs at our own peril. Ancient South American civilizations thrived on bird poop. The 50 best cult movies. Note: Please send ice and complaints to Mark Gongloff at mgongloff1@bloomberg.net. Sign up here and follow us on Twitter and Facebook. |

Post a Comment