| Jobless claims due, Trump refuses to commit to a peaceful transfer of power, and more virus restrictions reimposed. Holding Today's initial jobless claims number is expected to come in at 840,000, a number that would not represent a significant improvement on recent data. Continuing claims are forecast to drop to 12.3 million. The data comes as policy maker warnings increase on the pace of the recovery from the pandemic shutdown, with Fed Chair Jerome Powell saying the path ahead for employment remains uncertain. Treasury Secretary Steven Mnuchin will join Powell in the Senate today for testimony. TransferPresident Donald Trump refused to commit to a peaceful transfer of power if a tally of ballots show Democrat Joe Biden is victorious in November. The president has criticized the legitimacy of mail-in voting, and yesterday made the point that it was important to have the new Supreme Court justice confirmed before the election as the result "will be before the United States Supreme Court and I think having a 4-4 situation is not a good situation." Market analysts are already warning about higher volatility around November 3, with fears of a drawn-out process feeding expectations of increased uncertainty to the end of the year. Virus fears Investor worries about a second wave of virus lockdowns are starting to come true, with Israel the latest country to reintroduce restrictions as it battles a resurgence of infections. In the U.K., the government canceled plans for a budget this year, with Chancellor of the Exchequer Rishi Sunak set to outline plans for short-term economic support later today. President Trump signaled he may veto any tightening of U.S. rules on the emergency clearance of a vaccine, saying it "sounds like a political move." Global deaths from the disease are approaching 1 million, according to data from Johns Hopkins University. Markets dropYesterday's afternoon slump in the S&P 500 Index pushed the gauge close to a correction as investors heed warnings from a range of Fed speakers on the need for further stimulus. That slump is weighing on global equities today, with the MSCI Asia Pacific Index dropping 1.7% overnight, while Japan's Topix index closed 1.1% lower. In Europe, the Stoxx 600 Index slipped 0.8% by 5:50 a.m., with improving German business optimism and a strong take-up of the latest European Central Bank liquidity operation providing some relief. S&P 500 futures shifted between gains and losses, the 10-year Treasury yield was at 0.664% and gold dropped. Coming up...There is another cacophony of Fed speakers today all addressing various events, with Dallas Fed President Robert Kaplan, St. Louis Fed President James Bullard, Chicago Fed President Charles Evans, Richmond Fed President Thomas Barkin (twice), New York Fed President John Williams and Atlanta Fed President Raphael Bostic. New home sales data for August is at 10:00 a.m. Costco Wholesale Corp., Accenture Plc and Blackberry Ltd. are among the companies reporting results. What we've been readingThis is what's caught our eye over the last 24 hours. And finally, here's what Joe's interested in this morningIt's well understood by now that even though the major stock indexes have had an incredible run over the last six months (even with the recent dip) that the gains have not been shared evenly. Some sectors have seen eye-watering gains (tech), while others continue to trade at deeply impaired levels (financials, airlines).

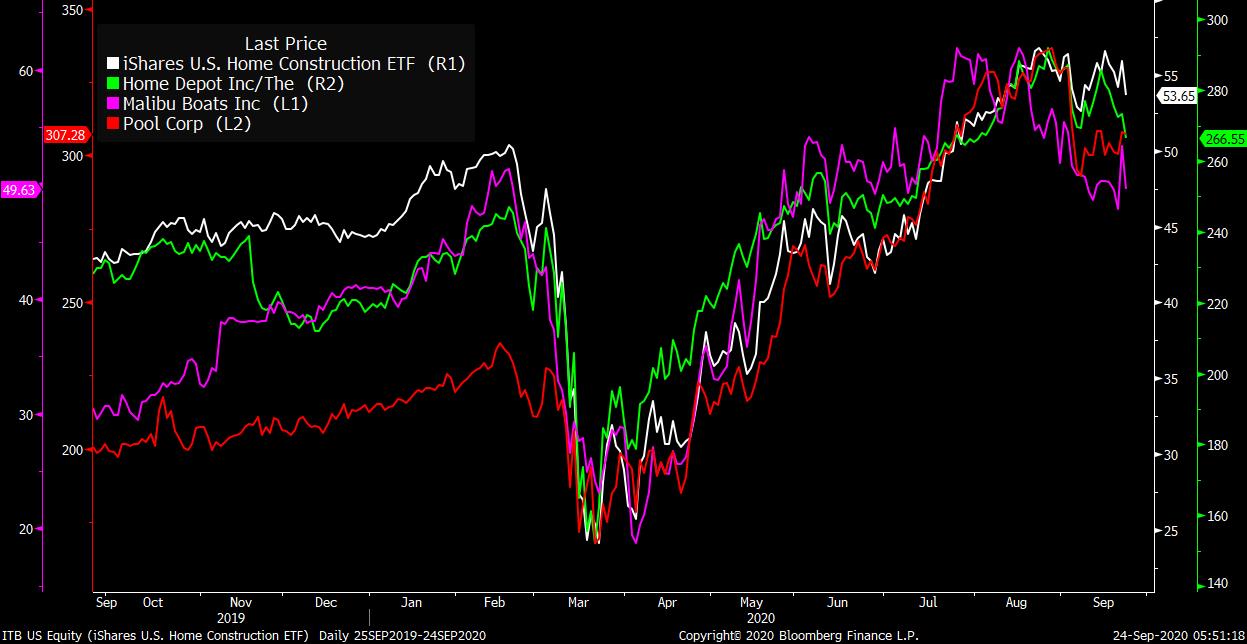

Broadly speaking, there are two big categories of Covid winners. The first I would categorize as macro winners. Things like cloud-computing companies, other growth stocks, and gold have all taken off as real interest rates have plunged, prompting investors to pay up for assets that are perceived to be havens from the current turmoil. They've all been cooling off lately.  The second category of winners are more idiosyncratic, and relate to specific companies or industries that have benefitted greatly from the changing consumption and lifestyle patterns over the several months. Housing, including home renovation, has boomed. Boat sales surged over the summer. Pools as well. It hasn't gotten as much attention but these names have also stopped going up over the last several weeks. Of course not everything is quite so simple. Some companies are probably in both of the above categories. Names like Amazon, Zoom and Peloton have benefited both in the immediate situation, and also due to high growth macro properties. These companies have had unbelievably strong years. As we go through this period of market volatility, it probably makes sense to see if either of the above trades regain momentum, or see further positive catalysts, and if not, see if anything else is set to pick up the baton.  Joe Weisenthal is an editor at Bloomberg. Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. |

Post a Comment