| Good morning. The reality of rising Covid-19 infections is gripping stocks, the euro toppled the dollar in global payments and a giant chipmaker's shares slipped. Here's what's moving markets. RealityEuropean equity futures are lower after U.S. stocks slipped as New York City shut schools because of rising coronavirus cases. Some shares in Tokyo fell too as the city raised its alert to the highest of four levels. Investors are reining in some of the vaccine euphoria that propelled global stocks to record highs, with money managers focused on the latest data showing jumping transmission rates in Europe and the U.S., where deaths from the illness surpassed 250,000. Markets just can't ignore the reality of a dark winter, Bloomberg Opinion writes. Euro Rules

The euro was the most used currency for global payments last month, according to data from the Society for Worldwide Interbank Financial Telecommunications, the first time it has outpaced the dollar since February 2013. Trade upheaval, a pandemic-induced recession and political disharmony renewed pressure to reduce the share of international payments in dollars. The U.S. currency has weakened more than 11% from its March peak, with predictions of more downside and investors fleeing a bullish dollar exchange-traded fund. The dollar remains the top funding currency, the Bank for International Settlements said in a July report.

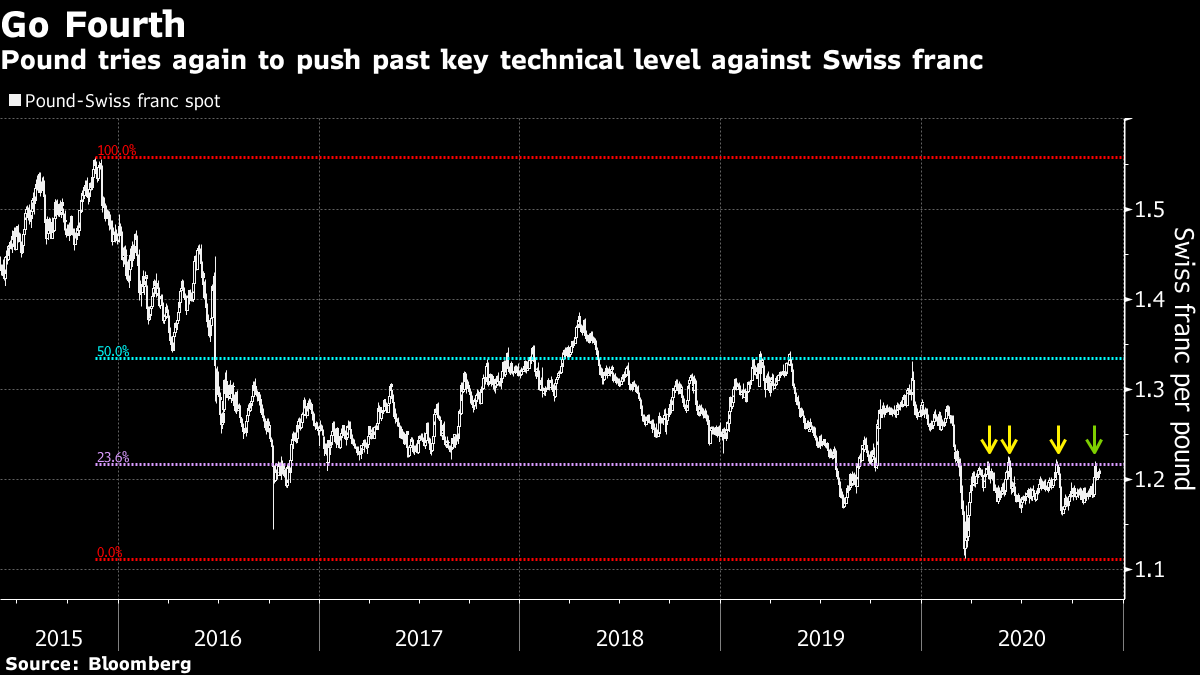

Nvidia SlipsNvidia, the U.S. technology group with a market capitalization of more than $330 billion dollars, slipped in extended trading after warning that data center chip sales will decline slightly in the current quarter. Mellanox, a networking chip business Nvidia acquired earlier this year, booked a big order last quarter that won't recur in the current period, the firm said, with analysts speculating the customer is Huawei Technologies, which is the subject of trade sanctions by the U.S. government. `Childish'America's longest-serving major bank boss waded into the stimulus debate. JPMorgan Chase & Co.'s Jamie Dimon said U.S. lawmakers are failing the country in their inability to reach a compromise on fiscal stimulus. "We have this big debate: Is it $2.2 trillion, $1.5 trillion? You've got to be kidding me," Dimon said at a virtual New York Times event. "Just split the baby and move on. This is childish behavior on the part of our politicians," he added. Coming Up…Turkey is expected to raise interest rates, despite the objections of President Recep Tayyip Erdogan. Elsewhere, European Union leaders hold an online summit to discus efforts to contain the coronavirus, and the U.K. and Canada are on the brink of signing a new trade agreement, Bloomberg reports. Finally, telecommunications and construction service group Bouygues is reporting earnings after steel firm Thyssenkrupp's sales missed estimates and the company said it would cut 11,000 jobs. What We've Been ReadingThis is what's caught our eye over the past 24 hours. And finally, here's what Cormac Mullen is interested in this morningEuropean currency traders looking for a double dose of exposure to a risk-on rally into next year are no doubt running the rule over sterling versus the Swiss franc. With optimism growing toward both a Brexit deal and a coronavirus vaccine, the pound is making a fourth attempt this year to push past a key technical level against its continental cousin. A break of the resistance -- the 23.6% Fibonacci retracement from its five-year downtrend against the franc -- would open up the door for further upside in sterling. The word from Brussels is that the U.K. and EU could strike a deal on their future trading relationship early next week -- an obvious catalyst for bullish pound positions. And the discussion over a vaccine has more or less moved on to distribution and logistics after the positive efficacy data from Pfizer and Moderna. That points to the potential for weakness ahead in the haven franc. FX strategists too are warming toward a sterling-swissie trade. As those at UBS put it this week, the pair is "the most extreme value proposition" among Group-of-10 currencies at the moment.  Cormac Mullen is a Cross-Asset reporter and editor for Bloomberg News in Tokyo. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment