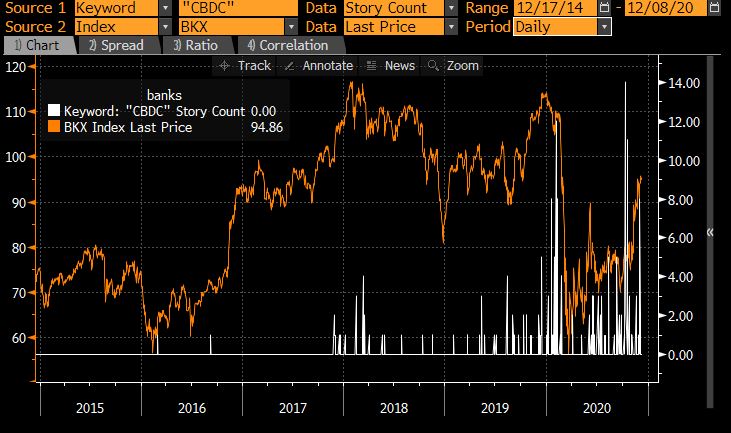

| As the first Covid-19 vaccines are rolled out, questions remain. Stocks set for more gains. China's massive stock overhang. A vaccine developed by the University of Oxford and AstraZeneca provided protection against severe Covid-19, a peer-reviewed study found, although more analysis is needed to see how well it works in older people, among those at highest risk in the pandemic. It also shows only a limited ability to stop transmission of the coronavirus despite preventing Covid-19 illness in a majority of those who are infected. Meanwhile, Pfizer Inc.'s vaccine prevents symptomatic cases of the virus, but it's not clear if the shot keeps the disease from being transmitted, according to the U.S. Food and Drug Administration. The world's first Covid shot has just been administered in the U.K. Asian equities looked poised for modest gains after a fresh record in their U.S. counterparts, as stimulus hopes tempered concern about a surge in coronavirus cases. The dollar was steady. Futures rose in Japan, Hong Kong and Australia rose. S&P 500 contracts ticked higher after the benchmark closed at an all-time high. Senate Majority Leader Mitch McConnell suggested setting aside some issues that have been roadblocks to a relief package, in a strategic retreat aimed at striking a deal. The Nasdaq 100 advanced for a 10th straight day, the longest rally in about a year. Pfizer Inc. jumped as U.S. regulators gave early indications they may grant emergency-use authorization to its vaccine. Benchmark Treasury yields dipped back below 0.92%. More than $722 billion worth of Chinese stocks will be unlocked for sale next year, testing a market where valuations are at a five-year high. That would be the largest amount since at least 2011, according to China Merchants Securities Co. It's also equivalent to about 7% of the value of the entire Chinese equity market, data compiled by Bloomberg show. From initial public offerings to additional placements, China's cash-hungry companies have been encouraged by Beijing to raise funds by selling new shares. As China-Australia relations descend into a morass of sanctions and mutual recriminations, Beijing is delivering a huge cash windfall to Canberra and Australia's economy through its insatiable demand for iron ore. China has few alternatives as it seeks to stimulate its economy post Covid-19 through infrastructure investment, with Australia accounting for more than half of iron ore shipments globally. If Beijing were to try to purchase solely from non-Australian producers, at best it could get 56% of the volumes it typically imports, according to analysis by Goldman Sachs Group Inc. Some of the world's biggest investors are snapping up office space in India with plans to turn them into real estate investment trusts, betting that demand will sustain and provide attractive yields in coming decades. Brookfield Asset Management Inc. in October agreed to pay $2 billion for 12.5 million square feet of rent-yielding offices and co-working spaces in Asia's No. 3 economy. That's the biggest real estate deal ever for India. Blackstone Group Inc. bought $1.2 billion of malls and other commercial properties from a local developer, set to further expand its 9.6 million square feet of fully-owned real estate assets in India. What We've Been ReadingThis is what's caught our eye over the past 24 hours: And finally, here's what Tracy's interested in todayThere seems to be a growing recognition on Wall Street that "something" has gone wrong with the system, with sell-side analysts at well-known firms even invoking Marx in their research. One reason the financial industry might take an interest in a growing public backlash against the "system" is because at some point it could become a major threat to the business of finance itself. Banks were subject to a bunch of new restrictions after the financial crisis and now they're being challenged again, although perhaps not in the way most people might expect.  Bloomberg Bloomberg Viktor Shvets at Macquarie details one of the more existential threats facing banks and other lenders at the moment. In a note published on Tuesday, he argues that central bank digital currencies (CBDC) will eventually allow public authorities to displace private arbiters of capital. "The argument has been that central banks cannot collect deposits, assess risks and monetize assets as efficiently as commercial banks," Shvets writes. "But, over the last decade, we have already seen central banks becoming major direct players in the bond and credit markets and they even provide direct lending to the main street." In other words, if the private financial industry is doing a bad job of allocating money or excess in a fair way — preferably one that doesn't lead to revolution and anger — then central banks might see an opportunity to use CBDCs to do so in a more equitable manner. You can follow Tracy Alloway on Twitter at @tracyalloway. |

Post a Comment