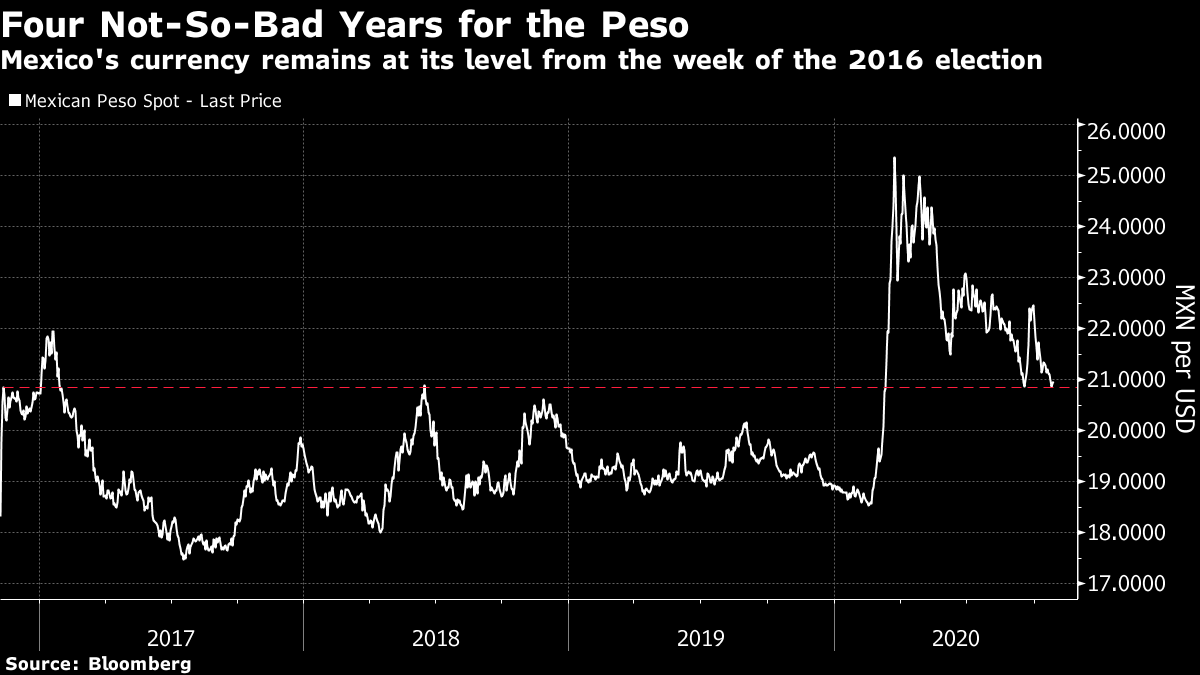

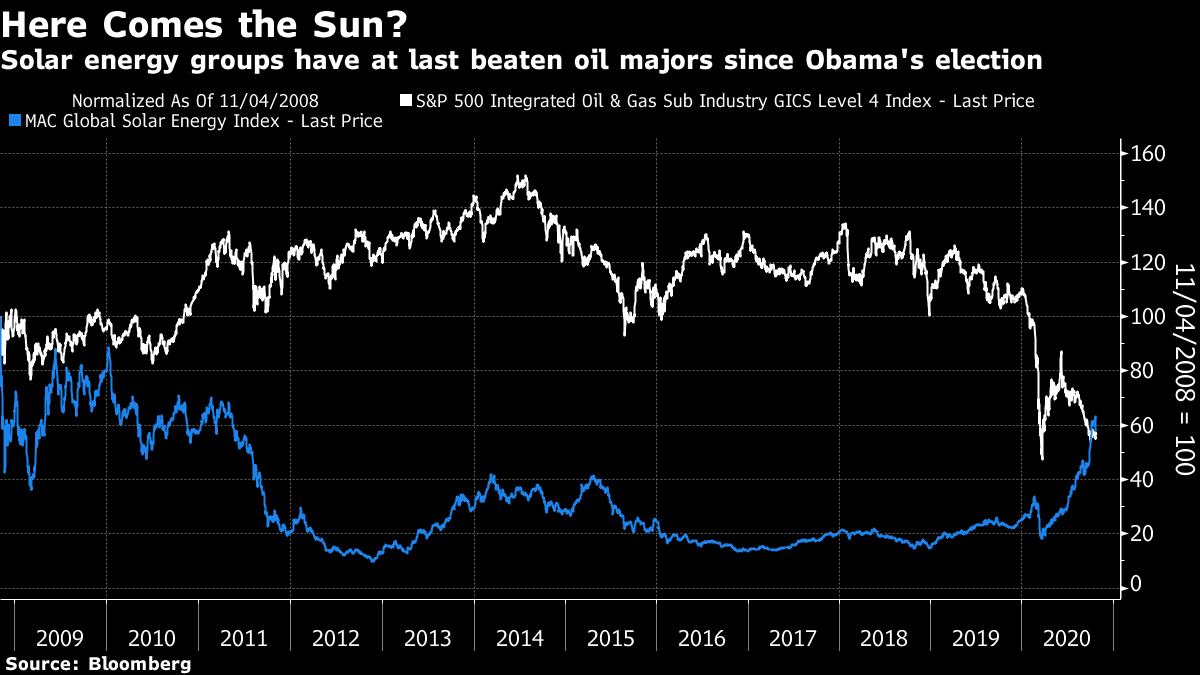

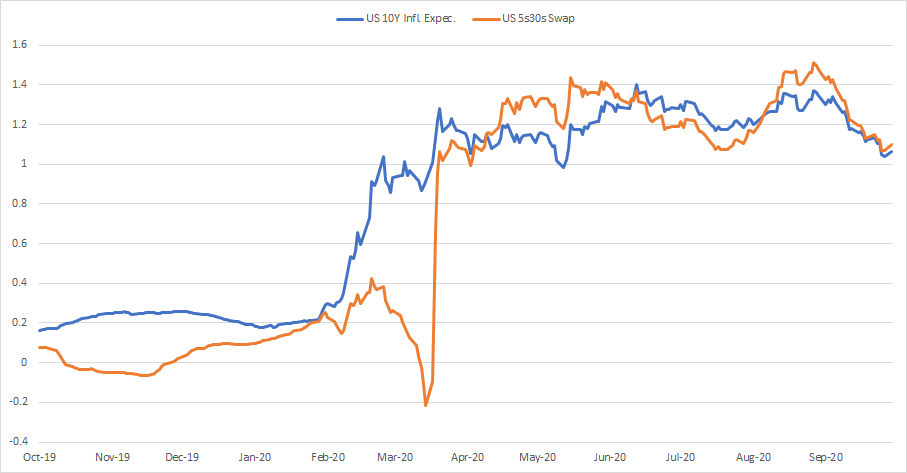

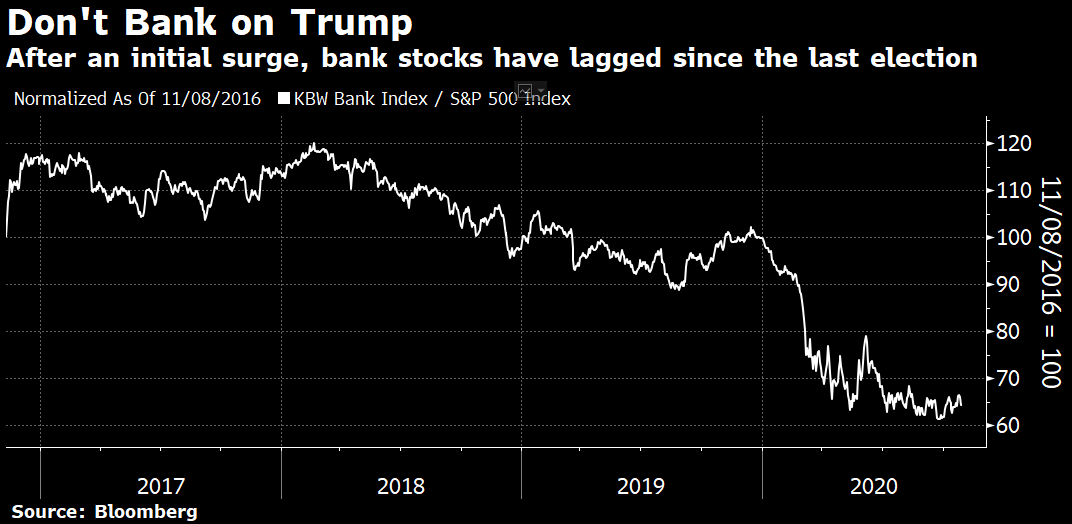

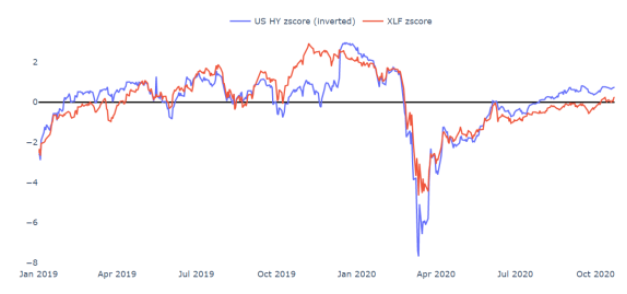

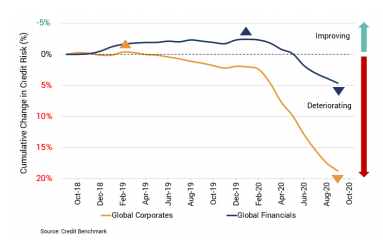

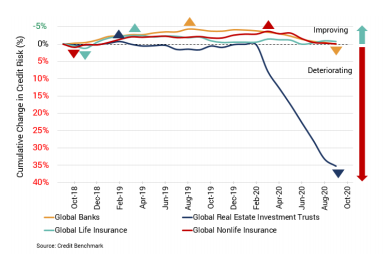

Political Counter-IntuitionsLet's not delve into the likely outcome of the election again. It's altogether too difficult. Instead, I'd like to dive into some scenario analysis. And let's start with a warning. Outcomes are often counterintuitive. Nothing was clearer in the 2016 Trump campaign than his determination to clamp down on Mexican immigration and come to a new more favorable trade agreement. The Mexican peso sank on news of his shock victory. But you would only have had until the end of the week to sell the currency. The peso recovered from there, and didn't touch such low levels again until this year's Covid-19 shock.  This happened despite Mexicans' decision to elect an aggressive left-wing populist, Andres Manuel Lopez Obrador, as their own president in 2018. Rather than a falling out, the Nafta trade agreement has survived with minimal change and a rebranding, the border wall remains unbuilt, Mexico certainly hasn't had to pay for it, and the flow of money from migrant laborers north of the border has risen substantially. During the eight years of the Obama administration, the flow of remittances flatlined. In the last four years those money transfers, which are vital in maintaining economic activity in many rural areas of Mexico, have surged:  For another example of how Trump's pre-election agenda didn't translate into workable investment strategies over the last four years, look at global coal stocks. His promise to rescue the coal industry was critical to his election. But coal groups, as represented by the Stowe Global Coal index, have radically underperformed world stock markets since his election:  To be fair, they had enjoyed an impressive rally in the months leading up to the vote, but this is still a clear sign that allocating money in line with the declared Trump agenda wasn't a foolproof strategy. Then there is the vexed case of solar power, currently regarded as an obvious beneficiary of a Biden presidency. This involves a little faith. The MAC Global solar energy index (which can be bought via the exchange-traded fund with the ticker symbol TAN) performed miserably throughout the eight years that Biden was vice president. The big U.S. oil majors, though troubled themselves, did much better:  Ironically, it was only under Trump that a "Long the Sun/Short Fossils" trade began to work, thanks to the collapse in the oil price. And it is only thanks to a surge in the last few months, buoyed by Biden optimism, that the solar index has at last outperformed the oil majors. Anyone confidently putting on this trade when Biden was elected vice president would have had to wait a long time. And the scale of the run-up in solar energy stocks in the last few months is reminiscent of the pre-Trump rally in coal stocks. It will be hard for them to keep performing like this. Politics can never be safely ignored. But its readthrough to markets is often far from obvious. Blue Wave: Buy EnergySeveral outcomes command attention. Let's leave it at the big two, and look at the broad outlines of who will benefit if Biden wins in a wave, or if Trump upsets the odds to triumph again. First, what happens with a Blue Wave? Quant Insight comes up with the prediction that traditional energy groups might do best. This seems startling, especially in the light of Biden's declaration during the final debate that he hoped to transition away from fossil fuels. But that is for the longer term. Nobody thinks he can do it overnight. And energy stocks, as the chart above makes clear, wouldn't be starting his presidency in a healthy place. It shouldn't take much for them to rise. Now we come to the reasons for Quant Insight's call. As all readers will know by now, a Blue Wave would likely bring with it higher inflation expectations, and a steeper yield curve. There would also be more risk appetite without the unpredictable Trump, and with a policy more likely to deliver growth in the short term (no matter the longer-term effects). Looking at different sectors' sensitivity to macro factors, QI found that energy prices were positively related to rising inflation expectations, and a steeper yield curve. They also prefer lower risk aversion. These sensitivities have all grown much stronger:  For risk aversion, QI looked at the relationship with the gold-silver ratio, and with the VIX. In both cases, as these rose, so the XLE energy ETF fell:  To be clear about what is being measured in these charts, they show the percentage sensitivity of the S&P 500 Energy index to a one standard deviation increase in each of the macro factors. So a reduction in risk aversion, combined with a steeper yield curve and higher inflation expectations, should help to drive energy stocks up under a President Biden, no matter what possible "Green" new deals might lie in the future. Trump Does It Again: Buy BanksHere comes another counterintuitive, which again involves the yield curve. Banks are ultimately very cyclical. They do well when the economy is expanding, and when the yield curve is steep — in other words, when there is nice big spread between short- and long-term borrowing rates, allowing them to make a fatter profit on their standard banking activities. The yield curve flattened in the early part of the Trump presidency, before inverting last year. It remains very flat. So after an initial burst of enthusiasm that Trump meant growth, and that therefore meant buying bank stocks, the sector went on to have an awful four years compared to the market. They haven't yet started to recover from the damage sustained in the Covid shock.  And yet, banks should be positioned to perform well under Trump, according to the QI models. Why? A Trump victory would mean a broad continuation of the macroeconomic policy to which we have all now become accustomed — an ultra-lenient monetary stance, combined with not much in the way of active fiscal support. That isn't generally great for banks. The Fed would keep the yield curve pretty flat. But as this chart shows, banks are less sensitive to the steepness of the yield curve than they used to be. In this chart, the units are standard deviations for the S&P 500 banks index (the XLF ETF) and the 5 year-30 year yield curve. The relationship isn't what it was:  Instead, there is a much closer relationship to credit risk, as proxied here by the spread at which high-yield bonds trade. The higher junk bond yields go, the lower go bank stocks, and vice versa. A large part of the collapse of bank stocks this year has been driven by the (reasonable) belief that a solvency crisis lies in wait. After all the lost revenues during the shutdown, many take it as inevitable that banks will have serious credit losses coming down the pike. And indeed, the relationship to perceived credit risk shown by high-yield spreads is tight:  As shown by Credit Benchmark, a service that aggregates internal credit risk views from more than 40 leading global institutions, financials' credit ratings have stayed roughly intact over the last few months, even as other corporates have seen a sharp rise in concern over solvency:  Thus, a situation in which the banks are left with continuing support from a Fed that continues to be the only game in town turns out to benefit the sector more than any other stocks. As at the beginning of Trump's first term, a second period in office might well be accompanied by banking outperformance. For the greatest risk to this scenario, look to real estate. In yet another outcome that runs counter to intuition, the property developer president hasn't delivered the goods for the industry. Banks and insurance companies' credit has been upgraded somewhat over the last few months, according to Credit Benchmark. The same absolutely isn't true of real estate companies, which must face up to the risk of many months of unpaid rents.  The Credit Benchmark assessment of the long-term trajectory for real estate is alarming: The Credit Benchmark aggregate for US Hotel risk shows a staggering 230% increase since February – the equivalent of nearly 6 notches in the 21-category scale. Some iconic properties (e.g. The Royalton Hotel) have been sold at significant discounts to previous purchase prices. B-rated CMBS are trading at less than half of their face value. While it is the higher rated CMBS that are widely held by asset managers and insurance companies, they are unlikely to be immune to problems afflicting retail, hospitality and office spaces simultaneously. Banks will suffer from drying up deal flow, and some of them have direct exposures to potential write downs.

So, there may be a congruence between the Trump and Biden outcomes. Initially, buy exactly what you were inclined to leave alone. But be prepared to move away again if some form of "Green new deal" or a round of real estate foreclosures come to pass. Survival TipsPablo Neruda's poetry inspired more music than I had realized. This is the last of the five Neruda songs written by the American composer Peter Lieberson, to be sung by his wife Lorraine Hunt Lieberson. The recording was made eight months before she died of breast cancer. The first verse can be translated as follows: My love, should I die and you don't,

let us give grief no more ground:

my love, should you die and I don't,

there is no piece of land like this on which we've lived.

Like Bloomberg's Points of Return? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment