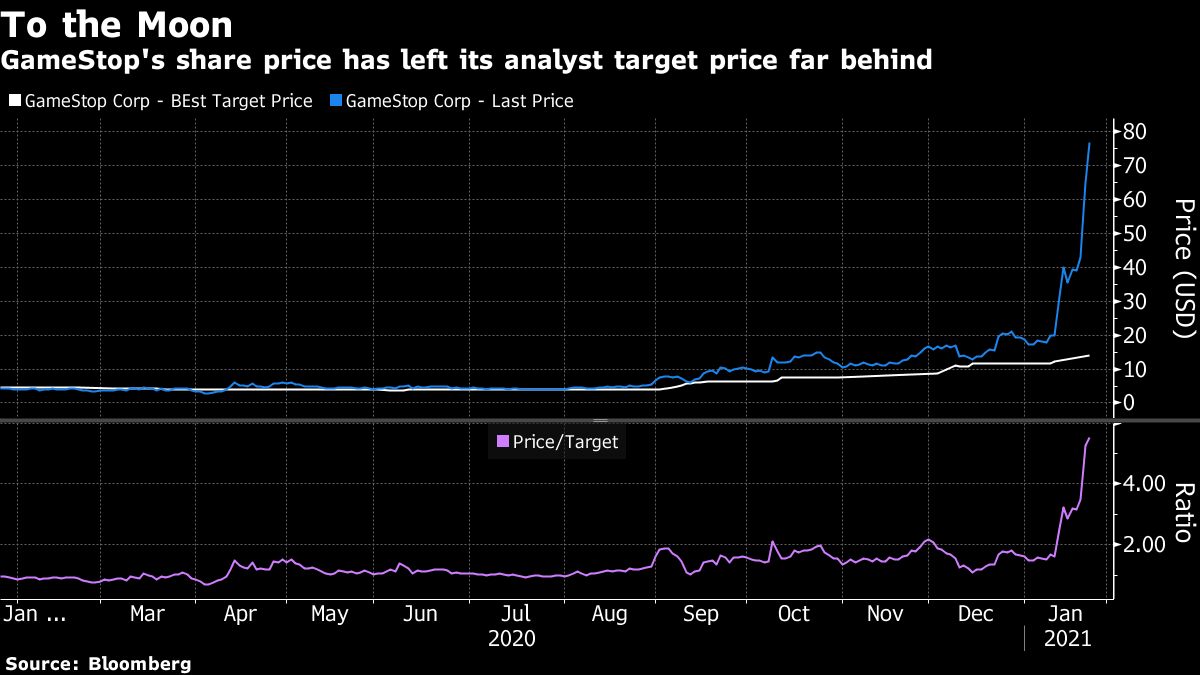

| Xi Jinping speaks at Davos. Tencent nears $1 trillion. The best and worst places to be during Covid. President Xi Jinping called on the world to abandon "ideological prejudice" and shun an "outdated Cold-War mentality" as he signaled that China will continue to forge its own path regardless of western criticism. It's vital to stay committed to international law and international rules "instead of staying committed to supremacy," Xi told the Davos Agenda event, in his first address since Joe Biden entered the White House. "Confrontation will lead us to a dead end," he said, and urged a return to mutual respect to help recovery from the pandemic. The Biden administration said it was approaching ties with Beijing with "patience" and will review Donald Trump's actions, including tariffs and company delistings. A world-beating surge in Tencent Holdings Ltd. has pushed its market value to the cusp of $1 trillion for the first time, a marker for the euphoria sweeping global technology stocks. The Chinese Internet behemoth jumped 11% in Hong Kong trading on Monday, its best gain since 2011, taking its capitalization to almost $950 billion. The options market went wild, with one contract expiring Thursday soaring 118,300%. There were few obvious catalysts for a rally of that size, although traders cited an ambitious listing plan from video startup Kuaishou Technology, in which Tencent holds a stake, as well as a bullish note from Citigroup analysts. Asian stocks looked set to slip after a choppy U.S. session as investors mulled the timing of further stimulus amid gains for technology shares. Treasury yields fell and the dollar pushed higher. Futures pointed to modest declines in Japan and Hong Kong, and were little changed in Australia. The S&P 500 Index ended higher, though gains were limited after the top Senate Democrat said an aid package was unlikely before mid-March and a U.S. health official expressed concern about vaccination delays. Elsewhere, crude oil climbed toward $53 a barrel and gold fluctuated. European stocks retreated. Bitcoin rebounded above $34,000 before paring the advance. People are finally getting shots, but the biggest global vaccination campaign in living memory has yet to reach a point where it's causing meaningful shifts in Bloomberg's Covid Resilience Ranking, a measure of the best — and the worst — places to be in the coronavirus era. Israel and the United Arab Emirates, which lead the world in inoculating against Covid-19, have been propelled into the top 15 due to the fast pace of their vaccine rollouts. Top performers like New Zealand, Australia and Taiwan haven't been hurt by the fact they've not yet started vaccinating their populations, as low community transmission and balmy weather helps maintain their Covid edge. See the full Resilience Ranking here. The People's Bank of China will seek to balance supporting economic growth and curbing emerging risks, Governor Yi Gang said, signaling a continuation of the central bank's existing policy stance. "Going forward, China's monetary policy will, on one hand, adjust to new economic developments in a timely manner, and on the other hand maintain policy stability to avoid a policy cliff," the central bank chief said at a virtual conference hosted by Hungary's central bank on Monday. He added that "China will try to maintain normal monetary policy for as long as possible and keep our yield curve upward sloping." What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayI can't stop thinking about how the Robinhood and Wall Street Bets-powered phenomenon of retail trading is changing markets and how ill-equipped incumbent financial professionals are to deal with it. On the one hand, it seems inevitable that the populist forces that have disrupted almost everything else in recent years would eventually arrive to democratize investing in the most chaotic way possible. On the other hand, the sheer impact of this type of trading has been breathtaking. Investors on Wall Street Bets — the Reddit forum dedicated to "making money and being amused while doing it" — have set their sights on exploiting a financial system which is perceived to have locked them out for years. Outsized investment gains were the preserve of professional traders and big banks with access to inside information and big balance sheets. Much to the growing horror of the financial establishment, r/wallstreetbets then figured out a way to capitalize on this system and bend it to their own will. In doing so, Wall Street Bets and other retail trading communities are changing the way markets work in some pretty big ways. Here are a few I've been thinking about: 1) Value has become a dirty word. Traditional fund managers used to identify a cheap stock and buy it in the hope that it would gain in value. Nowadays cheapness is a turn off rather than a turn on. Expensive stocks get more expensive as they attract more flows, and cheap stocks are shunned as losers rather than diamonds waiting to be discovered. One way of thinking about this is that prices used to be self-limiting. Stocks would rise to a point where valuations (earnings multiples or price-to-book) would become unattractive, which would cause the stock to go down and give valuations a chance to normalize. Nowadays, the amount of money chasing inflows means that prices can go much higher than traditional security analysis might suggest. In a world of sluggish growth and asset price inflation, chasing inflows has arguably become the best bet to generate outperformance. 2) Flows before Pros. I've written about this a lot this year. But the simple premise here is that in an environment where flows matter more than fundamentals, the guy trading stocks in his basement might be better equipped to judge where money is going next. He might have a better sense of the strength of a stock's particular "story," for instance, than a portfolio manager wedded to valuation models. In a more-than-a-little-ironic turn of events, finance professionals are now chasing retail flows. 3) The options tail wags the dog. It's certainly not the first time options activity has impacted the underlying, but I don't think we've had to consider before whether it's doing so on a systemically-important level. Traders on r/wallstreetbets have been upfront about trying to move the market with options-buying. The idea here is that buying a ton of options forces market-makers to hedge their own exposure by buying the stock in the underlying company. That dynamic may be enough to move a target share price upwards, which can then spark more call-buying in a frenzied feedback loop. For dealers on the other side of the trade, the question is whether a prudent hedging strategy turns into something else. 4) The shorts have become the target. Once upon a time, short-selling firms would unveil a new position to great anticipation and attention (if not acclaim). The current scrum over Gamestop — in which retail traders have gone head-to-head with short-selling firm Citron — suggests that might become a thing of the past. As Scott Nations at Nations Indexes points out: "The old game of shorting a stock then putting out a negative report is done. From now on that will just be the signal to start a massive short squeeze." A hedge fund or short-seller advertising a bet against a stock might now be the equivalent of waving a red flag to r/wallstreetbets' herd of bulls: a signal to charge in with call options and force a move higher. The predators have turned prey.  5). Fantasy becomes reality. It would be tempting to dismiss all of the above as a market curio if it weren't for the fact that it was, you know, actually moving stocks and impacting real companies. Meme stocks gifted with retail attention and inflows do find themselves in a better position. Shares of Gamestop, the ultimate posterchild for "flows versus pros," have surged more than 400% so far this year. Message boards are alight with suggestions for what Gamestop could actually do with that very real money (think strategic acquisitions and expansions to grow its market share). Flows may matter more than fundamentals, but at some point those flows start impacting fundamentals too. Of course, this could all come crashing to the ground at any moment. But for now, it seems clear that Wall Street is only just beginning to come to grips with the phenomenon that is Wall Street Bets. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment