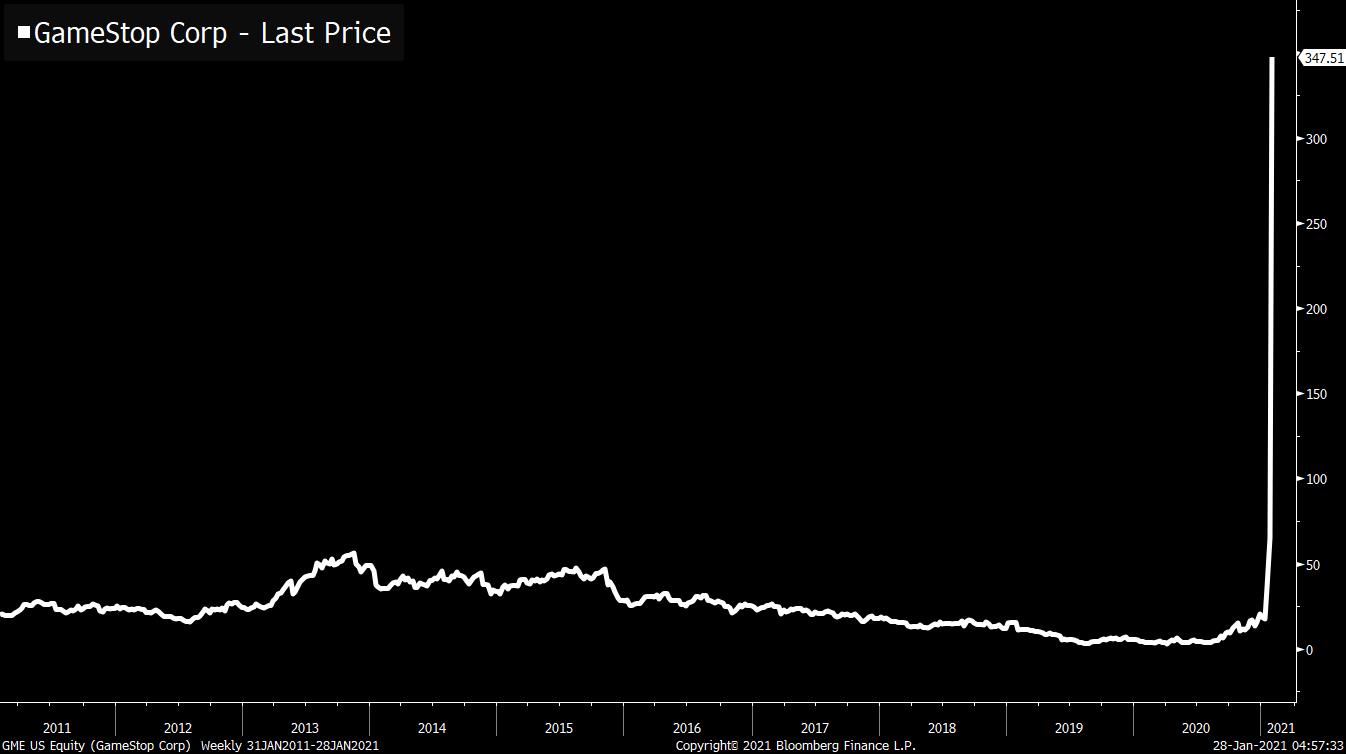

| GameStop mania goes global, claims data due, and more Covid restrictions lifted. Long shorts Heavily shorted companies across the globe are seeing their shares jump as traders race to bet on where the flood of retail money might head next. There is a long list of potential targets - companies that have short-interest levels above 30% of their share float - which have seen rallies in recent days. Shares in GameStop Corp. surged again in premarket trading, moving above $500 at one point. For hedge funds, the attack on their short positions is proving painful, and moving the wider market as they slash their equity exposure at the fastest rate since 2014. GDP, claimsThe U.S. economy probably grew 4.2% in the last quarter of 2020, a long way from the Covid-recovery 33.4% expansion in the previous three months. Last year ended with a resurgence in the pandemic and a weakening labor market, factors Fed Chair Jerome Powell highlighted yesterday when he reiterated that there would be no reduction in support for the economy for "some time." We will get another health check on employment this morning when weekly jobless claims are published, with economists surveyed by Bloomberg expecting a small decline to a still-elevated 875,000. Both GDP and claims numbers are published at 8:30 a.m. Eastern Time. EasingThe European Union and AstraZeneca Plc remain at loggerheads after the drugmaker rejected demands that it take supplies from its U.K. factories to increase doses going to the bloc. There was some good news on the vaccine front with Pfizer Inc. and BioNTech SE saying results of studies indicate their vaccine is effective against both the U.K. and South Africa variants. In the U.S. cases are rapidly dropping in western states and falling across the country. Governor Andrew Cuomo lifted restrictions in most hot spots across New York, declaring an end to a post-holiday surge in the virus. Markets dropEquity markets are dropping today, driven by a raft of concerns in the wake of weaker-than-expected tech earnings, the fallout from frenzied retail trading and continued pandemic concerns. Overnight, the MSCI Asia Pacific Index fell 1.9% while Japan's Topix index closed down 1.1%. In Europe, the Stoxx 600 Index had dropped 1% by 5:50 a.m. with all but two industry sectors in the red. S&P 500 futures pointed to more losses at the open, the 10-year Treasury yield was at 1.008%, oil slipped and gold was slightly lower. Coming up...As well as claims and GDP data, U.S. December wholesale and retail inventories data is at 8:30 a.m. New home sales numbers for the month are at 10:00 a.m. and Kansas Fed January manufacturing activity is at 11:00 a.m. Virtual Davos, Bloomberg's Year Ahead and the Future Investment Initiative in Riyadh all continue. It's another busy day for earnings with Visa Inc., Mastercard Inc., McDonald's Corp., American Airlines Group Inc. and Comcast Corp. among the many companies reporting results. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningHere's a familiar looking stock chart that you might see out in the wild. It could be something like Enron. It could be Lehman. Or it could be some tiny stock in an emerging market where the CEO was discovered to have faked his own kidnapping after embezzling all the company cash...  Ok, you probably already guessed what the chart is. It's GameStop, but just upside down. Here's the real chart.  But the point is, the top chart is familiar. The second chart is not. The intuition is straightforward. Entropy is a thing. It's much quicker and easier for something to collapse than to be built in the first place and so forth. And yet here we are. One of my favorite finance books is My Life As A Quant by Emanuel Derman, who was among the first of the theoretical physicists to go work on Wall Street. And in it he talked about the aftermath of the 1987 stock market crash "Black Monday" and how it left a permanent mark on how options are priced. After the world witnessed such a steep fall in one day (the Dow fell 22.6% in one session), the cost of put options (which protect against downside risk) permanently got more expensive. Once people became aware that such a severe crash in so short a time was even possible, the likelihood that it could happen again was never dismissed. The consequences aren't as big, but in a sense, what we've seen in GameStop (and AMC and Blackberry and a bunch of another names) could be thought of as a Reverse 1987. Upcrash. A gain so fast and rapid, that it might previously have been thought to be impossible. And it is, weirdly, kind of a crash. I mean, whoever heard of the SEC putting out a statement on market volatility because stocks were going up too much? Whoever heard of hedge funds having to quickly reduce their overall market exposure because some stocks were doing too well? It's new and weird!

But just like with 1987, now that we've seen it, we can't unsee it. And we can't ever dismiss the possibility of more single-stock upcrashes happening at a moment's notice. At least as long as the market structure remains as it is. It reminds me of the stock version of when the NY Times covered the OK, Boomer meme in late 2019, and then it suddenly was literally everywhere for weeks on end. 0-100. This is the stock version of that.

Maybe something will change with the price of call options going forward. Maybe something will change with the nature of shorting. Whatever it is, the possibility that such a thing can happen -- and the awareness among individual traders that they can possibly make something like this happen again, especially with smaller or less-liquid securities -- is now always with us, and could leave a permanent mark, as investors fear the possibility of getting GameStopped. Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment