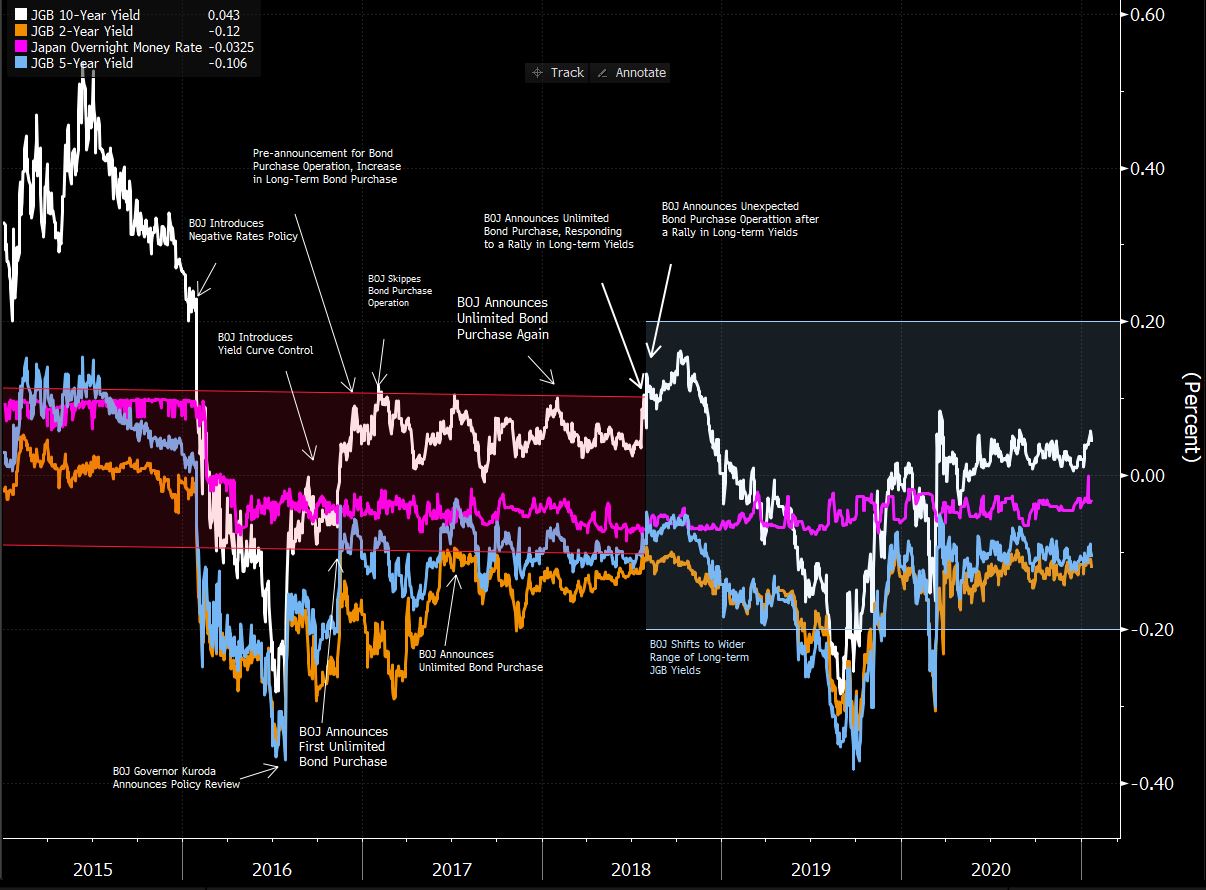

| Bitcoin slumps — again. Australia counts the cost of its trade spat with China. Wall Street gets frugal with employees. Bitcoin closed in on the lowest in three weeks as the cryptocurrency's sizzling rally gives way to pessimism that prices are too high. Bitcoin tumbled as much as 11% Thursday, sliding below $31,000. Losses have accelerated in the past two days, sparking a hunt for reasons why the notoriously volatile asset was selling off. A report in a trade blog suggested that there had been what's known as a double-spend, where the same token is used by the same person in two transactions - though it turned out not to be cause for concern. Google searches for the phenomenon surged. Australia's trade fight with China cost it about $3 billion in commodities sales last year, and that relatively small impact suggests there's little economic need for the country to bow to Beijing's pressure. That's the value of Australian exports lost in 2020 compared to the prior year, and covers commodities from copper and coal to wine and lobsters that are now subject to trade restrictions by Beijing, according to Chinese customs data. While the impact on some industries has been savage, China's state-aided splurge on infrastructure to rescue its economy from the pandemic has lifted the amount of iron ore it needs to fuel record-breaking steel production. And there, Australia is the dominant producer. Purchases by China rose almost $10 billion last year. Asian stocks looked set to pull back from an all-time high Friday as investors assessed earnings expectations and the prospect economic growth will be bolstered by more U.S. fiscal spending. The dollar slipped. The S&P 500 Index eked out another record high Thursday as tech shares advanced. Benchmark Treasury yields remained higher after a small decline in initial jobless claims. Deluged by client orders and often working from home, Goldman Sachs's workforce generated 15% more revenue per employee during the tumult of 2020. But as the year wound down, the firm had spent an average of just 2% more on each person. Inside JPMorgan's investment bank, revenue per employee surged 22%. The figure for pay: up 1%. While some U.S. lenders have granted special pay to rank-and-file staff, investment banks have warned that there would be modest rewards for traders hauling in a windfall, and it seems to be a trend. China failed to meet its 2020 trade deal targets with the U.S. By the end of December, Beijing had purchased about 58.1% of the $172 billion worth of goods it pledged to buy last year under the "phase one" agreement with Washington. It's no surprise that the annual target wasn't met, since the monthly data had shown China was well behind on purchase commitments all year. The latest figures show China sped up in December, but that wasn't enough to meet its goals. The trade deal wasn't a win for the U.S. as Trump had promised. The U.S. trade deficit with China grew to $317 billion last year. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayIs this the week that yield curve control began falling out of favor? The policy, first pioneered by the Bank of Japan, aims to cap yields on longer-term bonds in an attempt to boost economic activity. But in recent days we've seen the first hints of pushback against the idea — even from the BOJ itself as it revealed its latest interest rate decision. The central bank is undertaking a review of its policies, including the effectiveness of yield curve control. BOJ Governor Haruhiko Kuroda didn't give many clues on what the review might say, but he did suggest that more flexibility in the yield curve for Japanese government bonds (JGBs) was on the cards, rather than rigidity. As Ben Emons at Medley Global Advisors put it: "The press conference signaled that now the BOJ holds almost half of all JGBs issued by the government, it has become easier to control long-term rates even if the BOJ reduces purchase volumes at its daily market operations. The BOJ could reduce these purchase volumes, making the yield curve more flexible."  Bloomberg Bloomberg Meanwhile, some had expected the European Central Bank to head towards yield curve control policies of its own at its Thursday meeting. Instead, ECB President Christine Lagarde laid out a broad and holistic approach, with the focus on boosting financial conditions rather than capping yields. She also suggested the central bank could theoretically slow asset purchases if there are favorable financial conditions — a far cry from methodically targeting yields through continued bond-buying. None of this amounts to a repudiation of the entire yield curve control concept, of course. But it is noteworthy that two of the world's major banks have suggested a willingness to explore something more flexible and fluid. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment