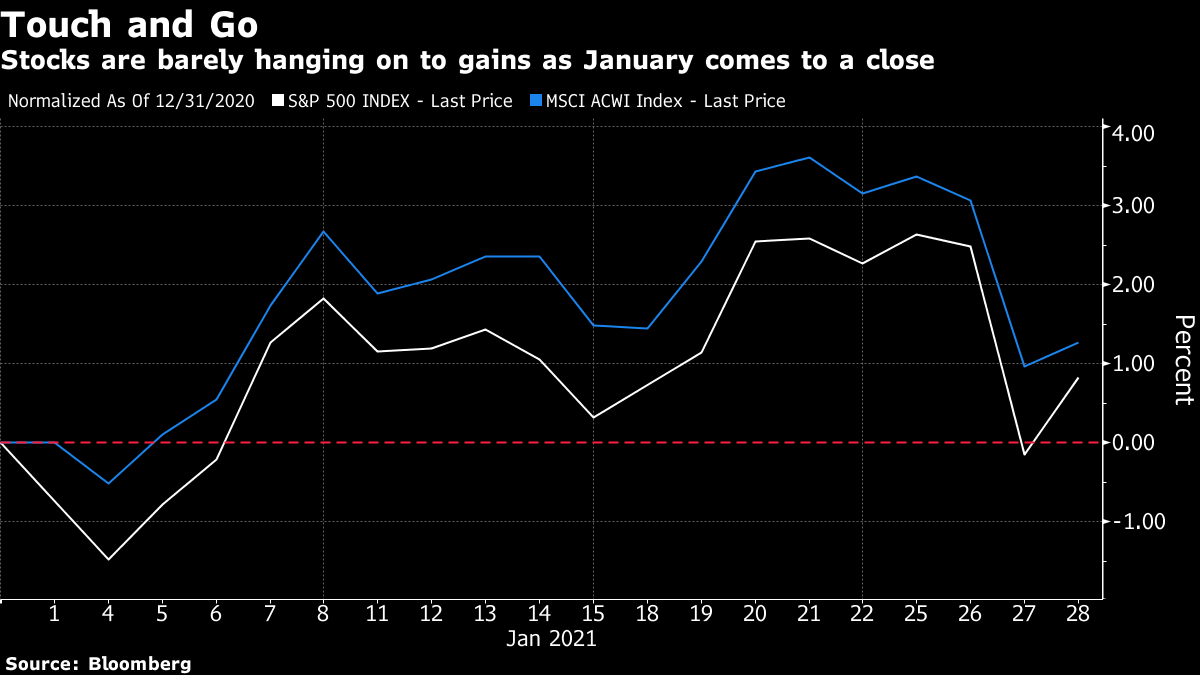

| Want the lowdown on what's moving European markets in your inbox every morning? Sign up here. Good morning & Happy Friday. Europe takes control, Robinhood eases curbs and stocks are heading lower. Here's what's moving markets. Europe FirstThe European Union will tighten rules on the export of Covid-19 vaccines today, risking a major escalation in the global battle to secure access to the life-saving shots. With EU governments under fire over the shortfall in deliveries from drugmakers including AstraZeneca, the EU's executive arm will start to require companies seeking to ship the inoculations outside the bloc to obtain prior authorization. European Council President Charles Michel has also raised the prospect of effectively seizing control of vaccine production if those measures fail to get the program back on track, a European official said. Meanwhile, a new shot from Novavax proved effective against the U.K. coronavirus strain, but less so against South Africa's. LiftedWallStreetBets' go-to trading app Robinhood said it will today loosen curbs on buying a set of stocks that have been caught up in a crowd-driven campaign to force short squeezes. The limitations, which Robinhood said were meant to protect itself and users, had sparked outrage on Thursday, even prompting displays of rarely-seen U.S. bipartisanship. The unprecedented frenzy has forced Robinhood to borrow cash in order to meet financial requirements. GameStop, the centerpiece of the retail trading mania, rallied back above $300 during extended trading overnight. Meanwhile, new posts encouraged people to pile into iShares Silver Trust, the largest silver exchange-traded fund, sending spot prices for the precious metal into the biggest one-day rally since August. Taiwan TroubleDeutsche Bank, Standard Chartered and ING are among major foreign companies under investigation in Taiwan for speculating on the surging local currency last year, people familiar said. The positions were based on overseas physical grain trades deliberately transacted via their Taiwan units to speculate on the local currency, destabilizing the market, the central bank said. Others allegedly involved include Cargill, JPMorgan and ANZ. Deutsche Bank, JPMorgan, ING, ANZ and Cargill declined to comment. A Standard Chartered spokeswoman said the bank wasn't able to comment as this involves regulatory process. Grim FuturesEuropean and U.S. stock futures are pointing to a negative finish to the week, both down more than 1%, mirroring broad-based losses in Asian markets. Global stocks are set for their worst weekly slide in about three months, partly on the turmoil caused by hoards of day-traders hatching stock bets that roiled hedge funds and strained trading platforms. Some strategists say investors should buy the dip because of the expected stimulus-fueled economic recovery from the pandemic. Others fear an uneven vaccine rollout signals a fragile outlook amid stretched valuations. Coming Up…Results are just in from chip wafer maker Siltronic, posting sales that met expectations, and Spain's second-largest bank BBVA, whose bottom line surpassed the high end of analyst estimates. Comms equipment maker Ericsson's profit also beat the top end of expectations. Ericsson is just the beginning of this morning's smorgasbord of big-name Swedish earnings, which also includes fast fashion behemoth H&M, industrial group Atlas Copco as well as papermill owner Svenska Cellulosa. Later, the European Medicines Agency is expected to clear AstraZeneca's Covid vaccine. Around mid-day, get ready for U.S. earnings including Eli Lilly, Chevron, Honeywell and Caterpillar. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningThis year's January Barometer is coming down to the wire, leaving stock market soothsayers just today's trading session to determine the fate of the year's returns. The old adage "As goes January, so goes the year" suggests that equity market returns in the first month can be used to predict the year's performance. The S&P 500 is sitting on just a 0.8% gain month-to-date, with futures pointing lower in Asia trading. The MSCI AC World Index is up just over 1%. Popularized in the Stock Trader's Almanac in the late 1960s, the theory has little beyond what could be just a coincidental correlation to explain its claim. But a strong January may reflect investor enthusiasm for stocks which can carry into the rest of the year. Since 2000, the U.S. benchmark has gained on average 10% in years where January returns were positive, and just 3% when they were negative, according to data compiled by Bloomberg. The global stock gauge climbed an average 8% in years with a positive January, and 2% in negative ones, the data showed.  Cormac Mullen is a cross-asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment